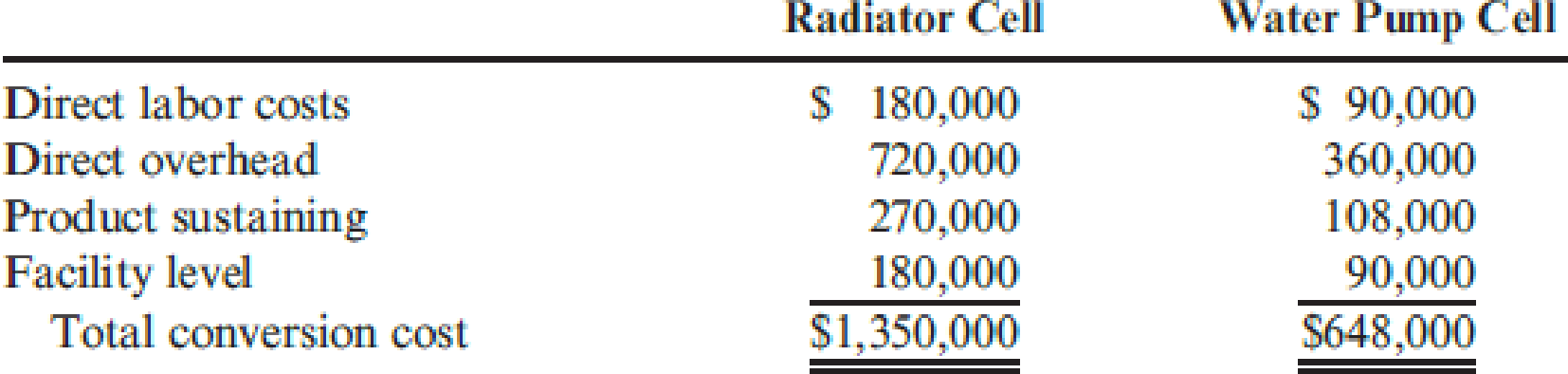

Southward Company has implemented a JIT flexible manufacturing system. John Richins, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, he has decided to treat direct labor cost as a part of overhead and to discontinue the detailed direct labor accounting of the past. The company has created two manufacturing cells, each capable of producing a family of products: the radiator cell and the water pump cell. The output of both cells is sold to a sister division and to customers who use the radiators and water pumps for repair activity. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility-level costs are allocated to each cell on the basis of square footage. The budgeted direct labor and overhead costs are as follows:

The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 45,000 hours available for production, and the water pump cell has 27,000 hours. Conversion costs are applied to the units produced by multiplying the conversion rate by the actual time required to produce the units. The radiator cell produced 81,000 units, taking 0.5 hour to produce one unit of product (on average). The water pump cell produced 90,000 units, taking 0.25 hour to produce one unit of product (on average).

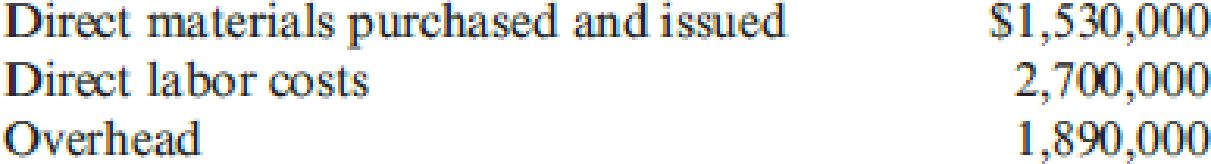

Other actual results for the year are as follows:

All units produced were sold. Any conversion cost variance is closed to Cost of Goods Sold.

Required:

- 1. Calculate the predetermined conversion cost rates for each cell.

- 2. Prepare

journal entries using backflush accounting. Assume two trigger points, with completion of goods as the second trigger point. - 3. Repeat Requirement 2, assuming that the second trigger point is the sale of the goods.

- 4. Explain why there is no need to have a work-in-process inventory account.

- 5. Two variants of backflush costing were presented in which each used two trigger points, with the second trigger point differing. Suppose that the only trigger point for recognizing

manufacturing costs occurs when the goods are sold. How would the entries be listed here? When would this backflush variant be considered appropriate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardThe management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: Required: 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost? 2. Using the high and low points, compute a power cost formula. 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination. 4. Rerun the regression and drop the point (20,000; 26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?arrow_forwardAnderson Company has the following departmental manufacturing structure for one of its products: After some study, the production manager of Anderson recommended the following revised cellular manufacturing approach: Required: 1. Calculate the total time it takes to produce a batch of 20 units using Andersons traditional departmental structure. 2. Using cellular manufacturing, how much time is saved producing the same batch of 20 units? Assuming the cell operates continuously, what is the production rate? Which process controls this production rate? 3. What if the processing times of molding, welding, and assembly are all reduced to six minutes each? What is the production rate now, and how long will it take to produce a batch of 20 units?arrow_forward

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardSalem Electronics currently produces two products: a programmable calculator and a tape recorder. A recent marketing study indicated that consumers would react favorably to a radio with the Salem brand name. Owner Kenneth Booth was interested in the possibility. Before any commitment was made, however, Kenneth wanted to know what the incremental fixed costs would be and how many radios must be sold to cover these costs. In response, Betty Johnson, the marketing manager, gathered data for the current products to help in projecting overhead costs for the new product. The overhead costs based on 30,000 direct labor hours follow. (The high-low method using direct labor hours as the independent variable was used to determine the fixed and variable costs.) All depreciation. The following activity data were also gathered: Betty was told that a plantwide overhead rate was used to assign overhead costs based on direct labor hours. She was also informed by engineering that if 20,000 radios were produced and sold (her projection based on her marketing study), they would have the same activity data as the recorders (use the same direct labor hours, machine hours, setups, and so on). Engineering also provided the following additional estimates for the proposed product line: Upon receiving these estimates, Betty did some quick calculations and became quite excited. With a selling price of 26 and just 18,000 of additional fixed costs, only 4,500 units had to be sold to break even. Since Betty was confident that 20,000 units could be sold, she was prepared to strongly recommend the new product line. Required: 1. Reproduce Bettys break-even calculation using conventional cost assignments. How much additional profit would be expected under this scenario, assuming that 20,000 radios are sold? 2. Use an activity-based costing approach, and calculate the break-even point and the incremental profit that would be earned on sales of 20,000 units. 3. Explain why the CVP analysis done in Requirement 2 is more accurate than the analysis done in Requirement 1. What recommendation would you make?arrow_forwardMott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Motts two products are weed eaters and lawn edgers. The unit prime costs under the old system are as follows: Under the old manufacturing system, the company operated three service centers and two production departments. Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Under the old system, the overhead costs of the service departments were allocated directly to the producing departments and then to the products passing through them. (Both products passed through each producing department.) The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system, the Machining Department used 80,000 machine hours, and the Assembly Department used 20,000 direct labor hours. Each weed eater required 1.0 machine hour in Machining and 0.25 direct labor hour in Assembly. Each lawn edger required 2.0 machine hours in Machining and 0.5 hour in Assembly. Bases for allocation of the service costs are as follows: Upon implementing JIT, a manufacturing cell for each product was created to replace the departmental structure. Each cell occupied 40,000 square feet. Maintenance and materials handling were both decentralized to the cell level. Essentially, cell workers were trained to operate the machines in each cell, assemble the components, maintain the machines, and move the partially completed units from one point to the next within the cell. During the first year of the JIT system, the company produced and sold 20,000 weed eaters and 30,000 lawn edgers. This output was identical to that for the last year of operations under the old system. The following costs have been assigned to the manufacturing cells: Required: 1. Compute the unit cost for each product under the old manufacturing system. 2. Compute the unit cost for each product under the JIT system. 3. Which of the unit costs is more accurate? Explain. Include in your explanation a discussion of how the computational approaches differ. 4. Calculate the decrease in overhead costs under JIT, and provide some possible reasons that explain the decrease.arrow_forward

- Abernathy, Inc., produces two different generators and is concerned about their quality. The company has identified the following quality activities and costs associated with the two products: Required: 1. Calculate the quality cost per unit for each product, and break this unit cost into quality cost categories. Which of the two seems to have the lowest quality? 2. How might a manager use the unit quality cost information?arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forwardReducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forward

- Kagle design engineers are in the process of developing a new green product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed 550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit-and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system: Variable conversion activity rate: 100 per direct labor hour Material usage rate: 20 per part ABC system: Labor usage: 15 per direct labor hour Material usage (direct materials): 20 per part Machining: 75 per machine hour Purchasing activity: 150 per purchase order Setup activity: 3,000 per setup hour Warranty activity: 500 per returned unit (usually requires extensive rework) Customer repair cost: 25 per repair hour (average) Required: 1. Select the lower-cost design using unit-based costing. Are logistical and post-purchase activities considered in this analysis? 2. Select the lower-cost design using ABC analysis. Explain why the analysis differs from the unit-based analysis. 3. What if the post-purchase cost was an environmental contaminant and amounted to 10 per unit for Design A and 40 per unit for Design B? Assume that the environmental cost is borne by society. Now which is the better design?arrow_forwardQuincy Farms is a producer of items made from farm products that are distributed to supermarkets. For many years, Quincys products have had strong regional sales on the basis of brand recognition. However, other companies have been marketing similar products in the area, and price competition has become increasingly important. Doug Gilbert, the companys controller, is planning to implement a standard costing system for Quincy and has gathered considerable information from his coworkers on production and direct materials requirements for Quincys products. Doug believes that the use of standard costing will allow Quincy to improve cost control and make better operating decisions. Quincys most popular product is strawberry jam. The jam is produced in 10-gallon batches, and each batch requires six quarts of good strawberries. The fresh strawberries are sorted by hand before entering the production process. Because of imperfections in the strawberries and spoilage, one quart of strawberries is discarded for every four quarts of acceptable berries. Three minutes is the standard direct labor time required for sorting strawberries in order to obtain one quart of strawberries. The acceptable strawberries are then processed with the other ingredients: processing requires 12 minutes of direct labor time per batch. After processing, the jam is packaged in quart containers. Doug has gathered the following information from Joe Adams, Quincys cost accountant, relative to processing the strawberry jam. a. Quincy purchases strawberries at a cost of 0.80 per quart. All other ingredients cost a total of 0.45 per gallon. b. Direct labor is paid at the rate of 9.00 per hour. c. The total cost of direct material and direct labor required to package the jam is 0.38 per quart. Joe has a friend who owns a strawberry farm that has been losing money in recent years. Because of good crops, there has been an oversupply of strawberries, and prices have dropped to 0.50 per quart. Joe has arranged for Quincy to purchase strawberries from his friends farm in hopes that the 0.80 per quart will put his friends farm in the black. Required: 1. Discuss which coworkers Doug probably consulted to set standards. What factors should Doug consider in establishing the standards for direct materials and direct labor? 2. Develop the standard cost sheet for the prime costs of a 10-gallon batch of strawberry jam. 3. Citing the specific standards of the IMA Statement of Ethical Professional Practice described in Chapter 1, explain why Joes behavior regarding the cost information provided to Doug is unethical. (CMA adapted)arrow_forwardMiller Minerals Co. manufactures a product that requires the use of a considerable amount of natural gas to heat it to a desired temperature. The process requires a constant level of heat, so the furnaces are maintained at a set temperature for 24 hours a day. Although units are not continuously processed, management desires that the variable cost be charged directly to the product and the fixed cost to the factory overhead. The following data have been collected for the year: Required: 1. Separate the variable and fixed elements, using the high-low method. 2. Determine the variable cost to be charged to the product for the year. (Hint: First determine the number of annual units produced.) 3. Determine the fixed cost to be charged to factory overhead for the year.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College