a.

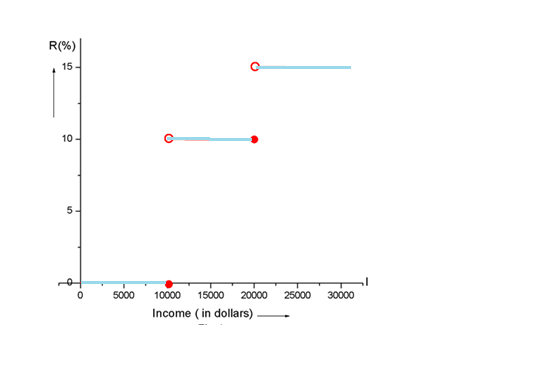

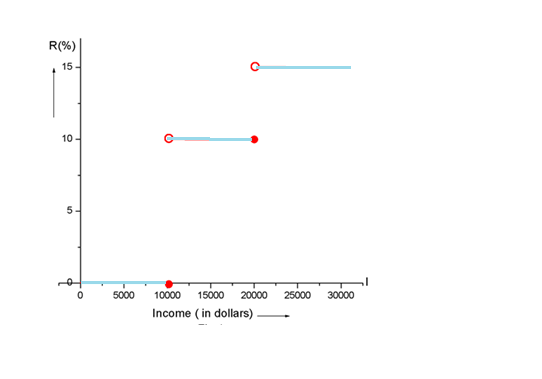

Sketch the graph of the tax rate

a.

Answer to Problem 61E

Explanation of Solution

Given information:

In a certain country, income tax is assessed as follows. There is no tax on income up to

Sketch the graph of the tax rate

Calculation:

Suppose

Now we have been given that, there is no tax income up to

So

If the income

So

If the income is more than

Then

Now we can write the tax rate

Now we can draw a graph,

b.

How much tax is assessed on an income of

b.

Answer to Problem 61E

Explanation of Solution

Given information:

In a certain country, income tax is assessed as follows. There is no tax on income up to

How much tax is assessed on an income of

Calculation:

We have to calculate tax on income of

There is no tax if income

So non-taxable income is =

Then taxable income is =

Since the total income is in the interval

So the income tax =

Hence,

Now, we have to calculate the tax on income of

First we have to break this

Tax on first

Tax on second

Tax on last

Then total tax on income of

Hence, the

c.

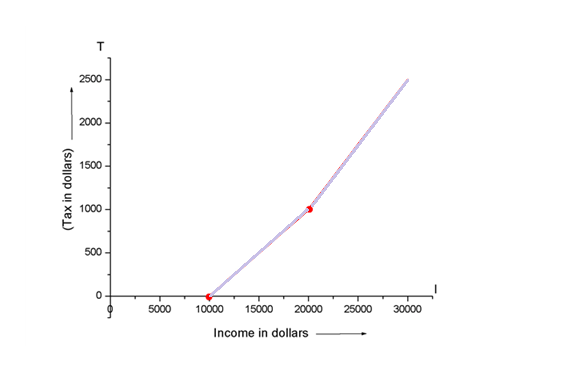

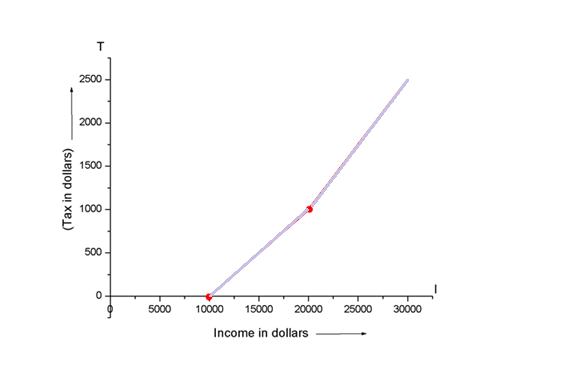

Sketch the graph of the total assessed tax

c.

Answer to Problem 61E

Explanation of Solution

Given information:

In a certain country, income tax is assessed as follows. There is no tax on income up to

Sketch the graph of the total assessed tax

Calculation:

Since there is no tax if income

If the income

Maximum taxable income in the interval is

Then maximum tax in this interval =

Hence curve passes through the point

Now if income tax

So tax T (I) =

Or

Hence the graph of tax

Chapter 1 Solutions

Single Variable Calculus: Concepts and Contexts, Enhanced Edition

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning