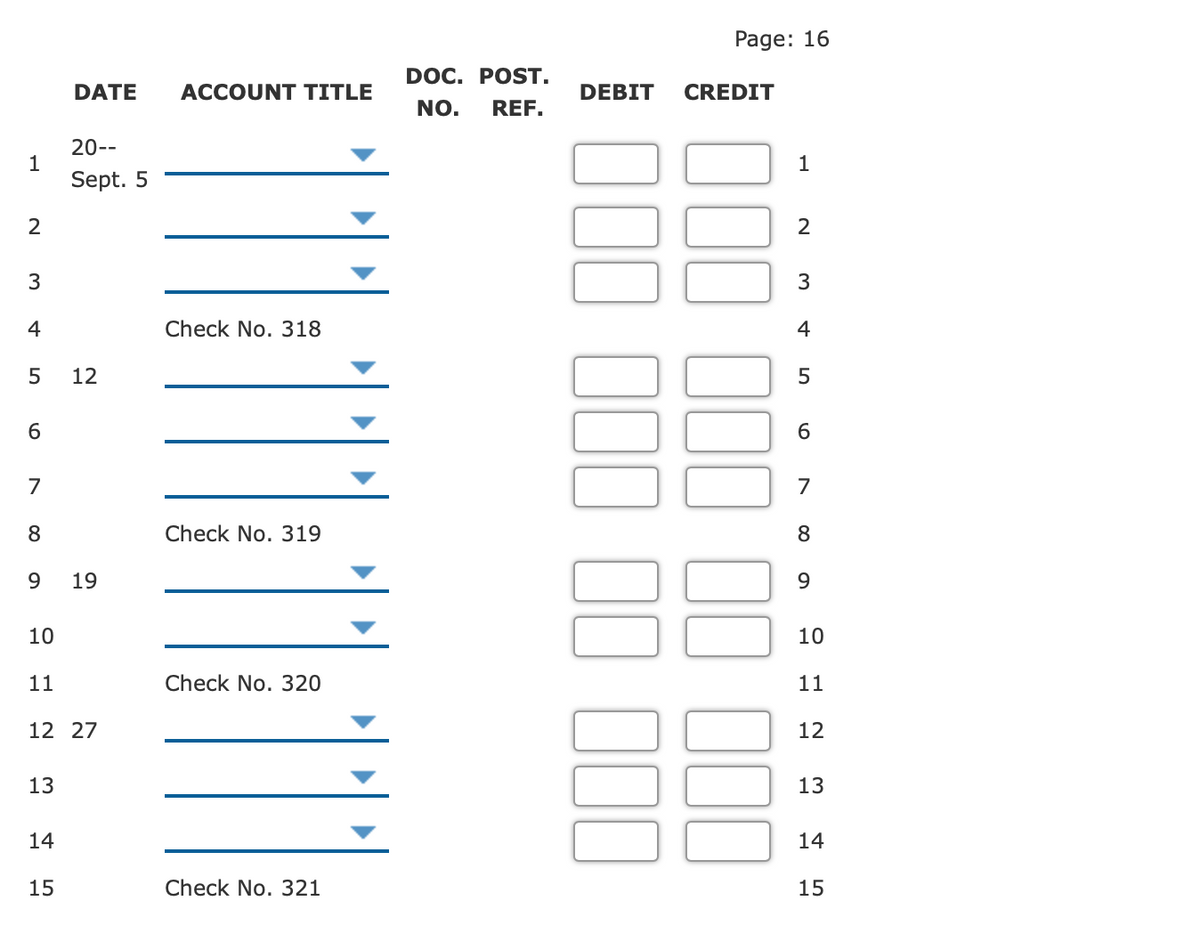

Journalizing Cash Payments Transactions Enter the following cash payments transactions in a general journal: Sept. 5 Issued Check No. 318 to Clinton Corp. for merchandise purchased August 28, $5,500, terms 2/10, n/30. Payment is made within the discount period. 12 Issued Check No. 319 to Martin Company for merchandise purchased September 2, $7,500, terms 1/10, n/30. A credit memo had been received on September 8 from Martin Company for merchandise returned, $500. Payment is made within the discount period after deduction for the return dated September 8. 19 Issued Check No. 320 to Expert Systems for merchandise purchased August 20, $3,600, terms n/30. 27 Issued Check No. 321 to Dynamic Data for merchandise purchased September 17, $9,000, terms 2/10, n/30. Payment is made within the discount period.

Journalizing Cash Payments Transactions Enter the following cash payments transactions in a general journal: Sept. 5 Issued Check No. 318 to Clinton Corp. for merchandise purchased August 28, $5,500, terms 2/10, n/30. Payment is made within the discount period. 12 Issued Check No. 319 to Martin Company for merchandise purchased September 2, $7,500, terms 1/10, n/30. A credit memo had been received on September 8 from Martin Company for merchandise returned, $500. Payment is made within the discount period after deduction for the return dated September 8. 19 Issued Check No. 320 to Expert Systems for merchandise purchased August 20, $3,600, terms n/30. 27 Issued Check No. 321 to Dynamic Data for merchandise purchased September 17, $9,000, terms 2/10, n/30. Payment is made within the discount period.

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

Journalizing Cash Payments Transactions

Enter the following cash payments transactions in a general journal:

| Sept. 5 | Issued Check No. 318 to Clinton Corp. for merchandise purchased August 28, $5,500, terms 2/10, n/30. Payment is made within the discount period. |

| 12 | Issued Check No. 319 to Martin Company for merchandise purchased September 2, $7,500, terms 1/10, n/30. A credit memo had been received on September 8 from Martin Company for merchandise returned, $500. Payment is made within the discount period after deduction for the return dated September 8. |

| 19 | Issued Check No. 320 to Expert Systems for merchandise purchased August 20, $3,600, terms n/30. |

| 27 | Issued Check No. 321 to Dynamic Data for merchandise purchased September 17, $9,000, terms 2/10, n/30. Payment is made within the discount period. |

Transcribed Image Text:Page: 16

DOC. POST.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

NO.

REF.

20--

1

Sept. 5

1

4

Check No. 318

4

12

6

6

7

7

Check No. 319

8

9.

19

9.

10

10

11

Check No. 320

11

12 27

12

13

13

14

14

15

Check No. 321

15

00

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you