Q: Calculate the leverage ratio which includes total debt to total assets ratio, equity multiplier,…

A: Total Debts to Assets ratio = Long term debt + Short term DebtTotal Assets Equity Multiplier = Total…

Q: Provide an overall analysis of the ratios below. A. Debt Ratio Total Liabilities/ Total Assets…

A: Note: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: RATIO ANALYSIS Liquidity Ratio Current Ratio Solvency Ratio Debt to Equity Ratio Debt to Assets…

A: Financial Ratios are a method of analyzing the financial performances of the business and provide…

Q: Long-term solvency ratios Total debt ratio Debt-equity ratio Equity multiplier Times interest earned…

A: Long-term solvency ratio:- It is calculated to check the firm's long-term ability to meet its…

Q: Define Debt-to-equity ratio

A: Debt to equity ratio is an important ratio which is used by the companies in order to determine the…

Q: Select the Income Statements and Balance Sheets of Aramco Saudi from the calculate the following…

A: solution- Income…

Q: Which of the following ratios is most useful in evaluating solvency? a. Receivables turnover ratio.…

A: Solvency ratios disclose the firm's ability to meet its long-term liabilities as and when they…

Q: Give the formula for each of the following: a) Return on Equity b) Current Ratio

A: A quantitative method that provides information about the company including its liquidity,…

Q: Short-term creditors would probably most interested in which ratio? a. Current ratio c.…

A: Short-term creditors are mostly interested in liquidity ratios. It means the ability of the business…

Q: Debt-equity ratio is a sub-part of Select one: a. Liquidity ratio b. Solvency ratio c. Profitability…

A: EXPLNANTION:- The debt-equity ratio is an indicator of the lenders' and stockholders' or owners'…

Q: Required: Calculate following Ratios I) Current Ratio I) Acid Test Ratio II) IV) Long term Debt to…

A: Answer and calculations are given below

Q: The return on equity is calculated using which of the following formulas? Multiple Cholce Net Income…

A: The ratio analysis helps to analyse the financial statements of the business.

Q: The current ratio is O a solvency measure that indicates the margin of safety for bondholders O…

A: Note: Since you have asked multiple question, we will solve the first question for you. If you want…

Q: tatements, how would one calculate the Book Debt-to-Equity Ration and the Market Debt-to-Equity…

A: Debt to Equity ratio is the ratio which indicates the relative proportion of debt and equity which…

Q: Current ratio Quick ratio Debtors collection period Inventory turnover Creditors payment period

A: We will be applying the following accounting formulas: Current Ratio= Current Asset/ Current…

Q: How do you determine the mix (percentages or weights) of debt vs equity from the Debt to Equity…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: Define each of the following terms:a. Liquid assetb. Liquidity ratios: current ratio; quick (acid…

A: Hey, since there are multiple questions posted, we will answer the first question. If you want any…

Q: Which of the following is one measure of liquidity? a. Quick ratio b. Profit margin c.…

A: Introduction: Liquidity: Liquidity means which can be easily converted in to the cash with in short…

Q: What does the debt to equity ratio shows, and how is it calculated?

A: Debt to equity ratio and its implication:The ratio of company’s total debt to the total…

Q: Profit volume ratio is similar to which of the following ratios? Debtors' turnover ratio Operating…

A: Profit volume ratio shows ratio of contribution margin with sales revenue of the business.

Q: Return on equity is: the rate of return that owners earn on their investment O the relationship of…

A: Return on equity can be defined as the earning on the equity as hold by the equity shareholders of…

Q: Which of the following is NOT one of the ratios in Internal Liquidity group? Select one: O a. Quick…

A: The liquidity ratios helps to know about the capability of the business to pay off its liabilities…

Q: Debt to Total Assets Ratio can be improved by: A. Borrowing More, B. Issue of Debentures, C. Issue…

A: Debt to total assets ratio measures the proportion of total assets finance by creditors. it can be…

Q: Based on financial reports prepare ratio analysis and interpret the result of the Following ratios:…

A: Liquidity ratios are key financial metrics which determines the ability of a company to meet its…

Q: &G Co. has an equity multiplier of 2.4, and its assets are financed with some combination of…

A: Equity multiplier = Total Assets/ Equity 2.40 = (Equity + Debt)/ Equity 2.40 x Equity = Equity+ Debt…

Q: Inflation can have significant effects on income statements and balance sheets, and therefore on the…

A: Inflation : It is the situation in which consumer's demand exceeds supply for goods and services.…

Q: How is leverage expressed in DuPont Ratio System? a) Total Debt / Equity b) Total Debt / Total…

A: Dupont ratio system is used to analysis the financial statements and assess its financial condition.…

Q: Please calculate the below accounting ratios whilst referring to the attachment. A) Interest…

A: Here in this question, we are required to calculate the various ratios. Interest coverage ratio…

Q: How does the debt-to-equity ratio affect the return on equity?

A: Debt to equity ratio: The debt-equity ratio is also known as an external and internal equity ratio.…

Q: Compute the following ratio analysis: Return on Equity Return on Assets Gross Profit Margin…

A: Return on equity measures the return of common stockholders in firm . it can be calculated Return on…

Q: QUESTION 2 Which of the followings is commonly used for debt ratings? return on net capital total…

A: Debt ratings: Debt rating is a scoring method used to tell about the creditworthiness of debt.…

Q: Long-term solvency is indicated by a. Current ratio b. Debt/equity ratio c. Operating ratio d. Net…

A: Solvency refers to the company's ability to repay it's debt

Q: The debt to equity ratio is calculated as a. Total assets / Total equity. b. Current liabilities /…

A: Debt to equity ratio: The ratio of company’s total debt to the total stockholders’ equity is known…

Q: Calculate the following ratios based on the balance sheet, income statement and cash flow prepared…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Debt to Equity Total Debt Ratio Times Interest Earned

A: Financial ratios are quantitative measures used by analysts to determine the financial performance…

Q: d debt percentage

A: The net rate of return is the return on an asset after expenses such as taxes, depreciation, and…

Q: Illustrate how the debt-to-equity ratio impacts the return on equity?

A: A high debt-equity ratio can be acceptable in light of the fact that it shows a firm can without…

Q: Compute for Leverage Ratio for year 2018 - 2020: a. Debt Ratio b. Debt to Equity Ratio c. Time…

A: Debt ratio is the ratio which measures how much total assets has been financed from the debts of the…

Q: Which of the ratios listed helps to indicate whether current liabilities could be paid without…

A: The liquidity ratio indicates the ability of the business entity to payout the current liabilities…

Q: In the following balance sheet, estimate the impact on the economic value of equity (EVE). If…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: Illustrate how the debt-to-equity ratio (total debt over total equity)(distinct from the debt ratio)…

A: The debt-to-equity ratio is one of the important financial indicators of the company. The ratio of…

Q: Show the calculation of the following solvency ratios: (1) the debt to equity ratio, and (2) the…

A: Solvency: Solvency is the capability of a company to pay the long-term liabilities which are due.…

Q: Calculate Debt-to-equity Times interest earned Return on Financial leverage

A: Debt to equity=Outsiders' FundsShareholders' Funds 2019 2018 2017 2016 36,683,0008,573,000=4.28…

Q: Debt to equity ratio

A: (Note: Since you have posted a multi-part question, we will solve the first three parts for you. For…

Q: Given the formula for each of the following. A. Return on Equity. B. Current Ratio

A: A quantitative method that provides information about the company including its liquidity,…

Q: The debt to equity ratio is calculated as Total assets / Total equity. Current liabilities / Total…

A: Debt to equity ratio:The ratio of company’s total debt to the total stockholders’ equity is known as…

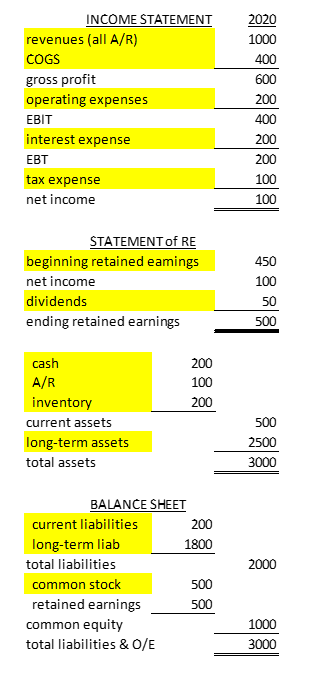

Help calculating the following ratios:

return on equity - current ratio

- quick ratio

- debt-to-equity

- times interest earned

ROE = Earning available to Equity shareholders * 100/ Equity shareholders fund

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Current Assets – Inventories – Prepaids)/ Current Liabilities

Debt to Equity = Debt / Equity

Times Interest Earned = EBITDA / Interest Expenses

Step by step

Solved in 2 steps

- The following information is provided for Sandhill Company and Indigo Corporation. (in $ millions) Sandhill Company Indigo Corporation Net income 2022 $125 $375 Net sales 2022 1540 4500 Total assets 12/31/20 1045 2010 Total assets 12/31/21 1220 3150 Total assets 12/31/22 1175 4070 What is Indigo's return on assets for 2022?SalesOperating costs (excluding depreciation and amortization) EBITDADepreciation and amortization Earnings before interest and taxes Interest Earnings before taxesTaxes (40%)Net income available to common stockholders Common dividendsSEBRINGCORPORATION: BALANCESHEETSFORYEARENDINGDECEMBER31 (FIGURES ARE STATED IN MILLIONS) Assets: Cash and marketable securities Accounts receivableInventories Total current assets Gross Fixed Assets Less DepreciationNet plant and equipment Total assets 2005 2004 $3,600.0 $3,000.0 $3,060.0 $2,550.0 $540.0 $450.0 90.0 75.0 $450.0 $375.0 65.0 60.0 $385.0 $315.0 154.0 126.0 $231.0 $189.0 $15.0 $13.0 2005 2004 $ 36.00 $ 30.00 $ 340.00 $ 250.00 $ 457.00 $ 351.00 $ 833.00 $ 631.00 $ 1,065.00 $ 825.00 $ (165.00) $ (75.00) $ 900.00 $ 750.00 $ 1,733.00 $ 1,381.00 $ 324.00 $ 270.00 $ 201.00 $ 155.00 $ 216.00 $ 180.00 $ 741.00 $ 605.00 $ 450.00 $ 450.00 $ 1,191.00 $ 1,055.00 $ 150.00 $ 150.00 $ 392.00 $ 176.00 $ 542.00 $ 326.00 $ 1,733.00 $ 1,381.00…The following are the financial statement Quick Ltd. for the year ended 31st December 2020: Quick Ltd. Income statement For year ended 31st December 2020 $”000” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) Profit before tax 150.00 Tax (70.00) Profit after tax 80.00 Quick Ltd. Statement of financial position as at 31 December 2020 2019 $”000” $”000d” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities: Loan 85 25…

- Consider the following financial information and answer the questions that follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000You are required to:iv) Calculate the cash flow from assetsv) Calculate net capital spendingvi) Calculate change in NWCProblem BPeter Senen Corporation provided the following account balances as of September 30, 2020: CashP112,000 Accumulated depreciationP 36,000Accounts Receivable64,000Accounts payable 40,000Finished Goods48,000Income tax payable9,000Work in process 36,000 Share Capital500,000Raw materials 52,000 Retained Earnings207,000Property and Equipment480,000The following transactions occurred during October:1. Materials purchased on account, P150,0002. Materials issued to production: direct materials- P90,000, Indirect materials- P10,000.3. Payroll for the month of October 2020 consisted of the following (also paid during the month):Direct labor P62,000Administrative salariesP16,000Indirect Labor 20,000Sales salaries 30,000Payroll deductions were as follows:Withholding taxes P19,800Phil health contributions P2,000SSS contributions 7,100HDMF contributions 2,0004. Employer contributions for the month were accrued:FactorySellingAdministrativeSSS contributionsP5,700P2,000P1,100Philhealth…Prepare an income statement with the information listed below: Accumulated Depreciation $ 35,000Accounts Payable $ 65,000Advertising Expense $ 20,625Prepaid Advertising $ 61,875Common Stock $ 50,000Depreciation Expense $ 12,500Dividend Payable $ 50,000Dividends $ 100,000Income Tax expense $ 48,000Income Tax Payable $ 35,000Interest Expense $ 3,750Interest Revenue $ 500Loss on Disposal of Assets $ 10,000Prepaid Rent $ 56,250Rent Expense $ 18,750Retained Earnings $ 836,875Sales Revenue $ 300,000Utilities Expense $ 8,750Utilities Payable $ 7,000Wage Expense $ 41,250Wages Payable $ 10,125

- Consider the following financial information and answer the questionsthat follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWC PLEASE SHOW WORKINGConsider the following financial information and answer the questionsthat follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCConsider the following financial information and answer the questionsthat follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 Calculate change in NWC

- The following are the financial statement Kin Ltd. for the year ended 31 March 2020: Kin Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 Kin Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities:…he condensed balance sheet and income statement data for SymbiosisCorporation are presented below.SYMBIOSIS CORPORATIONBalance SheetsDecember 312014 2013 2012Cash $ 30,000 $ 24,000 $ 20,000Accounts receivable (net) 110,000 48,000 48,000Other current assets 80,000 78,000 62,000Investments 90,000 70,000 50,000Plant and equipment (net) 503,000 400,000 360,000$813,000 $620,000 $540,000 Current liabilities $ 98,000 $ 75,000 $ 70,000Long-term debt 130,000 75,000 65,000Common stock, $10 par 400,000 340,000 300,000Retained earnings 185,000 130,000 105,000$813,000 $620,000 $540,000SYMBIOSIS CORPORATIONIncome StatementsFor the Years Ended December 312014 2013Sales revenue $800,000 $750,000Less: Sales returns and allowances 40,000 50,000Net sales 760,000 700,000Cost of goods sold 420,000 406,000Gross profit 340,000 294,000Operating expenses (including income taxes) 230,000 209,000Net income $110,000 $ 85,000Additional information:1. The market price of Symbiosis common stock was $5.00, $3.50, and…Consider the following financial information and answer the questions that follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 1) Calculate the cash flow from assets 2) Calculate net capital spending 3) Calculate change in NWC PLEASE TYPE AS OPPOSED TO WRITING ON PAPER. I MIGHT NOT UNDERSTAND THE HAND WRITING. PLEASE DO EACH QUESTION SEPARATELY. I HAVE ASKED THIS QUESTION MULTIPLE TIMES BECAUSE I COULD NOT UNDERSTAND THE RESPONSE. THANK YOU