Concept explainers

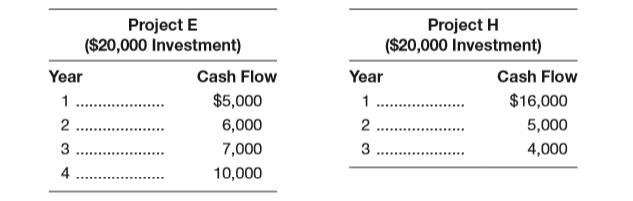

Keller Construction is considering two new investments. Project E calls for the purchase of earthmoving equipment. Project H represents an investment in a hydraulic lift. Keller wishes to use a

a. Determine the net present value of the projects based on a zero percent discount rate.

b. Determine the net present value of the projects based on a 9 percent discount rate.

c. The

d. If the two projects are not mutually exclusive, what would your acceptance or rejection decision be if the cost of capital (discount rate) is 8 percent? (Use the net present value profile for your decision; no actual numbers are necessary.)

e. If the two projects are mutually exclusive (the selection of one precludes the selection of the other), what would be your decision if the cost of capital is (1) 6 percent, (2) 13 percent, (3) 18 percent? Once again, use the net present value profile for your answer.

a.

To calculate: The NPV of the projects by using zero discount rate for Keller Construction Company.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the PV of cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Answer to Problem 23P

The NPV of the project E is $8,000 and project H is $5,000 based on zero discount rate for Keller Construction Company.

Explanation of Solution

The calculation of NPV of project E:

The calculation of NPV of project H:

Working Notes:

The calculation of inflows for project E:

The calculation of inflows for project H:

b.

To calculate: The NPV of the projects by using 9% discount rate for Keller Construction Company.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the PV of cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 23P

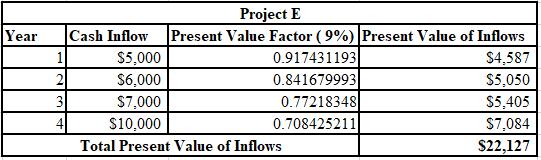

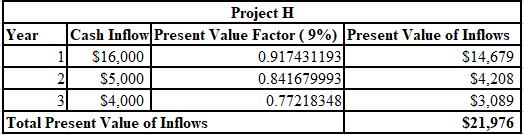

The calculation of PV of inflows for Project E at 9%:

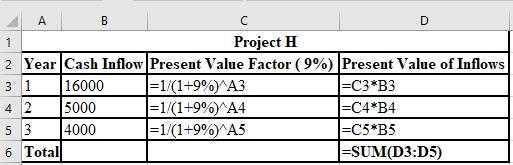

The calculation of PV of inflows for Project H at 9%:

Thus, the NPV of project E is $2,127 and project H is $1,976.

Explanation of Solution

The calculation of NPV of project E:

The calculation of NPV of project H:

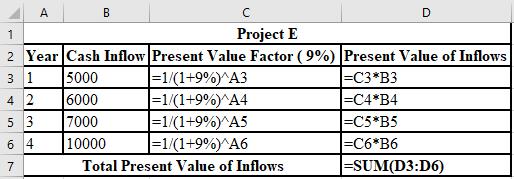

The formulae used for the calculation of PV of inflows for Project E:

The formulae used for the calculation of PV of inflows for Project E:

c.

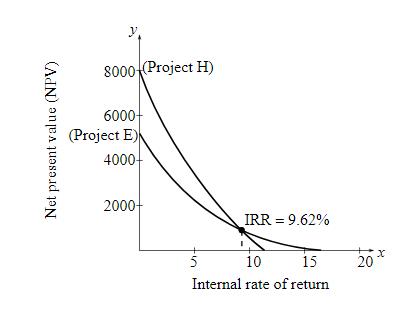

To plot: The graph for the NPV of the project according to the Fig. 12-3 for the Keller Construction Company.

Introduction:

Internal rate of return (IRR):

A method of capital budgeting that is used to measure the profitability of potential projects or investments. It is a discount that makes the NPV equals to zero for a specific project.

Answer to Problem 23P

The graph for the NPV of the project according to the Fig. 12-3 for the Keller Construction Company:

Explanation of Solution

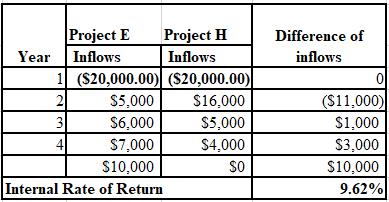

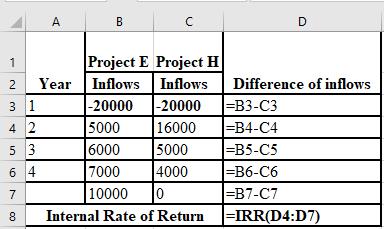

Calculation of IRR:

Working Note:

The formulae used in the calculation of IRR:

d.

To determine: The decision regarding the acceptance or the rejection of the projects, if the projects are mutually exclusive and discount rate of the cost of capital is 8% for the Keller Construction Company.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the PV of cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 23P

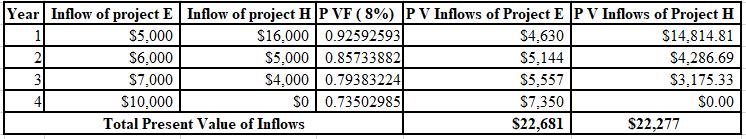

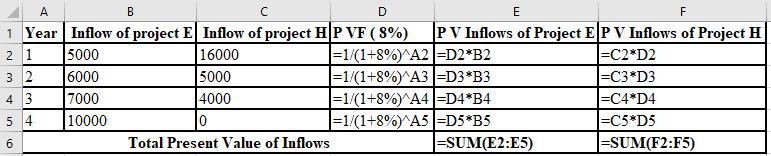

The calculation of PV of project E and project H at 8%:

The NPV of project E is $2,681 and project H is $2,277. Thus, the NPV of project E is higher than the project H. Therefore, project E must be accepted as it is more profitable than the project H.

Explanation of Solution

The calculation of NPV of project E:

The calculation of NPV of project H:

The formulae used in the calculation of PV of project E and H at 8% are shown below:

e.

To determine: The decision regarding the acceptance or rejection of the projects, if the projects are mutually exclusive and discount rates of cost of capital are 6%, 13%, and 18% for the Keller Construction Company.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the PV of cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Answer to Problem 23P

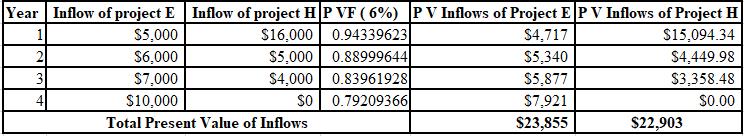

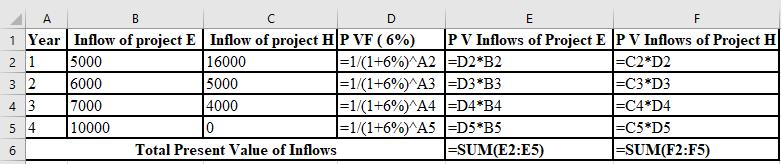

The calculation of PV of project E and project H at 6%:

The NPV of project E is $3,855 and project H is $2,903. Thus, the NPV of project E is higher than the project H, So, project E must be accepted at 6% discount rate as it is superior to the project H.

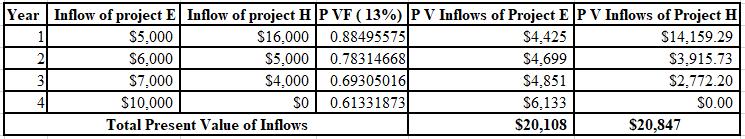

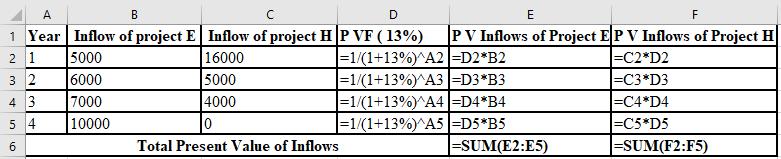

The calculation of PV of project E and project H at 13%:

The NPV of project E is $108 and project H is $847. Thus, the NPV of project H is higher than the project E, So, project H must be accepted at 13% discount rate as it is superior to the project E.

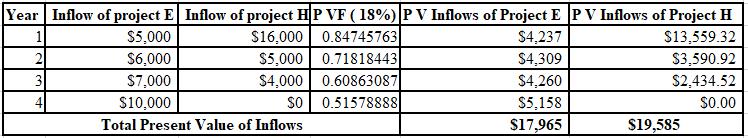

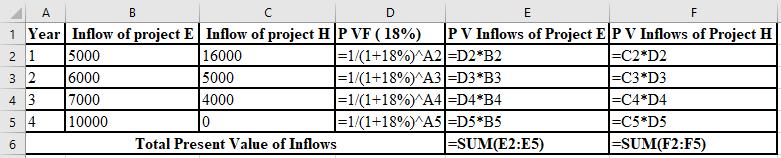

The calculation of PV of project E and project H at 18%:

The NPV of project E is ($2,035) and project H is ($415). Thus, both projects must be rejected at 18% discount rate as NPV of both projects are negative.

Explanation of Solution

The calculation of NPV of project E at 6%:

The calculation of NPV of project H at 6%:

The calculation of NPV of project E at 13%:

The calculation of NPV of project H at 13%:

The calculation of NPV of project E at 18%:

The calculation of NPV of project H at 18%:

The formulae used in the calculation of PV of project E and H at 6% are shown below:

The formulae used in the calculation of PV of project E and H at 13% are shown below:

The formulae used in the calculation of PV of project E and H at 18% are shown below:

Want to see more full solutions like this?

Chapter 12 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardThe management of Ryland International Is considering Investing in a new facility and the following cash flows are expected to result from the investment: A. What Is the payback period of this uneven cash flow? B. Does your answer change if year 6s cash inflow changes to $920,000?arrow_forwardSan Lucas Corporation is considering investment in robotic machinery based upon the following estimates: a. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 700,000. Use the present value tables appearing in Exhibits 2 and 5 of this chapter. b. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 500,000, 700,000, and 900,000. Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer. c. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 10%. Round to the nearest dollar. d. Interpret the results of parts (a), (b), and (c).arrow_forward

- The management of Kawneer North America is considering investing in a new facility and the following cash flows are expected to result from the investment: A. What is the payback period of this uneven cash flow? B. Does your answer change if year 10s cash inflow changes to $500,000?arrow_forwardClearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows: The companys capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals. Instructions 1. Compute the cash payback period for each of the four proposals. 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. Round to one decimal place. 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected. 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value table appearing in Exhibit 2 of this chapter. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forwardAssume Home Garden Inc. in MAD 26-5 assigns the following probabilities to the estimated construction cost of the warehouse and annual net cash flows: a. Compute the expected value of the construction cost. b. Compute the expected value of the annual net cash flows. c. Determine the expected net present value of building the distribution warehouse, assuming a desired rate of return of 14% and using the expected values computed in parts (a) and (b). Use the present value tables provided in Appendix A. Round to the nearest dollar. d. Based on your results in part (c), should Home Garden Inc. build the distribution warehouse?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,