College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 3PA

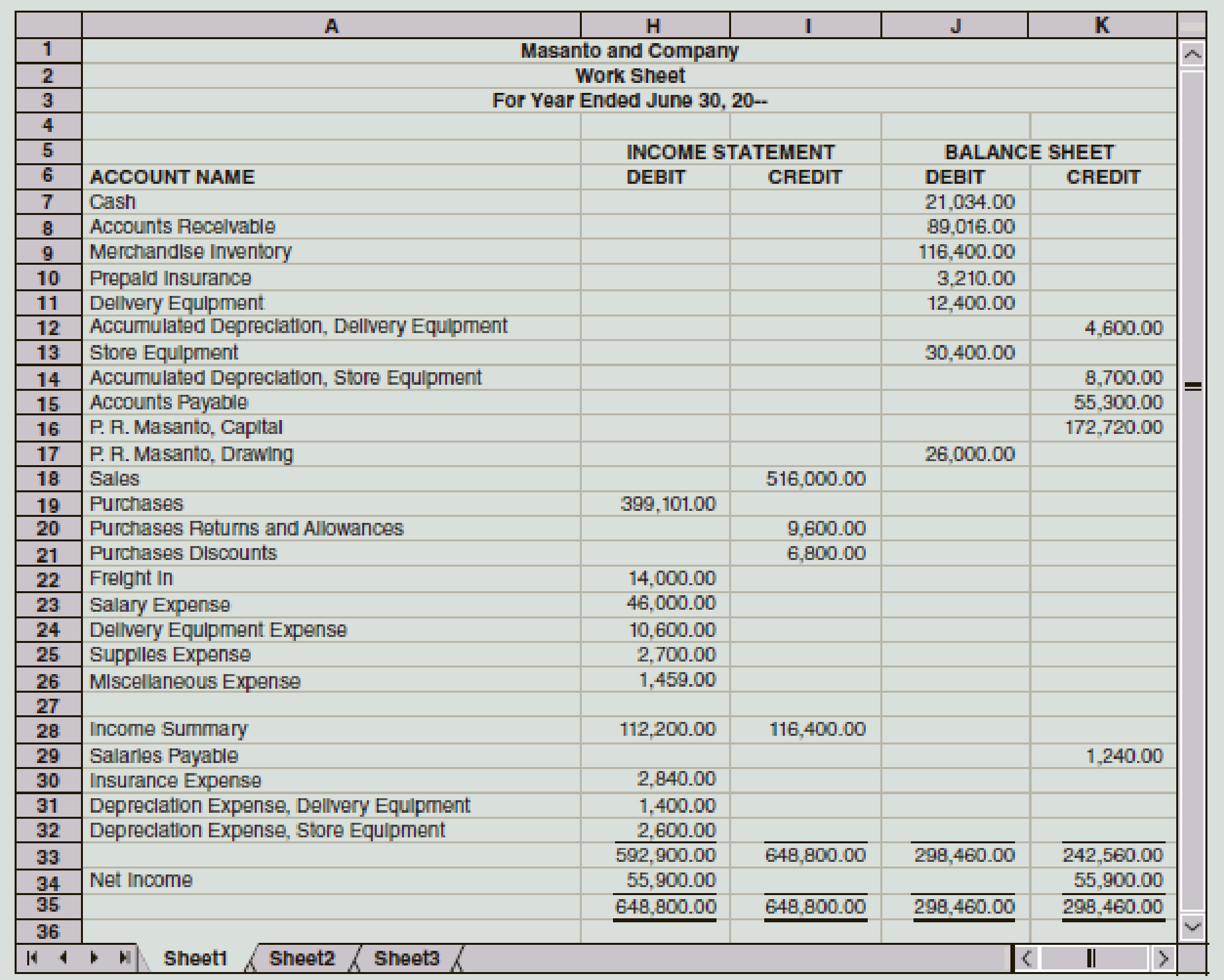

The following partial work sheet covers the affairs of Masanto and Company for the year ended June 30.

Required

- 1. Journalize the six

adjusting entries . - 2. Journalize the closing entries.

- 3. Journalize the reversing entry as of July 1, for the salaries that were accrued in the June adjusting entry.

Check Figure

Reversing entry amount, $1,240

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 12 Solutions

College Accounting (Book Only): A Career Approach

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Identify each of the following items relating to...Ch. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - It is now August 31. You have journalized and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals Of Financial Accounting

Calculate profit margin on sales ratio. (LO 5). Suppose a firm had sales of $200,000 and net income of $7,000 f...

Financial Accounting

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following partial work sheet covers the affairs of Ketcher and Company for the year ended June 30. Required 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accrued in the June adjusting entry. Check Figure Reversing entry amount, 1,645arrow_forwardThe trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forward

- The trial balance of Clayton Cleaners for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 800. b. Depreciation expense on equipment, 2,700. c. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). d. Supplies remaining at the end of month, 230. Required 1. Complete a work sheet. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardThe trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardOn July 1, a client paid an advance payment (retainer) of $5,000 to cover future legal services. During the period, the company completed $3,500 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the information provided, A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forward

- The trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardOn September 1, a company received an advance rental payment of $12,000, to cover six months rent on an office building. There was no beginning balance in the Unearned Rent account for the period. Based on the information provided, A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY