College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 7E

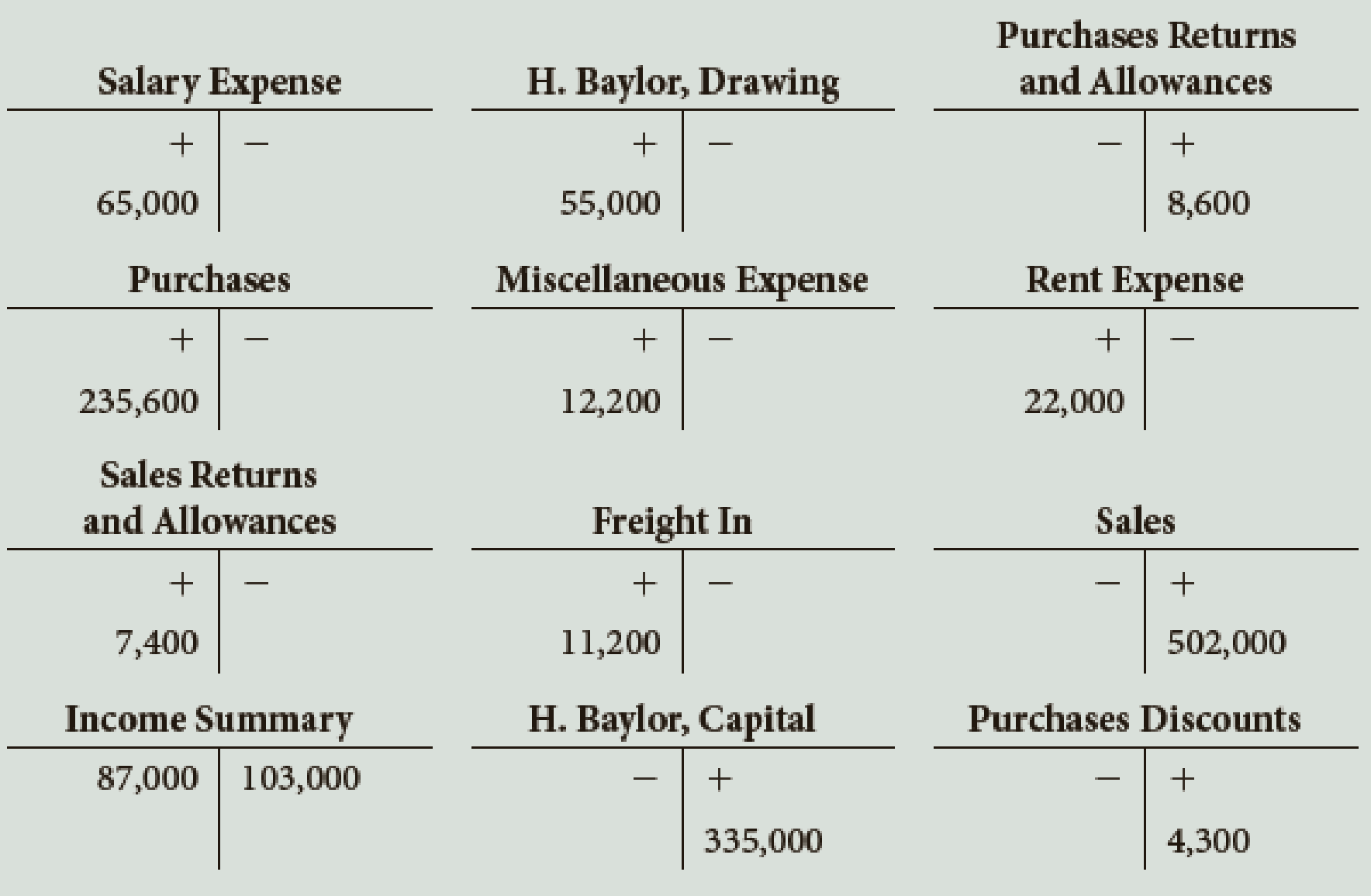

From the following T accounts, journalize the closing entries dated December 31 for Baylor Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 12 Solutions

College Accounting (Book Only): A Career Approach

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Identify each of the following items relating to...Ch. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - It is now August 31. You have journalized and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As of December 31, the end of the current year, the ledger of Harris Company contained the following account balances after adjustment. All accounts have normal balances. Journalize the closing entries.arrow_forwardReconstruction of Closing Entries The following T accounts summarize entries made to selected general ledger accounts of Cooper $ Company. Certain entries, dated December 31, are closing entries. Prepare the closing entries that were made on December 31.arrow_forwardCLOSING JOURNAL ENTRIES Prepare closing journal entries for Koehn Company for the year ended December 31. Data for the closing entries are as follows:arrow_forward

- Closing entries On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture retailer, are as follows: Prepare the July 31 closing entries for Serbian Interiors Company.arrow_forwardThe Income Statement columns of the work sheet of Cederblom Company for the fiscal year ended December 31 follow. During the year, S. Cederblom withdrew 17,000. Journalize the closing entries.arrow_forwardThe Income Statement columns of the work sheet of Redfax Company for the fiscal year ended December 31 follow. During the year, D. Redfax withdrew 12,000. Journalize the closing entries.arrow_forward

- The Income Statement columns of the work sheet of Dunn Company for the fiscal year ended June 30 follow. During the year, K. Dunn withdrew 4,000. Journalize the closing entries.arrow_forwardThe following partial work sheet covers the affairs of Ketcher and Company for the year ended June 30. Required 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accrued in the June adjusting entry. Check Figure Reversing entry amount, 1,645arrow_forwardBased on the data presented in Exercise 6-25, journalize the closing entries. On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forward

- The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:arrow_forwardADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Baldwin Company is shown on the next page. Data for adjusting the accounts are as follows: REQUIRED 1. Prepare the December 31 adjusting journal entries for Baldwin Company. 2. Prepare the December 31 closing journal entries for Baldwin Company. 3. Prepare the reversing journal entries as of January 1, 20-2, for Baldwin Company.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY