1.

Prepare the transaction in the sales journal, cash receipts journal and general journal and verify the total column and rule the column.

1.

Explanation of Solution

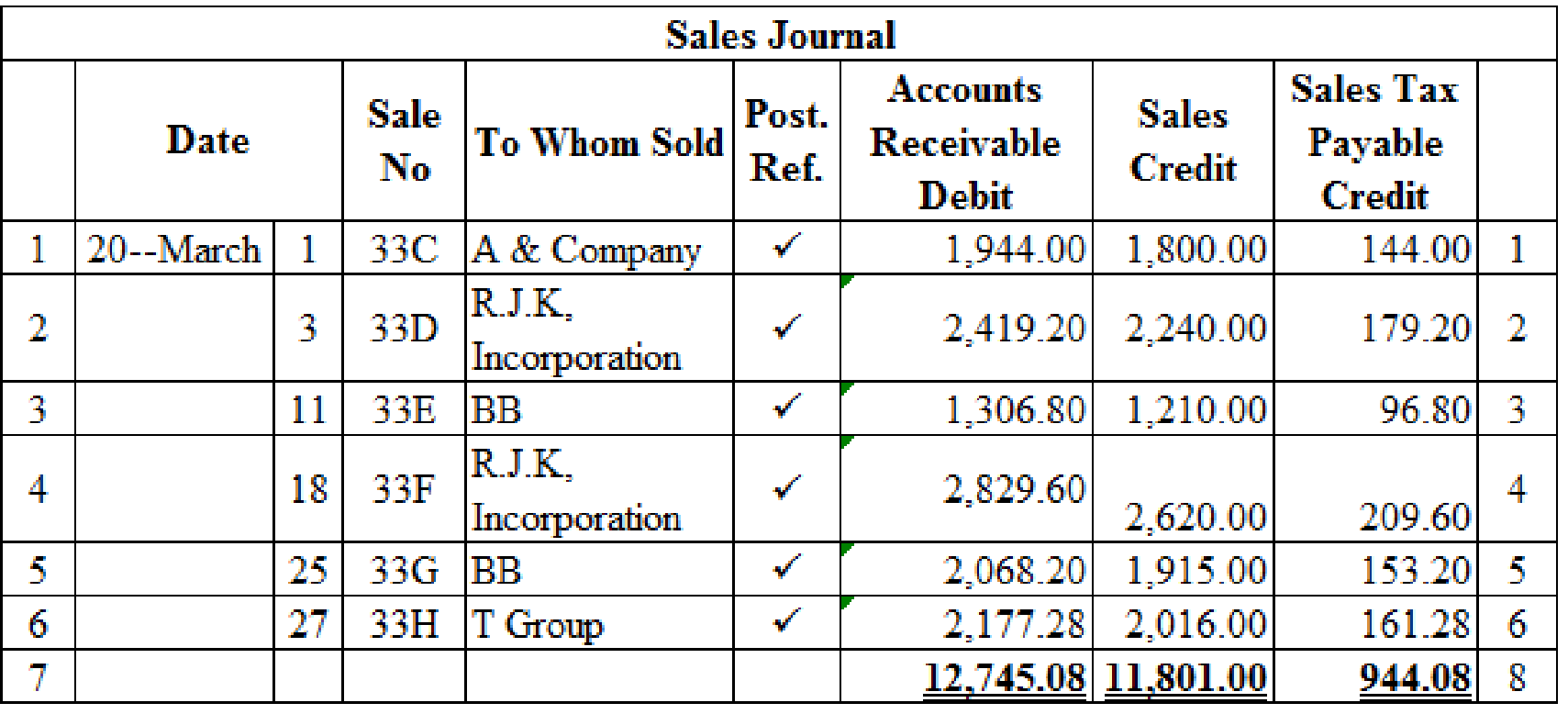

Sales Journal

Sales journal is one form of special journal book, which records all the sales transactions that are sold to customers on credit. In a single column sales journal, debit aspect of accounts receivable and credit aspect of inventory are recorded, and then posted to individual subsidiary customer account.

Prepare the given transaction in a sales journal and verify the total column and rule the column:

Table (1)

Working note 1:

Calculate the amount of accounts receivable (debit) on dated 1st March:

Working note 2:

Calculate the amount of accounts receivable (debit) on dated 3rd March:

Working note 3:

Calculate the amount of accounts receivable (debit) on dated 11th March:

Working note 4:

Calculate the amount of accounts receivable (debit) on dated 18th March:

Working note 5:

Calculate the amount of accounts receivable (debit) on dated 25th March:

Working note 6:

Calculate the amount of accounts receivable (debit) on dated 27th March:

Verification of total debit and credit column:

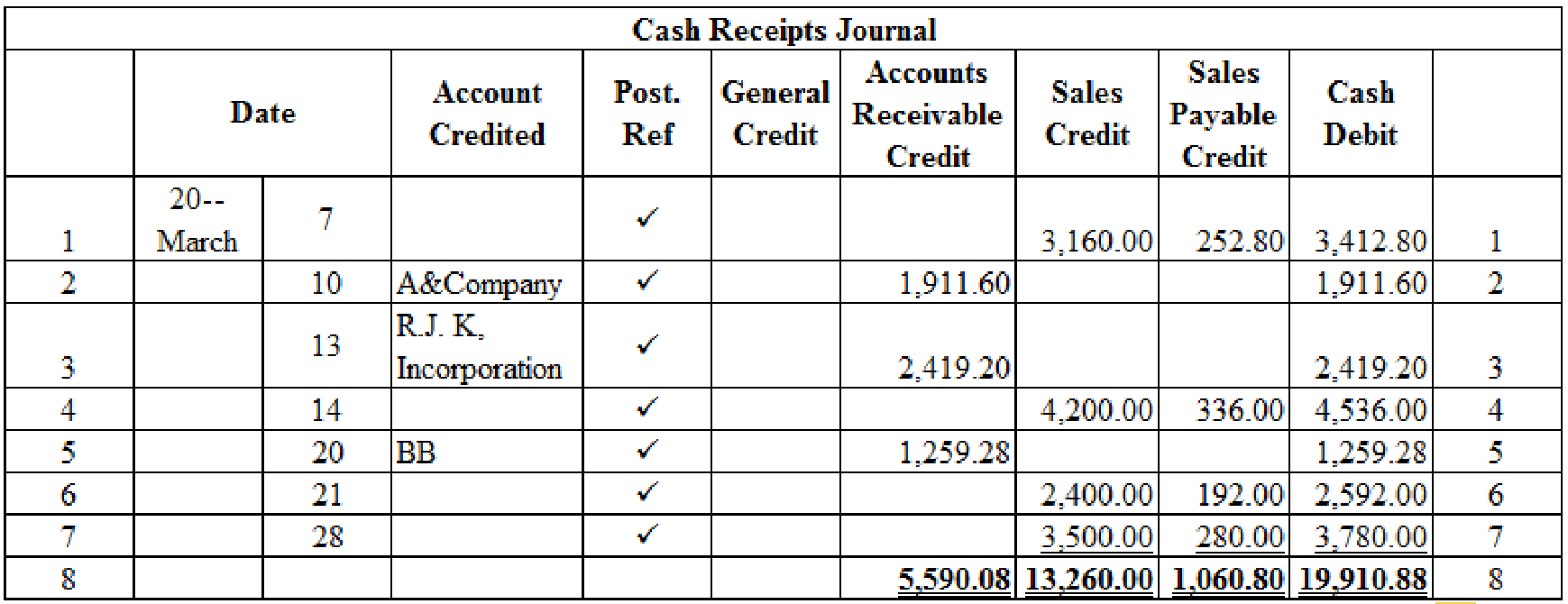

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column:

Table (2)

Working note 1:

Calculate the amount of cash on dated 7th March:

Working note 2:

Calculate the amount of cash on dated 14th March:

Working note 3:

Calculate the amount of cash on dated 21st March:

Working note 4:

Calculate the amount of cash on dated 28th March:

Verification of total debit and credit column:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on March 5:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| March | 5 | Sales Returns and Allowances | 401.1 | 30.00 | ||

| Sales Tax Payable | 231 | 2.40 | ||||

| Accounts Receivable, A &Company | 122/✓ | 32.40 | ||||

| (Record merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A &Company is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note:

Compute sales tax payable amount.

Transaction on March 16:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| March | 16 | Sales Returns and Allowances | 401.1 | 44.00 | ||

| Sales Tax Payable | 231 | 3.52 | ||||

| Accounts Receivable, BB | 122/✓ | 47.52 | ||||

| (Record merchandise returned) | ||||||

Table (4)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, BB is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 1:

Compute sales tax payable amount.

Working note 2:

Compute accounts receivable amount.

2.

Post the prepared journals to the general ledger, and the accounts receivable ledger accounts.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 1 | Balance | ✓ | 9,741.00 | |||

| 31 | CR9 | 19,910.88 | 29,651.88 | ||||

Table (5)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 1 | Balance | ✓ | 1,058.25 | |||

| 5 | J5 | 32.40 | 1,025.85 | ||||

| 16 | J5 | 47.52 | 978.33 | ||||

| 31 | S6 | 12,745.08 | 13,723.41 | ||||

| 31 | CR9 | 5,590.08 | 8,133.33 | ||||

Table (6)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 5 | J5 | 2.40 | 2.40 | |||

| 16 | J5 | 3.52 | 5.92 | ||||

| 31 | S6 | 944.08 | 938.16 | ||||

| 31 | CR9 | 1,060.80 | 1,998.96 | ||||

Table (7)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 31 | S6 | 11,801.00 | 11,801.00 | |||

| 31 | CR9 | 13,260.00 | 25,061.00 | ||||

Table (8)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 5 | J5 | 30.00 | 30.00 | |||

| 16 | J5 | 44.00 | 74.00 | ||||

Table (9)

Post the journals to the accounts receivable ledger:

| NAME Corporation A & Company | ||||||

| ADDRESS 1424 J Creek Road, N, In 47448-2245 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 1 | S6 | 1,944.00 | 1,944.00 | ||

| 5 | J5 | 32.40 | 1,911.60 | |||

| 10 | CR9 | 1,911.60 | 0 | |||

Table (10)

| NAME BB | ||||||

| ADDRESS 6422 E. B Road, B, In 47401-7756 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 11 | S6 | 1,306.80 | 1,306.80 | ||

| 16 | J5 | 47.52 | 1,259.28 | |||

| 20 | CR9 | 1,259.28 | 0 | |||

| 25 | S6 | 2,068.20 | 2,068.20 | |||

Table (11)

| NAME RJ Incorporation | ||||||

| ADDRESS 3315 l Avenue, B, in 47401-7223 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 3 | S6 | 2,419.20 | 2,419.20 | ||

| 13 | CR9 | 2,419.20 | 0 | |||

| 18 | S6 | 2,829.60 | 2,829.60 | |||

Table (12)

| NAME T Group | ||||||

| ADDRESS 2300 E. National Road, Cd, IN 46229-4824 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 1 | Balance | ✓ | 1,058.25 | ||

| 27 | S6 | 2,177.28 | 3,235.53 | |||

Table (13)

Want to see more full solutions like this?

Chapter 12 Solutions

College Accounting, Chapters 1-27

- Screpcap Co. had the following transactions during the first week of June: June 1Purchased merchandise on account from Acme Supply, 2,700, plus freight charges of 160. 1Issued Check No. 219 to Denver Wholesalers for merchandise purchased on account, 720, less 1% discount. 1Sold merchandise on account to F. Colby, 246, plus 5% state sales tax plus 2% city sales tax. June 2Received cash on account from N. Dunlop, 315. 2Made cash sale of 413 plus 5% state sales tax plus 2% city sales tax. 2Purchased merchandise on account from Permon Co., 3,200, plus freight charges of 190. 3Sold merchandise on account to F. Ayres, 211, plus 5% state sales tax plus 2% city sales tax. 3Issued Check No. 220 to Ellis Co. for merchandise purchased on account, 847, less 1% discount. 3Received cash on account from F. Graves, 463. 4Issued Check No. 221 to Penguin Warehouse for merchandise purchased on account, 950, less 1% discount. 4Sold merchandise on account to K. Stanga, 318, plus 5% state sales tax plus 2% city sales tax. 4Purchased merchandise on account from Mason Milling, 1,630, plus freight charges of 90. 4Received cash on account from O. Alston, 381. 5Made cash sale of 319 plus 5% state sales tax plus 2% city sales tax. 5Issued Check No. 222 to Acme Supply for merchandise purchased on account, 980, less 1% discount. Required 1. Record the transactions in a general journal. 2. Assuming these are the types of transactions Screpcap Co. experiences on a regular basis, design the following special journals for Screpcap: (a) Sales journal (b) Cash receipts journal (c) Purchases journal (d) Cash payments journalarrow_forwardSALES TRANSACTIONS J. K. Bijan owns a retail business and made the following sales on account during the month of August 20--. There is a 6% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardThe following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forward

- SALES TRANSACTIONS T. M. Maxwell owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forwardSALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. REQUIRED 1. Record the transactions starring on page 7 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3Received cash from J. Smith in payment of June 29 invoice of 350, less cash discount. 6Issued Ck. No. 1718, 742.50, to Designer, Inc., for invoice. no. 2256, recorded previously for 750, less cash discount of 7.50. July 9Sold merchandise in the amount of 250 on a credit card. Sales tax on this sale is 6%. The credit card fee the bank deducted for this transaction is 5. 10Issued Ck. No. 1719, 764.40, to Smart Style, Inc., for invoice no. 1825, recorded previously on account for 780. A trade discount of 25% was applied at the time of purchase, and Smart Style, Inc.s credit terms are 2/10, n/30. 12Received 180 cash in payment of June 20 invoice from R. Matthews. No cash discount applied. 18Received 1,575 cash in payment of a 1,500 note receivable and interest of 75. 21Voided Ck. No. 1720 due to error. 25Received and paid utility bill, 152; Ck. No. 1721, payable to City Utilities Company. 31Paid wages recorded previously for the month, 2,586, Ck. No. 1722. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forwardReview the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.arrow_forwardCASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- Bell Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Bells sales staff fills out a sales slip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists charge sales for March: Mar. 4Sold potted plant on account to C. Morales, sales slip no. 242, 27, plus sales tax of 1.35, total 28.35. 6Sold floral arrangement on account to R. Dixon, sales slip no. 267, 54, plus sales tax of 2.70, total 56.70. 12Sold corsage on account to B. Cox, sales slip no. 279, 16, plus sales tax of 0.80, total 16.80. 16Sold wreath on account to All-Star Legion, sales slip no. 296, 104, plus sales tax of 5.20, total 109.20. 18Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, 260, plus sales tax of 13, total 273. 21Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a 30 credit plus sales tax of 1.50, credit memo no. 27. 23Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, 180, plus sales tax of 9, total 189. 24Allowed Price Savings and Loan Association credit, 25, plus sales tax of 1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance of the Accounts Receivable controlling account.arrow_forwardPrepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.arrow_forwardSmith Company is required to charge customers an 8% sales tax on all goods it sells. At the time of sale, Smith includes the combined amount of both sales and sales tax in the sales account. At the end of May, Smiths sales account for May has a credit balance of 540,000. Prepare the sales tax adjusting journal entry for the end of May.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College