Accounting Alternatives and Financial Analysis

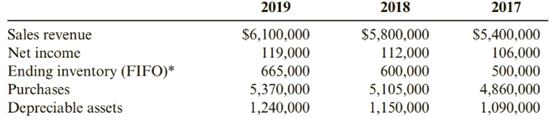

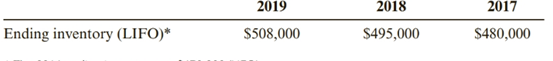

Lemon Automobiles has asked your bank for a $100,000 loan to expand its sales facility. Lemon provides you with the following data:

Your inspection of the financial statements of other automobiles sales firms indicates that most of these firms adopted the LIFO method in the late 1970s. You further note that Lemon has used 5% of

Required:

1. Compute cost of goods sold for 2017-2019. using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Lemon for 20l72019. using both 5% and 10% of the cost of depreciable assets.

3. Recompute Lemon’s net income for 2017--2019. using LIFO and JOY0 depreciation. (Don’t forget the tax impact of the increases in cost of goods sold and depreciation expense.,)

4. CONCEPTUAL CONNECTION Explain whether Lemon appears to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and 5% (rather than 10%) depreciation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Cornerstones of Financial Accounting

- Income Taxes and Net Present Value Analysis Winthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a piece of equipment for $130,000. The equipment would have a useful life of five years and zero salvage value. It would be depreciated for financial reporting and tax purposes using the straight-line method. After careful study, Winthrop estimated the following annual costs and revenues for the new product: The company’s tax rate is 30% and its after-tax cost of capital is 15%. Required: 1. Calculate the annual income tax expense that will arise as a result of this investment. 2. Calculate the net present value of this investment opportunity.arrow_forward. Ryan Alcoa, a new associate at Jonas Partners, has compiled the following data for a potential investment for the firm: Investment: $300,000 Annual sales revenues = $180,000 Annual cash costs = $80,000 4-year useful life,no salvage value Jonas Partners faces a 30% tax rate on income and is aware that the tax authorities will only permit straightline depreciation for tax purposes. The firm has an after-tax required rate of return of 8%. Q. Based on net present value considerations, is this a project Jonas Partners would want to take?arrow_forwardSpotless Cleaning Ltd wishes to evaluate an investment on a particular washing machine. In your role as consultant to the company you have collected the following information regarding this machine: Washing Machine Purchase Price 9,800 Life 10 years Annual Maintenance cost 150 Expected Salvage Value 1,000 Once bought, this machine will be depreciated to zero over its life. The company's tax rate is 30%. The company has revenues that are not impacted by the choice of machine against which any losses for tax purposes can be offset. The cost of capital required to finance this project is 8% p.a. compounded annually. 1.What is the net cash flow of this washing machine investment at the start (in Year 0)? 2.What is the net cash flow of this washing machine investment in year 10? 3.Calculate the net present value of the investment opportunity to buy this washing machine.arrow_forward

- The Berndt Corporation expects to have sales of $12 million. Costs other than depreciation are expected to be 70% of sales, and depreciation is expected to be $1.8 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Brendt's federal-plus-state tax rate is 35%. Berndt has no debt. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Set up an income statement. What is Berndt's expected net cash flow? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. Round your answer to the nearest dollar. $ fill in the blank 2 Suppose Congress changed the tax laws so that Berndt's depreciation expenses doubled. No changes in operations occurred. What is Berndt's expected net cash flow? Round your answer to the nearest dollar. $ fill in the…arrow_forward. Ryan Alcoa, a new associate at Jonas Partners, has compiled the following data for a potential investment for the firm: Investment: $300,000 Annual sales revenues = $180,000 Annual cash costs = $80,000 4-year useful life,no salvage value Jonas Partners faces a 30% tax rate on income and is aware that the tax authorities will only permit straightline depreciation for tax purposes. The firm has an after-tax required rate of return of 8%. Q. Jonas Partners use straight-line depreciation for internal accounting and measure investment as the net book value of assets at the start of the year. Calculate the residual income in each year if the project were adopted.arrow_forward. Ryan Alcoa, a new associate at Jonas Partners, has compiled the following data for a potential investment for the firm: Investment: $300,000 Annual sales revenues = $180,000 Annual cash costs = $80,000 4-year useful life,no salvage value Jonas Partners faces a 30% tax rate on income and is aware that the tax authorities will only permit straightline depreciation for tax purposes. The firm has an after-tax required rate of return of 8%.Q. Jonas Partners use straight-line depreciation for internal accounting and measure investment as the net book value of assets at the start of the year. Q.If Ryan Alcoa is evaluated on the residual income of the projects he undertakes, would he take this project? Explain.arrow_forward

- . Ryan Alcoa, a new associate at Jonas Partners, has compiled the following data for a potential investment for the firm: Investment: $300,000 Annual sales revenues = $180,000 Annual cash costs = $80,000 4-year useful life,no salvage value Jonas Partners faces a 30% tax rate on income and is aware that the tax authorities will only permit straightline depreciation for tax purposes. The firm has an after-tax required rate of return of 8%.Q. Jonas Partners use straight-line depreciation for internal accounting and measure investment as the net book value of assets at the start of the year. Q.Demonstrate that the conservation property of residual income, as described on page 900, holds in this example.arrow_forwardConsider the case of Scorecard Corporation: Scorecard Corporation is considering the purchase of new manufacturing equipment with an after-tax cost of $11,250. (The equipment qualifies for 100% bonus depreciation and $11,250 is the investment amount after bonus depreciation has been applied. Since the equipment has been fully depreciated at the time of purchase, there is no annual depreciation expense.) Scorecard can take out a four-year $11,250 loan to pay for the equipment at an interest rate of 3.60%. The loan and purchase agreements will also contain the following provisions: • The annual maintenance expense for the equipment is expected to be $113. • The corporate tax rate for Scorecard is 25%. Based on the preceding information, complete the following tables: Value Annual tax savings from maintenance will be: ? Year 1 Year 2 Year 3 Year 4 Net cash flow ? ? ? ? Thus, the net present value (NPV) cost of owning the asset will be: -$17,524.00…arrow_forwardThe Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000arrow_forward

- Use the spreadsheet to determine the after-tax internal rate of return. For this problem, assumea a 10 year analysis period, straight-line depreciation is used, 21% corporate tax rate , an initial cost of $ 200,000, an annual benefit of $60,000 and no salvage value but instead you must pay a disposal fee of $20,000 that your corporate accountant determined is tax deductible.arrow_forwardNicholas Health Systems recently reported an EBITDA of $25.0 million and net income of $15.8 million. It had $2.0 million of interest expense, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its charge for depreciation and amortization?arrow_forwardUse the information in Problem A-1 to solve this problem. Assume that the van is five-year property for tax purposes. Required Prepare a schedule of depreciation under MACRS. Round figures to the nearest whole dollar. PROBLEM A-1 A delivery van was bought for 18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be 2,000. Check Figure Year 3 depreciation, 3,456arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT