Problem 1 2-93B Accounting Alternatives and Financial Analysis

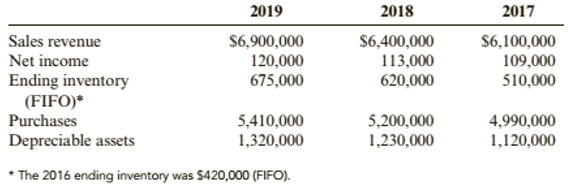

Affordable Autos Inc. has asked your bank for a SlOO.000 loan to expand its sales facility. Affordable Autos provides you with the following data:

Your inspection of the financial statements of other automobiles sales firms indicates that most of these firms adopted the LIFO method in the late 1970s. You further note that Afford able Autos has used 10% of

Required:

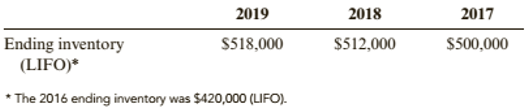

1. Compute cost of goods sold for 2017-2019. using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Affordable Autos for 2017-2019. using both 10% and 20% of the cost of depreciable assets.

3. Recompute Affordable Autos's net income for 2017-2019. using LIFO and 20% depreciation. (Do&t forget the tax impact of the increases in cost of goods sold and depreciation expense.)

4. CONCEPTUAL CONNECTiON Does Affordable Autos appear to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and l0% (rather than 20%) depreciation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Cornerstones of Financial Accounting

- CORNERSTONE 2.1 Cornerstone Exercise 2-16 Qualitative Characteristics Three statements are given below. When financial information is free from error or bias, the information is said to possess this characteristic. Griffin Company uses the same depreciation method from period to period. A trash can that is purchased for $10 is expensed even though it will be used for many years. Required: Give the qualitative characteristic or constraint that is most applicable to each of the statements.arrow_forwardProblem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts. Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) Post your journal entries to the T-accounts. Add additional T-accounts when needed. Use the ending balances in the T-accounts to prepare a trial balance.arrow_forwardProblem 1-583 Arrangement of the Income Statement Parker Renovation Inc. renovates historical buildings for commercial use. During 2019. Parker had $763,400 of revenue from renovation services and $5,475 of interest income from miscellaneous investments. Parker incurred $222,900 of wages expense $135,000 of depreciation expense, $65,850 of insurance expense, $109,300 of utilities expense, $31,000 of miscellaneous expense, and $61,400 of income taxes expense. Required: Prepare a single-step income statement for Parker for 2019.arrow_forward

- Multiple choice: 1. Which of the following would result to total expenses of ₱480,000? A. Total income of ₱630,000 and profit of ₱150,000 B. Total income of ₱630,000 and loss of ₱150,000 C. Total income of ₱360,000 and profit ₱120,000 D. Total income of ₱580,000 and loss of ₱100,000 2. In accounting, it means the allocation of the cost of an asset over the periods in which the asset is used. A. Bad debts B. Allocationing C. Cost spreading D. Depreciationarrow_forwardProblem 3.7 The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2011: sales of $1,272,973, costs of goods sold of $720,878.62, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has a tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25)arrow_forward2-2B. (Review offinancial statements) Prepare a balance sheet and income statement as of December 31, 2003, for the Sabine Mfg. Co. from the following list of items. Ignore income taxes and interest expense. Accounts receivable $150,000 Machinery and equipment 700,000 Accumulated depreciation 236,000 Notes payable---eurrent 90,000 Net sales 900,000 Inventory 110,000 Accounts payable 90,000 Long-term debt 160,000 Cost of goods sold 550,000 Operating expenses 280,000 Common stock 320,000 Cash 90,000 Retained earnings-prior year ? Retained earnings---current year ?arrow_forward

- Question 2 Base Company carried out the following transactions during Years 1 to Year 6. Year 1: January 1: Purchased equipment for $120,000 cash. It has a 10-year life, a $20,000 residual value, and will be depreciated using the straight-line method. January 1: Purchased land for $280,000 cash. October 31: Borrowed $340,000 from the bank by issuing a three-month 9% note. December 31: Accrued interest on the note of October 31. You can round to the nearest full month. December 31: A pending product liability lawsuit will more likely than not be lost. A reasonable estimate of the loss is $50,000. We accrued the contingency. December 31: Journalized depreciation on the equipment. Year 2: January 31: Repaid the October 31 note plus interest. Year 6: July 10: Traded our land (acquired in Year 1) plus $60,000 cash for a small airplane. The airplane has a market value of $380,000. September 20: Sold the equipment for $52,000 cash. Depreciation expense for Years 2…arrow_forwardEXERCISE 6: CALCULATING ROA USING THE DUPONT FINANCIAL SYSTEM The following accounts are included in Eva's retail store financial statements: Cost of sales Administrative expenses Prepaid expenses Inventories Depreciation/amortization Cash Trade receivables Revenue Non-current assets Distribution costs $2,300,000 170,000 60,000 300,000 25,000 25,000 250,000 3,000,000 1,700,000 200,000 170 Questions 1. Calculate her ROA by using the DuPont financial system. 2. What impact would there be on the ROA if the revenue account changed to $3,200,000?arrow_forwardQuestion 3A businessman has bought the following items for his business uses: Machinery RM100,000Computers RM50,000Pen RM10A4 paper rim RM15Printer cartridge RM20 Required: (iii) State an accounting concept whichever applicable that requires an accounting adjustment in the presentation of financial statements.arrow_forward

- Question 1Land is purchased by making a cash down payment of $40,000 and signing a note payable for the balance of $130,000. The journal entry to record this transaction in the accounting records of the purchaser includes:a)A credit to Land for $40,000.b)A debit to Cash for $40,000.c)A debit to Land for $170,000.d)A debit to Note Payable for $130,000. Qestion 2The accounting principle that assumes that a company will operate in the foreseeable future is:a)Going concern.b)Objectivity.c)Liquidity.d)Disclosure. Question 3Total assets must always equal total liabilities plus total owners' equity.a)True b)False Question 4In which of the following situations would the largest amount be recorded as an expense of the current year? (Assume accrual basis accounting.)a)$4,000 is paid in January for equipment with a useful life of four years.b)$1,800 is paid in January for a two-year fire insurance policy.c)$1,200 cash dividends are declared and paid.d)$900 is paid to an attorney for legal…arrow_forwardQuestion 6 a) Ibu Mertuaku Berhad manufactures paper boxes. The company closes its accounts annually on 31 May, and in its year ended 31 May 2022, the company acquired the following assets: A lorry was acquired under a hire purchase scheme and the relevant details are as follows: A heavy machine was acquired for RM3,000 and used in the company. A reconditioned van was acquired for RM130,000 to transport their management team. The van was not licensed as a commercial vehicle. On 3 October 2022, the company bought a folding machine for RM120,000. Required: a)Compute the total capital allowances claimable by Ibu Mertuaku Berhad for the above assets for the year of assessment 2022.arrow_forwardLearning Case #3 Chapter 3 THIS IS A CONTINUATION OF LC 2B. Hawking, Inc. had the following activities occur in the current year: 6. Purchased $189,000 of inventory on account. 7. Earned $536,000 worth of sales revenue, receiving 85% in cash. 8. Incurred selling expenses of $210,000, paying half in cash and still owing the rest. 9. Incurred $33,000 in interest expense to be paid at the beginning of next year. Required a) Show the effects of the above transactions on the accounting equation. Use the transaction number for the date. b) Prepare journal entries for each transaction. c) Post journal entries to the general ledger/T-accounts, summarize accounts, and find balances. d) Prepare an unadjusted trial balance. e) Match your numbers to the prepared financial statements: Income Statement, Retained Earnings Statement, and Balance Sheet. Chapter 3 Learning CaseAnalyzing TransactionsDate Assets Liaiblities Stockholder's Equity…arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning