Concept explainers

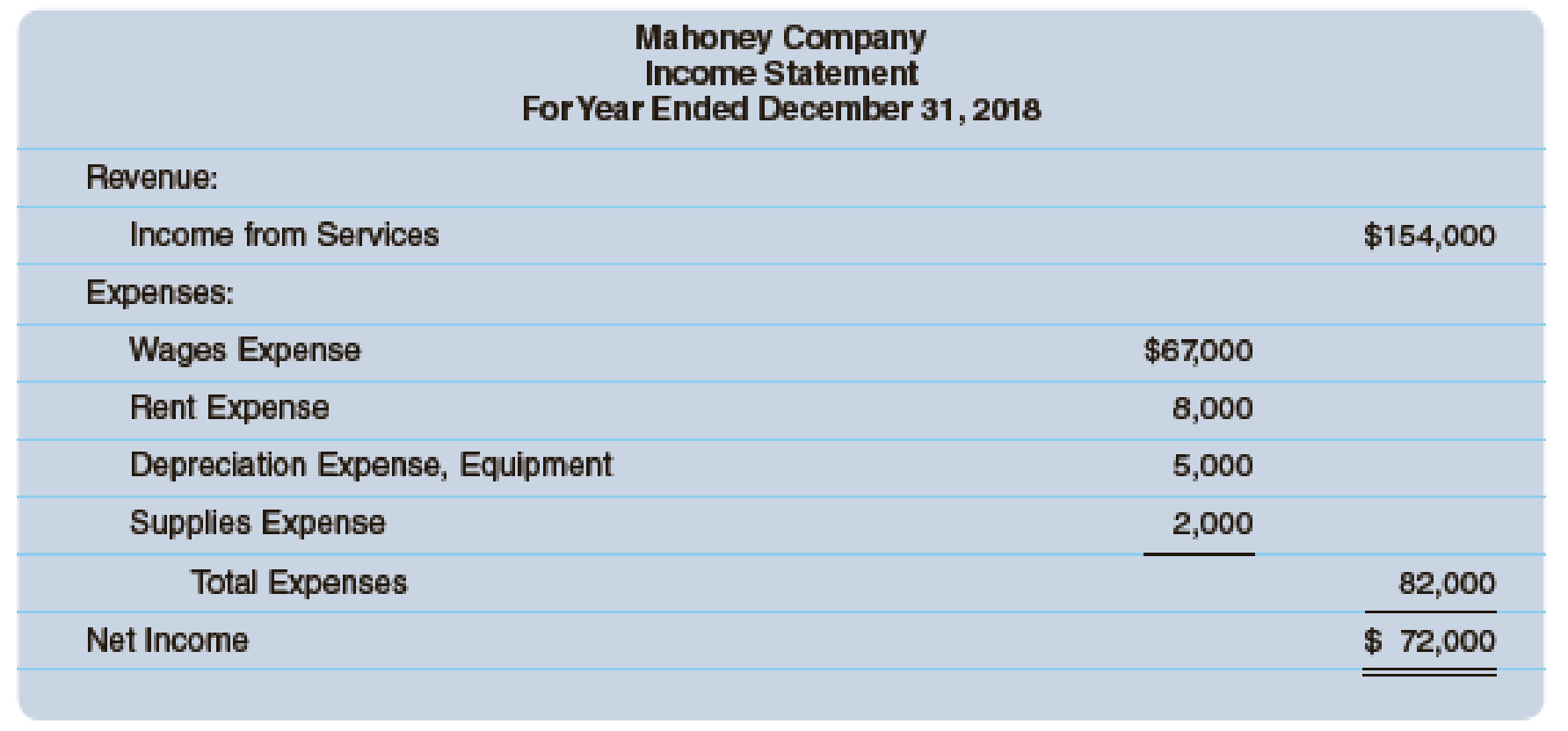

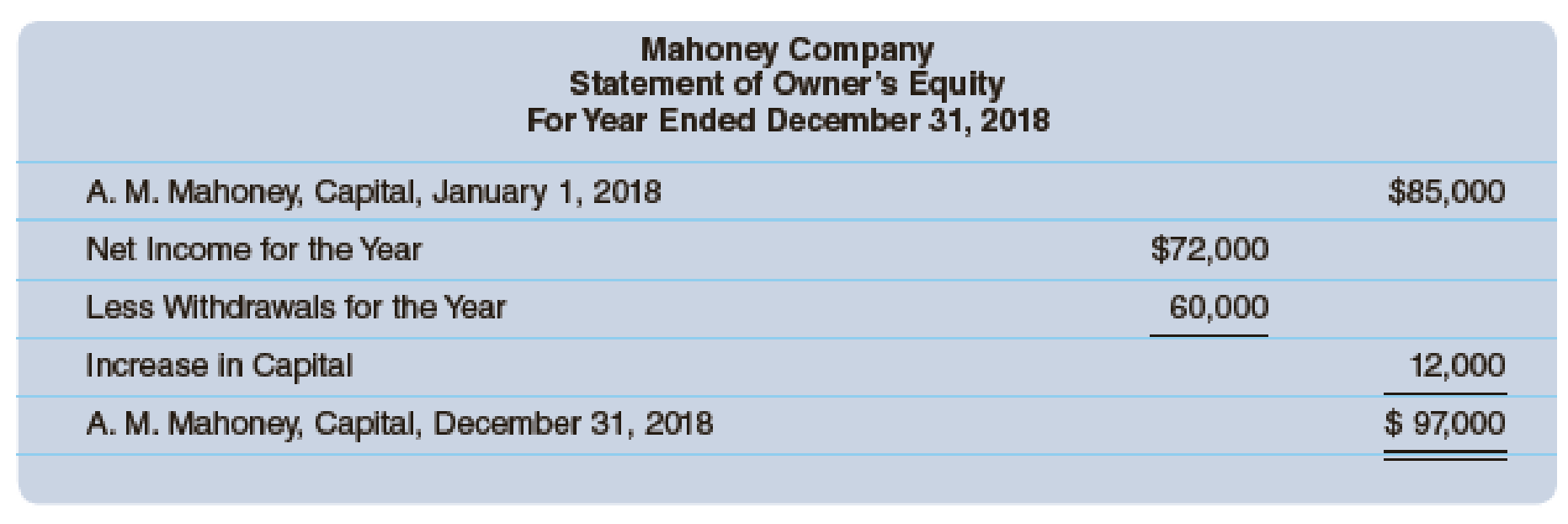

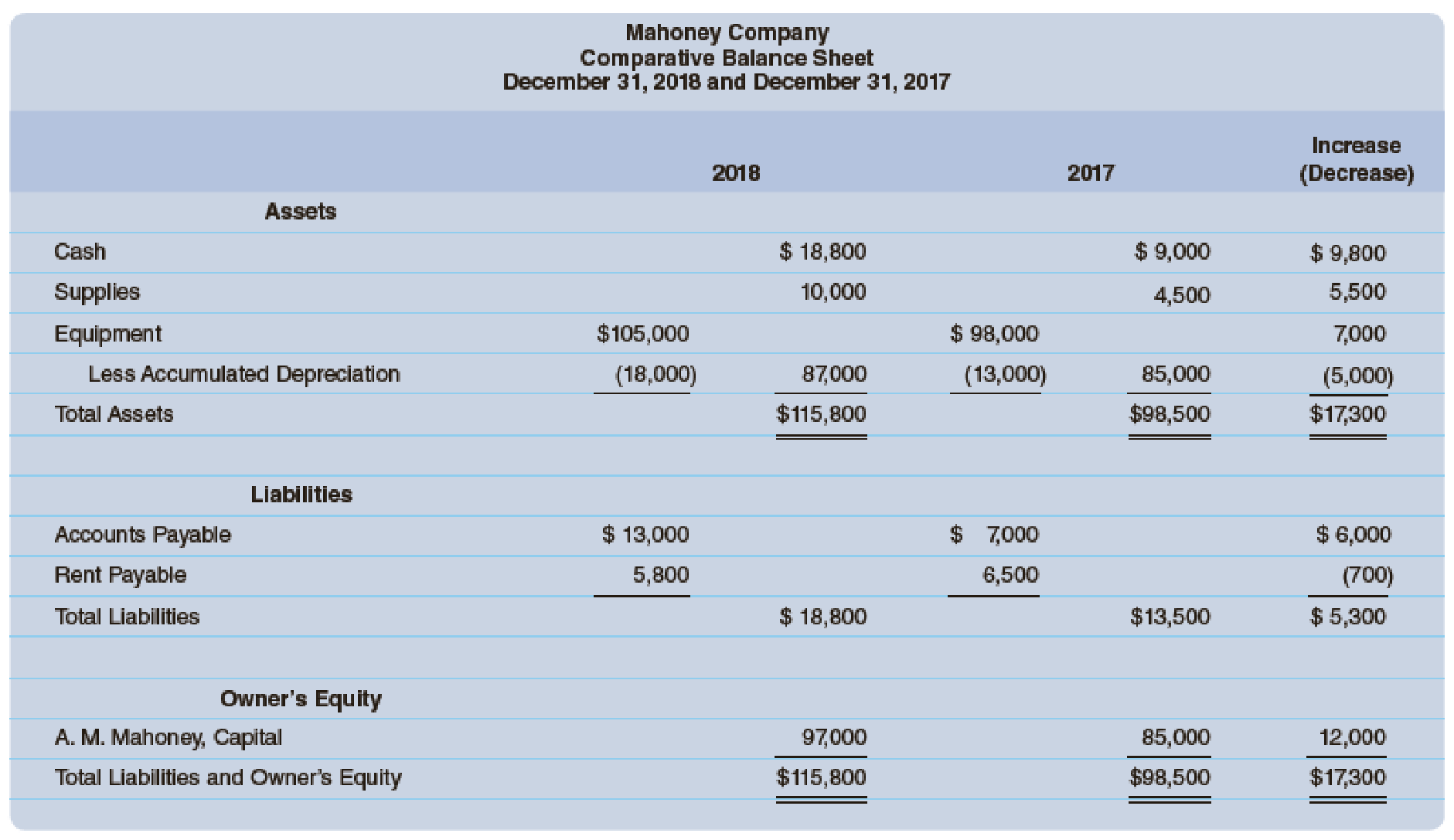

Mahoney Company has the following financial statements for 2017 and 2018. Assume that the purchase of equipment and the withdrawals were in the form of cash.

Required

Prepare a statement of

Check Figure

Net cash flows from operating activities, $76,800

Prepare statement of cash flows for Company M for the year ended December 31, 2018.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Operating activities include cash inflows and outflows from business operations. Investing activities includes cash inflows and cash outflows from purchase and sale of land or equipment, or investments. Financing activities includes cash inflows from borrowings and investment by owners, and outflows from payment of debt and withdrawals by owner for personal use.

Prepare statement of cash flows for Company M for the year ended December 31, 2018.

| Company M | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Cash flows from (used by) operating activities | ||

| Net income | $72,000 | |

|

Add (Deduct) items to convert net income from accrual basis to cash basis: | ||

| Depreciation expense | 5,000 | |

| Increase in supplies | (5,500) | |

| Increase in accounts payable | 6,000 | |

| Decrease in rent payable | (700) | |

| Net cash flows from operating activities | $76,800 | |

| Cash flows from (used by) investing activities | ||

| Purchase of equipment | (7,000) | |

| Net cash flows used by investing activities | (7,000) | |

| Cash flows from (used by) financing activities | ||

| Cash withdrawals by owner | (60,000) | |

| Net cash used by financing activities | (60,000) | |

| Net increase (decrease) in cash | $9,800 | |

| Cash balance, January 1, 2018 | 9,000 | |

| Cash balance, December 31, 2018 | $18,800 | |

Table (1)

Thus, statement of cash flows for Company M for the year ended December 31, 2018 reports cash balance of $18,800 at December 31, 2018.

Want to see more full solutions like this?

Chapter 12A Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Advanced Financial Accounting

Managerial Accounting (4th Edition)

Managerial Accounting

Intermediate Accounting

Construction Accounting And Financial Management (4th Edition)

- The financial statements for Romeo and Company follow. Assume that the additional investment and the withdrawals were in the form of cash. Required Prepare a statement of cash flows for the year ended December 31, 2018. Check Figure Net cash flows from operating activities, 172,000arrow_forwardThe following balance sheets and income statement were taken from the records of Rosie-Lee Company: Additional transactions were as follows: a. Sold equipment costing 21,600, with accumulated depreciation of 16,200, for 3,600. b. Issued bonds for 90,000 on December 31. c. Paid cash dividends of 36,000. d. Retired mortgage of 108,000 on December 31. Required: 1. Prepare a schedule of operating cash flows using (a) the indirect method and (b) the direct method. 2. Prepare a statement of cash flows using the indirect method.arrow_forwardUse the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forward

- Use the following excerpts from Indigo Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $225,000.arrow_forwardDuring the year, Hepworth Company earned a net income of 61,725. Beginning and ending balances for the year for selected accounts are as follows: There were no financing or investing activities for the year. The above balances reflect all of the adjustments needed to adjust net income to operating cash flows. Required: 1. Prepare a schedule of operating cash flows using the indirect method. 2. Suppose that all the data are used in Requirement 1 except that the ending accounts payable and cash balances are not known. Assume also that you know that the operating cash flow for the year was 20,475. What is the ending balance of accounts payable? 3. CONCEPTUAL CONNECTION Hepworth has an opportunity to buy some equipment that will significantly increase productivity. The equipment costs 25,000. Assuming exactly the same data used for Requirement 1, can Hepworth buy the equipment using this years operating cash flows? If not, what would you suggest be done?arrow_forwardUse the following excerpts from Algona Companys financial statements to determine cash received from customers in 2018.arrow_forward

- Tifton Co. had the following cash transactions during the current year: Refer to the information in RE21-6. Prepare the financing activities section of Tifton Co.s statement of cash flows.arrow_forwardCromwell Company has the following trial balance account balances, given in no certain order, as of December 31, 2018. Using the information provided, prepare Cromwells annual financial statements (omit the Statement of Cash Flows).arrow_forwardThe comparative balance sheet of Whitman Co. at December 31, 2016 and 2015, is as follows: The noncurrent asset, noncurrent liability, and stockholders equity accounts for 2016 are as follows: Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning