Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 6,000 shares of its common stock at $74 per share. On September 22, Mystic Lake sold 4,200 of the reacquired shares at $80 per share. The remaining 1,800 shares were sold at $71 per share on November 23. a. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank.

Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 6,000 shares of its common stock at $74 per share. On September 22, Mystic Lake sold 4,200 of the reacquired shares at $80 per share. The remaining 1,800 shares were sold at $71 per share on November 23. a. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 6,000 shares of its common stock at $74 per share. On September 22, Mystic Lake sold 4,200 of the reacquired shares at $80 per share. The remaining 1,800 shares were sold at $71 per share on November 23.

a. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank.

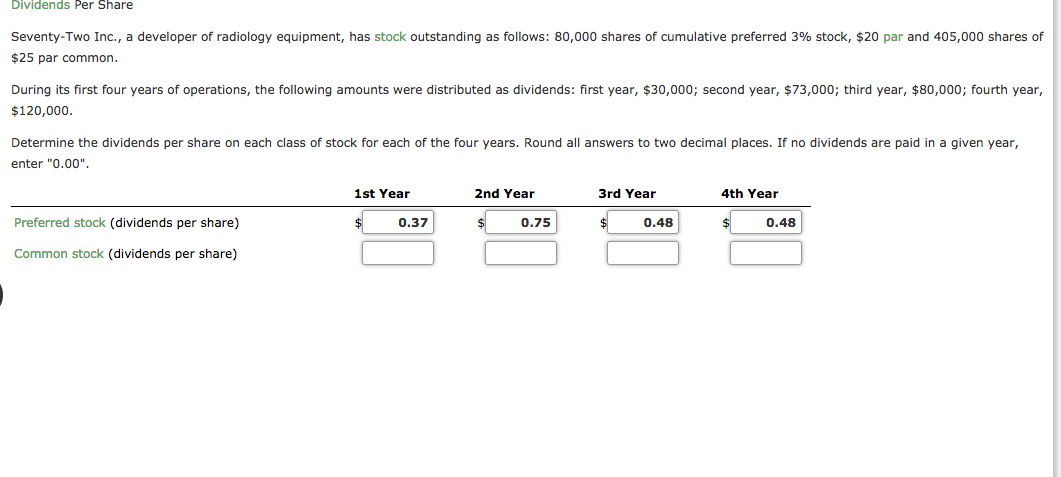

Transcribed Image Text:Dividends Per Share

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of

$25 par common.

During its first four years of operations, the following amounts were distributed as dividends: first year, $30,000; second year, $73,000; third year, $80,000; fourth year,

$120,000.

Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year,

enter "0.00".

1st Year

2nd Year

3rd Year

4th Year

Preferred stock (dividends per share)

0.37

$

0.75

0.48

0.48

Common stock (dividends per share)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning