Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.2.6P

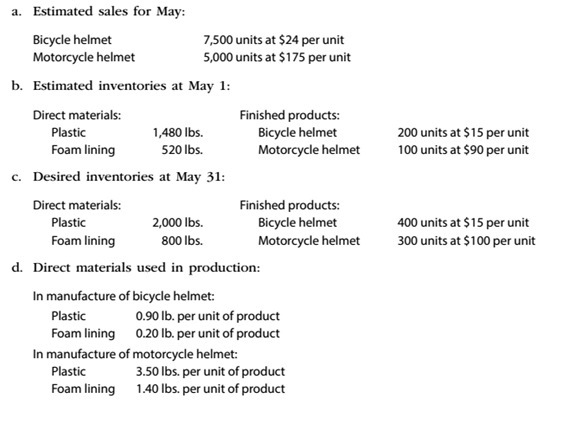

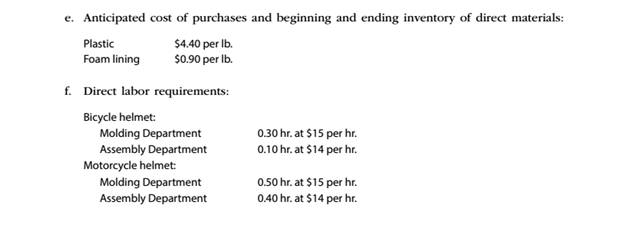

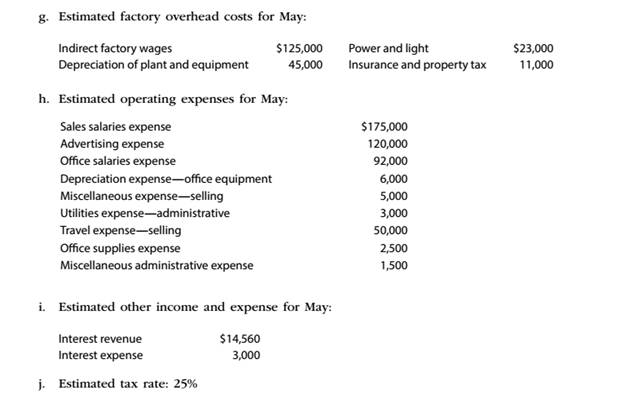

The budget director of Jupiter Helmets Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for May:

Prepare a cost of goods sold budget for May. Work in process at the beginning of May is estimated to be $4200. and work in process at the end of May is desired to be $3800.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 13 Solutions

Survey of Accounting (Accounting I)

Ch. 13 - Static budgets are often used: A.By production...Ch. 13 - The total estimated sales for the coming year is...Ch. 13 - Dixon Company expects $650,000 of credit sales in...Ch. 13 - The actual and standard direct materials costs for...Ch. 13 - Bower Company produced 4,000 units of product. The...Ch. 13 - Prob. 1CDQCh. 13 - What is the manager’s role in a responsibility...Ch. 13 - Briefly describe the type of human behavior...Ch. 13 - Give an example of budgetary slack.Ch. 13 - What behavioral problems are associated with...

Ch. 13 - Prob. 6CDQCh. 13 - Prob. 7CDQCh. 13 - Under what circumstances would a static budget be...Ch. 13 - How do computerized budgeting systems aid firms in...Ch. 13 - What is the first step in preparing a master...Ch. 13 - Why should the production requirements set forth...Ch. 13 - Why should the timing of direct materials...Ch. 13 - Prob. 13CDQCh. 13 - Prob. 14CDQCh. 13 - Prob. 15CDQCh. 13 - Prob. 16CDQCh. 13 - Prob. 17CDQCh. 13 - Prob. 18CDQCh. 13 - What is meant by reporting by the "principle of...Ch. 13 - Prob. 20CDQCh. 13 - How are standards used in budgetary performance...Ch. 13 - a. What are the two variances between the actual...Ch. 13 - Prob. 23CDQCh. 13 - Prob. 24CDQCh. 13 - Prob. 25CDQCh. 13 - Prob. 26CDQCh. 13 - Flexible budget for selling and administrative...Ch. 13 - Static budget vs. flexible budget The production...Ch. 13 - Flexible budget for Fabrication Department...Ch. 13 - Sales and production budgets Ultimate Audio...Ch. 13 - Professional fees earned budget Day & Spieth,...Ch. 13 - Professional labor cost budget Based on the data...Ch. 13 - Direct materials purchases budget Zippy's Frozen...Ch. 13 - Prob. 13.8ECh. 13 - Prob. 13.9ECh. 13 - Production and direct labor cost budgets Levi...Ch. 13 - Factory overhead cost budget Nutty Candy Company...Ch. 13 - Cost of goods sold budget The controller of Pueblo...Ch. 13 - Prob. 13.13ECh. 13 - Schedule of cash collections of accounts...Ch. 13 - Schedule of cash payments Tadpole Learning Systems...Ch. 13 - Schedule of cash payments Organic Physical Therapy...Ch. 13 - Capital expenditures budget On August 1, 20Y4. the...Ch. 13 - Standard product cost Sorrento Furniture Company...Ch. 13 - Prob. 13.19ECh. 13 - Direct materials variances The following data...Ch. 13 - Standard direct materials cost per unit from...Ch. 13 - Standard product cost, direct materials variance...Ch. 13 - Direct labor variances The following data relate...Ch. 13 - Prob. 13.24ECh. 13 - Direct materials and direct labor variances At the...Ch. 13 - Prob. 13.26ECh. 13 - Factory overhead cost variances The following data...Ch. 13 - Prob. 13.28ECh. 13 - Factory overhead variance corrections The data...Ch. 13 - Prob. 13.30ECh. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Prob. 13.2.7PCh. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Cash budget The controller of Shoe Mart Inc. asks...Ch. 13 - Cash budget The controller of Shoe Mart Inc. asks...Ch. 13 - Direct materials and direct labor variance...Ch. 13 - Direct materials and direct labor, variance...Ch. 13 - Prob. 13.6.1PCh. 13 - Prob. 13.6.2PCh. 13 - Prob. 13.6.3PCh. 13 - Prob. 13.6.4PCh. 13 - Prob. 13.6.5PCh. 13 - Standards for nonmanufacturing expenses The...Ch. 13 - Prob. 13.7PCh. 13 - Prob. 13.1.1MBACh. 13 - Prob. 13.1.2MBACh. 13 - Prob. 13.1.3MBACh. 13 - Prob. 13.1.4MBACh. 13 - Prob. 13.1.5MBACh. 13 - Prob. 13.1.6MBACh. 13 - Prob. 13.2.1MBACh. 13 - Prob. 13.2.2MBACh. 13 - Prob. 13.2.3MBACh. 13 - Prob. 13.2.4MBACh. 13 - Process yield Hendrick Motorsports sponsors cars...Ch. 13 - Prob. 13.3.1MBACh. 13 - Prob. 13.3.2MBACh. 13 - Prob. 13.3.3MBACh. 13 - Prob. 13.3.4MBACh. 13 - Prob. 13.4.1MBACh. 13 - Prob. 13.4.2MBACh. 13 - Prob. 13.4.3MBACh. 13 - Prob. 13.4.4MBACh. 13 - Prob. 13.5.1MBACh. 13 - Prob. 13.5.2MBACh. 13 - Prob. 13.5.3MBACh. 13 - Prob. 13.5.4MBACh. 13 - Utilization rate Delta Air Lines (DAL) reported...Ch. 13 - Prob. 13.6.2MBACh. 13 - Prob. 13.6.3MBACh. 13 - Prob. 13.7.1MBACh. 13 - Prob. 13.7.2MBACh. 13 - Prob. 13.7.3MBACh. 13 - Ethics and professional conduct in business The...Ch. 13 - Prob. 13.2.1CCh. 13 - Prob. 13.2.2CCh. 13 - Prob. 13.3.1CCh. 13 - Prob. 13.3.2CCh. 13 - Objectives of the master budget Domino's Pizza LLC...Ch. 13 - Prob. 13.5.1CCh. 13 - Prob. 13.5.2CCh. 13 - Prob. 13.6CCh. 13 - Prob. 13.7C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Budgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March: Estimated sales for March: Estimated inventories at March 1: Desired inventories at March 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for March: Estimated operating expenses for March: Estimated other revenue and expense for March: Estimated tax rate: 30% Instructions Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March.arrow_forwardBudgeted income statement and supporting budgets for three months Bellaire Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year: Estimated sales at 125 per unit: Estimated finished goods inventories: Work in process inventories are estimated to be insignificant (zero). Estimated direct materials inventories: Manufacturing costs: Selling expenses: Instructions Prepare the following budgets using one column for each month and a total column for the first quarter, as shown for the sales budget: Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement with budgeted operating income for March.arrow_forwardSales, production, direct materials purchases, and direct labor cost budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: Estimated sales for July by sales territory: Estimated inventories at July 1: Desired inventories at July 31: Direct materials used in production: Anticipated purchase price for direct materials: Direct labor requirements: Instructions Prepare a sales budget for July. Prepare a production budget for July. Prepare a direct materials purchases budget for July. Prepare a direct labor cost budget for July.arrow_forward

- Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 35,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions Prepare a budgeted income statement for 20Y9. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.arrow_forwardDigital Solutions Inc. uses flexible budgets that are based on the following data: Prepare a flexible selling and administrative expenses budget for October for sales volumes of 500,000, 750,000, and 1,000,000.arrow_forwardPerformance Report Based on Budgeted and Actual Levels of Production Balboa Company budgeted production of 4,500 units with the following amounts: At the end of the year, Balboa had the following actual costs for production of 4,700 units: Required: 1. Calculate the budgeted amounts for each cost category listed above for the 4,500 budgeted units. 2. Prepare a performance report using a budget based on expected (budgeted) production of 4,500 units. 3. Prepare a performance report using a budget based on the actual level of production of 4,700 units.arrow_forward

- Performance Report Based on Budgeted and Actual Levels of Production Bowling Company budgeted the following amounts: At the end of the year, Bowling had the following actual costs for production of 3,800 units: Required: 1. Calculate the budgeted amounts for each cost category listed above for the 4,000 budgeted units. 2. Prepare a performance report using a budget based on expected production of 4,000 units. 3. Prepare a performance report using a budget based on the actual level of production of 3,800 units.arrow_forwardPreparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of activity and the actual operating results listed below for the 29,000- unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 29,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardProduction budget Healthy Measures Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: The finished goods inventory estimated for March 1, for the Bath and Gym scale models is 11,800 and 8,100 units, respectively. The desired finished goods inventory for March 31 for the Bath and Gym scale models is 15,000 and 7,500 units, respectively. Prepare a production budget for the Bath and Gym scales for the month ended March 31.arrow_forward

- Static budget versus flexible budget The production supervisor of the Machining Department for Hagerstown Company agreed to the following monthly static budget for the upcoming year: The actual amount spent and the actual units produced in the first three months in the Machining Department were as follows: The Machining Department supervisor has been very pleased with this performance because actual expenditures for May-July have been significantly less than the monthly static budget of2,358,000. However, the plant manager believes that the budget should not remain fixed for every month but should flex or adjust to the volume of work that is produced in the Machining Department. Additional budget information for the Machining Department is as follows: a. Prepare a flexible budget for the actual units produced for May, June, and July in the MachiningDepartment. Assume depreciation is a fixed cost. b. Compare the flexible budget with the actual expenditures for the first three months.What does this comparison suggest?arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales.arrow_forwardSales, production, direct materials, direct labor, and factory overhead budgets King Tire Co.s budgeted unit sales for the year 2016 were: The budgeted selling price for truck tires was 200 per tire, and for passenger car tires it was 65 per tire. The beginning finished goods inventories were expected to be 2,000 truck tires and 5,000 passenger tires, for a total cost of 326,478, with desired ending inventories at 2,500 and 6,000, respectively, with a total cost of 400,510. There was no anticipated beginning or ending work-in- process inventory for either type of tire. The standard materials quantities for each type of tire were as follows: The purchase prices of rubber and steel were 2 and 3 per pound, respectively. The desired ending inventories for rubber and steel were 60,000 and 6,000 lb, respectively. The estimated beginning inventories for rubber and steel were 75,000 and 7,000 lb, respectively. The direct labor hours required for each type of tire were as follows: The direct labor rate for each department is as follows: Budgeted factory overhead costs for 2016 were as follows: Required: Prepare each of the following budgets for King for the year ended December 31, 2016: 1. Sales budget. 2. Production budget. 3. Direct material budget. 4. Direct labor budget. 5. Factory overhead budget. 6. Cost of goods sold budget.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY