Bond Discount, Entries for Bonds Payable Transactions On July 1, Year 1, Livingston Corporation, a wholesaler of manufacturing equipment, issued $8,100,000 of 9-year, 10% bonds at a market (effective) interest rate of 11%, receiving cash of $7,644,536. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 5. Compute the price of $7,644,536 received for the bonds by using Table 1, Table 2, Table 3 and Table 4. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences. Present value of the face amount Present value of the semiannual interest payments Price received for the bonds

Bond Discount, Entries for Bonds Payable Transactions On July 1, Year 1, Livingston Corporation, a wholesaler of manufacturing equipment, issued $8,100,000 of 9-year, 10% bonds at a market (effective) interest rate of 11%, receiving cash of $7,644,536. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 5. Compute the price of $7,644,536 received for the bonds by using Table 1, Table 2, Table 3 and Table 4. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences. Present value of the face amount Present value of the semiannual interest payments Price received for the bonds

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 23E: Refer to 10.22. If the imputed interest rate is 6%, what is Anders Company residual income for the...

Related questions

Question

Bond Discount, Entries for Bonds Payable Transactions

On July 1, Year 1, Livingston Corporation, a wholesaler of manufacturing equipment, issued $8,100,000 of 9-year, 10% bonds at a market (effective) interest rate of 11%, receiving cash of $7,644,536. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year.

Required:

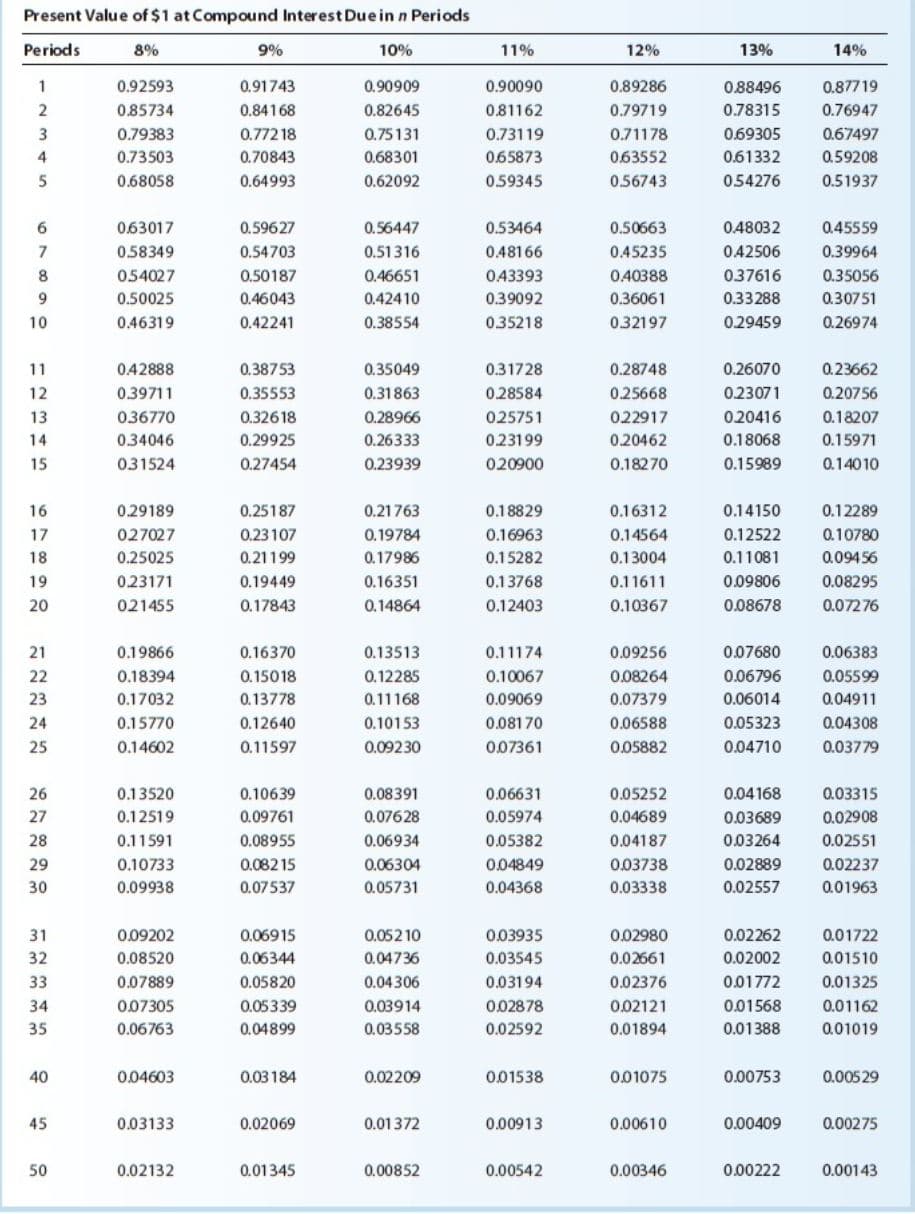

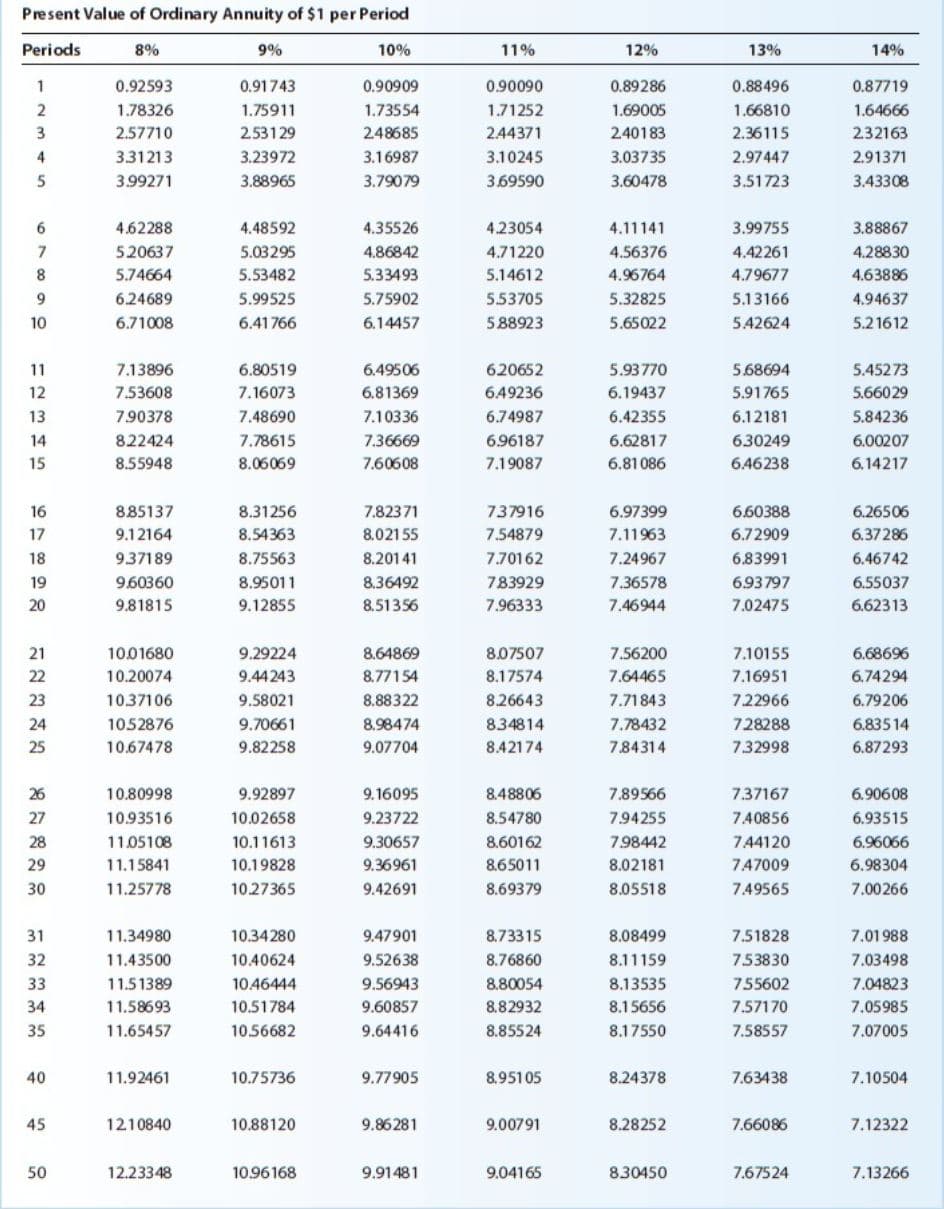

5. Compute the price of $7,644,536 received for the bonds by using Table 1, Table 2, Table 3 and Table 4. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences.

| Present value of the semiannual interest payments | |

| Price received for the bonds |

Transcribed Image Text:Present Value of $1 at Compound Interest Duein n Periods

Periods

8%

9%

10%

11%

12%

13%

14%

1

0.92593

0.91743

0.90909

0.90090

0.89286

0.88496

0.87719

2

0.85734

0.84168

0.82645

0.81162

0.79719

0.78315

0.76947

3

0.79383

0.772 18

0.75131

0.73119

0.71178

0.69305

0.67497

4

0.73503

0.70843

0.68301

0.65873

0.63552

0.61332

0.59208

0.68058

0.64993

0.62092

0.59345

0.56743

054276

0.51937

0.63017

0.59627

0.56447

0.53464

0.50663

0.48032

0.45559

7

0.58349

0.54703

0.51316

0.48166

0.45235

0.42506

0.39964

8

054027

0.50187

0.46651

043393

0.40388

037616

0.35056

9.

0.50025

0.46043

0.42410

0.39092

0.36061

0.33288

0.30751

10

0.46319

0.42241

0.38554

0.35218

0.32197

0.29459

0.26974

11

042888

0.38753

0.35049

0.31728

0.28748

0.26070

0.23662

12

0.39711

0.35553

0.31863

0.28584

0.25668

0.23071

0.20756

13

036770

0.32618

0.28966

025751

022917

0.20416

0.18207

14

0.34046

0.29925

0.26333

0.23199

0.20462

0.18068

0.15971

15

031524

0.27454

0.23939

020900

0.18270

0.15989

0.14010

16

0.29189

0.25187

0.21763

0.18829

0.16312

0.14150

0.12289

17

027027

0.23107

0.19784

0.16963

0.14564

0.12522

0.10780

18

0.25025

0.21199

0.17986

0.15282

0.13004

0.11081

0.09456

19

0.23171

0.19449

0.16351

0.13768

0.11611

0.09806

0.08295

20

021455

0.17843

0.14864

0.12403

0.10367

0.08678

0.07276

21

0.19866

0.16370

0.13513

0.11174

0.09256

0.07680

0.06383

22

0.18394

0.15018

0.12285

0.10067

0.08264

0.06796

0.05599

23

0.17032

0.13778

0.11168

0.09069

0.07379

0.06014

0.04911

24

0.15770

0.12640

0.10153

0.08170

0.06588

0.05323

0.04308

25

0.14602

0.11597

0.09230

0.07361

0.05882

0.04710

0.03779

26

0.13520

0.10639

0.08391

0.06631

0.05252

0.04168

0.03315

27

0.12519

0.09761

0.07628

0.05974

0.04689

0.03689

0.02908

28

0.11591

0.08955

0.06934

0.05382

0.04187

0.03264

0.02551

29

0.10733

0.082 15

0.06304

0,04849

0.03738

0.02889

0.02237

30

0.09938

0.07537

0.05731

0.04368

0.03338

0.02557

0.01963

31

0.09202

0.06915

0.05210

0.03935

0.02980

0.02262

0.01722

32

0.08520

0.06344

0.04736

0.03545

0.02661

0.02002

0.01510

33

0.07889

0.05820

0.04306

0.03194

0.02376

0.01772

0.01325

34

0.07305

0.05339

0.03914

0.02878

0.02121

0.01568

0.01162

35

0.06763

0.04899

0.03558

0.02592

0.01894

0.01388

0.01019

40

0.04603

0.03184

0.02209

0.01538

0.01075

0.00753

0.00529

45

0.03133

0.02069

0.01372

0.00913

0.00610

0.00409

0.00275

50

0.02132

0.01345

0.00852

0.00542

0.00346

0.00222

0.00143

Transcribed Image Text:Present Value of Ordinary Annuity of $1 per Period

Periods

8%

9%

10%

11%

12%

13%

14%

1

0.92593

0.91743

0.90909

0.90090

0.89286

0.88496

0.87719

1.78326

1.75911

1.73554

1.71252

1.69005

1.66810

1.64666

3

2.57710

2.53129

248685

2.44371

240183

2.36115

232163

4

3.31213

3.23972

3.16987

3.10245

3.03735

2.97447

2.91371

3.99271

3.88965

3.79079

3.69590

3.60478

3.51723

3.43308

4.62288

4.48592

4.35526

4.23054

4.11141

3.99755

3.88867

520637

5.03295

4.86842

4.71220

4.56376

4.42261

4.28830

5.74664

5.53482

5.33493

5.14612

4.96764

4.79677

4.63886

6.24689

5.99525

5.75902

553705

5.32825

5.13166

4.94637

10

6.71008

6.41766

6.14457

588923

5.65022

5.42624

5.21612

11

7.13896

6.80519

6.49506

620652

5.93770

5.68694

5.45273

12

7.53608

7.16073

6.81369

6.49236

6.19437

5.91765

5.66029

13

7.90378

7.48690

7.10336

6.74987

6.42355

6.12181

5.84236

14

822424

7.78615

7.36669

6.96187

6.62817

630249

6.00207

15

8.55948

8.06069

7.60608

7.19087

6.81086

6.46238

6.14217

16

885137

8.31256

7.82371

737916

6.97399

6.60388

6.26506

17

9.12164

8.54363

8.02155

7.54879

7.11963

6.72909

6.37286

18

937189

8.75563

8.20141

7.70162

7.24967

6.83991

6.46742

19

9.60360

8.95011

8.36492

783929

7.36578

693797

6.55037

20

9.81815

9.12855

8.51356

7.96333

7.46944

7.02475

6.62313

21

10.01680

9.29224

8.64869

8.07507

7.56200

7.10155

6.68696

22

10.20074

9.44243

8.77154

8.17574

7.64465

7.16951

6.74294

23

10.37106

9.58021

8.88322

8.26643

7.71843

7.22966

6.79206

24

1052876

9.70661

8.98474

834814

7.78432

728288

6.835 14

25

10.67478

9.82258

9.07704

8.42174

7.84314

7.32998

6.87293

26

10.80998

9.92897

9.16095

8.48806

7.89566

7.37167

6.90608

27

10.93516

10.02658

9.23722

8.54780

7.94255

7.40856

6.93515

28

11.05108

10.11613

9.30657

8.60162

7.98442

7.44120

6.96066

29

11.15841

10.19828

9.36961

8.65011

8.02181

7.47009

6.98304

30

11.25778

10.27365

9.42691

8.69379

8.05518

7.49565

7.00266

31

11.34980

10.34280

9.47901

8.73315

8.08499

7.51828

7.01988

32

11.43500

10.40624

9.52638

8.76860

8.11159

753830

7.03498

33

11.51389

10.46444

9.56943

8.80054

8.13535

755602

7.04823

34

11.58693

10.51784

9.60857

8.82932

8.15656

7.57170

7.05985

35

11.65457

10.56682

9.64416

8.85524

8.17550

7.58557

7.07005

40

11.92461

10.75736

9.77905

8.951 05

8.24378

7.63438

7.10504

45

1210840

10.88120

9.86 281

9.00791

8.28252

7.66086

7.12322

50

12.23348

10.96168

9.91481

9.04165

830450

7.67524

7.13266

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning