a)

Prepare all necessary journal entries to record the given transactions.

a)

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare all necessary journal entries to record the given transactions:

| Date | Accounts title and Explanation | Debit ($) | Credit ($) |

| 1 | Rent expense | $35,000 | |

| Contributions-without donor restrictions | $35,000 | ||

| (To record the rent expenses paid for the net assets) | |||

| 2 | Cash | $335,000 | |

| Contributions receivable | $100,000 | ||

| Contributions-without donor restrictions | $185,000 | ||

| Contributions with donor restrictions — program | $250,000 | ||

| (To record the cash receipt and contribution receivables) | |||

| 3. | Salaries & benefits expense | $224,560 | |

| Cash | $208,560 | ||

| Salaries & benefits payable | 16,000 | ||

| (To record the salaries and benefits expenses) | |||

| 4 | Contributions receivable | $100,000 | |

| Contributions with donor restrictions—time | $94,260 | ||

| Discount on contributions receivable | $5,740 | ||

| (To record the contribution receivable) | |||

| 5. | Equipment & furniture | $21,600 | |

| Cash | $12,000 | ||

| Contributions without donor restrictions | $9,600 | ||

| (To record the purchase of furniture and equipment) | |||

| 6 | Telephone expense | $5,200 | |

| Printing & postage expense | $12,000 | ||

| Utilities expense | $8,300 | ||

| Supplies expense | $4,300 | ||

| Cash | $26,200 | ||

| Accounts payable | $3,600 | ||

| (To record the expenses partly paid and partly payable) | |||

| 7 | For this transaction no | ||

| 8 | Provision for uncollectible pledges | $10,000 | |

| Allowance for uncollectible pledges -Unrestricted | $10,000 | ||

| (To record the provision for uncollectible pledges) | |||

| $3,360 | |||

| Allowance for depreciation - equipment & furniture | $3,360 | ||

| (To record the depreciation expense) | |||

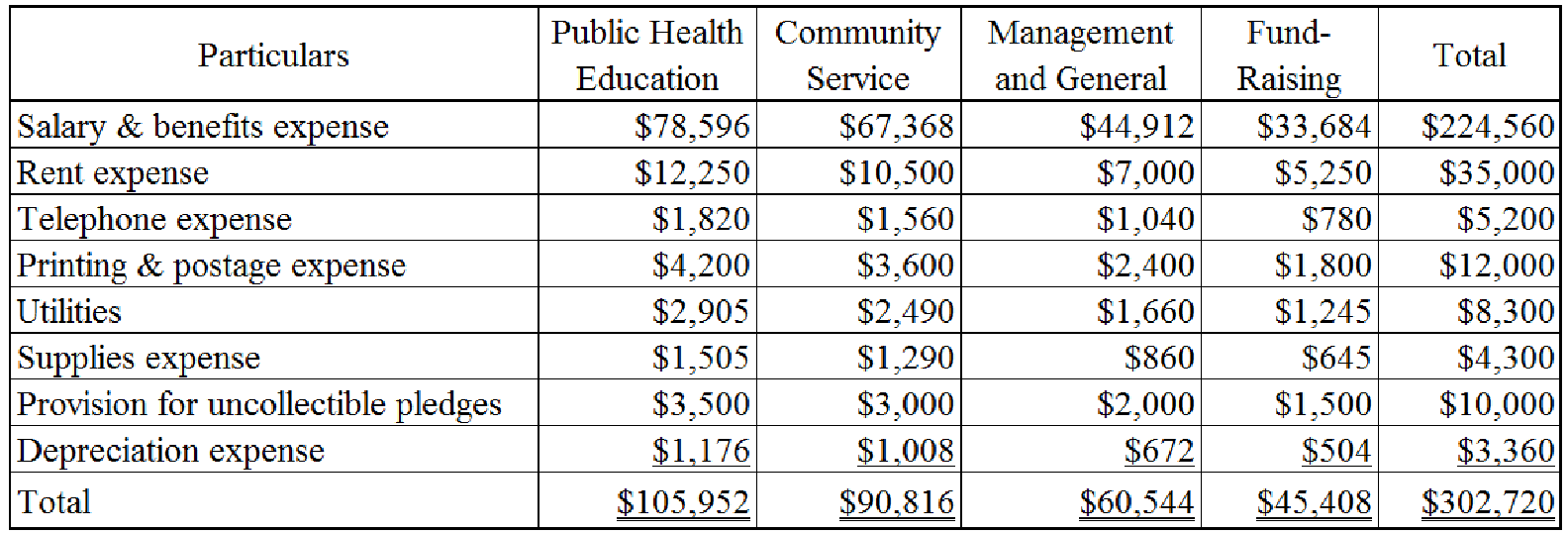

| 9 | Public health education program | $105,952 | |

| Community service program | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| Salaries & benefits expense | $224,560 | ||

| Rent expense | $35,000 | ||

| Telephone expense | $5,200 | ||

| Printing & postage expense | $12,000 | ||

| Utilities | $8,300 | ||

| Supplies expense | $4,300 | ||

| Provision for uncollectible accounts | $10,000 | ||

| Depreciation expense | $3,360 | ||

| (To record the | |||

| 10 | Net assets released satisfaction of purpose restriction - with donor restrictions | $105,952 | |

| Net assets released-satisfaction of purpose restriction-without donor restrictions | $105,952 | ||

| (To record the release of net assets) | |||

| 11 | Contributions—without donor restrictions (transactions 1, 2 and 5) | $229,600 | |

| Net assets without donor restrictions | $73,120 | ||

| Public health education | $105,952 | ||

| Community service | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| (To record the closing entry for contributions- without donor restrictions) | |||

| Contributions-with donor restrictions- program | $250,000 | ||

| Contributions-with donor restrictions- time (transactions 2 &4) | $94,260 | ||

| Net assets with donor restrictions | $344,260 | ||

| (To record the closing entry for the contributions – with donor restrictions | |||

| Net assets with donor restrictions | $105,952 | ||

| Net assets released—satisfaction of purpose restriction—with donor restrictions | $105,952 | ||

| (To record the closing entry for the net assets with donor restrictions) | |||

Table (1)

Notes to the above table:

- Compute the resource allocation based on the available information (transaction 9):

Table (2)

b.

Prepare the statement of activity for the year ended December 31, 2020.

b.

Explanation of Solution

Prepare the statement of activity for the year ended December 31, 2020:

| Entity I | |||

| Statement of activities | |||

| For the year ended December 31, 2020 | |||

| Particulars | Without donor restrictions | With donor restrictions | total |

| Revenue and other Support: | |||

| Contributions-net assets released from restriction | $ 229,600 | $ 344,260 | $ 573,860 |

| Satisfaction of purpose | $105,952 | ($105,952) | |

| Total revenue & other support (A) | $335,552 | $238,308 | $573,860 |

| Expenses: | |||

| Public health education | $105,952 | 105,952 | |

| Community services | $90,816 | 90,816 | |

| Management & general | $60,544 | 60,544 | |

| Fund-raising | $45,408 | 45,408 | |

| Total expenses (B) | $302,720 | 302,720 | |

| Increase in net assets (A) – (B) | $32,832 | $238,308 | $271,140 |

| Beginning net assets | 0 | 0 | 0 |

| Ending net assets | $ 32,832 | $ 238,308 | $ 271,140 |

Table (3)

Therefore, the total ending net assets are $271,140.

c)

Prepare a

c)

Explanation of Solution

Statement of financial position: It is an itemized list of total assets and “liabilities and net assets.” The assets are classified into current and noncurrent assets. The liabilities are also classified into current and noncurrent liabilities. The assets should be equal to the liabilities and net assets.

Prepare a statement of financial position for the year ended December 31, 2020:

| Entity I | |

| Statement of Financial Positions | |

| For the year ended December 31, 2020 | |

| Assets | Amount ($) |

| Cash | $88,240 |

| Contributions receivable (less allowance for uncollectible accounts of $10,000 and discount on contributions receivable of $5,740) | $184,260 |

| Equipment and furniture (less allowance for |

$18,240 |

| Total Assets | $290,740 |

| Liabilities: | |

| Accounts payable | $3,600 |

| Salaries & benefits payable | $16,000 |

| Total liabilities | $19,600 |

| Net Assets: | |

| Without donor restrictions | $32,832 |

| With donor restrictions | $238,308 |

| Total net assets | $271,140 |

| Total liabilities and net assets | $290,740 |

Table (4)

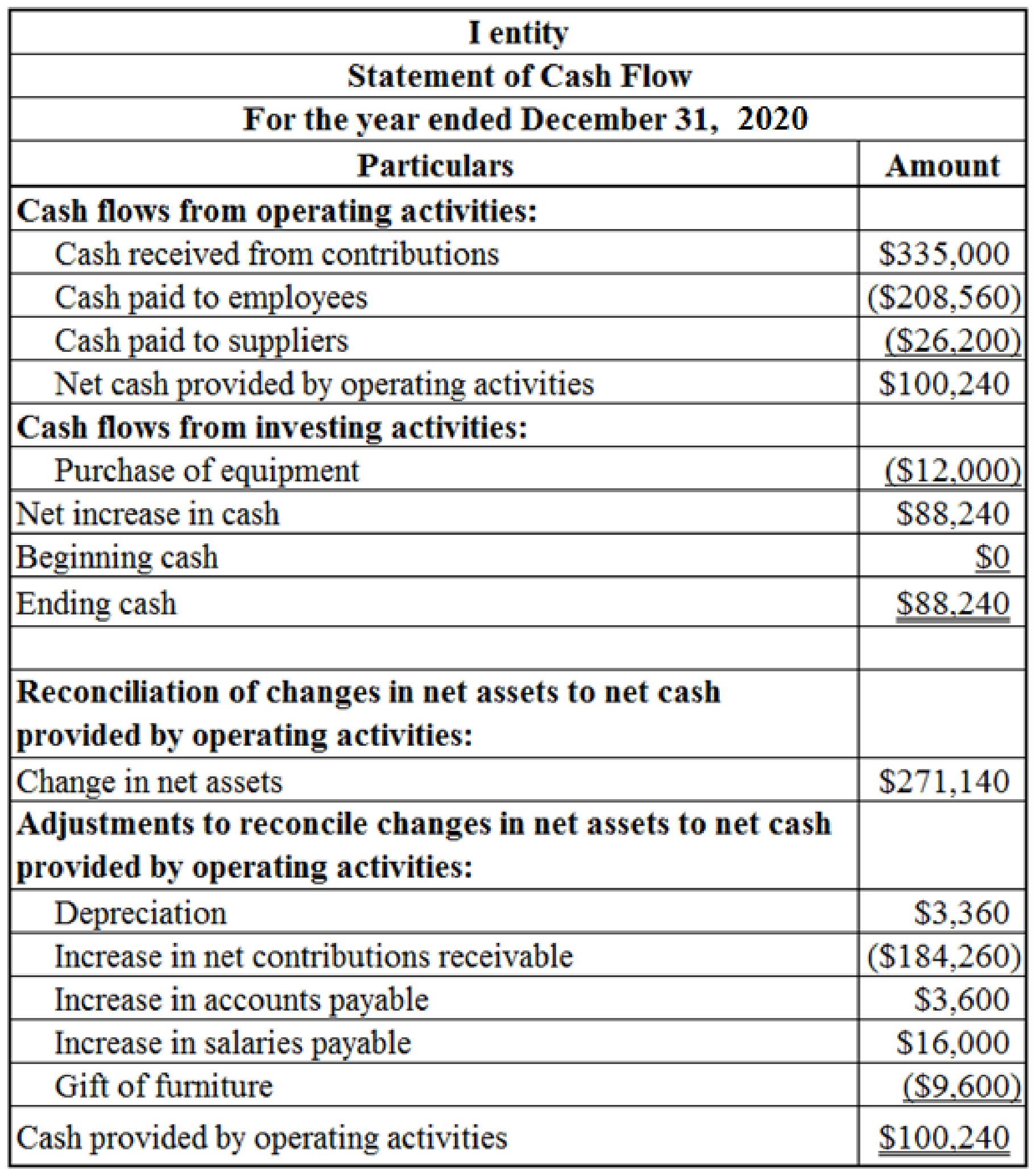

d)

Prepare a statement of cash flow for the year ended December 31, 2020.

d)

Explanation of Solution

Prepare a statement of cash flow for the year ended December 31, 2020:

Table (5)

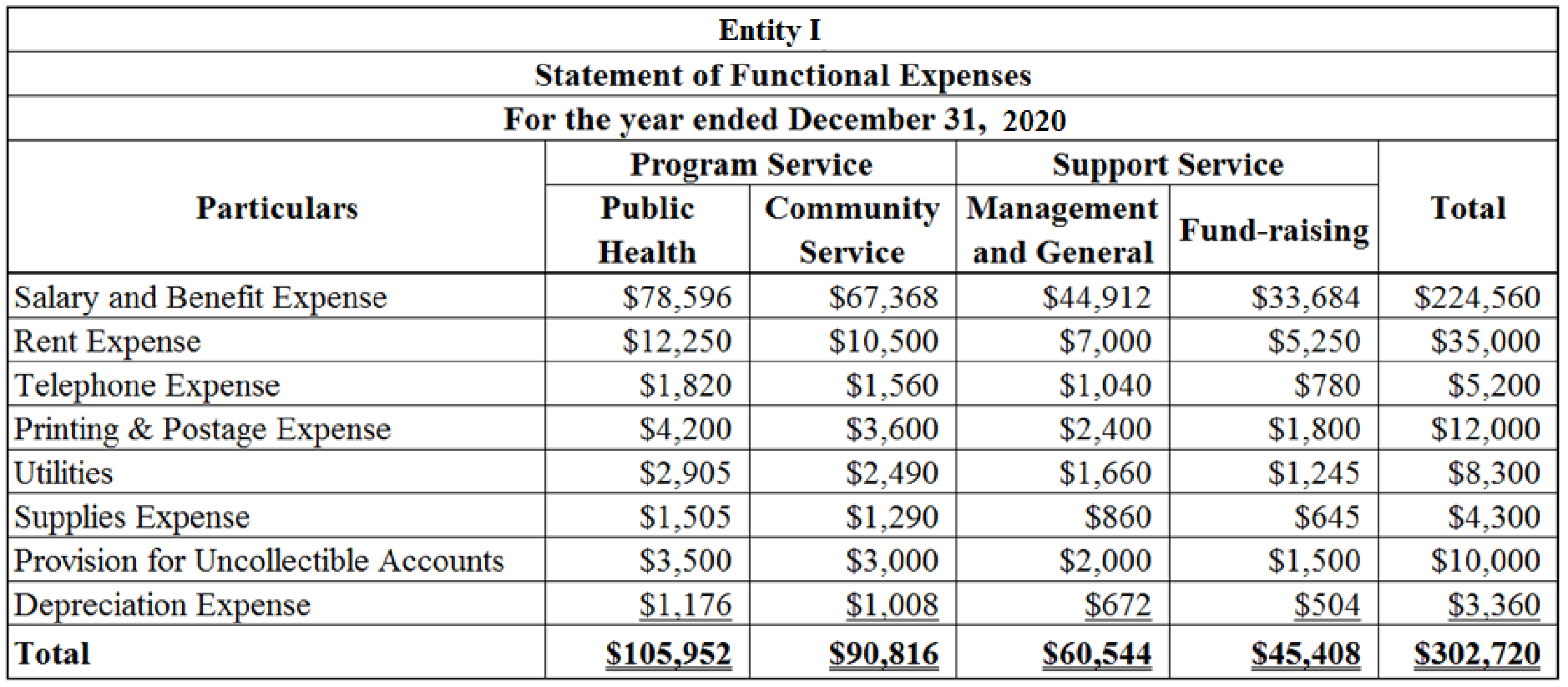

e)

Prepare the schedule of expenses by nature and function for the year ended December 31, 2020.

e)

Explanation of Solution

Prepare the schedule of expenses by nature and function for the year ended December 31, 2020:

Table (6)

Want to see more full solutions like this?

Chapter 14 Solutions

Accounting For Governmental & Nonprofit Entities

- December 31, 2020, the following transactions occurred.(INVOLVED COMPANY)1) A business donated rent-free office space to the organization that would normally rent for 35,000 a year.2) A fund drive raised 185,000 in cash and 100,000 in pledges that will be paid within one year. A state government grant of 150,000 was received for program operating cost related to public health education.3) Salaries and fringe benefits paid during the year amounted to 208,560. At year-end, an additional 16,000 of salaries and fringe benefits were accrued.4) A donor pledged 100,000 for construction of a new building payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be 94,260.5) Office equipment purchased for 12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of 9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are…arrow_forwardPrepare journal entries to record the following transactions and events, based on the assumption that the nonprofit, with a June 30 fiscal year-end, uses a single account to record all unrealized and realized investment gains and losses. Then, prepare journal entries for Events 2 and 3, based on the assumption that the nonprofit separates unrealized from realized investment gains and losses. 1. On July 15, a nonprofit received a donation of Apple stock that had a fair value of $75,000 at the time of the donation. The donor told the nonprofit that the stock could be sold and used only to finance a particular research project. 2. On December 31, when the nonprofit closed its books, the stock had a fair value of $76,500. 3. On February 15, the nonprofit sold the stock for $76,000. 4. On March 15, the nonprofit spent the entire $76,000 on the research project for which the donor made the gift.arrow_forwardGood Charity is a new not-for-profit organization that opened in January 2020. It is funded by government grants and private donations. It prepares its annual financial statements using the deferral method of accounting for contributions and uses only one fund to account for all activities. Required: 1) Prepare all related journal entries for the following transactions for Good Charity for 2020: a) Jan 1: a donor contributes land for a future operations site. Land has a fair value of $32,000. b) Feb 1: A donor contributes $60,000 on the condition that the principal amount be invested in marketable securities and that only the income earned from the investment be spent on operations. Income of $2,000 was earned and received during 2020 on these investments. c) General donations of $85,000 were received during 2020. d) Feb 1: the government gave $80,000 to Good Charity to purchase equipment and furniture with a useful life of 10 years. This was all used to…arrow_forward

- December 31, 2020, the following transactions occurred.(INVOLVED COMPANY)1) A business donated rent-free office space to the organization that would normally rent for 35,000 a year2) A fund drive raised 185,000 in cash and 100,000 in pledges that will be paid within one year. A state government grant of 150,000 was received for program operating cost related to public health education.3) Salaries and fringe benefits paid during the year amounted to 208,560. At year-end an additional 16,000 of salaries and fringe benefits were accrued.4) A donor pledged 100,000 for construction of a new building payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be 94,260.5) Office equipment purchased for 12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of 9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are…arrow_forwardDecember 31, 2020, the following transactions occurred.(INVOLVED COMPANY)1) A business donated rent-free office space to the organization that would normally rent for 35,000 a year2) A fund drive raised 185,000 in cash and 100,000 in pledges that will be paid within one year. A state government grant of 150,000 was received for program operating cost related to public health education.3) Salaries and fringe benefits paid during the year amounted to 208,560. At year-end an additional 16,000 of salaries and fringe benefits were accrued.4) A donor pledged 100,000 for construction of a new building payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be 94,260.5) Office equipment purchased for 12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of 9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are…arrow_forwardDecember 31, 2020, the following transactions occurred.(INVOLVED COMPANY)1) A business donated rent-free office space to the organization that would normally rent for 35,000 a year2) A fund drive raised 185,000 in cash and 100,000 in pledges that will be paid within one year. A state government grant of 150,000 was received for program operating cost related to public health education.3) Salaries and fringe benefits paid during the year amounted to 208,560. At year-end an additional 16,000 of salaries and fringe benefits were accrued.4) A donor pledged 100,000 for construction of a new building payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be 94,260.5) Office equipment purchased for 12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of 9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are…arrow_forward

- December 31, 2020, the following transactions occurred.(INVOLVED COMPANY)1) A business donated rent-free office space to the organization that would normally rent for 35,000 a year2) A fund drive raised 185,000 in cash and 100,000 in pledges that will be paid within one year. A state government grant of 150,000 was received for program operating cost related to public health education.3) Salaries and fringe benefits paid during the year amounted to 208,560. At year-end an additional 16,000 of salaries and fringe benefits were accrued.4) A donor pledged 100,000 for construction of a new building payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be 94,260.5) Office equipment purchased for 12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of 9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are…arrow_forwardEffect of different measurement focuses and bases of accounting Following are some of Vista Village’s events during calendar year 2021. For each event, state (a) the amount the Village would report as expenditures if the event occurred in a governmental-type fund and (b) the amount it would report as expenses if the eventoccurred in an Enterprise Fund.1. The amount owed to employees for vacation and sick leave increased from $720,000to $765,000 during the year. Employees are permitted to receive payment for unusedvacation and sick leave days when they retire; at year-end, however, none of the employees had retired.2. At December 31, 2021 interest accrued on outstanding long-term debt amounted to $63,000. The interest was due to be paid on May 1, 2022.arrow_forwardThe Ombudsman Foundation is a private nonprofit organization providing dispute resolution and conflict management training. The Foundation had the following preclosing trial balance at December 31, 2024, the end of its fiscal year: Account: Debits Credits Accounts payable $23,600 Accounts receivable (net) $46,300 Accrued interest receivable 16,700 Accumulated depreciation 3,260,500 Cash 110,000 Contributed services 26,000 Contributions—no restrictions 2,410,000 Contributions—purpose restrictions 796,000 Contributions—endowment 2,371,700 Current pledges receivable 75,500 Education program expenses 1,536,100 Fund-raising expenses 116,500 Investment revenue—purpose restrictions 86,500 Training seminars expenses 4,546,100 Land, buildings, and equipment 5,610,700 Long-term investments 2,743,300 Management and general expenses 396,600 Net assets without donor restrictions 448,000 Net assets with donor restrictions…arrow_forward