Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 32BEB

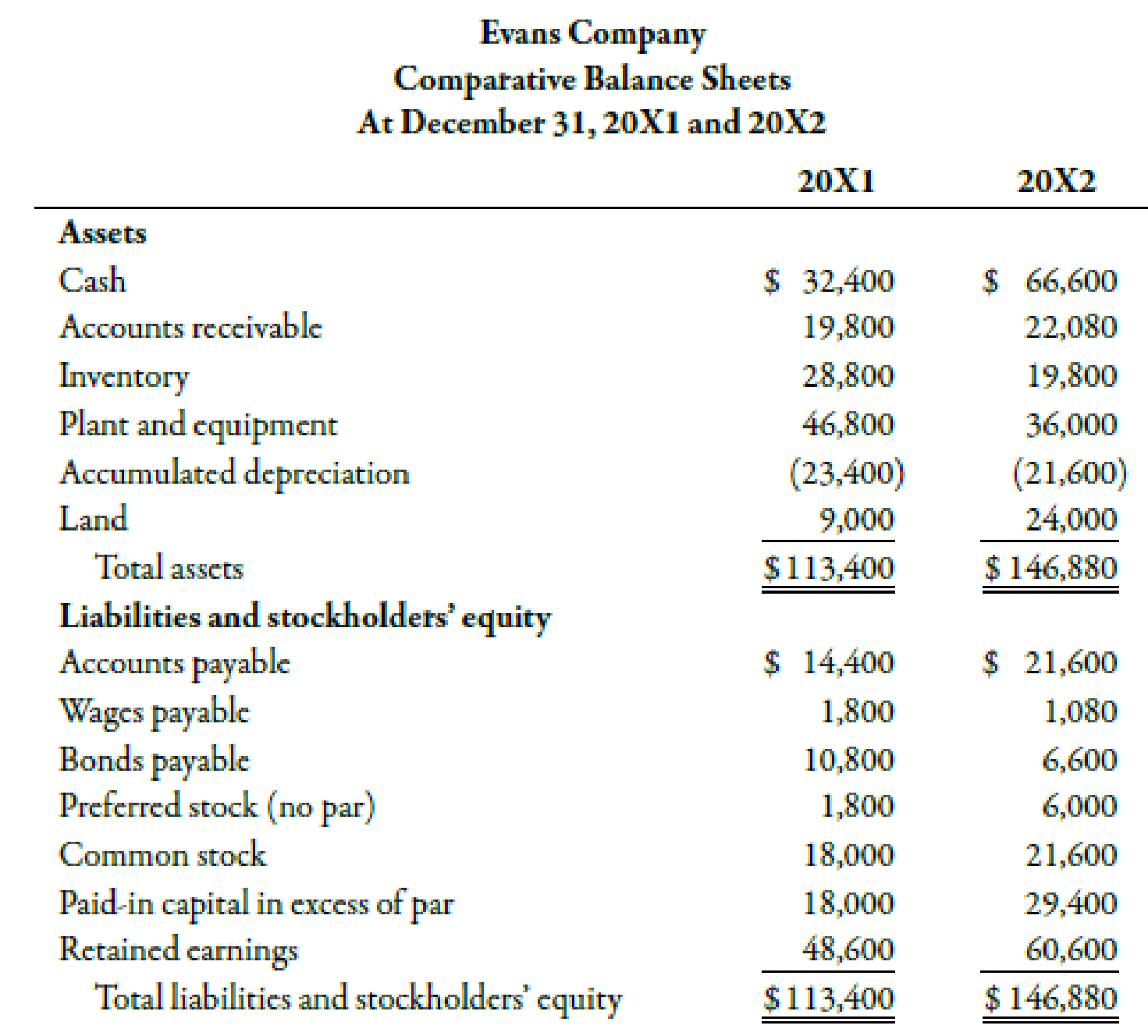

During 20X2, Evans Company had the following transactions:

- a. Cash dividends of $6,000 were paid.

- b. Equipment was sold for $2,880. It had an original cost of $10,800 and a book value of $5,400. The loss is included in operating expenses.

- c. Land with a fair market value of $15,000 was acquired by issuing common stock with a par value of $3,600.

- d. One thousand shares of

preferred stock (no par) were sold for $4.20 per share.

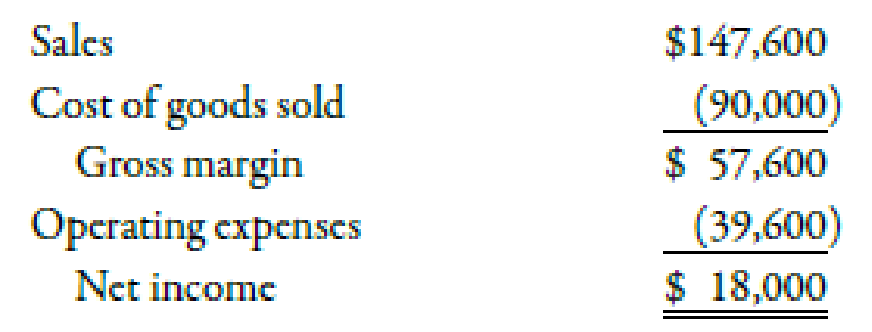

Evans provided the following income statement (for 20X2) and comparative balance sheets:

Required:

Prepare a worksheet for Evans Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 14 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Of the three categories on the statement of cash...Ch. 14 - Prob. 4DQCh. 14 - Why is it better to report the noncash investing...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Explain how a company can report a loss and still...Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Prob. 10DQ

Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Explain the reasoning for including the payment of...Ch. 14 - What are the advantages in using worksheets when...Ch. 14 - Prob. 14DQCh. 14 - Cash inflows from operating activities come from...Ch. 14 - Prob. 2MCQCh. 14 - Prob. 3MCQCh. 14 - Sources of cash include a. profitable operations....Ch. 14 - Uses of cash include a. cash dividends. b. the...Ch. 14 - Prob. 6MCQCh. 14 - Prob. 7MCQCh. 14 - Which of the following adjustments to net income...Ch. 14 - An increase in accounts receivable is deducted...Ch. 14 - An increase in inventories is deducted from net...Ch. 14 - The gain on sale of equipment is deducted from net...Ch. 14 - Which of the following is an investing activity?...Ch. 14 - Which of the following is a financing activity? a....Ch. 14 - Prob. 14MCQCh. 14 - A worksheet approach to preparing the statement of...Ch. 14 - In a completed worksheet, a. the debit column...Ch. 14 - Prob. 17BEACh. 14 - Prob. 18BEACh. 14 - Prob. 19BEACh. 14 - Prob. 20BEACh. 14 - Swasey Company earned net income of 1,800,000 in...Ch. 14 - Prob. 22BEACh. 14 - Prob. 23BEACh. 14 - During 20X2, Norton Company had the following...Ch. 14 - Prob. 25BEBCh. 14 - Prob. 26BEBCh. 14 - Roberts Company provided the following partial...Ch. 14 - Prob. 28BEBCh. 14 - Prob. 29BEBCh. 14 - Prob. 30BEBCh. 14 - Prob. 31BEBCh. 14 - During 20X2, Evans Company had the following...Ch. 14 - Stillwater Designs is a private company and...Ch. 14 - Prob. 34ECh. 14 - Jarem Company showed 189,000 in prepaid rent on...Ch. 14 - During the year, Hepworth Company earned a net...Ch. 14 - During 20X1, Craig Company had the following...Ch. 14 - Tidwell Company experienced the following during...Ch. 14 - Prob. 39ECh. 14 - Oliver Company provided the following information...Ch. 14 - Prob. 41ECh. 14 - Prob. 42ECh. 14 - Prob. 43ECh. 14 - Solpoder Corporation has the following comparative...Ch. 14 - Solpoder Corporation has the following comparative...Ch. 14 - The following financial statements were provided...Ch. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Booth Manufacturing has provided the following...Ch. 14 - The following balance sheets and income statement...Ch. 14 - The following balance sheets and income statement...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Prob. 54PCh. 14 - Prob. 55PCh. 14 - The following balance sheets were taken from the...Ch. 14 - The following balance sheets were taken from the...Ch. 14 - The comparative balance sheets and income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 20X2, Norton Company had the following transactions: a. Cash dividends of 20,000 were paid. b. Equipment was sold for 9,600. It had an original cost of 36,000 and a book value of 18,000. The loss is included in operating expenses. c. Land with a fair market value of 50,000 was acquired by issuing common stock with a par value of 12,000. d. One thousand shares of preferred stock (no par) were sold for 14 per share. Norton provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Norton Company.arrow_forwardBalance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the worksheet approach. Use the indirect method to prepare the statement.arrow_forwardBalance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the indirect method.arrow_forward

- For the current year, Vidalia Company reported revenues of 250,000 and expenses of 225,000. At the beginning of the year, its retained earnings had a balance of 95,000. During the year, Vidalia paid 11,000 dividends to shareholders. Its contributed capital was 56,000 at the beginning of the year, and it did not issue any new stock during the year. Vidalias assets total 237,500 on December 31 of the current year. What are Vidalias total liabilities on December 31 of the current year?arrow_forwardAssume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?arrow_forwardMontana Incorporated began the year with a retained earnings balance of $50,000. The company paid a total of $5,000 in dividends and experienced a net loss of $25,000 this year. What is the ending retained earnings balance?arrow_forward

- Farmington Corporation began the year with a retained earnings balance of $20,000. The company paid a total of $3,000 in dividends and earned a net income of $60,000 this year. What is the ending retained earnings balance?arrow_forwardDuring 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds issued by Makenzie Inc. b. Acquired land valued at 105,000 in exchange for machinery. c. Sold equipment with original cost of 810,000 for 495,000; accumulated depreciation taken on the equipment to the point of sale was 270,000. d. Purchased new machinery for 180,000. e. Purchased common stock in Lemmons Company for 82,500. Required: 1. Prepare the net cash from investing activities section of the statement of cash flows. 2. CONCEPTUAL CONNECTION Usually, the net cash from investing activities is negative. How can Craig cover this negative cash flow? What other information would you like to have to make this decision?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License