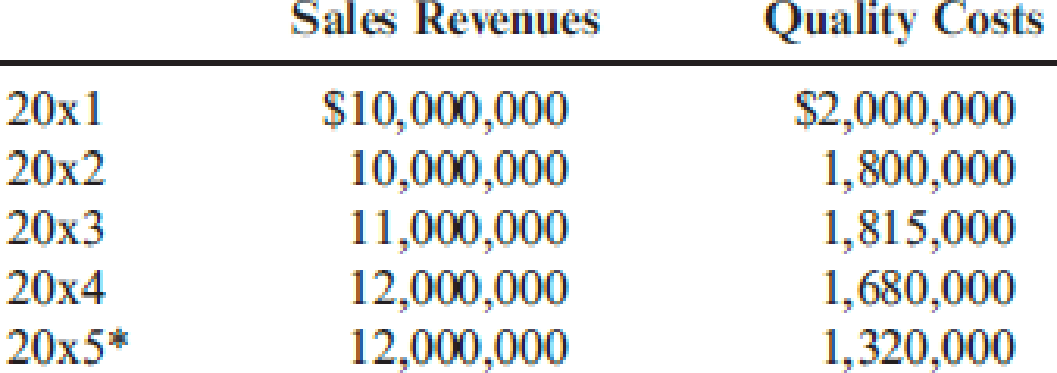

Iona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lower quality costs to 10 percent of sales by the end of 20x5. Sales and quality costs for each year are as follows:

* Budgeted figures.

Quality costs by category are expressed as a percentage of sales as follows:

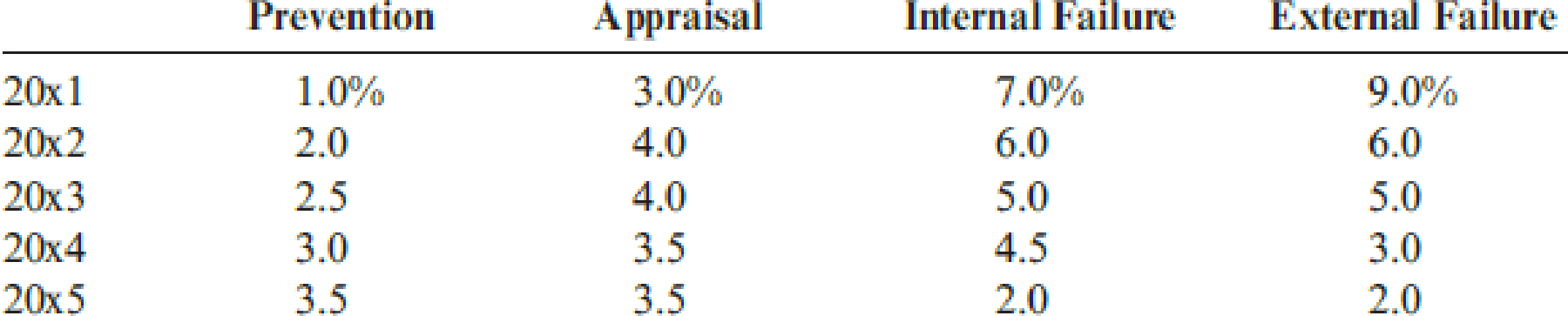

The detail of the 20x5 budget for quality costs is also provided.

All prevention costs are fixed; all other quality costs are variable.

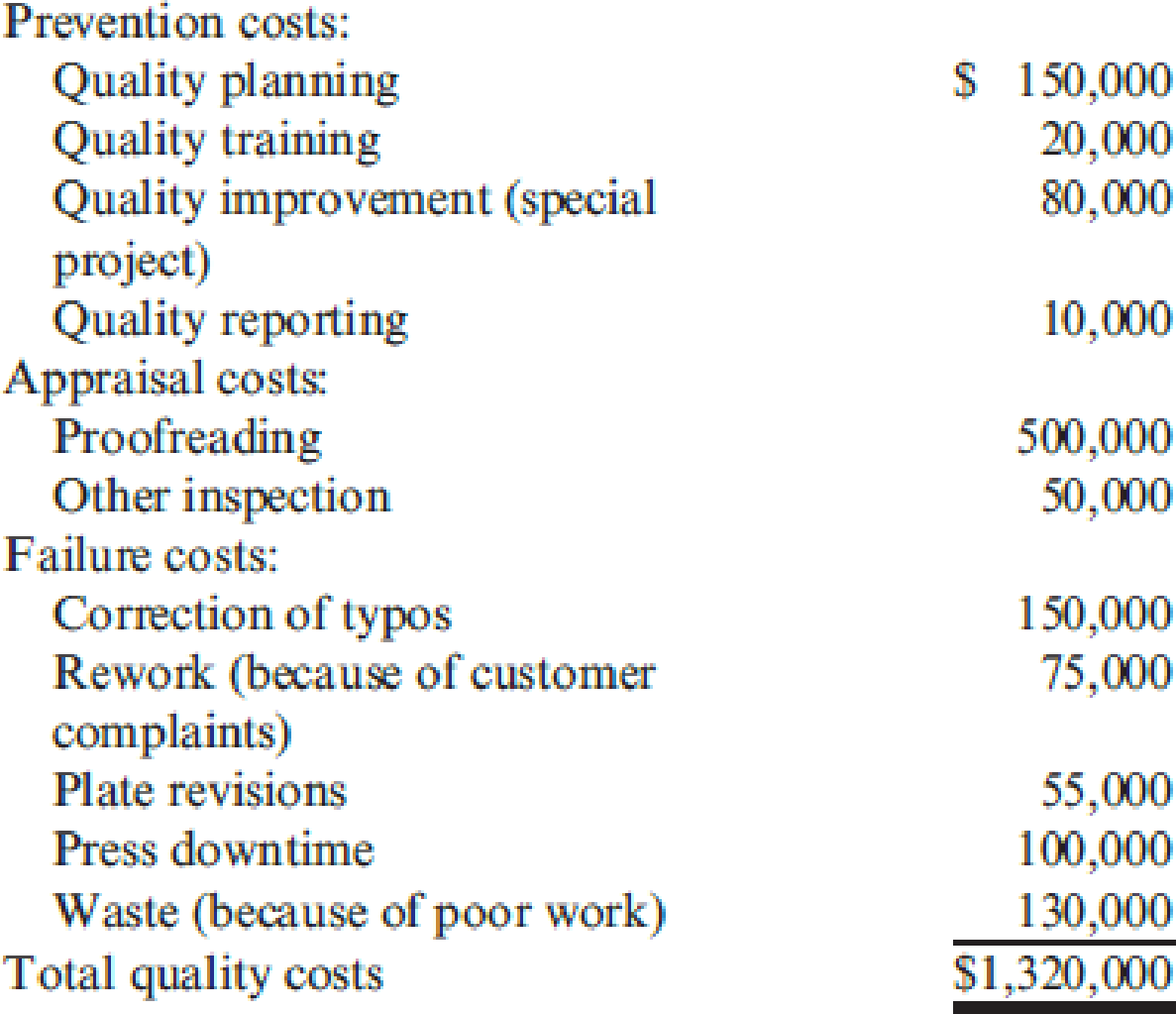

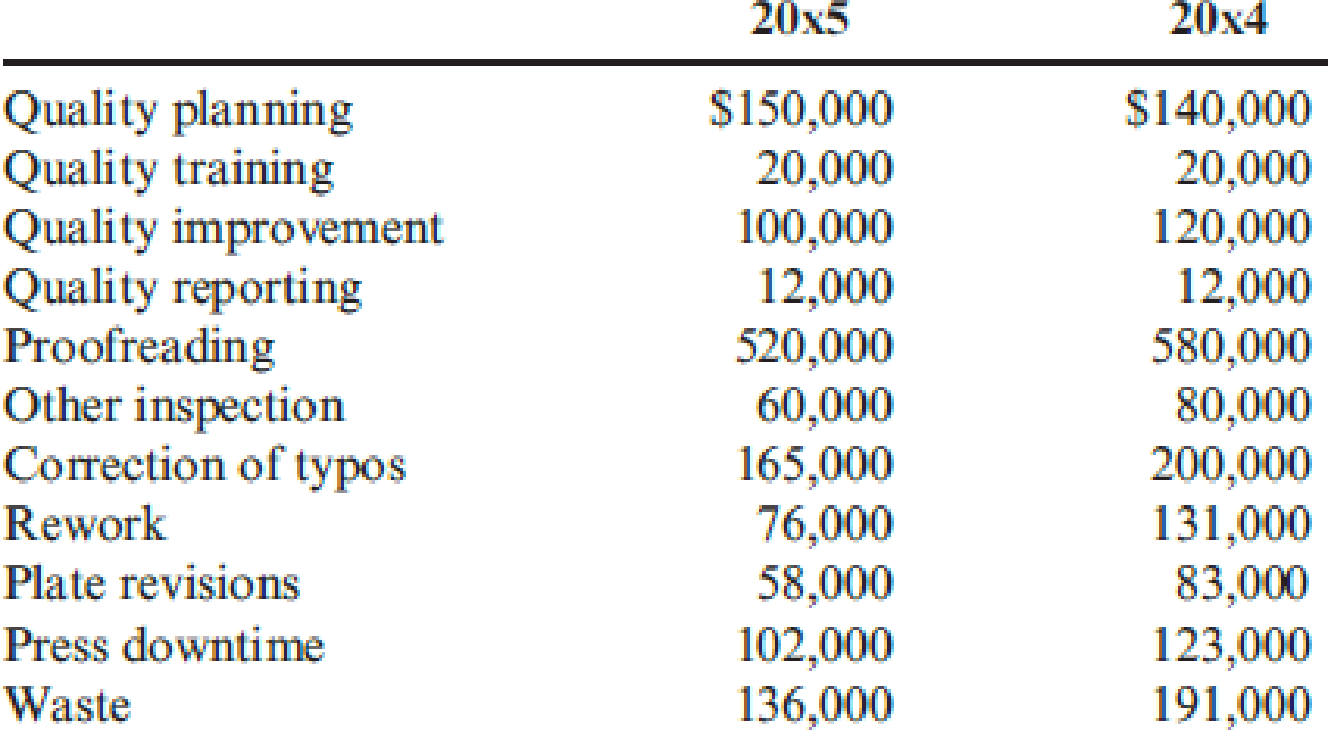

During 20x5, the company had $12 million in sales. Actual quality costs for 20x4 and 20x5 are as follows:

Required:

- 1. Prepare an interim quality cost performance report for 20x5 that compares actual quality costs with budgeted quality costs. Comment on the firm’s ability to achieve its quality goals for the year.

- 2. Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5. How much did profits change because of improved quality?

- 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program.

- 4. Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements?

- 5. Assume that the company is preparing a second five-year plan to reduce quality costs to 2.5 percent of sales. Prepare a long-range quality cost performance report assuming sales of $15 million at the end of five years. Assume that the final planned relative distribution of quality costs is as follows: proofreading, 50 percent; other inspection, 13 percent; quality training, 30 percent; and quality reporting, 7 percent.

1.

Prepare an interim quality cost performance report for the year 20x5 that compares actual quality costs with budgeted quality costs and comment on the ability of the firm for achieving its quality goals for the year.

Explanation of Solution

Quality cost performance reports: In a quality cost performance report, identification of quality standard is the main element and it has two important elements namely; actual outcomes and expected or standard outcomes.

Interim quality report: Interim quality performance report compares the actual quality at the end of the period with the budgeted costs and this report examines the progress attained within the period comparative to the planned level of progress for that period.

Prepare an interim quality cost performance report for the year 20x5:

| Company I | ||||

| Interim Performance Report: Quality Costs | ||||

| For the Year Ended December 31, 20x5 | ||||

| Particulars |

Actual Costs (a) |

Budgeted costs (b) |

Variance | |

| Prevention costs: | ||||

| Fixed: | ||||

| Quality planning | $150,000 | $150,000 | $0 | |

| Quality training | $20,000 | $20,000 | $0 | |

| Quality improvement | $100,000 | $80,000 | $20,000 | U |

| Quality reporting | $12,000 | $10,000 | $2,000 | U |

| Total prevention costs | $282,000 | 260,000 | $22,000 | U |

| Appraisal costs: | ||||

| Variable: | ||||

| Proofreading | $520,000 | $500,000 | $20,000 | U |

| Other inspection | $60,000 | $50,000 | $10,000 | U |

| Total appraisal costs | $580,000 | 550,000 | $30,000 | U |

| Failure costs: | ||||

| Variable: | ||||

| Correction of typos | $165,000 | $150,000 | $15,000 | U |

| Rework | $76,000 | $75,000 | $1,000 | U |

| Plate revisions | $58,000 | $55,000 | $3,000 | U |

| Press downtime | $102,000 | $100,000 | $2,000 | U |

| Waste | $ 136,000 | $130,000 | $ 6,000 | U |

| Total failure costs | $537,000 | $510,000 | $27,000 | U |

| Total quality costs | $1,399,000 | $1,320,000 | $79,000 | U |

Table (1)

Every single category and each individual item are equivalent to or higher than the budgeted amounts. Therefore, the firm cannot achieve its budgeted goals for the year.

2.

Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5 and state the amount of change in profit due to improvement in quality.

Explanation of Solution

Prepare a one-period quality performance report for 20x5:

| Company I | ||||

| Performance Report: Quality Costs | ||||

| One-Year Trend | ||||

| For the Year Ended December 31, 20x5 | ||||

| Particulars |

Actual Costs 20x5 (a) |

Actual Costs 20x4 (b) |

Variance | |

| Prevention costs: | ||||

| Fixed: | ||||

| Quality planning | $150,000 | $140,000 | ($10,000) | U |

| Quality training | $20,000 | $20,000 | $0 | |

| Quality improvement | $100,000 | $120,000 | $20,000 | F |

| Quality reporting | $12,000 | $12,000 | $0 | |

| Total prevention costs | $282,000 | $292,000 | $10,000 | F |

| Appraisal costs: | ||||

| Variable: | ||||

| Proofreading | $520,000 | $580,000 | $60,000 | F |

| Other inspection | $60,000 | $80,000 | $20,000 | F |

| Total appraisal costs | $580,000 | $660,000 | $80,000 | F |

| Failure costs: | ||||

| Variable: | ||||

| Correction of typos | $165,000 | $200,000 | $35,000 | F |

| Rework | $76,000 | $131,000 | $55,000 | F |

| Plate revisions | $58,000 | $83,000 | $25,000 | F |

| Press downtime | $102,000 | $123,000 | $21,000 | F |

| Waste | $ 136,000 | $191,000 | $ 55,000 | F |

| Total failure costs | $537,000 | $728,000 | $191,000 | F |

| Total quality costs | $1,399,000 | $1,680,000 | $281,000 | F |

Table (2)

- The quality cost reduced from 20x4 to 20x5; therefore, the profit increased to $281,000. There is still considerable improvement even though the budgeted reductions for the year are not met.

- Additionally, the improvement was due to the “reduction of failure costs” which is a positive sign denoting that quality is certainly increasing.

3.

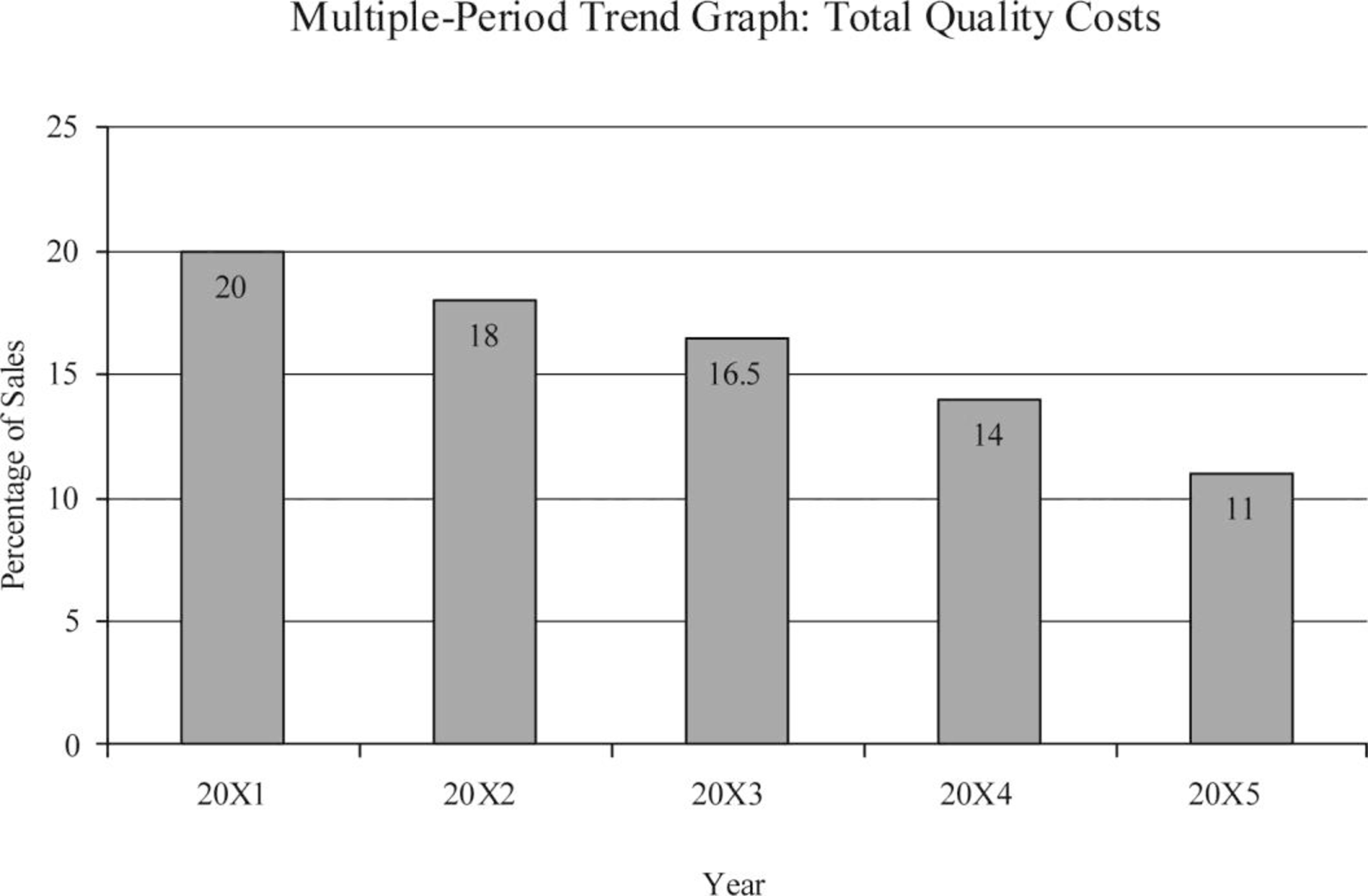

Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program.

Explanation of Solution

Multiple-period quality trend reports: Multiple-period quality trend reports is a chart or graph that tracks the change in quality from the starting of the program to the present.

Prepare a graph:

Figure (1)

Working notes:

(1)Calculate the percent of sales:

| Year |

Quality Costs (a) |

Sales Revenues (b) |

Percent of sales |

| 20x1 | $2,000,000 | $10,000,000 | 20% |

| 20x2 | $1,800,000 | $10,000,000 | 18% |

| 20x3 | $1,815,000 | $11,000,000 | 16.5% |

| 20x4 | $1,680,000 | $12,000,000 | 14% |

| 20x5 | $1,320,000 | $12,000,000 | 11.65% |

Table (3)

4.

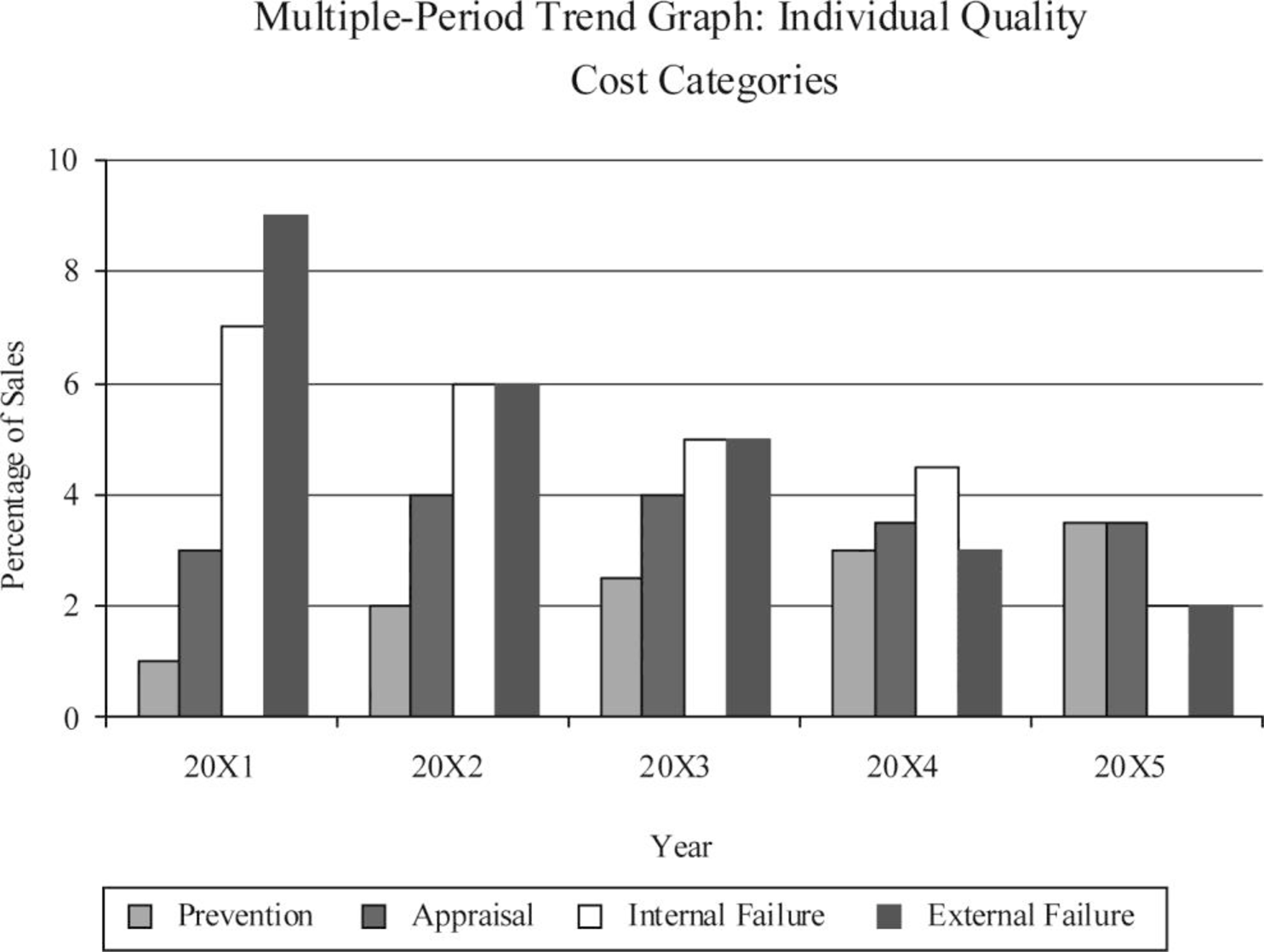

Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5 and state the manner in which the graphs helps management to know that the reduction in total quality costs is attributable to quality improvement.

Explanation of Solution

Prepare a graph:

Figure (2)

“Increases in prevention and appraisal costs” along with simultaneous decrease in failure costs are good indication that in general quality is increasing. It is to be noted, that decreases in external failure costs are mostly difficult to attain without increase in actual quality.

5.

Prepare a long-range quality cost performance report.

Explanation of Solution

Long-range performance report: Long-range performance report compares the “current actual” with the costs that will be allowed if the “zero-defects standard” is being met by assuming that sales level is equal to that of the existing period.

Prepare a long-range quality cost performance report:

| Company I | ||||

| Performance Report: Quality Costs | ||||

| One-Year Trend | ||||

| For the Year Ended December 31, 20x5 | ||||

| Particulars |

Actual Costs 20x5 (a) |

Long-Range Target Costs (b) |

Variance | |

| Prevention costs: | ||||

| Fixed: | ||||

| Quality planning | $150,000 | $0 | $150,000 | U |

| Quality training | $20,000 | (9)$112,500 | ($92,500) | F |

| Quality improvement | $100,000 | $0 | $100,000 | U |

| Quality reporting | $12,000 | (10)$26,250 | ( $14,250) | F |

| Total prevention costs | $282,000 | $138,750 | $143,250 | U |

| Appraisal costs: | ||||

| Variable: | ||||

| Proofreading | (2)$650,000 | (11)$187,500 | $462,500 | U |

| Other inspection | (3) $75,000 | (12)$48,750 | $26,250 | U |

| Total appraisal costs | $725,000 | $236,250 | $488,750 | U |

| Failure costs: | ||||

| Variable: | ||||

| Correction of typos | (4)$206,250 | $0 | $206,250 | U |

| Rework | (5)$95,000 | $0 | $95,000 | U |

| Plate revisions | (6)$72,500 | $0 | $72,500 | U |

| Press downtime | (7)$127,500 | $0 | $127,500 | U |

| Waste | (8) $170,000 | $0 | $170,000 | U |

| Total failure costs | $671,250 | $0 | $671,250 | U |

| Total quality costs | $1,678,250 | $375,000 | $1,303,250 | U |

Table (4)

Note: Apart from for prevention costs, which is a fixed cost, actual costs of 20x5, are adjusted to a sales level of $15 million.

Workings notes:

(2)Calculate the proofreading costs:

(3)Calculate the other inspection costs:

(4)Calculate the correction of typos costs:

(5)Calculate the rework costs:

(6)Calculate the plate revision costs:

(7)Calculate the press downtime costs:

(8)Calculate the cost of waste:

(9)Calculate the long-range target costs for quality training:

(10)Calculate the long-range target costs for quality reporting:

(11)Calculate the long-range target costs for proofreading:

(12)Calculate the long-range target costs for other inspection:

(13)Calculate the amount of total quality costs:

Want to see more full solutions like this?

Chapter 14 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.arrow_forwardCassara, Inc., had the following quality costs for the years ended December 31, 20X1 and 20X2: At the end of 20X1, management decided to increase its investment in control costs by 40% for each categorys items, with the expectation that failure costs would decrease by 25% for each item of the failure categories. Sales were 12,000,000 for both 20X1 and 20X2. Required: 1. Calculate the budgeted costs for 20X2, and prepare an interim quality performance report. 2. Comment on the significance of the report. How much progress has Cassara made?arrow_forwardShalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forward

- Andresen Company had the following quality costs for the years ended June 30, 20X1 and 20X2: At the end of 20X1, management decided to increase its investment in control costs by 50% for each categorys items, with the expectation that failure costs would decrease by 20% for each item of the failure categories. Sales were 6,000,000 for both 20X1 and 20X2. Required: 1. Calculate the budgeted costs for 20X2, and prepare an interim quality performance report. 2. Comment on the significance of the report. How much progress has Andresen made?arrow_forwardLuna Company is a printing company and a subsidiary of a large publishing company. Luna is in its fourth year of a 5-year, quality improvement program. The program began in 20X1 as a result of a report by a consulting firm that revealed that quality costs were about 20% of sales. Concerned about the level of quality costs, Lunas top management began a 5-year plan in 20X1 with the objective of lowering quality costs to 10% of sales by the end of 20X5. Sales and quality costs for each year are as follows: Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20X5 budget for quality costs is also provided. Actual quality costs for 20X4 and 20X5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20X5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a single-period quality performance report for 20X5 that compares the actual quality costs of 20X4 with the actual costs of 20X5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20X1 through 20X5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second 5-year plan to reduce quality costs to 2.5% of sales. Prepare a long-range quality cost performance report that compares the costs for 20X5 with those planned for the end of the second 5-year period. Assume sales of 45 million at the end of 5 years. The final planned relative distribution of quality costs is as follows: proofreading, 50%; other inspection, 13%; quality training, 30%; and quality reporting, 7%. Assume that all prevention costs are fixed and all other costs are variable (with respect to sales).arrow_forwardIn 20x4, Tru-Delite Frozen Desserts, Inc., instituted a quality improvement program. At the end of 20x5, the management of the corporation requested a report to show the amount saved by the measures taken during the year. The actual sales and quality costs for 20x4 and 20x5 are as follows: Tru-Delites management believes that quality costs can be reduced to 2.5 percent of sales within the next five years. At the end of 20x9, Tru-Delites sales are projected to grow to 750,000. The projected relative distribution of quality costs at the end of 20x9 is as follows: Required: 1. Profits increased by what amount due to quality improvements made in 20x5? 2. Prepare a long-range performance report that compares the quality costs incurred at the end of 20x5 with the quality cost structure expected at the end of 20x9. 3. Are the targeted costs in the year 20x9 all value-added costs? How would you interpret the variances if the targeted costs are value-added costs? 4. What would be the profit increase in 20x9 if the 2.5 percent performance standard is met in that year?arrow_forward

- Evans Company had total sales of 3,000,000 for fiscal 20x5. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution. 3. What if, five years from now, quality costs are 7.5 percent of sales, with control costs being 65 percent of the total quality costs? What would your conclusion be?arrow_forwardFoy Company has a welding activity and wants to develop a flexible budget formula for the activity. The following resources are used by the activity: Four welding units, with a lease cost of 12,000 per year per unit Six welding employees each paid a salary of 50,000 per year (A total of 9,000 welding hours are supplied by the six workers.) Welding supplies: 300 per job Welding hours: Three hours used per job During the year, the activity operated at 90 percent of capacity and incurred the actual activity and resource costs, shown on page 676. Lease cost: 48,000 Salaries: 315,000 Parts and supplies: 805,000 Required: 1. Prepare a flexible budget formula for the welding activity using welding hours as the driver. 2. Prepare a performance report for the welding activity. 3. What if welders were hired through outsourcing and paid 30 per hour (the welding equipment is provided by Foy)? Repeat Requirement 1 for the outsourcing case.arrow_forwardNabors Company had actual quality costs for the year ended June 30, 20x5, as given below. At the zero-defect state, Nabors expects to spend 375,000 on quality engineering, 75,000 on vendor certification, and 50,000 on packaging inspection. Assume sales to be 25,000,000. Required: 1. Prepare a long-range performance report for 20x5. What does this report tell the management of Nabors? 2. Explain why quality costs still are present for the zero-defect state. 3. What if Nabors achieves the zero-defect state reflected in the report? What are some of the implications of this achievement?arrow_forward

- Optima Company is a high-technology organization that produces a mass-storage system. The design of Optimas system is unique and represents a breakthrough in the industry. The units Optima produces combine positive features of both compact and hard disks. The company is completing its fifth year of operations and is preparing to build its master budget for the coming year (20X1). The budget will detail each quarters activity and the activity for the year in total. The master budget will be based on the following information: a. Fourth-quarter sales for 20X0 are 55,000 units. b. Unit sales by quarter (for 20X1) are projected as follows: The selling price is 400 per unit. All sales are credit sales. Optima collects 85% of all sales within the quarter in which they are realized; the other 15% is collected in the following quarter. There are no bad debts. c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter: d. Each mass-storage unit uses 5 hours of direct labor and three units of direct materials. Laborers are paid 10 per hour, and one unit of direct materials costs 80. e. There are 65,700 units of direct materials in beginning inventory as of January 1, 20X1. At the end of each quarter, Optima plans to have 30% of the direct materials needed for next quarters unit sales. Optima will end the year with the same amount of direct materials found in this years beginning inventory. f. Optima buys direct materials on account. Half of the purchases are paid for in the quarter of acquisition, and the remaining half are paid for in the following quarter. Wages and salaries are paid on the 15th and 30th of each month. g. Fixed overhead totals 1 million each quarter. Of this total, 350,000 represents depreciation. All other fixed expenses are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the years total fixed overhead by the years budgeted production in units. h. Variable overhead is budgeted at 6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total 250,000 per quarter, including 50,000 depreciation. j. Variable selling and administrative expenses are budgeted at 10 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. k. The balance sheet as of December 31, 20X0, is as follows: l. Optima will pay quarterly dividends of 300,000. At the end of the fourth quarter, 2 million of equipment will be purchased. Required: Prepare a master budget for Optima Company for each quarter of 20X1 and for the year in total. The following component budgets must be included: 1. Sales budget 2. Production budget 3. Direct materials purchases budget 4. Direct labor budget 5. Overhead budget 6. Selling and administrative expenses budget 7. Ending finished goods inventory budget 8. Cost of goods sold budget (Note: Assume that there is no change in work-in-process inventories.) 9. Cash budget 10. Pro forma income statement (using absorption costing) (Note: Ignore income taxes.) 11. Pro forma balance sheet (Note: Ignore income taxes.)arrow_forwardThe Sea Wharf Restaurant would like to determine the best way to allocate a monthly advertising budget of 1,000 between newspaper advertising and radio advertising. Management decided that at least 25% of the budget must be spent on each type of media and that the amount of money spent on local newspaper advertising must be at least twice the amount spent on radio advertising. A marketing consultant developed an index that measures audience exposure per dollar of advertising on a scale from 0 to 100, with higher values implying greater audience exposure. If the value of the index for local newspaper advertising is 50 and the value of the index for spot radio advertising is 80, how should the restaurant allocate its advertising budget to maximize the value of total audience exposure? a. Formulate a linear programming model that can be used to determine how the restaurant should allocate its advertising budget in order to maximize the value of total audience exposure. b. Develop a spreadsheet model and solve the problem using Excel Solver.arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning