Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 3BE

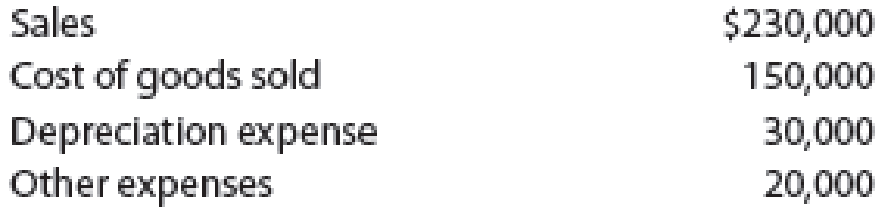

Moses Moonrocks Inc. has developed a balanced scorecard with a measure map that suggests that the number of erroneous shipments has a direct effect on operating profit. The company estimates that every shipment error leads to a reduction of revenue by $3,000 and increased costs of about $2,000. If the company has the following budgeted sales and costs for next month (without accounting for any possible shipping errors), determine how many shipping errors the company can afford to have and still break even:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Mark Fletcher, President of SoftGro, Inc., was looking forward to seeing the performance reports for November because he knew the company's sales for the month had exceeded budget by a considerable margin. SoftGro, a distributor of educational software packages, has been growing steadily for approximately two years. Fletcher's biggest challenge at this point was to ensure that the company did not lose control of expenses during this growth period. When Fletcher received the November reports, he was dismayed to see the large unfavorable variance in the company's Monthly Selling expense Report that follows:

Annual Budget

November Budget

November Actual

November Variance

Unit sales

2,000,000

280,000

310,000

30,000

Dollar sales

$ 80,000,000.00

$ 11,200,000.00

$ 12,400,000.00

$ 1,200,000.00

Orders processed

54,000

6,500

5,800

-700

Sales personnel per month

90

90

96

-6

Advertising

$ 19,800,000.00

$…

Following increased competition and customer expectations, ABC company has been forced to revisit its operational strategy and its quality standards. The following budgeted data for 2022 are available:Number of Trainees 4,500, Operating Income $54,000Budgeted Variable Cost per Trainee:

Trainee's Support Service $36 Training Materials $12 Foods $20Miscellaneous Products & Services $20

Budgeted Fixed Cost per Training:

Facilities 14,500

Salaries 15,500

Based on the customer survey it conducted, ABC company has learned that several improvements to its products and services are required. The improvements would provide the following impacts:Increase in the Number of Trainees 60%Increase in the Total Variable Costs 55%Increase in the Total Fixed Costs 85%You are required to:(i) Calculate the budgeted revenue per trainee based on the available data. (ii) Assuming that budgeted revenue per trainee remains unchanged, explain (with numerical justifications) whether ABC company should…

Lux Co. believes that its collection costs could be reduced through modification of collection procedures. This action is expected to result in a lengthening of the average collection period from 30 to 40 days; however, there will be no change in uncollectible accounts, or in total credit sales. Furthermore, the variable cost ratio is 65%, the opportunity cost of a longer collection period is assumed to be negligible, the company's budgeted credit sales for the coming year are P45,000,000, and the required rate of return is 5%. To justify changes in collection procedures, the minimum annual reduction of costs (using a 360-day year and ignoring taxes) must be

Chapter 14 Solutions

Managerial Accounting

Ch. 14 - How does a strategic performance measurement...Ch. 14 - What is the difference between a leading indicator...Ch. 14 - Prob. 3DQCh. 14 - Prob. 4DQCh. 14 - What do strategy maps show, and how do they add...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Prob. 8DQCh. 14 - How is sustainability distinguishable from...Ch. 14 - How can the balanced scorecard be used to address...

Ch. 14 - 72 Inc. has developed a balanced scorecard with...Ch. 14 - Bluetiful Inc. has the following strategic...Ch. 14 - Moses Moonrocks Inc. has developed a balanced...Ch. 14 - Prob. 4BECh. 14 - Lonnies Shipping Co. is considering switching to...Ch. 14 - Henrys Cafe is a local restaurant that is growing...Ch. 14 - American Express Company is a major financial...Ch. 14 - Eat-n-Run Inc. owns and operates 10 food trucks...Ch. 14 - Prob. 4ECh. 14 - Prob. 5ECh. 14 - The following is the balanced scorecard for Smith...Ch. 14 - Grand Grocery developed a balanced scored with six...Ch. 14 - Coulson and Company is a large retail business...Ch. 14 - Rizzo Goal Inc. produces and sells hockey...Ch. 14 - Silver Lining Inc. has a balanced scorecard with a...Ch. 14 - Two departments within Cougar Gear Inc. are...Ch. 14 - Sunny Nights Inc. is completely powered by the...Ch. 14 - Instructions 1. Label each element of the balanced...Ch. 14 - Strategic initiatives and CSR Get Hitched Inc. is...Ch. 14 - Prob. 3PACh. 14 - Instructions 1. Based on the balanced scorecard...Ch. 14 - Strategic initiatives and CSR Blue Skies Inc. is a...Ch. 14 - Eye Swear Inc. has a balanced scorecard that...Ch. 14 - Den-Tex Company is evaluating a proposal to...Ch. 14 - Analyze CSR initiatives at Boxwood Company Boxwood...Ch. 14 - Analyze CSR initiatives at Green Manufacturing...Ch. 14 - Prob. 1TIFCh. 14 - Blake McKenzie Tax Services is a company serving...Ch. 14 - Young Manufacturing Company is a startup...Ch. 14 - The fundamental concept behind strategic...Ch. 14 - Which of the following statements regarding the...Ch. 14 - The balanced scorecard provides an action plan for...Ch. 14 - Which of the following statements best describes...Ch. 14 - A sign of the successful implementation of a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Lockit Company manufactures door knobs for residential homes and apartments. Lockit is considering the use of simple (single-driver) and multiple regression analyses to forecast annual sales because previous forecasts have been inaccurate. The new sales forecast will be used to initiate the budgeting process and to identify more completely the underlying process that generates sales. Larry Husky, the controller of Lockit, has considered many possible independent variables and equations to predict sales and has narrowed his choices to four equations. Husky used annual observations from 20 prior years to estimate each of the four equations. Following are definitions of the variables used in the four equations and a statistical summary of these equations: St=ForecastedsalesindollarsforLockitinperiodtSt1=ActualsalesindollarsforLockitinperiodt1Gt=ForecastedU.S.grossdomesticproductinperiodtGt1=ActualU.S.grossdomesticproductinperiodt1Nt1=Lockitsnetincomeinperiodt1 Required: 1. Write Equations 2 and 4 in the form Y = a + bx. 2. If actual sales are 1,500,000 in the current year, what would be the forecasted sales for Lockit in the coming year? 3. Explain why Larry Husky might prefer Equation 3 to Equation 2. 4. Explain the advantages and disadvantages of using Equation 4 to forecast sales.arrow_forwardUchdorf Manufacturing just completed a study of its purchasing activity with the objective of improving its efficiency. The driver for the activity is number of purchase orders. The following data pertain to the activity for the most recent year: Activity supply: five purchasing agents capable of processing 2,400 orders per year (12,000 orders) Purchasing agent cost (salary): 45,600 per year Actual usage: 10,600 orders per year Value-added quantity: 7,000 orders per year Required: 1. Calculate the volume variance and explain its significance. 2. Calculate the unused capacity variance and explain its use. 3. What if the actual usage drops to 9,000 orders? What effect will this have on capacity management? What will be the level of spending reduction if the value-added standard is met?arrow_forwardIn 2011, Milton Thayne, president of Carbondale Electronics, received a report indicating that quality costs were 31 percent of sales. Faced with increasing pressures from imported goods, Milton resolved to take measures to improve the overall quality of the companys products. After hiring a consultant in 20x0, the company began an aggressive program of total quality control. At the end of 20x5, Milton requested an analysis of the progress the company had made in reducing and controlling quality costs. The Accounting Department assembled the following data: Required: 1. Compute the quality costs as a percentage of sales by category and in total for each year. 2. Prepare a multiple-year trend graph for quality costs, both by total costs and by category. Using the graph, assess the progress made in reducing and controlling quality costs. Does the graph provide evidence that quality has improved? Explain. 3. Using the 20x1 quality cost relationships (assume all costs are variable), calculate the quality costs that would have prevailed in 20x4. By how much did profits increase in 20x4 because of the quality improvement program? Repeat for 20x5.arrow_forward

- Recently, Ulrich Company received a report from an external consulting group on its quality costs. The consultants reported that the companys quality costs total about 21 percent of its sales revenues. Somewhat shocked by the magnitude of the costs, Rob Rustin, president of Ulrich Company, decided to launch a major quality improvement program. For the coming year, management decided to reduce quality costs to 17 percent of sales revenues. Although the amount of reduction was ambitious, most company officials believed that the goal could be realized. To improve the monitoring of the quality improvement program, Rob directed Pamela Golding, the controller, to prepare monthly performance reports comparing budgeted and actual quality costs. Budgeted costs and sales for the first two months of the year are as follows: The following actual sales and actual quality costs were reported for January: Required: 1. Reorganize the monthly budgets so that quality costs are grouped in one of four categories: appraisal, prevention, internal failure, or external failure. (Essentially, prepare a budgeted cost of quality report.) Also, identify each cost as variable (V) or fixed (F). (Assume that no costs are mixed.) 2. Prepare a performance report for January that compares actual costs with budgeted costs. Comment on the companys progress in improving quality and reducing its quality costs.arrow_forwardAndresen Company had the following quality costs for the years ended June 30, 20X1 and 20X2: At the end of 20X1, management decided to increase its investment in control costs by 50% for each categorys items, with the expectation that failure costs would decrease by 20% for each item of the failure categories. Sales were 6,000,000 for both 20X1 and 20X2. Required: 1. Calculate the budgeted costs for 20X2, and prepare an interim quality performance report. 2. Comment on the significance of the report. How much progress has Andresen made?arrow_forwardThe management of Hess, Inc., is developing a flexible budget for the upcoming year. It was not pleased with the small amount of net income the budget showed at all sales levels and Is contemplating using a less expensive material. This action reduces direct material cost by $1 per unit. What would be the effects on financial statements and a flexible budget if management takes this approach? Are there other factors that need to be considered?arrow_forward

- Rizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forwardCassara, Inc., had the following quality costs for the years ended December 31, 20X1 and 20X2: At the end of 20X1, management decided to increase its investment in control costs by 40% for each categorys items, with the expectation that failure costs would decrease by 25% for each item of the failure categories. Sales were 12,000,000 for both 20X1 and 20X2. Required: 1. Calculate the budgeted costs for 20X2, and prepare an interim quality performance report. 2. Comment on the significance of the report. How much progress has Cassara made?arrow_forwardLowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000 units per month. In November, Lowell Manufacturing decided to lower its price to 19 per unit expecting it can increase the units sold by 16%. a. Compute the normal revenue with a 20 selling price. b. Compute the planned revenue with a 19 selling price. c. Compute the actual revenue for November, assuming 135,000 units were sold in November at 19 per unit. d. Compute the revenue price variance, assuming 135,000 units were sold in November at 19 per unit. e. Compute the revenue volume variance, assuming 135,000 units were sold in November at 19 per unit. f. Analyze and interpret the lowering of the price to 19.arrow_forward

- A regional director responsible for business development in the state of Pennsylvania is concerned about the number of small business failures. If the mean number of small business failures per month is 10, what is the probability that exactly 4 small businesses will fail during a given month? Assume that the probability of a failure is the same for any two months and that the occurrence or nonoccurrence of a failure in any month is independent of failures in any other month.arrow_forwardFriendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forwardIn 20X1, Don Blackburn, president of Price Electronics, received a report indicating that quality costs were 31% of sales. Faced with increasing pressures from imported goods. Don resolved to take measures to improve the overall quality of the companys products. After hiring a consultant in 20X1, the company began an aggressive program of total quality control. At the end of 20X5, Don requested an analysis of the progress the company had made in reducing and controlling quality costs. The accounting department assembled the following data: Required: 1. Compute the quality costs as a percentage of sales by category and in total for each year. 2. Prepare a multiple-year trend graph for quality costs, both by total costs and by category. Using the graph, assess the progress made in reducing and controlling quality costs. Does the graph provide evidence that quality has improved? Explain. 3. Using the 20X1 quality cost relationships (assume all costs are variable), calculate the quality costs that would have prevailed in 20X4. By how much did profits increase in 20X4 because of the quality improvement program? Repeat for 20X5.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Elements of cost | Direct and Indirect: Material, Labor, & Expenses; Author: Educationleaves;https://www.youtube.com/watch?v=UFBaj6AHjHQ;License: Standard youtube license