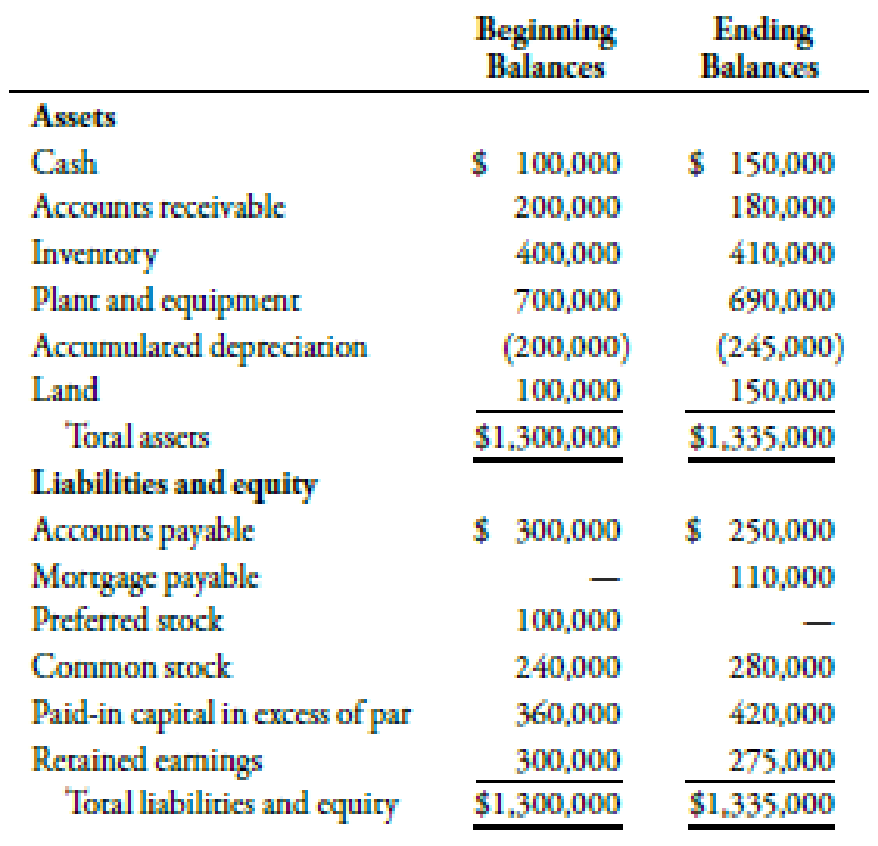

Balance sheets for Brierwold Corporation follow:

Additional transactions were as follows:

- a. Purchased equipment costing $50,000.

- b. Sold equipment costing $60,000, with a book value of $25,000, for $40,000.

- c. Retired

preferred stock at a cost of $110,000. (The premium is debited toRetained Earnings .) - d. Issued 10,000 shares of common stock (par value, $4) for $10 per share.

- e. Reported a loss of $15,000 for the year.

- f. Purchased land for $50,000.

Required:

Prepare a statement of

Construct a statement of cash flows with the help of a worksheet.

Explanation of Solution

Worksheet:

The chart prepared in a spreadsheet format as a helping tool in accounting is known as worksheet. With the help of worksheet, a cash flow statement can be prepared with less confusion and complexity.

The worksheet for the B Corporation is shown in the table below:

| Worksheet: B Corporation | |||||

| For the year ending | |||||

| Transactions | |||||

| Particulars | Beginning Balance ($) | Debit ($) | Credit ($) | Ending Balance ($) | |

| Assets: | |||||

| Cash | 100,000 | (1) 50,000 | 150,000 | ||

| Accounts receivable | 200,000 | (2) 20,000 | 180,000 | ||

| Inventory | 400,000 | (3) 10,000 | 410,000 | ||

| Plant and equipment | 700,000 | (4) 50,000 | (5) 60,000 | 690,000 | |

| Accumulated depreciation | (200,000) | (5) 35,000 | (6) 80,000 | (245,000) | |

| Land | 100,000 | (7) 50,000 | 150,000 | ||

| Total assets | 1,300,000 | 1,335,000 | |||

| Liabilities and stockholder’s equity: | |||||

| Accounts payable | 300,000 | (8) 50,000 | 250,000 | ||

| Mortgage payable | - | (9) 110,000 | 110,000 | ||

| Preferred stock | 100,000 | (10) 100,000 | - | - | |

| Common stock | 240,000 | (11) 40,000 | 280,000 | ||

| Paid-in capital in excess of par | 360,000 | (11) 60,000 | 420,000 | ||

| Retained earnings | 300,000 | (10) 10,000 | |||

| (12) 15,000 | 275,000 | ||||

| Total liabilities and stockholder’s equity | 1,300,000 | 1,335,000 | |||

| Debit ($) | Credit ($) | ||||

| Cash flows from operating activities: | |||||

| Net loss | (12) 15,000 | ||||

| Decrease in accounts receivable | (2) 20,000 | ||||

| Increase in inventory | (5) 1,800 | (3) 10,000 | |||

| Decrease in accounts payable | (8) 50,000 | ||||

| Depreciation expense | (6) 80,000 | ||||

| Gain on sale of equipment | (5) 15,000 | ||||

| Cash flows from investing activities: | |||||

| Sale of equipment | (5) 40,000 | ||||

| Purchase of equipment | (4) 50,000 | ||||

| Purchase of land | (7) 50,000 | ||||

| Cash flows from financing activities: | |||||

| Retirement of preferred stock | (10) 110,000 | ||||

| Receipt of mortgage | (9) 110,000 | (11) 36,000 | |||

| Issuance of common stock | (11) 100,000 | ||||

| Net increase in cash | (1) 50,000 | ||||

Table (1)

The analysis of transactions is as follows:

(1). Change in cash:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash | 50,000 | ||

| Net increase in cash | 50,000 | ||

| (Being the change in cash recorded) |

Table (2)

Increase in accrual cash balance by $50,000 from the beginning to the end of the year is recorded.

(2). Change in accounts receivable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 20,000 | ||

| Accounts receivable | 20,000 | ||

| (Being the decrease in accounts receivable recorded) |

Table (3)

Decrease in accounts receivable by $20,000 is recognized on the income statement but is not collected. This cash inflow should be adjusted in the net income.

(3) Purchase of inventory:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Inventory | 10,000 | ||

| Operating cash | 10,000 | ||

| (Being the purchase value of inventory are recorded) |

Table (4)

The purchase value of inventory is recorded by debiting the inventory account and crediting the operating cash account.

(4) Purchase value of plant and equipment:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Plant and equipment | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the purchase value of plant and equipment recorded) |

Table (5)

The purchase value of the equipment which is $50,000 is debited and the operating cash account is credited.

(5). Gain on sale of equipment:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Cash from investing activities | 40,000 | ||

| Accumulated depreciation | 35,000 | ||

| Plant and equipment | 60,000 | ||

| Gain on sale of equipment | 15,000 | ||

| (Being the gain on sale of equipment recorded) |

Table (6)

The cash from investing activities records the value at which the equipment is sold which is $40,000. The accumulated depreciation is debited to record the expense. The plant and equipment account is credited to record the original cost of the equipment. The gain value on the sale of equipment is credited.

(6). Accumulated depreciation expense:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Depreciation expense | 80,0001 | ||

| Accumulated depreciation | 80,000 | ||

| (Being the accumulated depreciation recorded) |

Table (7)

The accumulated depreciation of $80,000 is credited to record the depreciation expense.

(7). Value of land:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Land | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the fair value of land recorded) |

Table (8)

The fair value of the land is recorded by debiting the land account and crediting the operating cash.

(8). Accounts payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Accounts payable | 50,000 | ||

| Operating cash | 50,000 | ||

| (Being the decrease in accounts payable recorded) |

Table (9)

The decrease in accounts payable by $50,000 shows that all the purchases were not from cash. The increase in accounts payable should be added back to the net income. The decrease in liability is recorded, hence it is debited.

(9). Mortgage payable:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Operating cash | 110,000 | ||

| Mortgage payable | 110,000 | ||

| (Being the increase in mortgage payable recorded) |

Table (10)

The increase in mortgage payable shows that the cash inflow is more than the expense recognized in the year by $110,000. The increase in liability is recorded, hence mortgages payable is credited and operating cash is debited.

(10). Preferred stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Preferred stock | 100,000 | ||

| Retained earnings | 10,000 | ||

| Cash flow from financing activities | 110,000 | ||

| (Being the retirement of preference stock recorded) |

Table (11)

The cash flow from financing activities records an outflow with the retirement of preferred stock.

(11). Common stock:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Noncash investing activities | 100,000 | ||

| Common stock | 40,000 | ||

| Paid-in capital in excess of par | 60,000 |

Table (12)

The noncash investing activity is recorded with the fair value of the equipment. The amount which is obtained by issuing the common stock is credited and the excess amount is credited in the paid-in capital stock.

(13). The reporting of loss:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| Retained earnings | 15,000 | ||

| Cash flow from financing activities | 15,000 | ||

| (Being the net loss recorded) |

Table (13)

The retained earnings is debited by the amount of the reported loss for the year.

The final step is the cash flow statement which is prepared from the worksheet. The worksheet derived statement is shown in the table below:

| B Corporation | ||

| Statement of Cash Flows | ||

| For the year ending | ||

| Amount ($) | Amount ($) | |

| Cash flows from operating activities: | ||

| Net income | (15,000) | |

| Add/Deduct: | ||

| Decrease in accounts receivable | 20,000 | |

| Increase in inventory | (10,000) | |

| Decrease in accounts payable | (50,000) | |

| Depreciation expense | 80,000 | |

| Gain on sale of equipment | (15,000) | |

| Net cash from operating activities | 10,000 | |

| Cash flows from investing activities: | ||

| Sale of equipment | 40,000 | |

| Purchase of investments | (50,000) | |

| Purchase of land | (50,000) | |

| Net cash from investing activities | (60,000) | |

| Cash flows from financing activities: | ||

| Retirement of mortgage | (110,000) | |

| Issuance of common stock | 100,000 | |

| Receipt of mortgage | 110,000 | |

| Net cash from financing activities | 100,000 | |

| Net increase in cash | 50,000 | |

Table (14)

Working Note:

1.

Calculation of difference in accounts receivable:

2.

Calculation of difference in amount of inventories:

3.

Calculation of difference in accounts payable:

4.

Calculation of depreciation expense:

Want to see more full solutions like this?

Chapter 14 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- During 20X2, Evans Company had the following transactions: a. Cash dividends of 6,000 were paid. b. Equipment was sold for 2,880. It had an original cost of 10,800 and a book value of 5,400. The loss is included in operating expenses. c. Land with a fair market value of 15,000 was acquired by issuing common stock with a par value of 3,600. d. One thousand shares of preferred stock (no par) were sold for 4.20 per share. Evans provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Evans Company.arrow_forwardDuring 20X2, Norton Company had the following transactions: a. Cash dividends of 20,000 were paid. b. Equipment was sold for 9,600. It had an original cost of 36,000 and a book value of 18,000. The loss is included in operating expenses. c. Land with a fair market value of 50,000 was acquired by issuing common stock with a par value of 12,000. d. One thousand shares of preferred stock (no par) were sold for 14 per share. Norton provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Norton Company.arrow_forwardBalance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the indirect method.arrow_forward

- Assume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?arrow_forwardErrol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?arrow_forwardThe following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forward

- Bastion Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the EPS for the year for Bastion?arrow_forwardFarmington Corporation began the year with a retained earnings balance of $20,000. The company paid a total of $3,000 in dividends and earned a net income of $60,000 this year. What is the ending retained earnings balance?arrow_forwardMontana Incorporated began the year with a retained earnings balance of $50,000. The company paid a total of $5,000 in dividends and experienced a net loss of $25,000 this year. What is the ending retained earnings balance?arrow_forward

- James Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the EPS for the year for James (rounded to the nearest dollar)?arrow_forwardOn April 2, West Company declared a cash dividend of $0.50 per share. There are 50,000 shares outstanding. What is the journal entry that should be recorded?arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning