To identify: The expected

Introduction:

Return on Equity:

The return, which is generated on the equity that is invested by the stockholders is known as return on equity.

Explanation of Solution

The capital ratio at 0% and none interest rate.

Compute the expected return on equity.

State-1

Compute the net income.

Given,

The probability is 0.2.

The EBIT is $4,200,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $4,200,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 1 is $2,520,000.

Compute the return on equity of state 1.

The net income is $2,520,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $2,520,000 for net income and $14,000,000 for equity.

The return on equity of state 1 is 18%.

State-2

Compute the net income.

Given,

The probability is 0.5.

The EBIT is $2,800,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $2,800,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 2 is $1,680,000.

Compute the return on equity of state 2.

The net income is $1,680,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $1,680,000 for net income and $14,000,000 for equity.

The return on equity on state 2 is 12%.

State-3

Compute the net income.

Given,

The probability is 0.3.

The EBIT is $700,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $700,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 3 is $420,000.

Compute the return on equity of state 3.

The net income is $420,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $420,000 for net income and $14,000,000 for equity.

The return on equity on state 3 is 3%.

Compute the expected return on equity of 3 states.

The return on equity of state 1 is18%. (Calculated in equation (1))

The return on equity of state 2 is 12%. (Calculated in equation (2))

The return on equity of state 3 is 3%. (Calculated in equation (3))

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 18%, 12% and 3% for return on earnings.

The expected return on earnings is 10.50%.

Compute the standard deviation.

| State | Probability |

Return on Equity (ROE) |

Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 18% | 10.50% | 11.25% |

| 2 | 0.5 | 12% | 10.50% | 1.125% |

| 3 | 0.3 | 3% | 10.50% | 16.88% |

| Variance | 29.25% |

Table (1)

The variance is 29.25%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 29.25% for variance.

The standard deviation is 5.408%.

Compute the coefficient of deviation.

The standard deviation is 5.408%.

The expected return on equity is 10.50%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 5.408% for standard deviation and 10.25% for EROE.

The coefficient of variance is 0.515.

The capital ratio at 10% and interest rateis 9%.

Compute the expected return on equity

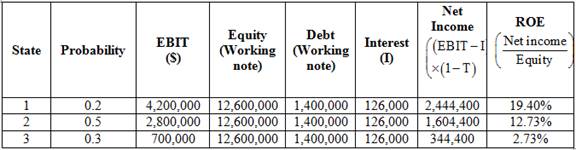

Statement to show the computation of return on equity of each state

Table (2)

Compute expected return on equity of 3 states.

The return on equity of state 1 is 19.40%. (Calculated above)

The return on equity of state 2 is 12.73%. (Calculated above)

The return on equity of state 3 is 2.73%. (Calculated above)

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 19.40%, 12.73% and 2.73% for return on earnings.

The expected return on earnings is 11.07%.

Compute the standard deviation

| State | Probability |

Return on Equity (ROE) |

Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 19.40% | 11.07% | 13.88% |

| 2 | 0.5 | 12.73% | 11.07% | 1.378% |

| 3 | 0.3 | 2.73% | 11.07% | 20.87% |

| Variance | 36.128% |

Table 3

The variance is 36.128%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 36.128% for variance.

The standard deviation is 6.01%.

Compute the coefficient of deviation.

The standard deviation is 6.01%.

The expected return on equity is 11.07%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 6.01% for standard deviation and 11.07% for EROE.

The coefficient of variance is 0.543.

The capital ratio at 50% and none interest rate is 11%.

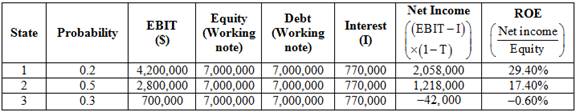

Compute the expected return on equity

Statement to show the computation of return on equity of each state

Table (4)

Compute expected return on equity of 3 states.

The return on equity of state 1 is 29.40%. (Calculated above)

The return on equity of state 2 is 17.40%. (Calculated above)

The return on equity of state 3 is

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 29.40%, 17.40% and

The expected return on earnings is 14.40%.

Compute the standard deviation.

| State | Probability | Return on Equity (ROE) | Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 29.40% | 14.40% | 45% |

| 2 | 0.5 | 17.40% | 14.40% | 4.5% |

| 3 | 0.3 |

| 14.40% | 67.5% |

| Variance | 117% |

Table (5)

The variance is 117%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 117% for variance.

The standard deviation is 10.82%.

Compute the coefficient of deviation.

The standard deviation is 10.82%.

The expected return on equity is 14.40%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 10.82% for standard deviation and 14.40% for EROE.

The coefficient of variance is 0.751.

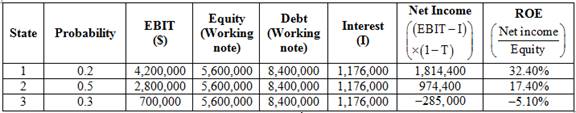

The capital ratio at 60% and none interest rate is 14%.

Compute the expected return on equity.

Statement to show the computation of return on equity of each state,

Table (6)

Computation of expected return on equity of 3 states

The return on equity of state 1 is 32.40%. (Calculated above)

The return on equity of state 2 is 17.40%. (Calculated above)

The return on equity of state 3 is

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 32.40%, 17.40% and

The expected return on earnings is 13.65%.

Compute the standard deviation.

| State | Probability | Return on Equity (ROE) | Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 32.40% | 13.65% | 70.31% |

| 2 | 0.5 | 17.40% | 13.65% | 7.031% |

| 3 | 0.3 |

| 13.65% | 105.47% |

| Variance | 182.8% |

Table (7)

The variance is 182.8%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 182.8% for variance.

The standard deviation is 13.521%.

Compute the coefficient of deviation.

The standard deviation is 13.521%.

The expected return on equity is 13.65%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 13.521% for standard deviation and 13.65% for EROE.

The coefficient of variance is 0.99.

Working note:

Compute the value of debt and equity at capital ratio of 10% and interest rate of 9%.

Given,

Thetotal capital structure is 14 million.

The capital structure is 10.

Compute the debt value,

The debt is $1,400,000.

Compute the equity

The total capital is $14,000,000. (Given)

The debt is $1,400,000. (Calculated)

Compute the equity value,

The equity is $12,600,000.

Compute the interest on debt.

The interest rate is 9% or 0.09. (Given)

The debt is $1,400,000. (Calculated)

Compute the interest on debt,

The interest on debt is $126,000.

Compute the value of debt and equity at capital ratio of 50% and interest rate of 11%.

Given,

The total capital structure is 14 million.

The capital structure is 50.

Compute the debt value,

The debt is $7,000,000.

Compute the equity.

The total capital is $14,000,000. (Given)

The debt is $7,000,000. (Calculated)

Compute the equity value,

The equity is $7,000,000.

Compute the interest on debt.

The interest rate is 11% or 0.11. (Given)

The debt is $7,000,000. (Calculated)

Compute the interest on debt,

The interest on debt is $770,000.

Compute the value of debt and equity at capital ratio of 60% and interest rate of 14%.

Given,

The total capital structure is 14 million.

The capital structure is 60.

Compute the debt value,

The debt is $8,400,000.

Compute the equity.

The total capital is $14,000,000. (Given)

The debt is $8,400,000. (Calculated)

Compute the equity value,

The equity is $5,600,000.

Compute the interest on debt.

The interest rate is 11% or 0.11. (Given)

The debt is $8,400,000. (Calculated)

Compute the interest on debt,

The interest on debt is $1,176,000.

Hence, the ROE, standard deviation, and coefficient of varianceat 0% capital ratio are 10.50%, 5.408% and 0.515.

The ROE, standard deviation, and coefficient of variance at 10% capital ratio and 9% interest are 11.07%, 6.01% and 0.543.

The ROE, standard deviation, and coefficient of variance at 50% capital ratio and 11% interest are 14.40%, 10.82% and 0.751.

The ROE, standard deviation, and coefficient of variance at 60% capital ratio and 14% interest are 13.65%, 13.52% and 0.099.

Want to see more full solutions like this?

Chapter 14 Solutions

Fundamentals of Financial Management (MindTap Course List)

- Optimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm’s EBIT is $14,933 million, and it faces a 40% federal-plus-state tax rate. The market risk premium is 4%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 9%. BEA has a beta of 1.0. What is BEA’s unlevered beta? Use market value D/S (which is the same as wd/ws when unlevering. What are BEA’s new beta and cost of equity if it has 40% debt? What are BEA’s WACC and total value of the firm with 40% debt?arrow_forwardWACC Estimation On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown here, is considered to be optimal. There is no short-term debt. New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 40%. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of equity, what is its WACC? Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to the WACC? No numbers are required to answer this question.arrow_forwardDividend Payout The Wei Corporation expects next year’s net income to be $15 million. The firm is currently financed with 40% debt. Wei has $12 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei’s dividend payout ratio be next year?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning