Concept explainers

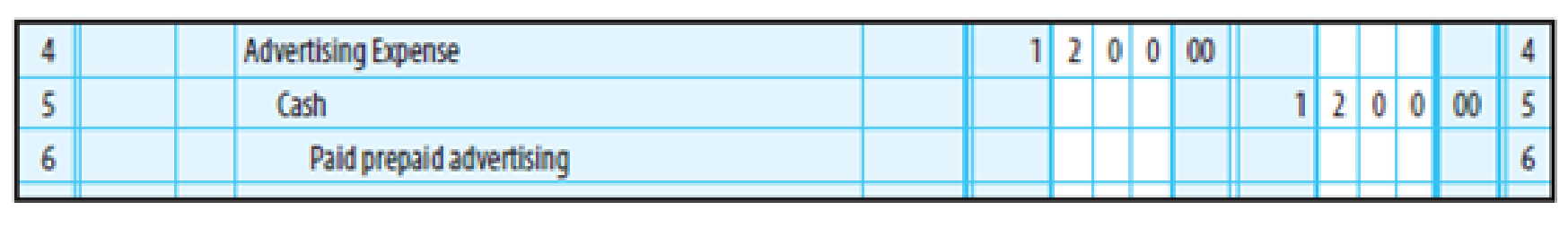

EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Davidson’s Food Mart paid $1,200 in advance to the local newspaper for advertisements that will appear monthly. The following entry was made:

At the end of the year, December 31, 20--, Davidson received notification that advertisements costing $800 had been run. Prepare the

Prepare the adjusting entry.

Explanation of Solution

The expense method of accounting for prepaid expenses:

In expense method of accounting for prepaid supplies, prepaid expenses and other prepaid items are recorded as purchases during its purchase.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting entries under prepaid expenses method:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Prepaid advertising | 400 | |

| Advertising expense | 400 | ||

| (To record amount of prepaid advertising ) |

Table (1)

- Prepaid advertising is a current asset and it is increased. Therefore, debit prepaid advertising account by $400.

- Advertising expense is a component of stockholders’ equity and it is increased. Therefore, credit advertising expense account by $400.

Want to see more full solutions like this?

Chapter 14A Solutions

College Accounting, Chapters 1-27

- Office Supplies Somerville Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand has a balance of $1,450 on May 1. Purchases of supplies during May amount to $1,100. Supplies on hand at May 31 amount to $920. Prepare the necessary adjusting entry on Somervilles books on May 31. What will be the effect on net income for May if this entry is not recorded?arrow_forwardEXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Ryans Fish House purchased supplies costing 3,000 for cash. This amount was debited to the supplies expense account. At the end of the year, December 31, 20--, an inventory showed that supplies costing 500 remained. Prepare the adjusting entry.arrow_forwardGarcia Company rents out a portion of its building to Jerry Company for 1,000 per month. On August 1, Jerry paid Garcia 12,000 for 1 year of rent in advance. Prepare journal entries for Garcia to record the collection ofrent and the related year-end adjusting entry on December 31.arrow_forward

- Rent Receivable Hudson Corp. has extra space in its warehouse and agrees to rent it out to Stillwater Company at the rate of $2,000 per month. The space was made available to Stillwater beginning on September 1. Under the terms of the agreement, Stillwater pays the months rent on the fifth day after the end of the month. Assume that Hudson prepares adjusting entries at the end of each month. Required How much revenue should Hudson record in September? How much revenue should Hudson record in October? Prepare the necessary entries on Hudsons books during the month of October.arrow_forwardCustomer Deposits Wolfe $ Wolfe collected $9,000 from a customer on April 1 and agreed to provide legal services during the next three months. Wolfe $ Wolfe expects to provide an equal amount of services each month. Required Prepare the journal entry for the receipt of the customer deposit on April 1. Prepare the adjusting entry on April 30. What will be the effect on net income for April if the entry in (2) is not recorded?arrow_forwardAccounts Payable Sleek Ride, a company providing limo services, has a December 31 year-end date. For Sleek Ride, the following transactions occurred during the first 10 days of June: a. Purchased, on credit, space for classified advertisements in the New York Times for $1,950. The advertising was run the day the space was purchased. b. Purchased office supplies from Office Max on credit in the amount of $475. c. One of Sleek Rides sales staff signed a $20,000 contract to provide exclusive limo services for a large company for the remainder of the month. The salespersons commission is 10% of service revenue. The commission will be paid July 10. ( Note: Concern yourself only with the commission.) d. Received electric bill for May. The bill is $4,200 and is due June 15. e. Received a bill for $970 from Harrys Auto. Harrys repaired 10 limos for Sleek Ride in late May. Payment is due June 18. Required: Prepare journal entries for the above transactions.arrow_forward

- COMPLETION OF A WORK SHEET SHOWING A NET INCOME The trial balance for the Venice Beach Kite Shop, a business owned by Molly Young k shown on page 550. Year-end adjustment information is as follows: (a and b)Merchandise inventory costing 35,000 is on hand as of December .31, 20--. (The periodic inventory system is used.) (c)Supplies remaining at the end of the year, 3,300. (d)Unexpired insurance on December 31, S3,800. (e)Depreciation expense on the building foe 20--, 2,500. (f)Depreciation expense on the store equipment for 20--, 3,500. (g)Unearned rent revenue as of December 31, 4,00. (h)Wages earned but not paid as of December 31, 800. 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter. 2. Complete the work sheet. 3. Enter the adjustments m a general journal.arrow_forwardReversing Entries Thomas Company entered into two transactions involving promissory notes and properly recorded each transaction. 1. On November 1, it purchased land at a cost of 8,000. It made a 2,000 down payment and signed a note payable agreeing to pay the 6,000 balance in 6 months plus interest at an annual rate of 10%. 2. On December 1, it accepted a 4,200, 3-month, 12% (annual interest rate) note receivable from a customer for the sale of merchandise. On December 31, Thomas made the following related adjustments: Required: 1. Assuming that Thomas uses reversing entries, prepare journal entries to record: a. the January 1, reversing entries b. the March 1, 4,326 collection of the note receivable c. the May 1, 6,300 payment of the note payable 2. Assuming instead that Thomas does not use reversing entries, prepare journal entries to record the collection of the note receivable and the payment of the note payable.arrow_forwardUnearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1, 2019, to provide plant watering services for Lola Inc.s office buildings. Jennifers received 4 months' service fees in advance on signing the contract. Required: 1. Prepare Jennifers journal entry to record the cash receipt for the first 4 months. 2. Prepare Jennifers adjusting entry at December 31, 2019. 3. CONCEPTUAL CONNECTION How would the advance payment (account(s) and amounts(s)] be reported in Jennifers December 31, 2019, balance sheet? How would the advance payment [account(s) and amount(s)] be reported in Lolas December 31, 2019, balance sheet?arrow_forward

- Adjusting Entries Kretz Corporation prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for March 2016: Kretz Corporation takes out a 90-day, 8%, $15,000 note on March 1, 2016, with interest and principal to be paid at maturity. The asset account Office Supplies on Hand has a balance of $1,280 on March 1, 2016. During March, Kretz adds $750 to the account for purchases during the period. A count of the supplies on hand at the end of March indicates a balance of $1,370. The company purchased office equipment last year for $62,600. The equipment has an estimated useful life of six years and an estimated salvage value of $5,000. The companys plant operates seven days per week with a daily payroll of $950. Wage earners are paid every Sunday. The last day of the month is Thursday, March 31. The company rented an idle warehouse to a neighboring business on February 1, 2016, at a rate of $2,500 per month. On this date, Kretz Corporation credited Rent Collected in Advance for six months rent received in advance. On March 1, 2016, Kretz Corporation credited a liability account, Customer Deposits, for $4,800. This sum represents an amount that a customer paid in advance and that Kretz will earn evenly over a four-month period. Based on its income for the month, Kretz Corporation estimates that federal income taxes for March amount to $3,900. Required For each of the preceding situations, prepare in general journal form the appropriate adjusting entry to be recorded on March 31, 2016.arrow_forwardAccrued Property Taxes Annual property taxes covering the preceding 12 months are always paid on July 1. Lou Inc. is always assessed $11,000 property taxes. Required: Given this information, determine the adjusting journal entry that Lou must make on December 31.arrow_forwardReview the following transactions and prepare any necessary journal entries for Woodworking Magazine. Woodworking Magazine provides one issue per month to subscribers for a service fee of $240 per year. Assume January 1 is the first day of operations for this company, and no new customers join during the year. A. On January 1, Woodworking Magazine receives advance cash payment from forty customers for magazine subscription services. Handyman had yet to provide subscription services as of January 1. B. On April 30, Woodworking recognizes subscription revenues earned. C. On October 31, Woodworking recognizes subscription revenues earned. D. On December 31, Woodworking recognizes subscription revenues earned.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage