Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 12P

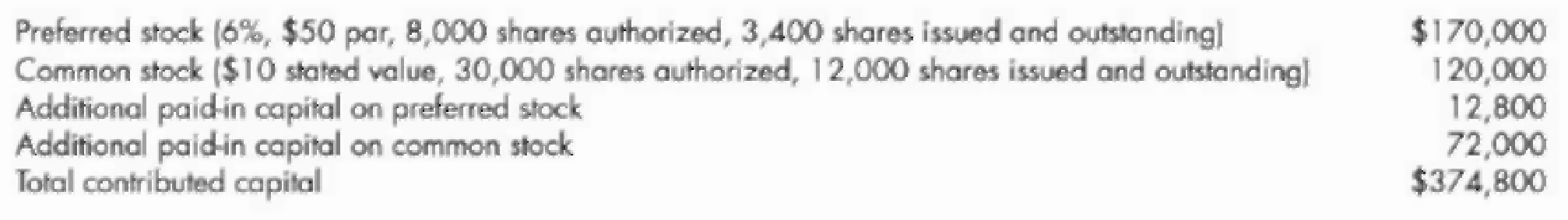

Comprehensive Byrd Company’s Contributed Capital section of its January 1, 2019,

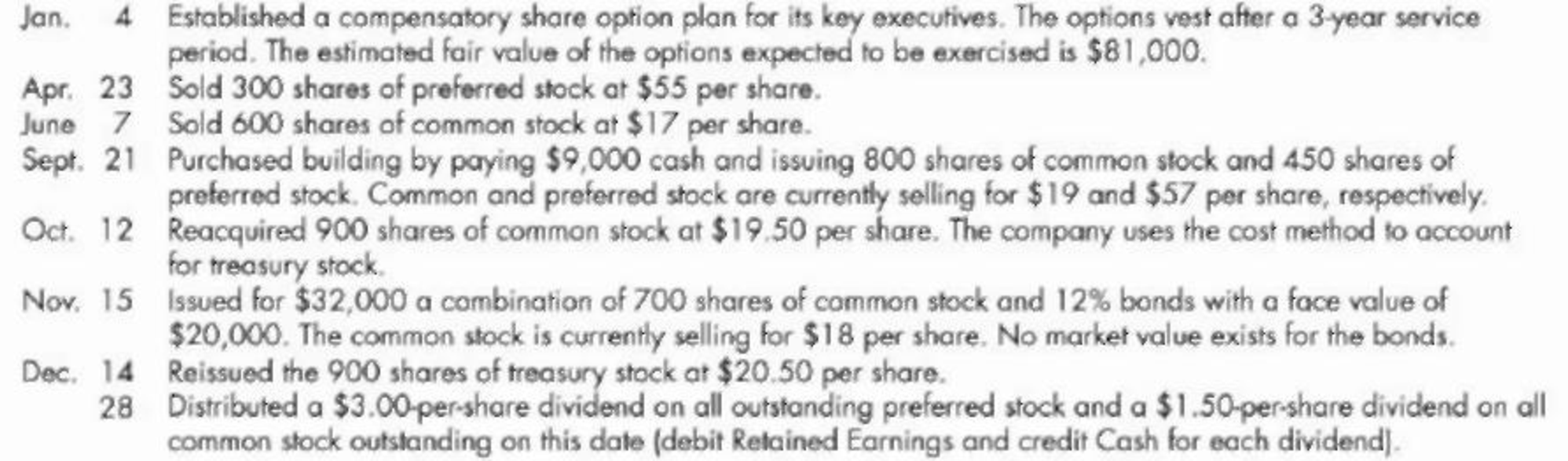

During 2019, Byrd entered into the following transactions:

Required:

- 1. Prepare memorandum and

journal entries to record the preceding transactions. - 2. Prepare the Contributed Capital section of Byrd’s December 31, 2019, balance sheet.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

On Jan. 1, 2020, the entity started the preparation of its buildingconstruction. On the same date, it specifically acquired a loan forthe construction.

The entity spent P3,000,000 on Jan. 1, 2020 and P5,000,000 on Mar.31, 2021.

The loan has a principal amount of P10,000,000, interest of 5% dueevery Jan. 1, maturity date of Jan. 1, 2023, net proceeds ofP9,732,700, and an effective interest rate of 6%. While not yet paidout for the construction, the amount borrowed was temporarilyinvested. Investment income for the two years totaled P480,000.

5. How much is the total capitalizable cost as of Dec. 31, 2021?

The following information was taken from the books of Newcastle Enterprises.

Balances in the general ledger of Newcastle Enterprises for the financial year ended 29 February 2020.

See attatched 4.JPG

Appropriations according to the partnership agreement for the financial year ended 29 February 2020:

Interest on capital must be appropriated at 5% per annum. Capital account balances remain constant.

Interest on drawings must be appropriated at 12% per annum. Assume drawings were made 3 months prior to the end of the financial year.

Interest on current accounts must be appropriated at 7% per annum (on opening balances)

4. Both partners must receive an annual salary at the end of the financial year as follows:

- M. Manchester – R65 000

- L. Liverpool – R45 000

5. L. Liverpool must receive an annual bonus of R10 000 at the end of the financial year.

6. R35 000 must be transferred to the replacement reserve at the end of the financial year.

7. The remaining profit…

R. Wilson Corporation commenced operations in early 2020. The corporation incurred $60,000 of costs such as fees to underwriters, legal fees, state fees, and promotional expenditures during its formation. Prepare journal entries to record the $60,000 expenditure and 2020 amortization, if any.

Chapter 15 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 15 - Prob. 1GICh. 15 - Prob. 2GICh. 15 - What are the three components and the basic...Ch. 15 - List the various rights of a shareholder. Which do...Ch. 15 - What is the meaning of the following terms: (a)...Ch. 15 - Prob. 6GICh. 15 - Prob. 7GICh. 15 - How does preferred stock differ from common stock?Ch. 15 - What amount of the proceeds from the issuance of...Ch. 15 - Prob. 10GI

Ch. 15 - Prob. 11GICh. 15 - Prob. 12GICh. 15 - Prob. 13GICh. 15 - Prob. 14GICh. 15 - Prob. 15GICh. 15 - Prob. 16GICh. 15 - Prob. 17GICh. 15 - Prob. 18GICh. 15 - Prob. 19GICh. 15 - How is a preferred stock similar to a long-term...Ch. 15 - Prob. 21GICh. 15 - Prob. 22GICh. 15 - Prob. 23GICh. 15 - Prob. 24GICh. 15 - Prob. 25GICh. 15 - What additional disclosures about preferred and...Ch. 15 - Prob. 1MCCh. 15 - Cary Corporation has 50,000 shares of 10 par...Ch. 15 - What is the most likely effect of a stock split on...Ch. 15 - Prob. 4MCCh. 15 - Prob. 5MCCh. 15 - Prob. 6MCCh. 15 - Prob. 7MCCh. 15 - When treasury stock is purchased for cash at more...Ch. 15 - Preferred stock that may be retired by the...Ch. 15 - When treasury stock accounted for by the cost...Ch. 15 - Brown Corporation issues 800 shares of its 5 par...Ch. 15 - Heart Corporation entered into a subscription...Ch. 15 - Blue Corporation issues 200 packages of securities...Ch. 15 - Sun Corporation issues 500 shares of 8 par common...Ch. 15 - Next Level Morgan Corporation issues 500 packages...Ch. 15 - Prob. 6RECh. 15 - On January 1, 2019, Phoenix Corporation adopts a...Ch. 15 - On January 2, 2019, Brust Corporation grants its...Ch. 15 - Prob. 9RECh. 15 - Assume Cole Corporation originally issued 300...Ch. 15 - Violet Corporation issues 1,200 shares of 150 par...Ch. 15 - Assume that Lily Corporation has outstanding 1,500...Ch. 15 - Tulip Corporation uses the cost method to account...Ch. 15 - Par Value and No-Par Stock Issuance Caswell...Ch. 15 - Combined Sale of Stock Maxville Company issues 300...Ch. 15 - Sale of Stock with Bonds Pilsen Company issues 12%...Ch. 15 - Issuance of Stock for Land Putt Company issues 500...Ch. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Restricted Share Units On January 2, 2019, Dekker...Ch. 15 - Prob. 10ECh. 15 - Convertible Preferred Stock On January 2, 2019,...Ch. 15 - Prob. 12ECh. 15 - Stock Rights with Preferred Stock Nelson...Ch. 15 - Various Journal Entries Lodi Company is authorized...Ch. 15 - Treasury Stock, Cost Method On January 1, Lorain...Ch. 15 - Contributed Capital Adams Companys records provide...Ch. 15 - Prob. 17ECh. 15 - Treasury Stock, Cost and Par Value Methods On...Ch. 15 - Treasury Stock, No Par Propst-Steele Production...Ch. 15 - Subscriptions On August 3, 2019, the date of...Ch. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - Prob. 5PCh. 15 - Prob. 6PCh. 15 - Issuances of Stock Cada Corporation is authorized...Ch. 15 - Issuances of Stock Epple Corporation is authorized...Ch. 15 - Comprehensive Young Corporation has been operating...Ch. 15 - Comprehensive The shareholders equity section of...Ch. 15 - Treasury Stock Analysis Ray Holt Corporation has...Ch. 15 - Comprehensive Byrd Companys Contributed Capital...Ch. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Reconstruct Journal Entries At the end of its...Ch. 15 - Treasury Stock, Cost Method Bush-Caine Company...Ch. 15 - Prob. 17PCh. 15 - Prob. 1CCh. 15 - Prob. 2CCh. 15 - Prob. 3CCh. 15 - Capital Stock Capital stock is an important area...Ch. 15 - Treasury Stock A corporation sometimes engages in...Ch. 15 - Prob. 6CCh. 15 - Prob. 7CCh. 15 - Compensatory Share Option Plan Tom Twitlet,...Ch. 15 - Prob. 9CCh. 15 - Treasury Stock For numerous reasons, a corporation...Ch. 15 - Prob. 11CCh. 15 - Prob. 12CCh. 15 - Prob. 13CCh. 15 - Prob. 14C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive Selected transactions of Lizard Lick Corporation during 2019 are as follows: Required: Prepare journal entries to record the preceding transactions for 2019. Include year-end interest accruals.arrow_forwardComprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. Round all calculations to the nearest dollar.arrow_forwardComprehensive The shareholders equity section of Superior Corporations balance sheet as of December 31, 2018, is as follows: The following events occurred during 2019: Required: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior's legal capital at December 31, 2019.arrow_forward

- Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forwardOn December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forwardTarget Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, Does the company separately report current assets and long-term assets, as well as current liabilities and long-term liabilities? Are any investments shown as a current asset? Why? In which liability account would the company report the balance of its gift card liability? What method does the company use to depreciate its property and equipment?arrow_forward

- The following information was taken from the books of Newcastle Enterprises. Balances in the general ledger of Newcastle Enterprises for the financial year ended 29 February 2020. (attatched 4.JPG) Appropriations according to the partnership agreement for the financial year ended 29 February 2020: Interest on capital must be appropriated at 5% per annum. Capital account balances remain constant. Interest on drawings must be appropriated at 12% per annum. Assume drawings were made 3 months prior to the end of the financial year. Interest on current accounts must be appropriated at 7% per annum (on opening balances). 4. Both partners must receive an annual salary at the end of the financial year as follows: - M. Manchester – R65 000 - L. Liverpool – R45 000 5. L. Liverpool must receive an annual bonus of R10 000 at the end of the financial year. 6. R35 000 must be transferred to the replacement reserve at the end of the financial year. 7. The remaining…arrow_forwardLee Manufacturing Corporation was incorporated on January 3, 2018.The corporation's financial statements for its first year's operations werenot examined by a CPA. You have been engaged to examine the financialstatements for the year ended December 31, 2019, and your examinationis substantially completed. Lee's trial balance at December 31, 2019,appears as follows: The following information relates to accounts that may vet requireadjustment:1. Patents for Lee's manufacturing process were acquired January2, 2019, at a cost of $68,000. An additional $17,000 was spent inDecember 2019 to improve machinery covered by the patents andcharged to the Patent account. Depreciation on fixed assets hasbeen properly recorded for 2019 in accordance with Lee's practicewhich provides a full year's depreciation for property on hand June30 and no depreciation otherwise. Lee uses the straight-linemethod fix all depreciation and amortization and amortizes itspatents over their legal life. 2. On January 3.…arrow_forwardOn December 01, 2021, SEVENTY-SEVEN Corporation declared equipment with carrying amount of P1,300,000 as property dividend to be distributed on January 31, 2022. The equipment had the following fair value on the following dates: December 01, 2021 1,500,000 December 31, 2021 1,600,000 January 31, 2022 1,900,000 Journal entry on December 31,2021 should include credit to:arrow_forward

- The December 31, 2019 condensed balance sheet of Ambani Services, an individual proprietorship, follows: Current assets P140,000 Equipment (net) 130,000 P270,000 Liabilities P 70,000 Mukesh Ambani, Capital 200,000 P270,000 Fair values at December 31, 2019 are as follows: Current assets P160,000 Equipment 210,000 Liabilities 70,000 On January 2, 2020, Ambani Services was incorporated with 5,000, P10 par value, ordinary shares issued. How much should be credited to share premium? a. P230,000 b. P200,000 c. P250,000 d. P320,000arrow_forwardOn December 01, 2021, SEVENTY-SEVEN Corporation declared equipment with carrying amount of P1,300,000 as property dividend to be distributed on January 31, 2022. The equipment had the following fair value on the following dates: December 01, 2021 1,500,000 December 31, 2021 1,600,000 January 31, 2022 1,900,000 Journal entry on January 31, 2022 should include credit to:arrow_forwardBalance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License