JED Capital Inc. Selected Income Statement Items For the Years Ended December 31, Year 2 and Year 3 Year 2 Year 3 Operating income a. e. Unrealized gain (loss) b. $(11,000) Net income C. 28,000 JED Capital Inc. Selected Balance Sheet Items December 31, Year 1, Year 2, and Year 3 Dec. 31, Year 3 Dec. 31, Year 1 Dec. 31, Year 2 Trading investments, at cost Valuation allowance for trading investments $144,000 $168,000 $205,000 (12,000) 17,000 g. Trading investments, at fair value Retained earnings d. f. h. $210,000 $245,000 i. There were no dividends.

JED Capital Inc. Selected Income Statement Items For the Years Ended December 31, Year 2 and Year 3 Year 2 Year 3 Operating income a. e. Unrealized gain (loss) b. $(11,000) Net income C. 28,000 JED Capital Inc. Selected Balance Sheet Items December 31, Year 1, Year 2, and Year 3 Dec. 31, Year 3 Dec. 31, Year 1 Dec. 31, Year 2 Trading investments, at cost Valuation allowance for trading investments $144,000 $168,000 $205,000 (12,000) 17,000 g. Trading investments, at fair value Retained earnings d. f. h. $210,000 $245,000 i. There were no dividends.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 28E: Multiple-step income statement The following income statement for Curbstone Company was prepared for...

Related questions

Question

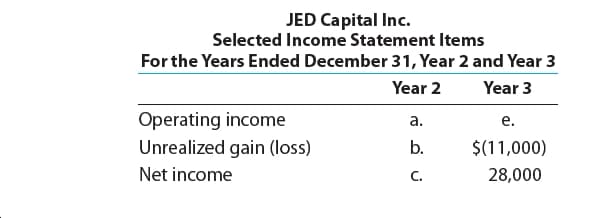

JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows:

Please see the attachment for details:

Determine the missing lettered items.

Transcribed Image Text:JED Capital Inc.

Selected Income Statement Items

For the Years Ended December 31, Year 2 and Year 3

Year 2

Year 3

Operating income

a.

e.

Unrealized gain (loss)

b.

$(11,000)

Net income

C.

28,000

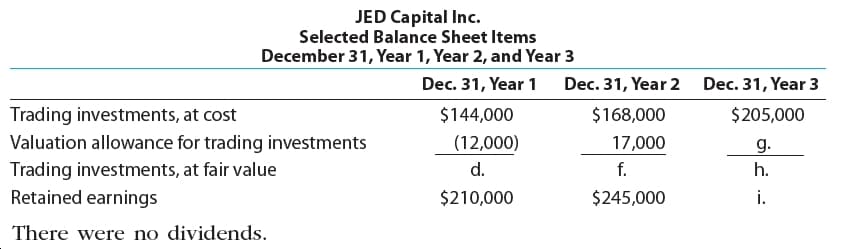

Transcribed Image Text:JED Capital Inc.

Selected Balance Sheet Items

December 31, Year 1, Year 2, and Year 3

Dec. 31, Year 3

Dec. 31, Year 1

Dec. 31, Year 2

Trading investments, at cost

Valuation allowance for trading investments

$144,000

$168,000

$205,000

(12,000)

17,000

g.

Trading investments, at fair value

Retained earnings

d.

f.

h.

$210,000

$245,000

i.

There were no dividends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning