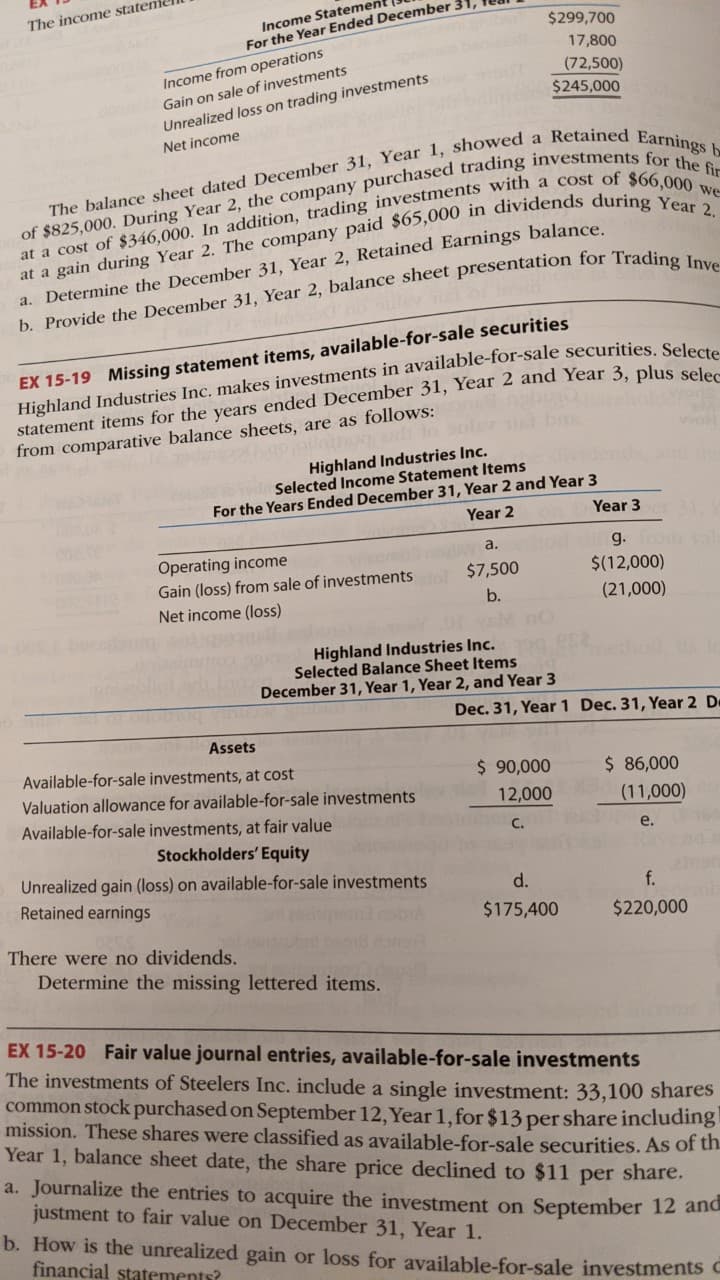

Highland Industries Inc. makes investments in avaialable-for-sale securities. Selected income statement items for the years ended December 321, Year 2 and 3, plus selected items from comparative balance sheets, are as follows. There were no dividends. Determine the missing lettered items.

Highland Industries Inc. makes investments in avaialable-for-sale securities. Selected income statement items for the years ended December 321, Year 2 and 3, plus selected items from comparative balance sheets, are as follows. There were no dividends. Determine the missing lettered items.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15E

Related questions

Question

Highland Industries Inc. makes investments in avaialable-for-sale securities. Selected income statement items for the years ended December 321, Year 2 and 3, plus selected items from comparative balance sheets, are as follows. There were no dividends. Determine the missing lettered items.

Transcribed Image Text:Income Statement

For the Year Ended December 31,

The income stateme

$299,700

Income from operations

Gain on sale of investments

17,800

(72,500)

$245,000

Unrealized loss on trading investments

Net income

a. Determine the December 31, Year 2, Retained Earnings balance.

EX 15-19 Missing statement items, available-for-sale securities

Highland Industries Inc. makes investments in available-for-sale securities Sal

statement items for the years ended December 31, Year 2 and Year 3, plus cele

from comparative balance sheets, are as follows:

Highland Industries Inc.

Selected Income Statement Items

For the Years Ended December 31, Year 2 and Year 3

Year 2

Year 3

Operating income

Gain (loss) from sale of investments

g.o

$(12,000)

a.

tor $7,500

b.

Net income (loss)

(21,000)

Highland Industries Inc.

Selected Balance Sheet Items

December 31, Year 1, Year 2, and Year 3

Dec. 31, Year 1 Dec. 31, Year 2 De

Assets

Available-for-sale investments, at cost

$ 90,000

$ 86,000

Valuation allowance for available-for-sale investments

12,000

(11,000)

Available-for-sale investments, at fair value

e.

Stockholders' Equity

Unrealized gain (loss) on available-for-sale investments

Retained earnings

d.

f.

$175,400

$220,000

There were no dividends.

Determine the missing lettered items.

EX 15-20 Fair value journal entries, available-for-sale investments

The investments of Steelers Inc. include a single investment: 33,100 shares

common stock purchased on September 12, Year 1, for $13 per share including

mission. These shares were classified as available-for-sale securities. As of th.

Year 1, balance sheet date, the share price declined to $11 per share.

a. Journalize the entries to acquire the investment on September 12 and

justment to fair value on December 31, Year 1.

b. How is the unrealized gain or loss for available-for-sale investments c

financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning