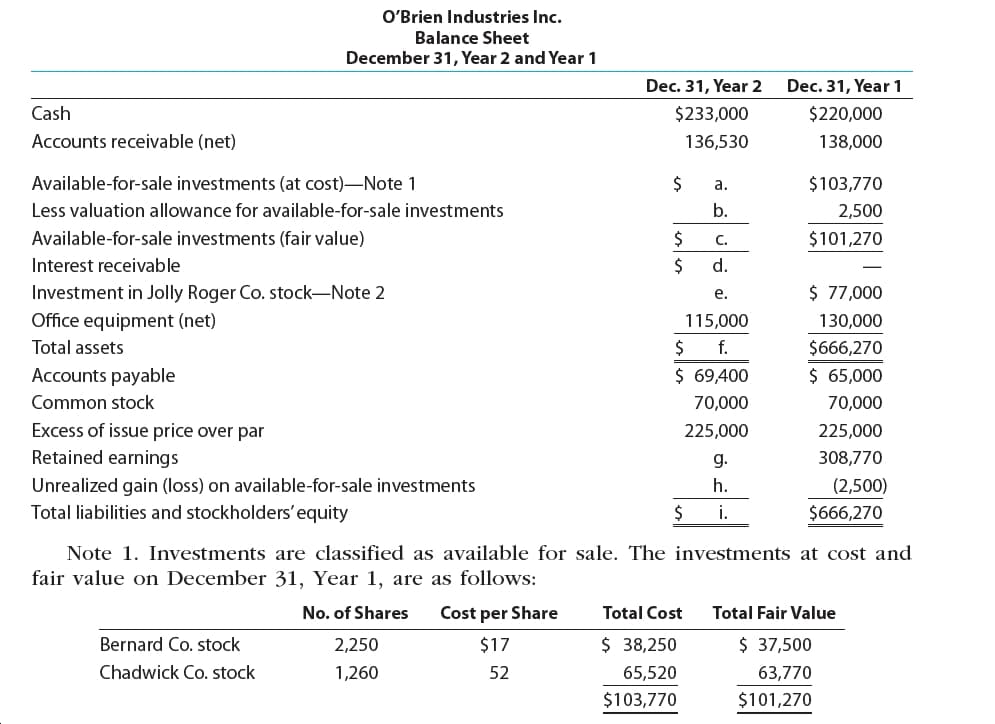

O'Brien Industries Inc. Balance Sheet December 31, Year 2 and Year 1 Dec. 31, Year 2 Dec. 31, Year 1 Cash $233,000 $220,000 Accounts receivable (net) 136,530 138,000 Available-for-sale investments (at cost)-Note 1 2$ $103,770 a. Less valuation allowance for available-for-sale investments b. 2,500 Available-for-sale investments (fair value) $101,270 C. Interest receivable 2$ d. $ 77,000 Investment in Jolly Roger Co. stock-Note 2 Office equipment (net) e. 115,000 130,000 Total assets f. $666,270 Accounts payable $ 69,400 $ 65,000 Common stock 70,000 70,000 Excess of issue price over par Retained earnings 225,000 225,000 308,770 g. Unrealized gain (loss) on available-for-sale investments h. (2,500) Total liabilities and stockholders'equity 2$ i. $666,270 Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, Year 1, are as follows: Total Cost No. of Shares Cost per Share Total Fair Value $ 38,250 $ 37,500 Bernard Co. stock 2,250 $17 Chadwick Co. stock 1,260 52 65,520 63,770 $103,770 $101,270 Available-for-Sale Investments Fair Value Bernard Co. stock $15.40 per share $46.00 per share Chadwick Co. stock $32.00 per share $98 per $100 of face amount Gozar Inc. stock Nightline Co. bonds

O’Brien Industries Inc. is a book publisher. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 follow. Selected missing balances are shown by letters.

Please see the attachment for details:

Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding shares of Jolly Roger Co.

The following selected investment transactions occurred during Year 2:

May 5. Purchased 3,080 shares of Gozar Inc. at $30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security.

Oct. 1. Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1.

9. Dividends of $12,500 are received on the Jolly Roger Co. investment.

Dec. 31. Jolly Roger Co. reported a total net income of $112,000 for Year 2. O’Brien Industries Inc. recorded equity earnings for its share of Jolly Roger Co. net income.

31. Accrued three months of interest on the Nightline bonds.

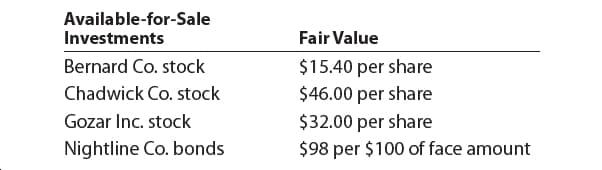

31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts:

Please see the attachment for details:

Dec. 31. Closed the O’Brien Industries Inc. net income of $146,230. O’Brien Industries Inc. paid no dividends during the year.

Instructions

Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images