Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 8E

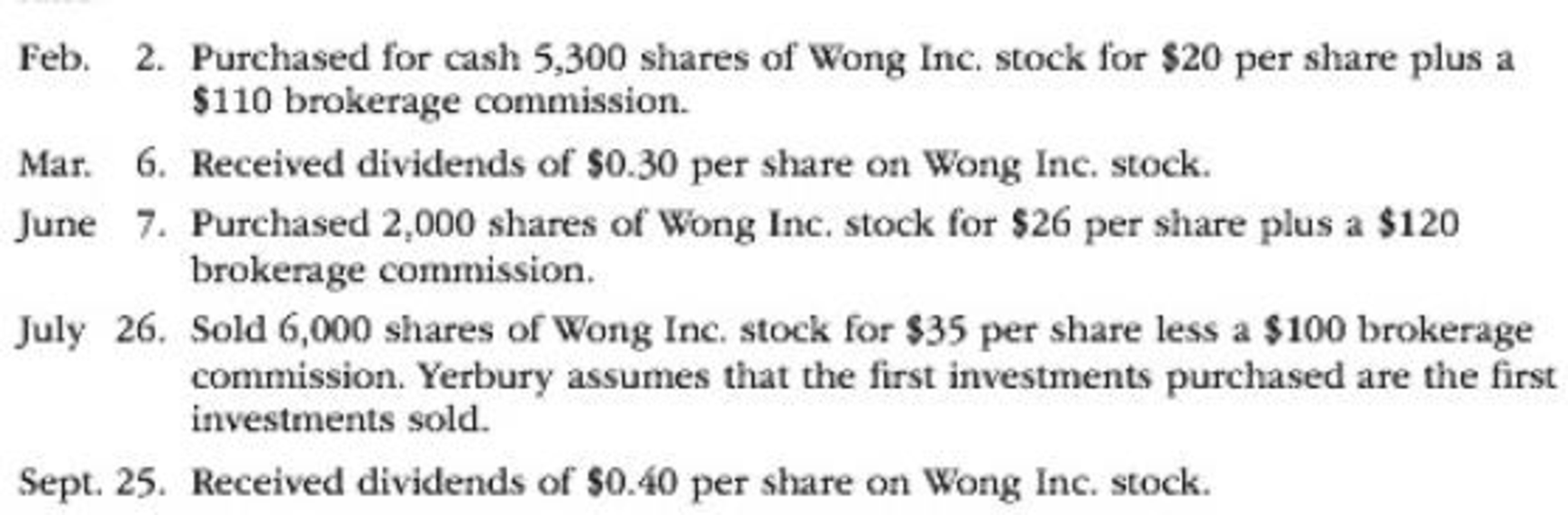

Yerbury Corp. manufactures construction equipment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Prepare journal entries to record the following investment-related transactions of a company for its first year of operations:

On May 4, the company purchased 600 shares of Orbital Company Stock at $140 per share as a short-term investment in an available-for-sale security.

On July 1, received a $2.50 per share cash dividend on the Orbital Company stock purchased in transaction (a).

On September 15, sold 250 shares of Orbital Company stock purchased in transaction (a) for $85 per share

On October 15, sold 100 shares of Orbital Company stock purchased in transaction (a) for $185 per share

Record the appropriate journal entry to reflect the following:

The investments that Veggies-R-Us. Inc. currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market auotes obtained for December 31, 20XX, the market value of these investments = $112,000. (It is management's intent to actively manage these shares for profit.)

You have been provided with the partial Trail Balance for this company below:

Veggies-R-Us.

Trial Balance (Partial)

December 31, 20XX

Cash $26,750 (Debit)

Accounts Receivable $47,630 (Debit)

Allowance for doubtful accounts $250 (Debit)

Prepaid rent $1,680 (Debit)

Supplies $8,700 (Debit)

Investments $113,520 (Debit)

Furniture $15,350 (Debit)

JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows:

Please see the attachment for details:

Determine the missing lettered items.

Chapter 15 Solutions

Financial Accounting

Ch. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - Prob. 2PEACh. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On June 30, Setzer Corporation had a market price...Ch. 15 - Prob. 6PEBCh. 15 - Prob. 1ECh. 15 - Prob. 2ECh. 15 - Bocelli Co. purchased 120,000 of 6%, 20-year Sanz...Ch. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On February 22, Stewart Corporation acquired...Ch. 15 - The following equity investment transactions were...Ch. 15 - Yerbury Corp. manufactures construction equipment....Ch. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - On January 6, Year 1, Bulldog Co. purchased 34% of...Ch. 15 - Hawkeye Companys balance sheet reported, under the...Ch. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - The investments of Charger Inc. include a single...Ch. 15 - Gruden Bancorp Inc. purchased a portfolio of...Ch. 15 - Last Unguaranteed Financial Inc. purchased the...Ch. 15 - The income statement for Delta-tec Inc. for the...Ch. 15 - Highland Industries Inc. makes investments in...Ch. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - During Year 1, its first year of operations,...Ch. 15 - During Year 2, Copernicus Corporation held a...Ch. 15 - Prob. 25ECh. 15 - The market price for Microsoft Corporation closed...Ch. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Soto Industries Inc. is an athletic footware...Ch. 15 - Rios Financial Co. is a regional insurance company...Ch. 15 - Forte Inc. produces and sells theater set designs...Ch. 15 - Prob. 4PACh. 15 - Rekya Mart Inc. is a general merchandise retail...Ch. 15 - Prob. 2PBCh. 15 - Glacier Products Inc. is a wholesaler of rock...Ch. 15 - Teasdale Inc. manufactures and sells commercial...Ch. 15 - Selected transactions completed by Equinox...Ch. 15 - Prob. 1CPCh. 15 - Prob. 2CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - On July 16, 20Y1, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following equity investment transactions were completed by Romero Company during a recent year: Journalize the entries for these transactions.arrow_forwardGlacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record the preceding transactions. 2. Prepare the investment-related asset and stockholders equity balance sheet presentation for Glacier Products Inc. on December 31, Year 2, assuming that the Retained Earnings balance on December 31, Year 2, is 700,000.arrow_forwardForte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Forte Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related asset and stockholders equity balance sheet presentation for Forte Inc. on December 31, Year 2, assuming that the Retained Earnings balance on December 31, Year 2, is 389,000.arrow_forward

- Rios Financial Co. is a regional insurance company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Rios Financial Co., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related current asset balance sheet presentation for Rios Financial Co. on December 31, Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Rios Financial Co.?arrow_forwardIndicate where each of the following items is reported on financial statements. Choose from the followingcategories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities,(e) other revenues and gains, ( f ) other expenses and losses, and (g) equity. Held-to-maturity securities (due in 15 years)arrow_forwardPrepare journal entries to record the following transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during the current year. a. On February 15, paid $160,000 cash to purchase GMI’s 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). b. On March 22, bought 700 shares of Fran Inc. common stock at $51 cash per share. Cancun’s stock investment results in it having an insignificant influence over Fran. c. On May 15, received a check from GMI in payment of the principal and 90 days’ interest on the notes purchased in part a. d. On July 30, paid $100,000 cash to purchase MP Inc.’s 8%, six-month notes at par, dated July 30 (classified as trading securities). e. On September 1, received a $1 per share cash dividend on the Fran Inc. common stock purchased in part b. f. On October 8, sold 30 shares of Fran Inc. common stock for $54 cash per share. g. On October 30, received a…arrow_forward

- Presented below are the captions of Faulk Company’s balance sheet. a. Current assets. b. Investments. c. Property, plant, and equipment. d. Intangible assets. e. Other assets. f. Current liabilities. g. Noncurrent liabilities. h. Capital stock. i. Additional paid-in capital. j. Retained earnings. Instructions Indicate by letter where each of the following items would be classified. 1. Preferred stock. 2. Goodwill. 3. Salaries and wages payable. 4. Accounts payable. 5. Buildings. 6. Equity investments (to be sold within one year). 7. Current maturity of long-term debt. 8. Premium on bonds payable. 9. Allowance for doubtful accounts. 10. Accounts receivable. 11. Cash surrender value of life insurance. 12. Notes payable (due next year). 13. Supplies. 14. Common stock. 15. Land. 16. Bond sinking fund. 17. Inventory. 18. Prepaid insurance. 19. Bonds payable. 20. Income taxes payable.arrow_forwardThe following financial statement information is from five separate companies. Compute the amount of owner investments for Company D during year 2019.arrow_forwardThe following data were taken from the financial statements of Gates Inc. for the current fiscal year. Please see the attachment for details: Assuming that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (a) ratio of fixed assets to long-term liabilities, (b) ratio of liabilities to stockholders’ equity, (c) asset turnover, (d) return on total assets, (e) return on stockholders’ equity, and (f) return on common stockholders’ equity. Round ratios and percentages to one decimal place as appropriate.arrow_forward

- For several years Fister Links Products has held shares of Microsoft common stock, considered by the company to be securities available-for-sale. The shares were acquired at a cost of $500,000. Their fair value last year was $610,000 and is $670,000 this year. At what amount will the investment be reported in this year’s balance sheet? What adjusting entry is required to accomplish this objective?arrow_forwardThe right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the sum of what the initial stockholders paid when they bought company shares and the earnings that the company has retained over the years. Equity is the difference between the paid-in capital and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $136 million. Last year, the company reported a retained earnings balance of $459 million, whereas this year it increased to $540 million. How much was paid out in dividends this year? $4 million $217 million $55 million $280 millionarrow_forwardEntries for selected corporate transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises stockholders equity accounts, with balances on January 1, 20Y6, are as follows: The following selected transactions occurred during the year: Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of 1,125,000 to the retained earnings account. 3. Prepare a statement of stockholders equity for the year ended December 31, 20Y6. Assume that net income was 1,125,000 for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y6, balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License