Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 14P

EXCESS CAPACITY Krogh Lumber’s 2019 financial statements are shown here.

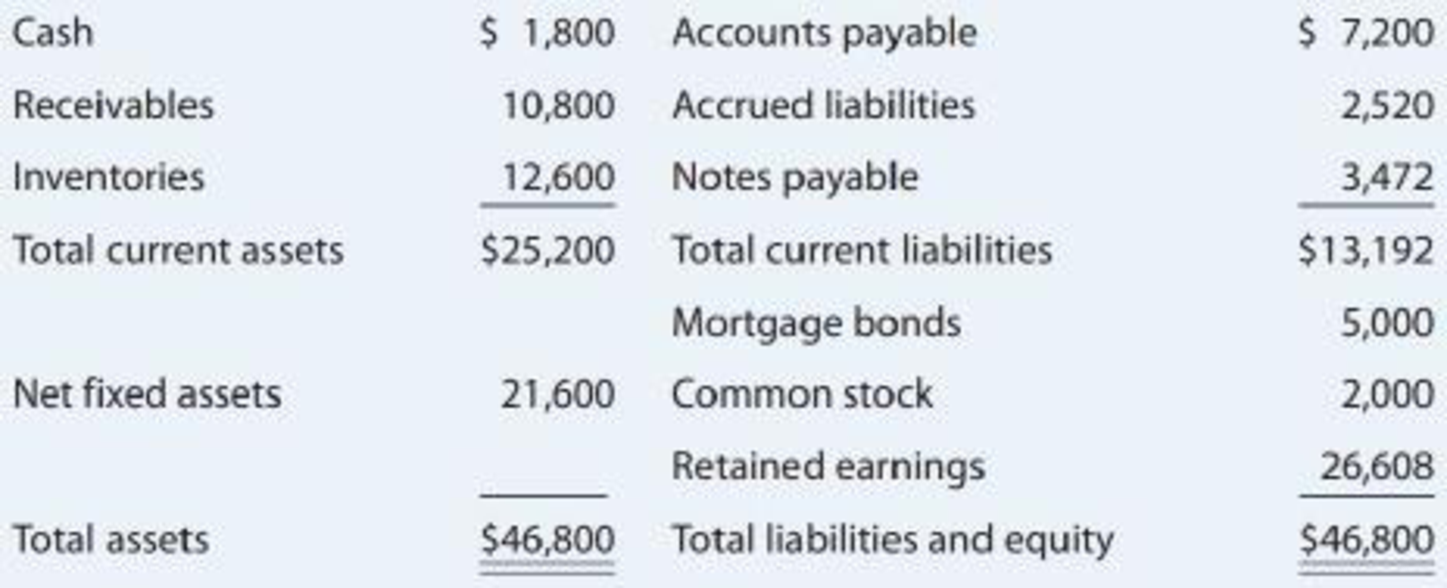

Krogh Lumber: Balance Sheet as of December 31, 2019 (thousands of dollars)

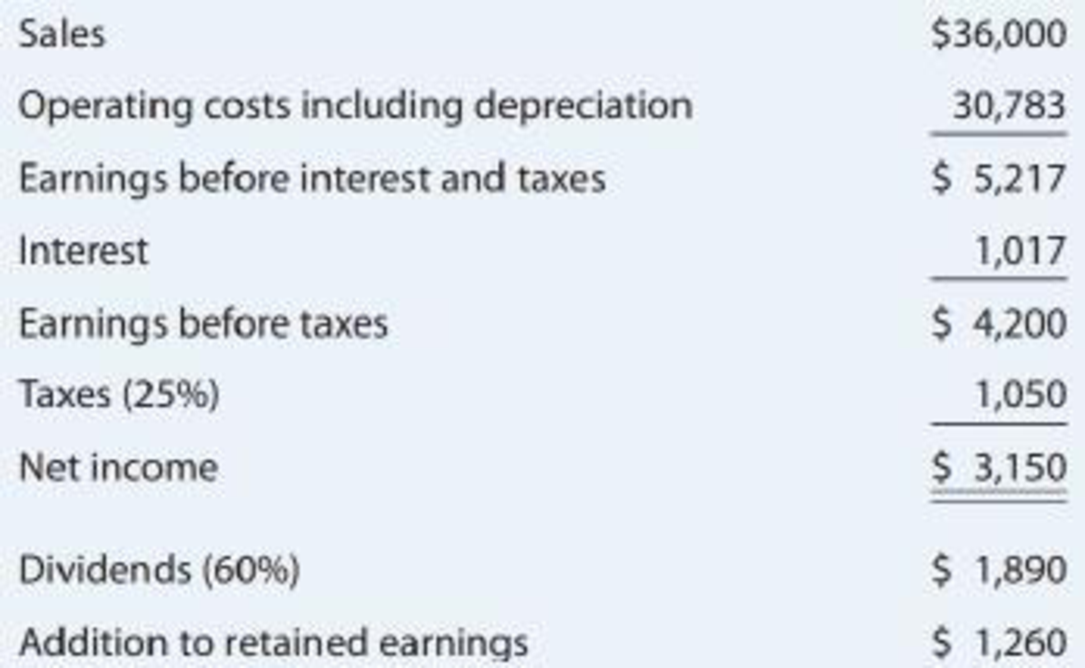

Krogh Lumber: Income Statement for December 31, 2019 (thousands of dollars)

- a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets?

- b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm

forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firm’s current stock price of $40. Develop Krogh’s projected financial statements like those shown in Table 16.2. What are the balances of notes payable, bonds, common stock, andretained earnings ?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Krogh Lumber's 2019 financial statements are shown here.

a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets?b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted inter est-bearing debt as notes payable, and it will issue bonds for the remainder. The firm forecasts that its before-tax cost of debt…

Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in

2020

will be

$1.59

million. Interest expense is expected to remain unchanged at

$36,000,

and the firm plans to pay

$66,000

in cash dividends during

2020.

Metroline Manufacturing's income statement for the year ended December 31,

2019,

is given

LOADING...

,

along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components.

a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31,

2020.

b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31,

2020.

c. Compare and contrast the statements developed in parts a. and b. Which statement probably provides the better estimate of

2020

income? Explain why.

Love Corp. is preparing the interim financial statements for the quarter ended March 31, 2020. Sales during the quarter is P5,000,000. The variable expense is 20% based on sales. The fixed expense of P3,000,000 included P1,500,000 an advertisement expense for one-year (incurred evenly in the year) and depreciation expense of P600,000 for 2020 for an equipment that was available for use on March 1, 2020. How much is the total expense reported as of March 31, 2020?

Chapter 16 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

Ch. 16 - Prob. 1QCh. 16 - Assume that an average firm in the office supply...Ch. 16 - Would you agree that computerized corporate...Ch. 16 - Certain liability and net worth items generally...Ch. 16 - Suppose a firm makes the following policy changes....Ch. 16 - AFN EQUATION Carlsbad Corporations sales are...Ch. 16 - AFN EQUATION Refer to Problem 16-1. What...Ch. 16 - AFN EQUATION Refer to Problem 16-1 and assume that...Ch. 16 - PRO FORMA INCOME STATEMENT Austin Grocers recently...Ch. 16 - EXCESS CAPACITY Williamson Industries has 7...

Ch. 16 - Prob. 6PCh. 16 - PRO FORMA INCOME STATEMENT At the end of last...Ch. 16 - LONG-TERM FINANCING NEEDED At year-end 2019, total...Ch. 16 - SALES INCREASE Paladin Furnishings generated 4...Ch. 16 - REGRESSION AND RECEIVABLES Edwards Industries has...Ch. 16 - REGRESSION AND INVENTORIES Charlies Cycles Inc....Ch. 16 - Prob. 12PCh. 16 - ADDITIONAL FUNDS NEEDED Morrissey Technologies...Ch. 16 - EXCESS CAPACITY Krogh Lumbers 2019 financial...Ch. 16 - Prob. 1TCLCh. 16 - FORECASTING THE FUTURE PERFORMANCE OF ABERCROMBIE ...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)arrow_forwardAdditional Funds Needed The Booth Company’s sales are forecasted to double from $1,000 in 2018 to $2,000 in 2019. Here is the December 31, 2018, balance sheet: Booth’s fixed assets were used to only 50% of capacity during 2018, but its current assets were at their proper levels in relation to sales. All assets except fixed assets must increase at the same rate as sales, and fixed assets would also have to increase at the same rate if the current excess capacity did not exist. Booth’s after-tax profit margin is forecasted to be 5% and its payout ratio to be 60%. What is Booth’s additional funds needed (AFN) for the coming year?arrow_forwardLong-Term Financing Needed At year-end 2018, Wallace Landscapings total assets were 2.17 million, and its accounts payable were 560,000. Sales, which in 2018 were 3.5 million, are expected to increase by 35% in 2019. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to 625,000 in 2018, and retained earnings were 395,000. Wallace has arranged to sell 195,000 of new common stock in 2019 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2019. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 5%, and 45% of earnings will be paid out as dividends. a. What were Wallaces total long-term debt and total liabilities in 2018? b. How much new long-term debt financing will be needed in 2019? [Hint: AFN New stock = New long-term debt.)arrow_forward

- Sales Increase Maggies Muffins Bakery generated 5 million in sales during 2018, and its year-end total assets were 2.5 million. Also, at year-end 2018, current liabilities were 1 million, consisting of 300,000 of notes payable, 500,000 of accounts payable, and 200,000 of accruals. Looking ahead to 2019, the company estimates that its assets must increase at the same rate as sales, its spontaneous liabilities will increase at the same rate as sales, its profit margin will be 7%, and its payout ratio will be 80%. How large a sales increase can the company achieve without having to raise funds externallythat is, what is its self-supporting growth rate?arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forwardQuestion # Paco Company --Additional Financing Needed Assume sales grow 40% in 2021 over 2020; the average collection period increases by 9 days in 2021 compared to 2020 (360 days in the year), inventory turnover based on sales decreases by 1 in 2021 compared to 2020, PACO pays a constant percentage of Net Income as a dividend, and 2020 net fixed assets are operating at 90% capacity. Estimate the following ratios for PACO after the first pass for 2021 assuming any additional financing needed is obtained 25% with notes payables and 75% long-term debt. Assume in 2020; short-term interest rates were 3% points less than long-term rates, i. e if short-term rates are 6%, then long-term rates are 9%. Assume further that rates are expected to remain at those levels in 2021. Finally, any remaining AFN after 1st pass is included in the total debt for ratios. Current Ratio? Times Interest Earned Ratio? Total Debt Ratio?arrow_forward

- Cola Company is preparing the interim financial statements for the quarter ended March 31, 2020. Sales during the quarter is P5,000,000. The variable expense is 20% based on sales. The other expense of P2,100,000 included P1,500,000 an advertisement expense for one-year (incurred unevenly in the year) and depreciation expense of P600,000 for 2020 for an equipment that was available for use on March 1, 2020. How much is the total expense reported as of March 31, 2020?arrow_forwardIncome Statement (Extract) for the year ended 31 March 2018 2019 £ £ Sales 3,000,000 5,400,000 Less: Cost of Sales 2,400,000 4,320,000 Gross Profit 600,000 1,080,000 Less: Expenses 360,000 500,000 Operating Profit 240,000 580,000 Statement of Financial Position (Extract) as at 31 March 2018 2019 £ £ Non- Current Assets 364,000 512,000 Current Assets Inventory 480,000 1,440,000 Trade Receivables 396,000 812,000 Total Assets £1,240,000 £2,764,000 Capital & Reserves Ordinary Share Capital 140,000 240,000 Reserves 260,000 560,000 Non-Current Liabilities 440,000 500,000 Trade Payables 320,000 724,000 Bank Overdraft 80,000 740,000 Total Equity and Liabilities £1,240,000 £2,764,000 Calculate : Trade Receivable Days Trade Payable Days Non-current assets turnoverarrow_forwardAn entity reported the following information for the year ended December 31, 2020: Sales 7,750,000 Cost of goods sold 2,400,000 Administrative expenses 700,000 Loss on sale of equipment 100,000 Sales commissions 500,000 Interest revenue 450,000 Freight out 150,000 Loss on early extinguishment of long-term debt 200,000 Doubtful accounts expense 150,000 16. What is the income from continuing operations for 2020? a. 4,000,000 b. 3,800,000 c. 2,800,000 d. 2,600,000 17. What net amount of loss should be reported as results of discontinued operations for 2020? a. 1,500,000 b. 1,700,000 c. 1,050,000 d. 1,400,000 18. What is the net income for 2020? a. 2,500,000 b. 1,750,000 c. 1,400,000 d. 1,540,000arrow_forward

- Utilize the 2019 financial statements for Micron Industries provided on page 1 and assume that the company is currently operating below capacity, at 80%.Required: Prepare Pro-Forma statements for 2020 (rounding all figures to the nearest dollar) assuming: All costs/income/expenses and net working capital vary directly with sales/revenue. No new equity is raised. Sales are projected to increase by 15% The tax rate and the dividend payout ratio will remain constant. Interest Expense and Depreciation Expense will remain unchanged.Clearly state if Micron Industries will require external financing or would have excess financing in 2020, and how much.arrow_forwardThe portion of the functional income statements of BP Company for 2021 and 2020 are presented below: 2021 P890,000 2020 Sales P800,000 Cost of goods sold Gross margin 530,000 450.000 360,000 350,000 Assuming that the selling price in 2021 is reduced by 11 percent effective January 1, calculate the change in gross profit due to change in unit cost.arrow_forwardThe portion of the functional income statements of Brief Company for 2021 and 2020 are presented below: 2021 2020 Sales P890,000 P800,000 Cost of goods sold 530,000 450,000 Gross margin 360,000 350,000 Assuming that effective January of 2021 the unit cost is higher by 6 percent, calculate the change in sales due to change in volume rounded to nearest thousands. Group of answer choices P85,000 Favorable P88,000 Favorable P88,000 Unfavorable P85,000 Unfavorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license