Concept explainers

a.

To calculate: The discount rate of Robinson Corporation.

Introduction:

Discount Rate:

A rate that is used for the calculation of the present value of the cash flows is termed as the discount rate.

a.

Answer to Problem 18P

The discount rate of Robinson Corporation is 7.53% and after rounding off to a whole number, the discount rate is 8%.

Explanation of Solution

Computation of the discount rate:

b.

To calculate: The PV of total outflows of Robinson Corporation.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the

b.

Answer to Problem 18P

The PV of total outflows of Robinson Corporation is $3,171,831.

Explanation of Solution

Computation of PV of total outflows:

Working Notes:

Calculation of net cost of underwriting expense on new issue:

Calculation of after-tax cost:

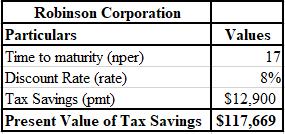

The calculation of the tax savings per year is as follows:

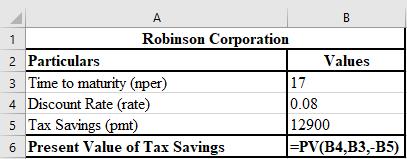

The calculation of current price of bond, that is, PV of future tax savings is shown below.

The formula used for the calculation of current price of bond, that is, PV of future tax savings is shown below.

c.

To calculate: The PV of total inflows of Robinson Corporation.

Introduction:

Present value:

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

c.

Answer to Problem 18P

The present value of total inflow of Robinson Corporation is $2,847,244.

Explanation of Solution

Calculation of the present value of total inflow:

Working Notes:

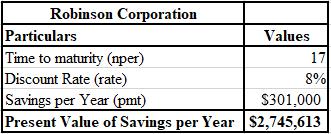

The calculation of the savings per year is as follows:

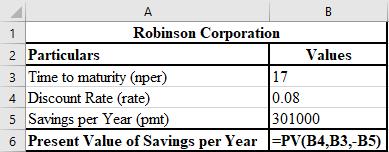

The calculation of PV of savings is shown below.

The formula used for the calculation of PV of savings is shown below.

Calculation of underwriting cost write off:

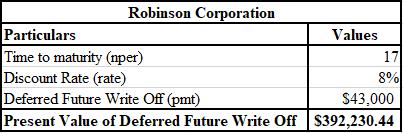

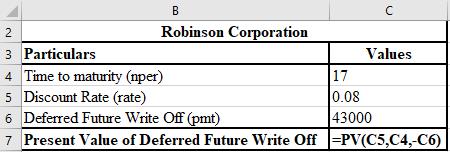

Calculation of PV of deferred future write off:

The calculation of current price of bond is shown below.

The formula used for the calculation of current price of bond is shown below.

d.

To calculate: The NPV of Robinson Corporation.

Introduction:

It is the difference between the PV (present value) of

d.

Answer to Problem 18P

The NPV of Robinson Corporation is ($324,478).

Explanation of Solution

Calculation of NPV:

Want to see more full solutions like this?

Chapter 16 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Smashing Cantaloupes Inc. issued 5-year bonds with a par value of $35,000 and an 8% semiannual coupon (payable June 30 and December 31) on January 1, 2018, when the market rate of interest was 10%. Were the bonds issued at a discount or premium? Assuming the bonds sold at 92.288, what was the sales price of the bonds?arrow_forwardOn July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%. The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the bond.arrow_forwardOShea Inc. issued bonds at a face value of $100,000, a rate of 6%, and a 5-year term for $98,000. From this information, we know that the market rate of interest was ________. A. more than 6% B. less than 6% C. equal to 6% D. cannot be determined from the information given.arrow_forward

- Waylan Sisters Inc. issued 3-year bonds with a par value of $100,000 and a 6% annual coupon when the market rate of interest was 5%. If the bonds sold at 102.438, how much cash did Williams Sisters Inc. receive from issuing the bonds?arrow_forwardNeubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond?arrow_forwardGingko Inc. issued bonds with a face value of $100,000, a rate of 7%, and a 10-yearterm for $103,000. From this information, we know that the market rate of interest was ________. A. more than 7% B. less than 7% C. equal to 7% D. equal to 1.3%arrow_forward

- Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?arrow_forwardCharleston Inc. issued $200,000 bonds with a stated rate of 10%. The bonds had a 10-year maturity date. Interest is to be paid semi-annually and the market rate of interest is 8%. If the bonds sold at 113.55, what amount was received upon issuance?arrow_forwardGoodwynn & Wolf Incorporated (G&W) issued a bond 7 years ago. The bond had a 20-year maturity, a 14% coupon paid annually, a 9% call premium and was issued at par, $1,000. Today, G&W called the bonds. If the original investors had expected G&W to call the bonds in 7 years, what was the yield to call at the time the bonds were issued?arrow_forward

- Beluga Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 3% when the market rate was 4%. Interest was paid annually. The bonds were sold at 87.5. What was the sales price of the bonds? Were they issued at a discount, a premium, or at par?arrow_forwardEvie Inc. issued 50 bonds with a $1,000 face value, a five-year life, and a stated annual coupon of 6% for $980 each. What is the total amount of interest expense over the life of the bonds?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning