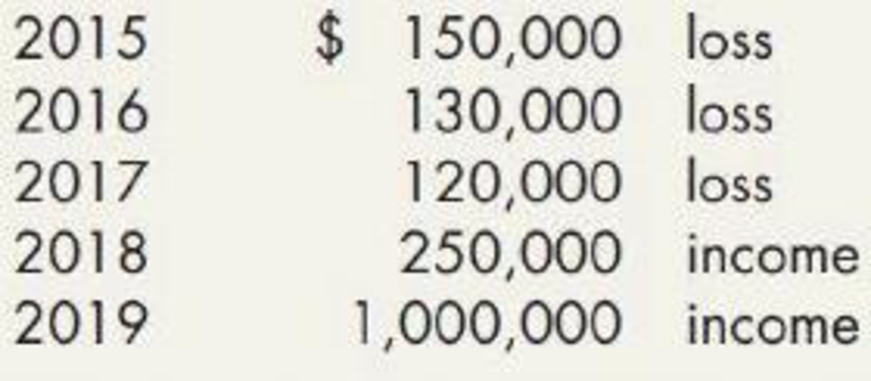

Otter Tail, Inc., began operations in January 2015 and had the following reported net income or loss for each of its 5 years of operations:

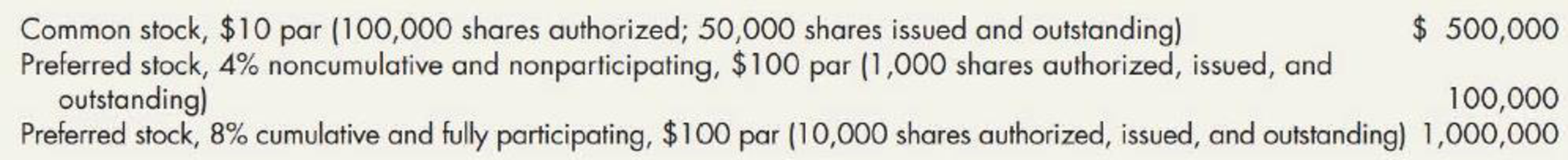

At December 31, 2019, Otter Tail’s capital stock was comprised of the following:

Otter Tail has never paid a cash or stock dividend. There has been no change in the capital accounts since Otter Tail began operations. The appropriate state law permits dividends only from

Required:

Prepare a worksheet showing the maximum amount available for cash dividends on December 31, 2019, and how it would be distributable to the holders of the common shares and each of the

Trending nowThis is a popular solution!

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

- Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). As vice president of finance for the firm, you have been asked to calculate earnings per share for 2011. The worksheet EPS has been provided to assist you.arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardPonce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). Open the file EPS from the website for this book at cengagebrain.com. Enter all input items (AF) in the appropriate cells in the Data Section. Enter all formulas in the appropriate cells in the Answer Section. Enter your name in cell A1. Save the completed file as EPS2. Print the worksheet when done. Also print your formulas. Check figure: Basic earnings per share from continuing operations (cell D29), 5.94.arrow_forward

- The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.arrow_forwardAt the beginning of 2021, Pioneer Products’ ownership interest in the common stock of LLB Co. increased to the point that it became appropriate to begin using the equity method of accounting for the investment. The balance in the investment account was $44 million at the time of the change but would have been $56 million if Pioneer had used the equity method since first investing in LLB. How should Pioneer report the change? Would your answer be the same if Pioneer is changing from the equity method rather than to the equity method?arrow_forwardPHN Foods granted 18 million of its no par common shares to executives, subject to forfeiture if employment is terminated within three years. The common shares have a market price of $5 per share on January 1, 2015, the grant date. Required: 1. What journal entry will PHN Foods prepare to record executive compensation regarding these restricted shares at December 31, 2015 and December 31, 2016? 2. When calculating diluted EPS at December 31, 2016, what will be the net increase in the denominator of the EPS fraction if the market price of the common shares averages $5 per share during 2016?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning