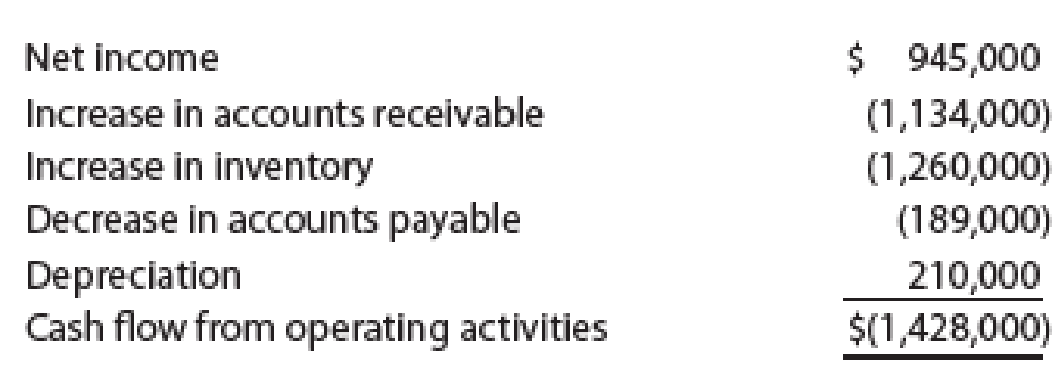

The Commercial Division of Tidewater Inc. provided the following information on its

The manager of the Commercial Division provided the accompanying memo with this report:

From: Senior Vice President, Commercial Division

I am pleased to report that we had earnings of $945,000 over the last period. This resulted in a return on invested capital of 8%, which is near our targets for this division. I have been aggressive in building the revenue volume in the division. As a result, I am happy to report that we have increased the number of new credit card customers as a result of an aggressive marketing campaign. In addition, we have found some excellent merchandise opportunities. Some of our suppliers have made some of their apparel merchandise available at a deep discount. We have purchased as much of these goods as possible in order to improve profitability. I’m also happy to report that our vendor payment problems have improved. We are nearly caught up on our overdue payables balances.

Comment on the senior vice president’s memo in light of the cash flow information.

Comment on the senior vice president’s memo in light of the cash flow information.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Financial Accounting

- The financial manager of Sarap Corporation wants to determine the amount of cash outlays to be spent for the next period. He asked the help of the accountant and the latter provided a cash budget for the next year. According to the computations, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12%. a. The optimum cash balance is?arrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash atlays to be spent for the next period. He asked the help of the accountant and the lattes provided a cash budget for the next year According to the computation, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12% a) the optimum cash tufence is? b) The average cash balance is? c) the number of conversion made during the year? d) The total cash cost is? Please help me with these. Thank youuuu!arrow_forwardThe financial manager of a firm wants to determine the amount of cash outlays to be spent for the next period. He asked the help of the accountant and the latter provided a cash budget for the next year. According to the computations, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm’s opportunity cost ratio is 12%. The optimum cash balance is? The average cash balance is? the number of conversion made during the year is? The total cash cost is?arrow_forward

- The following information relates to last year's operations at the Legumes Division of Gervani Corporation: Minimum required rate of return 12% Return on investment (ROI) 15% Sales $ 900,000 Turnover (on operating assets) 3 times What was the Legume Division's net operating income last year?arrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash outlays to be spent for the nextperiod. He asked the help of the accountant and the latter provided a cash budget for the next year. According tothe computations, the company would be incurring cash expenses of P6,612,500 per month. The financial managerhas estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm’s opportunity costratio is 12%.a. The optimum cash balance is?b. The average cash balance is?c. the number of conversion made during the year is?d. The total cash cost is?arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department charges): Sales $210,000,000 Cost of goods sold 117,200,000 Gross profit $92,800,000 Administrative expenses 67,400,000 Operating income $25,400,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $125,550,000 of assets have been invested in the Consumer Products Division. Round your answers for the profit margin and the rate of return on investment to the nearest whole number, round your answer for the…arrow_forward

- Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardLast Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.arrow_forward

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardThe income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College