Find Missing Data for Profit

Required

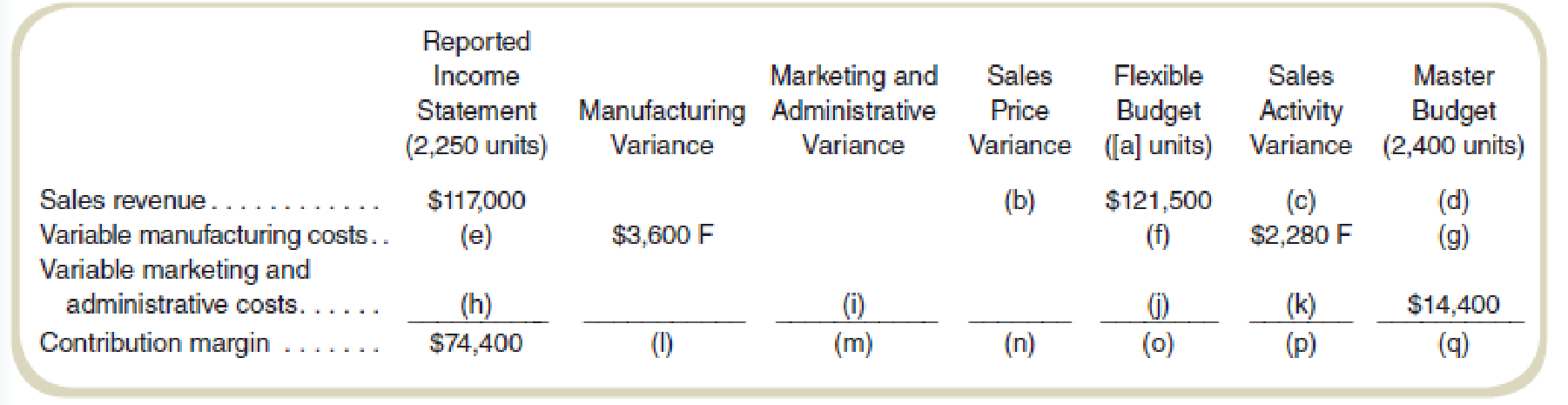

Find the values of the missing items (a) through (q). Assume that the actual sales volume equals actual production volume. (There are no inventory level changes.)

Find the missing data for profit variance analysis.

Explanation of Solution

Profit variance analysis:

The analysis that studies the difference between the actual operating profit and the standard operating profit is called the profit variance analysis.

Prepare profit variance analysis:

| Actual Revenue & Costs | Manufacturing variance | Marketing and administrative variance | Sales price variance | Flexible budget | Sales Activity Variance | Master budget | |

| Units Produced | 2,250 | 2,250 | 150U(1) | 2,400 | |||

| Sales revenue | $117,000 | $4,500U(2) | $121,500 | $8,100(13) | $129,600(3) | ||

| Less: Variable costs | |||||||

| Manufacturing | $30,600(7) | $3,600F | $34,200(5) | $2,280F | $36,480(6) | ||

| Marketing &administrative costs | $12,000(8) | $1,500F(11) | $13,500(10) | $900F | $14,400 | ||

| Contribution margin | $74,400 | $3,600F | $1,500F | $4,500U | $73,800 | $4,920U | $78,720 |

Table: (1)

Working Note 1:

Sales activity variance units and sales revenue:

Working Note 2:

Working Note 3:

Working Note 4:

Working Note 5:

Working Note 6:

Working Note 7:

Working Note 8:

Working Note 9:

Working Note 10:

Working Note 11:

Working Note 12:

Working Note 13:

Want to see more full solutions like this?

Chapter 16 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Data for Torleson Company are as follows: Required: 1. Calculate the sales price variance. 2. Calculate the sales volume variance. 3. Suppose that the product is in the introductory stage of the product life cycle. What information do these two variances provide to Torlesons managers?arrow_forwardIn comparing actual sales revenue to flexible budget sales revenue, would it be possible to have a favorable variance and still not have met revenue expectations?arrow_forwardWhat are some possible reasons for a material price variance? A. substandard material B. labor rate increases C. labor rate decreases D. labor efficiencyarrow_forward

- When is the direct labor time variance unfavorable? A. when the actual quantity used is greater than the standard quantity B. when the actual quantity used is less than the standard quantity C. when the actual price paid is greater than the standard price D. when the actual price is less than the standard pricearrow_forwardWhen is the labor rate variance unfavorable? A. when the actual quantity used is greater than the standard quantity B. when the actual quantity used is less than the standard quantity C. when the actual price paid is greater than the standard price D. when the actual price is less than the standard pricearrow_forwardWhich of the following is a possible cause of an unfavorable material quantity variance? A. purchasing substandard material B. hiring higher-quality workers C. paying more than should have for workers D. purchasing too much materialarrow_forward

- What are some possible reasons for a labor rate variance? A. hiring of less qualified workers B. an excess of material usage C. material price increase D. utilities usage changearrow_forwardA flexible budget______. A. predicts estimated revenues and costs at varying levels of production B. gives actual figures for selling price C. gives actual figures for variable and fixed overhead D. is not used in overhead variance calculationsarrow_forwardWhich of the following is a possible cause of an unfavorable labor rate variance? A. hiring too many workers B. hiring higher-quality workers at a higher wage C. making too many units D. purchasing too much materialarrow_forward

- When is the material price variance unfavorable? A. when the actual quantity used is greater than the standard quantity B. when the actual quantity used is less than the standard quantity C. when the actual price paid is greater than the standard price D. when the actual price is less than the standard pricearrow_forwardWhen is the labor rate variance favorable? A. when the actual quantity used is greater than the standard quantity B. when the actual quantity used is less than the standard quantity C. when the actual price paid is greater than the standard price D. when the actual price is less than the standard pricearrow_forwardWhen is the direct labor time variance favorable? A. when the actual quantity used is greater than the standard quantity B. when the actual quantity used is less than the standard quantity C. when the actual price paid is greater than the standard price D. when the actual price is less than the standard pricearrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning