College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 10SPA

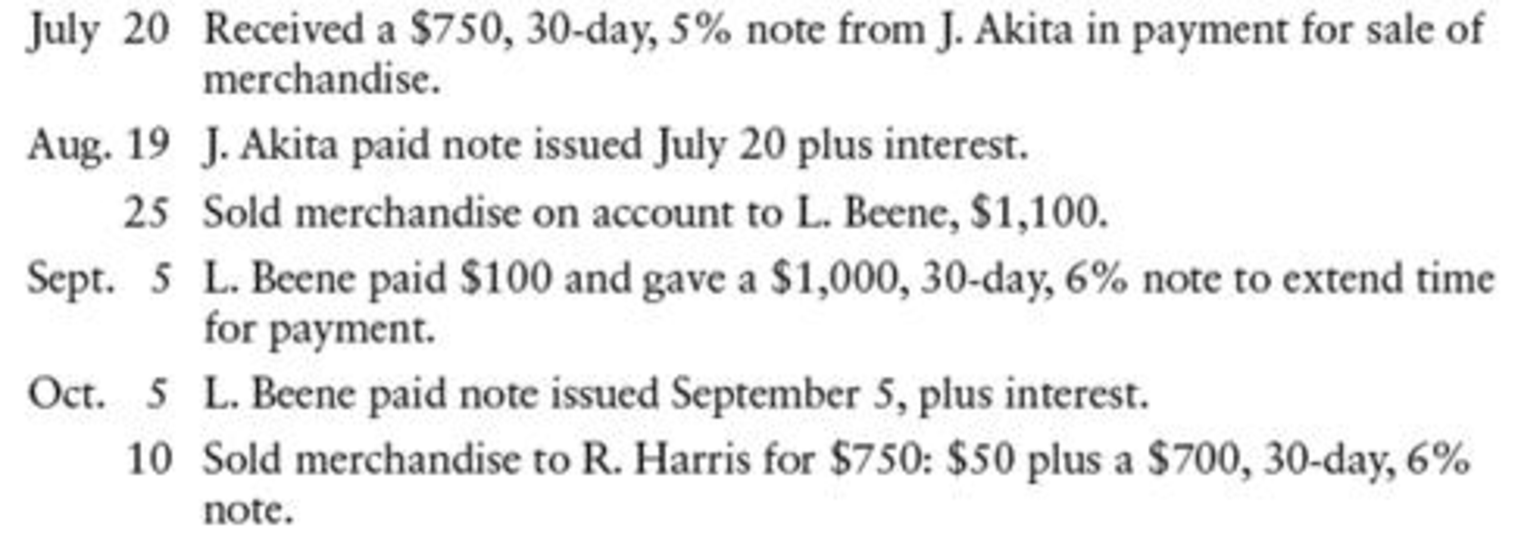

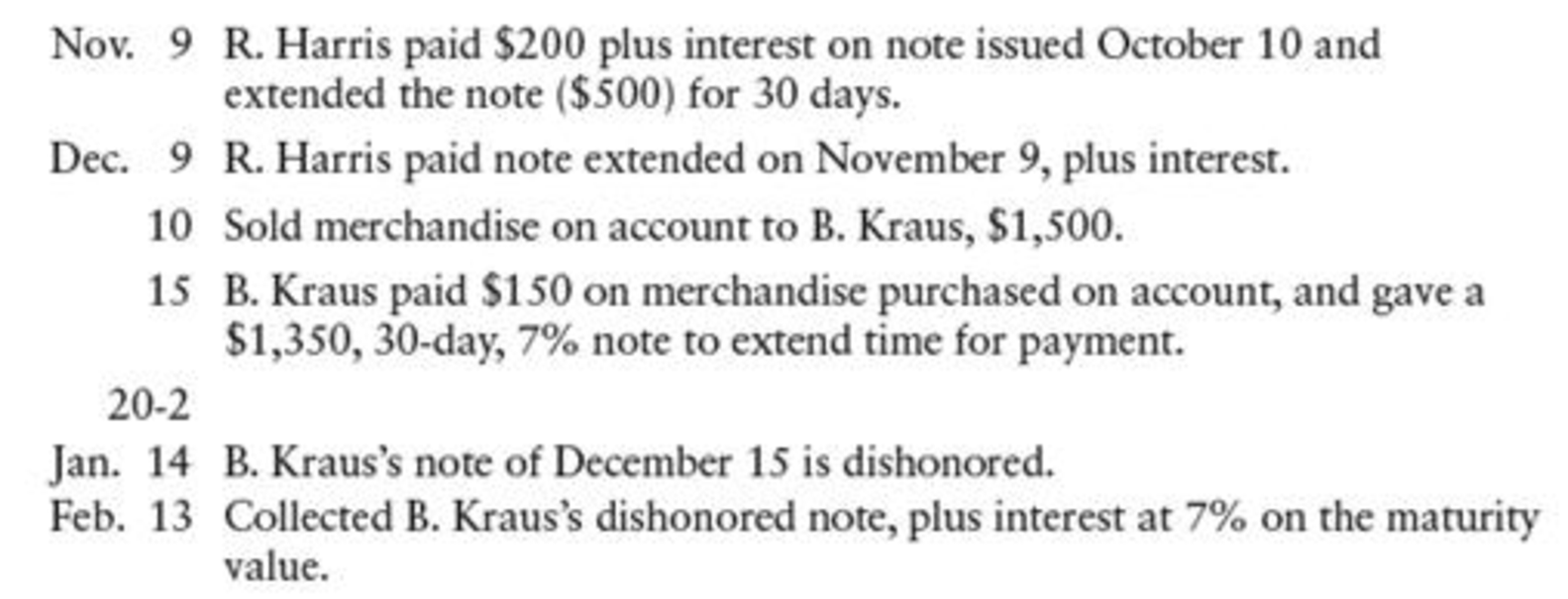

NOTES RECEIVABLE ENTRIES J. K. Pratt Co. had the following transactions: 20-1

REQUIRED

Record the transactions in a general journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Sales and notes receivable transactionsThe following were selected from among the transactions completedduring the current year by Danix Co., an appliance wholesale company:

Instructions

Journalize the entries to record the transactions.

a. Record April transactions and related adjustment entries in a sales journal, a single-column purchases journal, a cash receipts journal, a cash payment journal, and general journal. (The references for sales journal, single-column purchases journal, cash receipts journal, and cash payment journal were respectively S1, P1, CR1, and CP1)

b. Post the appropriate journal entries to the accounts payable subsidiary ledger,

accounts receivable subsidiary ledger, and 3 column general ledger. (Beginning

balance accounts receivable subsidiary ledger for XYZ Co., Denia Co., and CEF

Co., were respectively S6,300; $10,500; and S4,200 and beginning balance accounts payable subsidiary ledger for JKL Co. was $9,700; the remaining

accounts has not had a beginning balance)

c.Prepare an adjusted trial balance at April 30, 2021.

d. Prepare a single-step Statement of Profit or Loss for the month ended April 30, 2021.

Post the entries in the general journal below to the Accounts Receivable account in the general ledger and to the appropriate accounts in the accounts receivable ledger for Calderone Company.

Assume the following account balances at January 1, 20X1:

Accounts Receivable (control account)

$

8,880

Accounts Receivable—John Gibrone

5,600

Accounts Receivable—Jim Garcia

2,180

Accounts Receivable—June Lin

1,100

GENERAL JOURNAL

DATE

DESCRIPTION

POST.REF.

DEBIT

CREDIT

20X1

Jan.

8

Cash

560

Accounts Receivable/John Gibrone

560

Received partial payment on

account from John Gibrone

20

Sales Returns and Allowances

300

Sales Tax Payable

24

Accounts Receivable/Jim Garcia

324

Accept return of defective…

Chapter 17 Solutions

College Accounting, Chapters 1-27

Ch. 17 - The maturity value of a note includes both...Ch. 17 - Prob. 2TFCh. 17 - The difference between the maturity value of a...Ch. 17 - Prob. 4TFCh. 17 - When a dishonored note is collected, interest is...Ch. 17 - Principal plus interest equals ______ of a note....Ch. 17 - Prob. 2MCCh. 17 - Prob. 3MCCh. 17 - Prob. 4MCCh. 17 - Accrued interest payable is reported as a ______...

Ch. 17 - Prob. 1CECh. 17 - Prob. 2CECh. 17 - Prob. 3CECh. 17 - Prob. 1RQCh. 17 - Prob. 2RQCh. 17 - Prob. 3RQCh. 17 - Prob. 4RQCh. 17 - Prob. 5RQCh. 17 - Prob. 6RQCh. 17 - Prob. 7RQCh. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - On which notes receivable and notes payable is it...Ch. 17 - Prob. 11RQCh. 17 - When a business borrows money from a bank on a...Ch. 17 - What kind of account is Discount on Notes Payable,...Ch. 17 - Prob. 14RQCh. 17 - Prob. 15RQCh. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - Prob. 2SEACh. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - Prob. 5SEACh. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES J. K. Pratt Co. had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Marienau Suppliers...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - NOTES PAYABLE ENTRIES Milo Radio Shop had the...Ch. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - CALCULATING INTEREST Using 360 days as the...Ch. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, DISCOUNTED,...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Madison Graphics had...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - Prob. 13SPBCh. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - Prob. 1MYWCh. 17 - Rochelle needed to borrow 3,000 for three months...Ch. 17 - Eddie Edwards and Phil Bell own and operate The...Ch. 17 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- NOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the following notes receivable transactions: REQUIRED Record the transactions in a general journal.arrow_forwardEntries for notes receivable The series of five transactions, (a) through (e), recorded in the following T accounts were related to a sale to a customer on account and the receipt of the amount owed. Briefly describe each transaction.arrow_forwardNotes receivable entries The following data relate to notes receivable and interest for CGH Cable Co., a cable manufacturer and supplier. (All notes are dated as of the day they are received.) Instructions Journalize the entries to record the transactions.arrow_forward

- SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts receivable ledger shown, prepare a schedule of accounts receivable for Gelph Co. as of November 30, 20--.arrow_forwardSCHEDULE OF ACCOUNTS RECEIVABLE Based on the information provided in Problem 10-11A, prepare a schedule of accounts receivable for Sourk Distributors as of March 31, 20--. Verify that the accounts receivable account balance in the general ledger agrees with the schedule of accounts receivable total.arrow_forwardSCHEDULE OF ACCOUNTS RECEIVABLE Based on the information provided in Problem 10-12A, prepare a schedule of accounts receivable for Sourk Distributors as of March 31, 20--. Verify that the accounts receivable account balance in the general ledger agrees with the schedule of accounts receivable total.arrow_forward

- Sales and notes receivable transactionsThe following were selected from among the transactions completed byCaldemeyer Co. during the current year. Caldemeyer Co. sells andinstalls home and business security systems. (attached) InstructionsJournalize the entries to record the transactions.arrow_forwardEntires for notes receivable, including year-end entries. The following selected transactions were completed by interlocking Devices Co., a supplier of zippers for clothing. journalize the entries to record the transactions.arrow_forwardSCHEDULE OF ACCOUNTS RECEIVABLE From the accounts receivableledger shown, prepare a schedule of accounts receivable for Pheng Co.as of August 31, 20--.arrow_forward

- JOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardDIRECT WRITE-OFF METHOD Lee and Chen Distributors uses the direct write-off method in accounting for uncollectible accounts. REQUIRED Record these transactions in general journal form.arrow_forwardDIRECT WRITE-OFF METHOD Williams Hendricks Distributors uses the direct write-off method in accounting for uncollectible accounts. REQUIRED Record these transactions in general journal form.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY