The predictions of the Keynesian economic theory.

Explanation of Solution

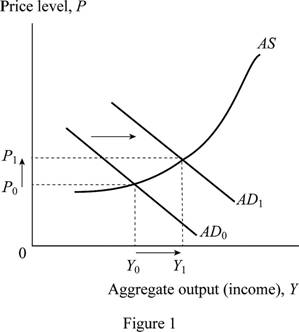

Using the aggregate demand-supply model, the likely effects of the major tax cut when the economy is not operating at a capacity and the Fed accommodates by increasing the money supply is depicted in Figure 1.

In Figure 1, the horizontal axis depicts the

Concept Introduction:

Real Gross Domestic Product (Real GDP): Real GDP refers to the market value of all the final goods and services produced in an economy during an accounting year, measured at constant prices.

Aggregate demand (AD): An aggregate demand refers to the total value of the goods and services that are demanded at a particular price within a given period of time.

Aggregate supply: An aggregate supply is the total value of supply of the final goods and services in an economy within a given period of time.

Want to see more full solutions like this?

Chapter 17 Solutions

ECO 2302 PRIN MACO W/MYECO ACC >IP<

- Explain how the Federal Reserve’s raising of interest rates affects the following variables in the short run: household consumption, business investment, real GDP, and the price level. Insert or attach a well-labeled Aggregate Demand/Aggregate Supply graph that would illustrate the effect of an increase in interest rates on Aggregate Demand when the economy is close to potential real GDP. Explain your graph.arrow_forwardDetermine whether the following items are examples of expansionary fiscal policy, contractionary fiscal policy, expansionary monetary policy or contractionary monetary policy as they affect the aggregate demand of an economy. 1. A Significant treasury bond buyback *a. Expansionary fiscal policyb. Contractionary fiscal policyc. Expansionary monetary policyd. Contractionary monetary policy 2. Issuance of new treasury bonds at a higher interest rate *a. Expansionary fiscal policyb. Contractionary fiscal policyc. Expansionary monetary policyd. Contractionary monetary policyarrow_forward

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning