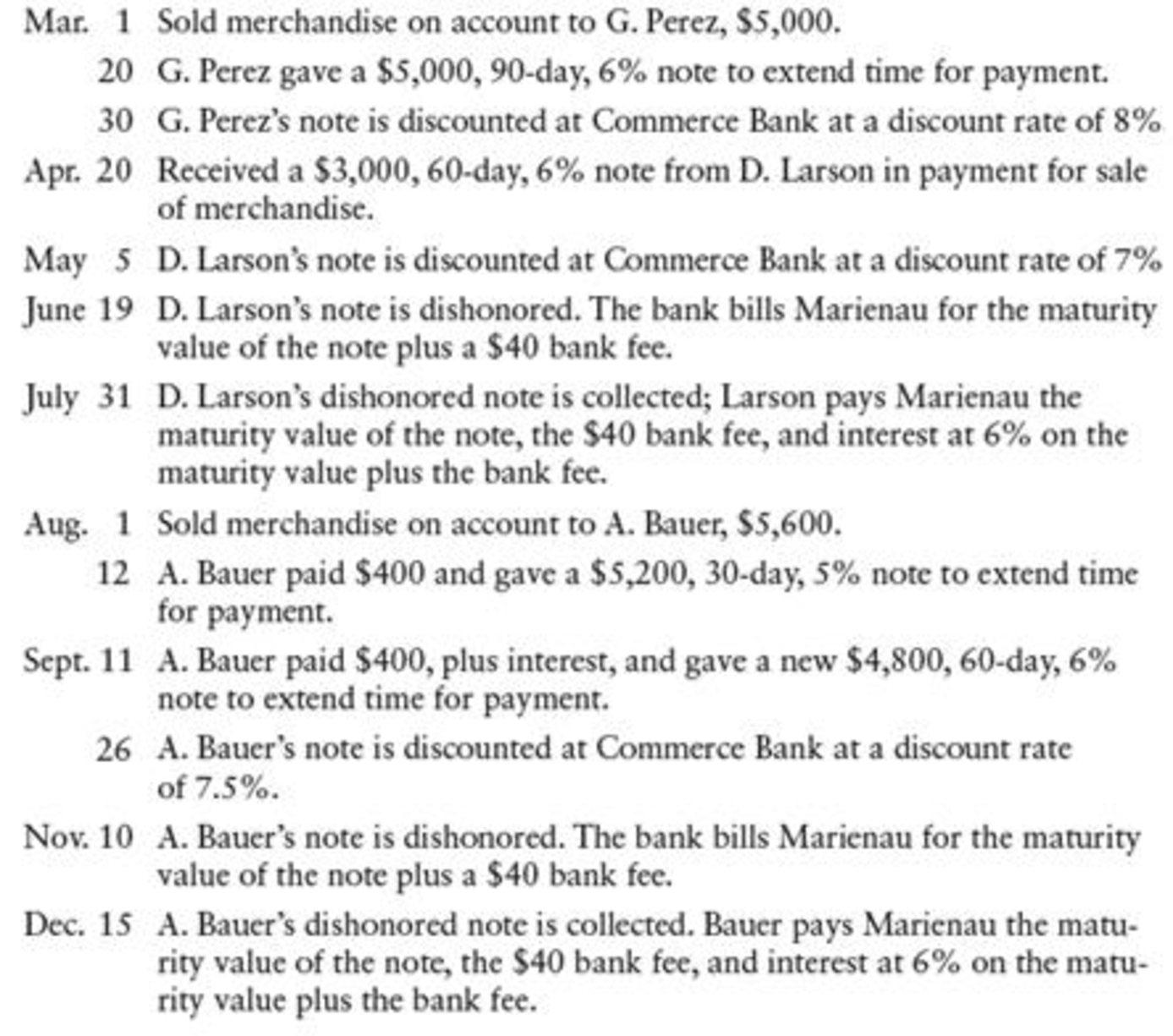

NOTES RECEIVABLE DISCOUNTING Marienau Suppliers had the following transactions:

REQUIRED

Record the transactions in a general journal.

Prepare a journal entry to record Suppliers M.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

| Date | Account titles and Explanation | Debit | Credit |

| March 1 | Accounts receivable -G.P | $5,000 | |

| Sales | $5,000 | ||

| (To record sale made on account) | |||

| March 20 | Notes receivable | $5,000 | |

| Accounts receivable - G.P | $5,000 | ||

| (To record received note to settle account) | |||

| March 30 | Cash (1) | $4,984.78 | |

| Interest expense (2) | $15.22 | ||

| Notes receivable | $5,000 | ||

| (To record discount on notes receivable) | |||

| April 20 | Notes receivable | $3,000 | |

| Sales | $3,000 | ||

| (To record received note for merchandise sale) | |||

| May 5 | Cash (3) | $3,003.49 | |

| Notes receivable | $3,000 | ||

| Interest revenue (4) | $3.49 | ||

| (To record received payment of note with interest) | |||

| June 19 | Accounts receivable - D. L | $3,070 | |

| Cash | $3,070 | ||

| (To record cash paid for dishonoured note) | |||

| July 31 | Cash | $3,091.49 | |

| Accounts receivable - D. L | $3,070 | ||

| Interest revenue (5) | $21.49 | ||

| (To record Collected dishonoured note with interest) | |||

| August 1 | Accounts receivable - A.B | $5,600 | |

| Sales | $5,600 | ||

| (To record sale made on account) | |||

| August 12 | Cash | $400 | |

| Notes receivable | $5,200 | ||

| Accounts receivable - A.B | $5,600 | ||

| (To record cash received and note to settle account) | |||

| September 11 | Cash (6) | $421.67 | |

| Notes receivable (new note) | $4,800 | ||

| Notes receivable (old note) | $5,200 | ||

| Interest revenue (7) | $21.67 | ||

| (To record received new note plus interest on old note) | |||

| September 26 | Cash | $4,802.55 | |

| Notes receivable | $4,800 | ||

| Interest revenue | $2.55 | ||

| (To record received payment of note with interest) | |||

| November 10 | Accounts receivable - A.B | $4,888 | |

| Cash | $4,888 | ||

| (To record cash paid for dishonoured note) | |||

| December 15 | Cash | $4,916.51 | |

| Accounts receivable - A.B | $4,888 | ||

| Interest revenue (8) | $28.51 | ||

| (To record Collected dishonoured note with interest) |

Table (1)

Working notes:

(1) Calculate cash proceeds.

(2) Calculate interest expense.

(3) Calculate cash proceeds.

(4) Calculate interest revenue.

(5) Calculate interest revenue.

(6) Calculate interest revenue.

(6) Calculate cash proceeds.

(7) Calculate interest revenue.

(8) Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- NOTES RECEIVABLE DISCOUNTING Madison Graphics had the following notes receivable transactions: REQUIRED Record the transactions in a general journal.arrow_forwardNOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the following notes receivable transactions: REQUIRED Record the transactions in a general journal.arrow_forwardWhat is the accounts receivable ledger? a. A record of credit customers and their balances b. A record of vendors and their balances c. Part of the sales journal d. Part of the general journal e. Part of the general ledgerarrow_forward

- JOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardPURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS PAYABLE LEDGER The purchases journal of Ryans Rats Nest, a small retail business, is as follows: REQUIRED 1. Post the total of the purchases journal to the appropriate general ledger accounts. Use account numbers as shown in the chapter. 2. Post the individual purchase amounts to the accounts payable ledger.arrow_forwardThe journal that should be used to record the return of merchandise for credit is the (a) purchases journal. (b) cash payments journal. (c) general journal. (d) accounts payable journal.arrow_forward

- Purchase-related transactions Based on the data presented in Exercise 5-16, journalize Balboa Co.s entries for (A) the purchase, (B) the return of the merchandise for credit, and (C) the payment of the invoice.arrow_forwardA journal entry that requires a debit to Accounts Receivable and a credit to Sales goes in which special journal?arrow_forwardThe journal entry to be recorded by the seller upon receiving payment from a customer who had previously purchased the goods on account would include which of the following? Assume the payment was made within the discount period. A. a debit to Sales Discounts. B. a credit to Inventory. C. a debit to Inventory. D. a debit to Accounts Receivable.arrow_forward

- Proving the postings of a one-column purchases journal would involve comparing the general ledger posting to Accounts Payable to the debit postings of the accounts receivable subsidiary ledger. general ledger debit posting to Accounts Payable to the general ledger credit posting to Inventory. general ledger credit posting to Accounts Payable to the general ledger debit posting to Inventory. debit postings to the accounts payable subsidiary ledger to the credit postings to the accounts payable subsidiary ledger.arrow_forwardAccounting Information System Prepare a step-by-step payment flowchart for a bookstore business, who's ordering inventory from their supplier. Provide an analysis/explanation of the flow of the flowchart.arrow_forwardWhen a customer returns a product to Hartville Equipment that the customer purchasedon account, Hartville will issue a to authorize a credit to the customer’saccount receivable on Hartville’s books:a. return authorizationb. refund notec. credit memod. manager approvalarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage