a)

To determine: The straight bond value of the bond.

Introduction:

The word conversion stands for the normal meaning as it is. The conversion feature states that the holder of the securities such as the specific bond, stock options or the warrants is able to convert these bonds or warrants into the normal common stock of the firm.

a)

Explanation of Solution

Given information:

Par value of the bond is given as $1,000 and it is given that the bonds can be converted into 40 shares of common stock. The annual coupon rate is 11% and the interest rate is 13%. Maturity year is 25 years.

Formula to determine the straight bond value of the bond:

Here,

B0 refers to the straight bond value

I refers to the discount value

rd refers to the interest rate

M refers to par value

n refers to maturity year

Determine the straight bond value of the bond:

Hence, the straight bond value is $853.4.

b)

To determine: The conversion value of the bond.

Introduction:

The word conversion stands for the normal meaning as it is. The conversion feature states that the holder of the securities such as the specific bond, stock options or the warrants is able to convert these bonds or warrants into the normal common stock of the firm.

b)

Explanation of Solution

Given information:

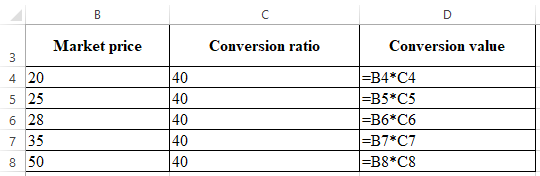

Par value of the bond is given as $1,000 and it is given that the bonds can be converted into 40 shares of common stock. The annual coupon rate is 11% and the interest rate is 13%. Maturity year is 25 years. The market price of the stocks are given as $20, $25, $28, $35, and $50.

Determine the conversion value of the bond:

| Market price | Conversion ratio | Conversion value |

| $20 | 40 | $800 |

| $25 | 40 | $1,000 |

| $28 | 40 | $1,120 |

| $35 | 40 | $1,400 |

| $50 | 40 | $2,000 |

Computation of conversion value:

c)

To determine: The selling price of the bond for each stock price given in part (c).

Introduction:

The word conversion stands for the normal meaning as it is. The conversion feature states that the holder of the securities such as the specific bond, stock options or the warrants is able to convert these bonds or warrants into the normal common stock of the firm.

c)

Explanation of Solution

Given information:

Par value of the bond is given as $1,000 and it is given that the bonds can be converted into 40 shares of common stock. The annual coupon rate is 11% and the interest rate is 13%. Maturity year is 25 years. The market price of the stocks are given as $20, $25, $28, $35, and $50.

Determine the selling price of the bond for each stock price given in part (c):

| Market price | Conversion ratio | Conversion value |

| $20 | 40 | $800 |

| $25 | 40 | $1,000 |

| $28 | 40 | $1,120 |

| $35 | 40 | $1,400 |

| $50 | 40 | $2,000 |

For each stock

d)

To determine: The least selling price for the bond.

Introduction:

The word conversion stands for the normal meaning as it is. The conversion feature states that the holder of the securities such as the specific bond, stock options or the warrants is able to convert these bonds or warrants into the normal common stock of the firm.

d)

Explanation of Solution

Given information:

Par value of the bond is given as $1,000 and it is given that the bonds can be converted into 40 shares of common stock. The annual coupon rate is 11% and the interest rate is 13%. Maturity year is 25 years.

Determine the least selling price for the bond:

The selling price of the bond should not be less than the straight value of the bond $853.4. Hence, the least selling price is the straight bond value.

Want to see more full solutions like this?

Chapter 17 Solutions

Principles of Managerial Finance, Student Value Edition Plus NEW MyLab Finance with Pearson eText -- Access Card Package (14th Edition)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education