Concept explainers

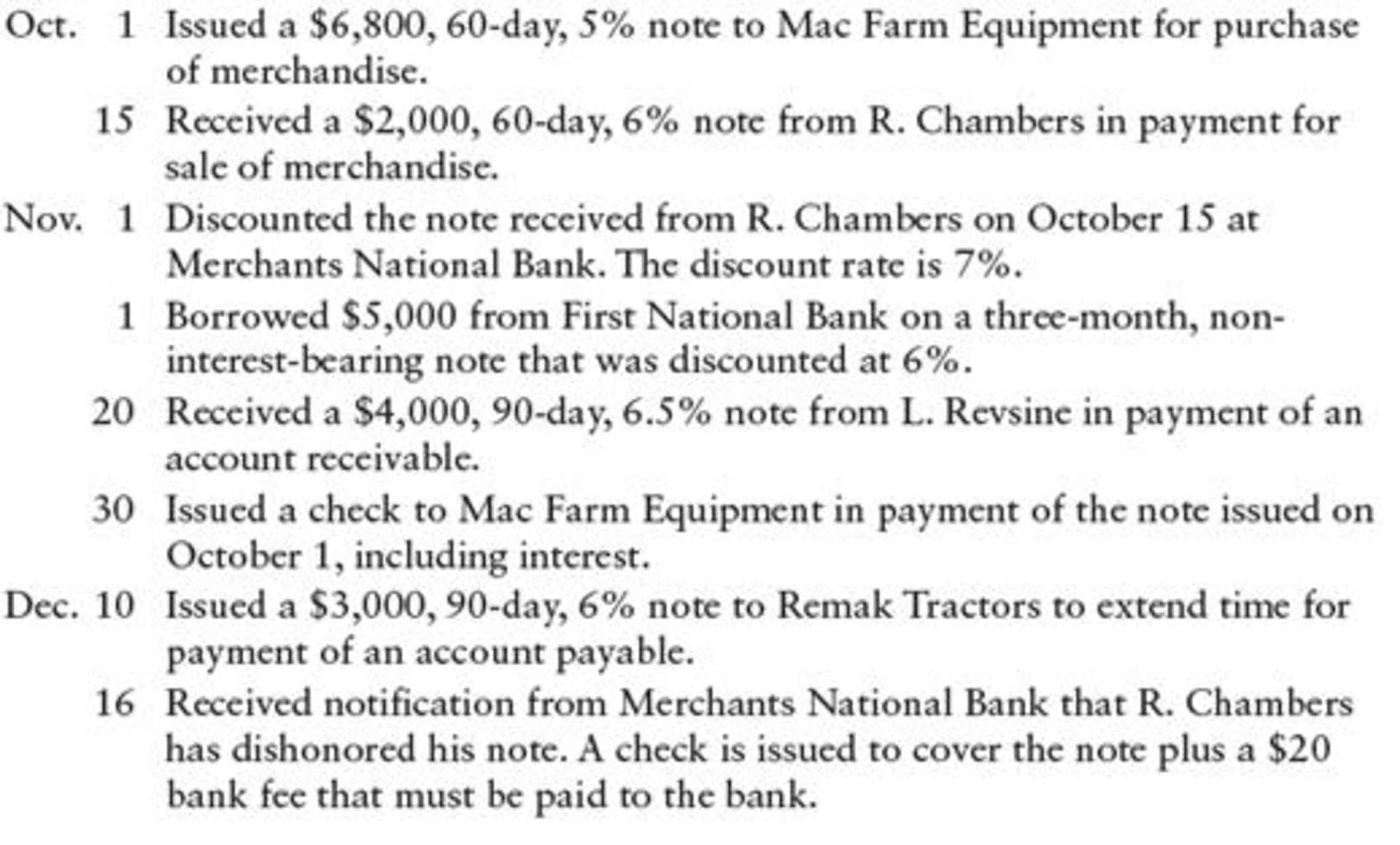

Eddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--:

REQUIRED

- 1. Prepare general

journal entries for the transactions. - 2. Prepare necessary

adjusting entries for the notes outstanding on December 31.

1.

Prepare journal entry to record the following transactions.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entry to record the following transactions.

| Date | Account titles and Explanation | Debit | Credit |

| October 1 | Purchases | $6,800 | |

| Notes payable | $6,800 | ||

| (To record note issued for inventory purchases) | |||

| October 15 | Notes receivable | $2,000 | |

| Sales | $2,000 | ||

| (To record note received for merchandise for sale) | |||

| November 1 | Cash (1) | $2,003.11 | |

| Notes receivable | $2,000 | ||

| Interest revenue (2) | $3.11 | ||

| (To record discount on notes receivable) | |||

| November 1 | Cash (4) | $4,925 | |

| Discount on notes payable (3) | $75 | ||

| Notes payable | $5,000 | ||

| (To record issued note for bank loan) | |||

| November 20 | Notes receivable | $4,000 | |

| Accounts receivable - L.R | $4,000 | ||

| (To record received note to settle account) | |||

| November 30 | Notes payable | $6,800 | |

| Interest expense (5) | $56.67 | ||

| Cash | $6,856.67 | ||

| (To record paid note with interest at maturity) | |||

| December 10 | Accounts payable - RT | $3,000 | |

| Notes payable | $3,000 | ||

| (To record issued note to settle account) | |||

| December 16 | Accounts receivable - R.C (6) | $2,040 | |

| Cash | $2,040 | ||

| (To record paid bank for dishonoured note) |

Table (1)

Working notes:

(1) Calculate cash proceeds.

(2) Calculate interest expense.

(3) Calculate discount on notes payable.

(4) Calculate cash proceeds.

(5) Calculate interest expenses.

(6) Calculate accounts receivable.

2.

Prepare adjusting entries for the notes outstanding on 31st December.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the notes outstanding on 31st December.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Interest expense (7) | $50 | |

| Discount on notes payable | $50 | ||

| (To record adjusting entry for interest expense) | |||

| December 31 | Interest expense (8) | $10.50 | |

| Accrued interest payable | $10.50 | ||

| (Record adjusting entry for interest expense) | |||

| December 31 | Accrued interest receivable | $29.61 | |

| Interest revenue (9) | $29.61 | ||

| (To record adjusting entry for interest revenue) |

Table (2)

Working notes:

(7) Calculate interest expense.

(8) Calculate interest expense.

(9) Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-27

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardPrepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600arrow_forwardFor the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2016, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during July is 375. b. Supplies on hand on July 31 are 1,525. c. Depreciation of office equipment for July is 750. d. Accrued receptionist salary on July 31 is 175. e. Rent expired during July is 2,400. f. Unearned fees on July 31 are 2,750. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.) Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forward

- The transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardOn October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during April is 350. b. Supplies on hand on April 30 are 1,225. c. Depreciation of office equipment for April is 400. d. Accrued receptionist salary on April 30 is 275. e. Rent expired during April is 2,000. f. Unearned fees on April 30 are 2,350. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardPrepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forward

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage