Concept explainers

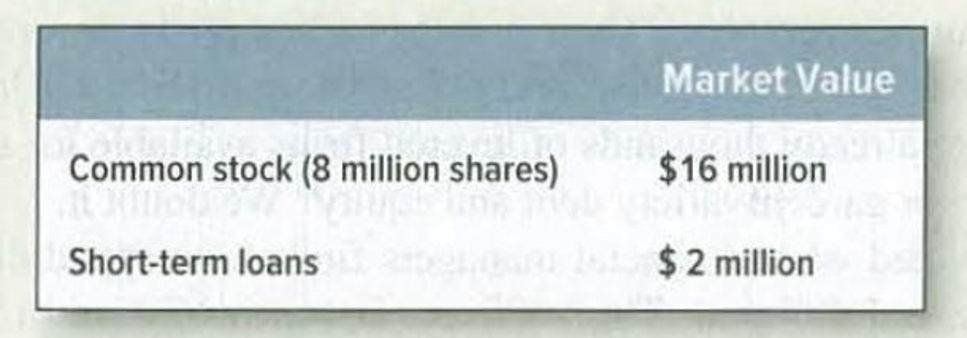

Homemade leverage* Ms. Kraft owns 50,000 shares of the common stock of Copperhead Corporation with a market value of $2 per share, or $100,000 overall. The company is currently financed as follows:

Copperhead now announces that it is replacing $1 million of short-term debt with an issue of common stock. What action can Ms. Kraft take to ensure that she is entitled to exactly the same proportion of profits as before?

To discuss: The action has to be taken by person K to ensure she is entitled to exactly the same proportion of profits as before.

Explanation of Solution

The market value of company C is very higher than the book value and the computation of ownership percent and borrowing amount is as follows:

The person K has 0.625% holding in the firm and which proposes the following:

- Increase common stock to $17 million.

- Decrease the short-term debt by $1 million.

Person K set of the change ion firms capital structure by borrowing $6,250 and acquiring more shares of company C.

Want to see more full solutions like this?

Chapter 17 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Essentials of Corporate Finance

Foundations Of Finance

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Fundamentals of Corporate Finance

- You currently own 600 shares of JKL, Inc. JKL is an all-equity firm that has 75,000 shares of stock outstanding at a market price of $40 a share. The company’s earnings before interest and taxes are $140,000. JKL has decided to issue $1 million of debt at 8 percent interest. This debt will be used to repurchase shares of stock. How many shares of JKL stock must you sell to unlever your position if you can loan out funds at 8 percent interest?arrow_forwardAAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 45 million shares of stock outstanding, currently worth $50 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB’s debt is $400mil., and its cost of debt is 3.5 percent. Each firm is expected to have earnings before interest and tax of $155mil. in perpetuity. Assume that every investor can borrow at 3.5 percent per year. Corporate tax rate is 35%. Q18. BBB is about to undertake a new project. Initial outlay for the project is $1.5 billion. The project is expected to generate annual after-tax free cash flows of $65 million indefinitely. If the project has similar risk characteristics to those of BBB company as a whole, and if it could be financed with the same financing proportions that the company currently uses, what would be the project’s net present value (NPV)? (with the rounding, choose the answer that is…arrow_forwardAAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 40million shares of stock outstanding, currently worth $15 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB’s debt is $100million and its cost of debt is 6.7 percent. Each firm is expected to have earnings before interest of $200 million in perpetuity. Assume that every investor can borrow at 6.7 percent per year. Corporate tax rate is 35%. (SHOW YOUR WORK) 1). What is the value of AAA Corporation? 2). What is the value of BBB Corporation? 3). What is the market value of BBB Corporation’s equity? 4). What would be the BBB’s cost of equity (Rs)? 5). What would be BBB’s weighted average cost of capital (WACC)?arrow_forward

- 1.Big Blue Banana (BBB) is a clothing retailer with a current share price of $10.00 and with 25 million shares outstanding. Suppose that Big Blue Banana announces plans to lower its corporate taxes by borrowing $100 million and using the proceeds to repurchase shares.Suppose that BBB pays corporate taxes of 21% and that shareholders expect the change in debt to be permanent. Assume that capital markets are perfect except for the existence of corporate taxes and financial distress costs. If the price of BBB's stock rises to $10.04 per share following the announcement, then the present value of BBB's financial distress costs is closest to: 2. If managed effectively, Rearden Metal will have assets with a market value of $200 million, $300 million, or $400 million next year, with each outcome being equally likely. Managers, however, may decide to engage in wasteful empire building, which will reduce Rearden's market value by $20 million in all cases. Managers may also increase the risk of…arrow_forwardAAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 30 million shares of stock outstanding, currently worth $55 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB’s debt is $400mil., and its cost of debt is 4.5 percent. Each firm is expected to have earnings before interest and tax of $165mil. in perpetuity. Assume that every investor can borrow at 4.5 percent per year. Corporate tax rate is 40%. Q14. How much will it cost to purchase 20% of BBB's equity?arrow_forwardFill the blanks. Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company’s stock currently is valued at $42.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $33.60 per share. Larry worries about the value of his investment. Larry’s current investment in the company is $84,000. If the company issues new shares and Larry makes no additional purchase, Larry’s investment will be worth ______________. This scenario is an example of dilution. Larry could be protected if the firm’s corporate charter includes a preemptive right provision. If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become ______________.arrow_forward

- You own 1,000 shares of a company, M&N Limited which is all-equity financed with 10,000 outstanding. The market price for each share is currently $40. M& N Limited follows a constant dividend policy, implying that it will pay the same dividend per share each year indefinitely. 4 The dividend per share is $4.50 per year. The company is debating of converting into a 60% debt capital structure by using the proceeds from debt to repurchase shares and the expected dividend per share is $5.85.The interest rate on borrowings in general is 9% per annum. Ignore taxes. (a) What is the value of your personal cash flow in M&N Limited based on the current capital structure and dividend policy of the company? (b) What is the value of your personal cash flow in M&N Limited, based on the proposed 60% debt capital structure and dividend policy of the company? How can you use homemade leverage to obtain the higher cash flow from the proposed 60% debt capital structure, if M&N Limited…arrow_forwardAlpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an all-equity firm, has 10,500 shares of stock outstanding, currently worth $25 per share. Beta Corporation uses leverage in its capital structure. The market value of Beta’s debt is $60,500 and its cost of debt is 7 percent. Each firm is expected to have earnings before interest of $70,500 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 7 percent per year. b) What is the value of Beta Corporation? c)What is the market value of Beta Corporation’s equity? d) How much will it cost to purchase 20 percent of each firm’s equity? e) Assuming each firm meets its earnings estimates, what will be the dollar return to each position in part (d) over the next year?arrow_forwardYou currently own 600 shares of JKL, Inc. JKL is an all-equity firmthat has 75,000 shares of stock outstanding at a market price of $40a share. The company’s earnings before interest and taxes are $140,000.JKL has decided to issue $1 million of debt at 8 percent interest.This debt will be used to repurchase shares of stock. How many sharesof JKL stock must you sell to unlever your position if you can loanout funds at 8 percent interest?b) If the cost of equity is 25%, the WACC is 16% and cost of debt is 10%,what will be the implied D/E ratio?arrow_forward

- Toady Inc. has 2 million shares outstanding selling at $70 a share. The Company intends to undertake a rights issue that allows 1 share to be purchased for every 5 shares currently held by shareholders for $40 each. If all shareholders take up their entitlement, which one of the following is true? The stock price will fall to $65. The number of shares outstanding will fall to 1.6 million. The firm will raise $13.33 million. The total value of the firm will equal $124 million.arrow_forward1. The company A has 10 million shares of common stock outstanding. The stock currently trades at $4.85 per share. The company also issues 10 million debt with 7% interest rate and will be repaid in next two years. The firm can also obtain debt with the same interest rate in the future. Company A’s weighted average cost of capital is 10.5 percent. The tax rate is 35 percent.a. Construct company A’s market value balance sheetb. What is the company’s cost of equity capital?c. What is the company’s unlevered cost of equity capital?d. Company A is thinking to invest on a project cost $5 million. Should the company choose debt financing or equity financing assume the financial distress cost is zero? How about if the financial distress cost is not zero?arrow_forwardDo not copy from any other source. A company finances its operations with 50 percent debt and 50 percent equity. Its net income is I = $30 million and it has a dividend payout ratio of x = 20%. Its capital budget is B = $40 million this year. The interest rate on company's debt is rd = 10% and the company's tax rate is T = 40%. The company's common stock trades at Po = $66 per share, and its current dividend of Do = $4 per share is expected to grow at a constant rate of g = 10% a year. The flotation cost of external equity, if issued, is F = 5% of the dollar amount issued. a) Will the company have to issue external equity (external equity implies issuing new stock while internal equity implies using retained earnings)? b) What is the company's WACC?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT