Marriott Нyatt $ 39 $ 677 Operating profit before other expenses and interest Other revenue (expenses) 54 118 (180) Interest expense (54) $ 551 $103 Income before income taxes Income tax expense 93 37 $ 458 $ 66 Net income Balance sheet information is as follows: Marriott Hyatt Total liabilities $7,398 $2,125 Total stockholders' equity Total liabilities and stockholders' equity 1,585 5,118 $8,983 $7,243 The average liabilities, average stockholders' equity, and average total assets are as follows: Marriott Нyatt $2,132 Average total liabilities Average total stockholders' equity $7,095 1,364 5,067 Average total assets 8,458 7,199

Marriott Нyatt $ 39 $ 677 Operating profit before other expenses and interest Other revenue (expenses) 54 118 (180) Interest expense (54) $ 551 $103 Income before income taxes Income tax expense 93 37 $ 458 $ 66 Net income Balance sheet information is as follows: Marriott Hyatt Total liabilities $7,398 $2,125 Total stockholders' equity Total liabilities and stockholders' equity 1,585 5,118 $8,983 $7,243 The average liabilities, average stockholders' equity, and average total assets are as follows: Marriott Нyatt $2,132 Average total liabilities Average total stockholders' equity $7,095 1,364 5,067 Average total assets 8,458 7,199

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.9P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

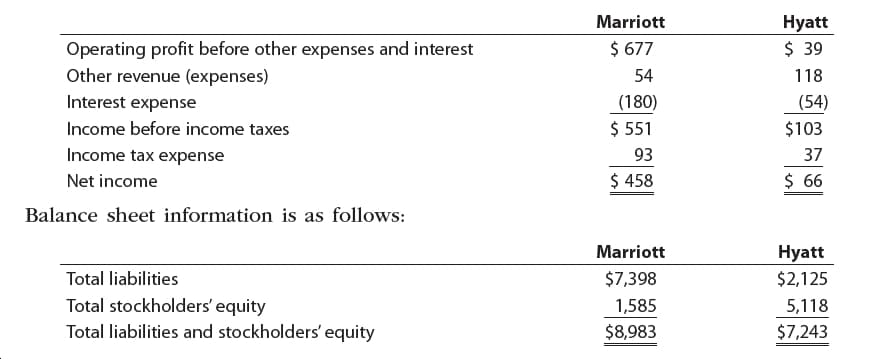

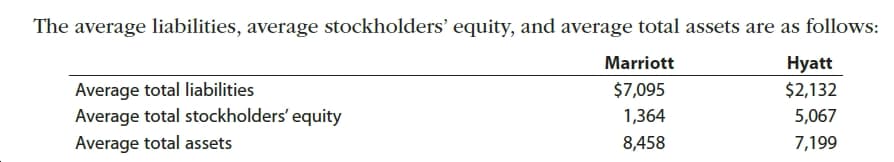

Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):

Please see the attachment for details:

1. Determine the following ratios for both companies, rounding ratios and percentages to one decimal place:

a. Return on total assets

b. Return on stockholders’ equity

c. Times interest earned

d. Ratio of total liabilities to stockholders’ equity

2. Based on the information in (1), analyze and compare the two companies’ solvency and profitability.

Transcribed Image Text:Marriott

Нyatt

$ 39

$ 677

Operating profit before other expenses and interest

Other revenue (expenses)

54

118

(180)

Interest expense

(54)

$ 551

$103

Income before income taxes

Income tax expense

93

37

$ 458

$ 66

Net income

Balance sheet information is as follows:

Marriott

Hyatt

Total liabilities

$7,398

$2,125

Total stockholders' equity

Total liabilities and stockholders' equity

1,585

5,118

$8,983

$7,243

Transcribed Image Text:The average liabilities, average stockholders' equity, and average total assets are as follows:

Marriott

Нyatt

$2,132

Average total liabilities

Average total stockholders' equity

$7,095

1,364

5,067

Average total assets

8,458

7,199

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning