Major Fund Tests

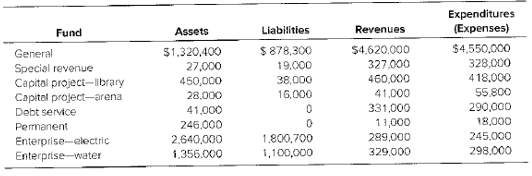

The City of Somerset has the following fund information:

Required

Apply the criteria specified in GASB 34 to determine which of these funds meets the major fund reporting criteria.

Introduction: GASB statement 34 requires governmental agencies to furnish two financial statements, governmental statements of revenues, expenditures, and changes in fund balance, and the governmental fund balance sheet. The fund based governmental entities only report major funds, to determine major funds, 10 percent criteria is used which says total assets, liabilities, revenues, or expenditures of the individual fund must be at least 10 percent, and 5 percent test which says that the total assets, liabilities, revenues or expenditures of the individual fund must be at least 5 percent of the corresponding total for all governmental plus enterprise funds combined.

The major fund for reporting using criteria specified in GASB 34.

Explanation of Solution

10 percent criterion test

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Governmental fund | ||||||||

| General fund | 1,320,400 | 878,300 | 4,620,000 | 4,550,000 | ||||

| Special revenue | 27,000 | 1.3 | 19,000 | 2 | 327,000 | 5.65 | 328,000 | 5.8 |

| Library | 450,000 | 21.3 | 38,000 | 3.99 | 460,000 | 7.94 | 418,000 | 7.39 |

| Arena | 28,000 | 1.33 | 16,000 | 1.68 | 41,000 | 0.71 | 55,800 | 0.99 |

| Debt service | 41,000 | 1.94 | 0 | 0 | 331,000 | 5.72 | 290,000 | 5.12 |

| Permanent | 246,000 | 11.65 | 0 | 0 | 11,000 | 0.19 | 18,000 | 0.32 |

| Total | 2,112,400 | 100 | 951,300 | 100 | 5,790,000 | 100 | 5,659,800 | 100 |

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Enterprise fund | ||||||||

| Enterprise − Electric | 2,640,000 | 66.1 | 1,800,700 | 62.1 | 289,000 | 47.8 | 245,000 | 45.1 |

| Enterprise − water | 1,355,000 | 33.9 | 1,100,000 | 37.9 | 329,000 | 53.2 | 298,000 | 54.9 |

| Total | 3,996,000 | 100 | 2,900,700 | 100 | 618,000 | 100 | 543,000 | 100 |

- General fund is always major fund.

- Funds percentage above 10 percent are major funds:

- Capital project fund − library and permanent fund is above 10 percent hence a major fund

- Both enterprise funds, electric and water are major funds as both the funds qualify 10 percent test

5 percent test:

| Funds | Assets $ | % | Liabilities$ | % | Revenues$ | % | Expenditures$ | % |

| Governmental fund | ||||||||

| General fund | 1,320,400 | 878,300 | 4,620,000 | 4,550,000 | ||||

| Special revenue | 27,000 | 0.44 | 19,000 | 0.5 | 327,000 | 5 | 328,000 | 5 |

| Library | 450,000 | 7.37 | 38,000 | 0.99 | 460,000 | 7.18 | 418,000 | 6.74 |

| Arena | 28,000 | 0.45 | 16,000 | 0.4 | 41,000 | 0.6 | 55,800 | 0.9 |

| Debt service | 41,000 | 0.7 | 0 | 0 | 331,000 | 5.16 | 290,000 | 4.7 |

| Permanent | 246,000 | 4.03 | 0 | 0 | 11,000 | 0.17 | 18,000 | 0.29 |

| Enterprise − Electric | 2,640,000 | 43.22 | 1,800,700 | 46.7 | 289,000 | 4.51 | 245,000 | 3.95 |

| Enterprise − water | 1,355,000 | 22.2 | 1,100,000 | 28.6 | 329,000 | 5.13 | 298,000 | 4.8 |

| Total | 6,108,400 | 100 | 3852,000 | 100 | 6,408,000 | 100 | 6,202,800 | 100 |

- General fund is always major fund.

- Funds percentage above 5 percent are major funds:

- Capital project fund − library and permanent fund is above 5 percent hence a major fund

- Both enterprise funds, electric and water are major funds as both the funds qualify 5 percent test

Want to see more full solutions like this?

Chapter 18 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

Financial Accounting (11th Edition)

Accounting For Governmental & Nonprofit Entities

Principles of Accounting Volume 1

Managerial Accounting: Creating Value in a Dynamic Business Environment

Intermediate Accounting (2nd Edition)

Fundamentals Of Financial Accounting

- Forest City has recently implemented GAAP reporting and is attempting to determine which of the following special revenue funds should be classified as “major funds” and, therefore, be reported in separate columns on the balance sheet and statement of revenues, expenditures, and changes in fund balances for the governmental funds. As the city’s external auditor, you have been asked to provide a rationale for either including or excluding each of the following funds as a major fund. Determine which of the following funds should be reported as a major fund.arrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forward

- The General Fund used electricity provided by the city-owned electric utility (an enterprise fund of the city). The General Fund general journal entry to record the transaction will include: Multiple Choice A debit to Expenditures. A debit to Interfund Transfers Out. A debit to Expenses. A debit to Due to Other Funds.arrow_forwardIndicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…arrow_forwardThe City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forward

- General Fund, Debt Service Fund, General Fund, Capital Projects Fund, Special Revenue Fund, Capital Projects Fund, Enterprise Fund, Pension Trust Fund (Fiduciary), General Fund, Internal Service Fund, Permanent Fund. List the Appropriate Fund List the appropriate fund(s) that will be affected for each of the following transactions for Sienna City. Journal entries are not required. Bonds were issued to finance the construction of a new bridge. Sienna received a grant from the state to assist in financing the construction of a new bridge. Funds were set aside to pay of the principal and interest due on this year’s bonds. Land was received from a donor to be used as a park. It was stipulated by the donor that the land cannot be sold. Proceeds were collected from the sale of lottery tickets. By ordinance, these funds must be used for education and the school system. Construction on the new bridge was completed. The total cost was under budget and the excess funds were set aside to pay…arrow_forwardAssume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries. (a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785. (b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20. (c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash. (d) The city received the supplies at an actual cost of $23. (e) The city collected revenues of $795.arrow_forwardThis problem has two parts, part a and part b. Answer each part separately using the same information. Do not mix answers to a and b; they are answered separately. Problem a: Using the list of transactions below, provide all necessary journal entries for the Fund statements. You also need to identify which funds are involved in the transaction, such as the Capital projects fund, Debt service fund Special revenue fund, or Permanent fund. Problem b: Using the same list of transactions, provide all necessary journal entries for the Governmental Activities section in the Government-wide statements. Write “no entry” if no entry is needed. Dunellen City, covered in this problem, issues a $10,000,000 bond at face value. The cash is to be used for the construction of a fire station. Previously undesignated cash of $100,000 from the General Fund is set aside to begin paying the bonds issued in item (1). A state cash grant of $300,000 is received that must be spent in the future for…arrow_forward

- Identification of activities with particular governmental-type funds Using only the governmental-type funds, indicate which would be used to record each of the following transactions and events. GF General Fund SRF Special Revenue Fund DSF Debt Service Fund CPF Capital Projects Fund PF Permanent Fund 1. Property taxes were received directly by the fund used to accumulate resources to pay bond principal and interest. 2. The city received its share of a state sales tax that is legally required to be used solely to finance library operations. 3. The city sent property tax bills to homeowners to help pay for day-to-day operating costs. 4. The city paid for five fire engines, using resources accumulated in a fund to pay for capital assets. 5. The city received a grant from the state to build an addition to the city hall. 6. The city received the proceeds of general obligation bonds to finance the construction of a new police station. 7. The mayor was paid his monthly…arrow_forwardThe schedule of capital assets has a significant impact on the reconciliations between fund and government‐wide statements. The schedule that follows pertaining to governmental capital assets was excerpted from the annual report of Urbana, Illinois (with changed dates): A related schedule indicates the following: Capital outlays $ 3,358,611 Depreciation (2,268,579) $ 1,090,032 As required by GASB Statement No. 34, the annual report includes reconciliations between: (1) total fund balance, governmental funds (per the funds statements), and net position of governmental activities (per the government‐wide statements); and (2) net change in fund balance, governmental funds (per the funds statements), and change in net position of governmental activities (per the government‐wide statements). In what way would the data provided in the accompanying schedules be incorporated into the two reconciliations? Be specific. The amount deleted from the equipment account ($452,194) exactly…arrow_forwardIf not expenditure driven, a grant approved and paid by the federal government to assist in a city’s welfare program during the current year should be credited to a. Revenues. b. Fund Balance—Reserved forWelfare Programs. c. Fund Balance—Unassigned. d. Other Financing Sources.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education