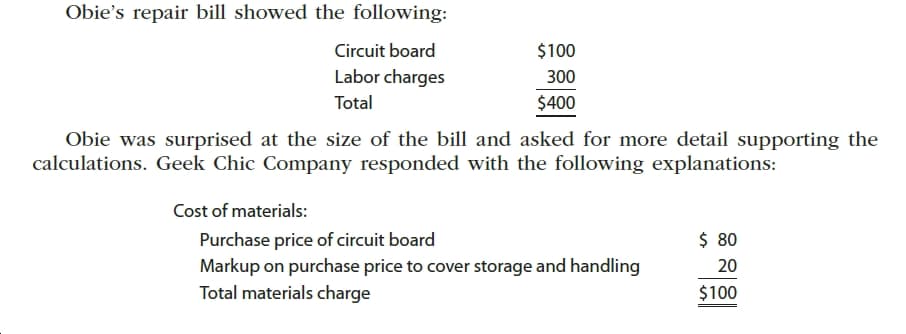

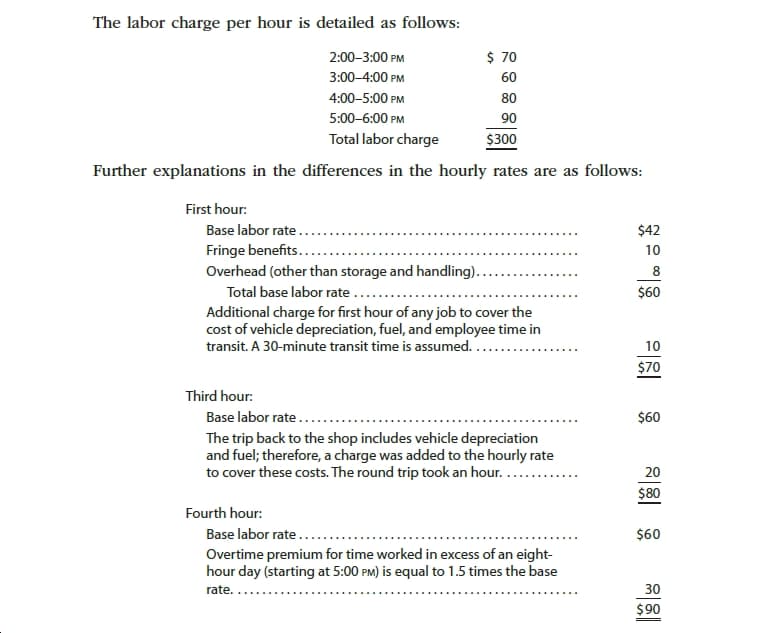

Obie's repair bill showed the following: Circuit board $100 Labor charges 300 Total $400 Obie was surprised at the size of the bill and asked for more detail supporting the calculations. Geek Chic Company responded with the following explanations: Cost of materials: $ 80 Purchase price of circuit board Markup on purchase price to cover storage and handling Total materials charge $100 The labor charge per hour is detailed as follows: $ 70 2:00-3:00 PM 3:00-4:00 PM 60 4:00-5:00 PM 80 5:00-6:00 PM 90 Total labor charge $300 Further explanations in the differences in the hourly rates are as follows: First hour: Base labor rate... $42 Fringe benefits.... Overhead (other than storage and handling). 10 Total base labor rate . $60 Additional charge for first hour of any job to cover the cost of vehicle depreciation, fuel, and employee time in transit. A 30-minute transit time is assumed..... 10 $70 Third hour: Base labor rate.... $60 The trip back to the shop includes vehicle depreciation and fuel; therefore, a charge was added to the hourly rate to cover these costs. The round trip took an hour. 20 $80 Fourth hour: Base labor rate .. $60 Overtime premium for time worked in excess of an eight- hour day (starting at 5:00 PM) is equal to 1.5 times the base 30 rate. . $90

Geek Chic Company provides computer repair services for the community. Obie Won’s computer was not working, and he called Geek Chic for a home repair visit. Geek Chic Company’s technician arrived at 2:00 pm to begin work. By 4:00 pm, the problem was diagnosed as a failed circuit board. Unfortunately, the technician did not have a new circuit board in the truck because the technician’s previous customer had the same problem and a board was used on that visit. Replacement boards were available back at Geek Chic Company’s shop. Therefore, the technician drove back to the shop to retrieve a replacement board. From 4:00 to 5:00 pm, Geek Chic Company’s technician drove the round trip to retrieve the replacement board from the shop.

At 5:00 pm, the technician was back on the job at Obie’s home. The replacement procedure is somewhat complex because a variety of tests must be performed once the board is installed. The job was completed at 6:00 pm.

Please chk the attachment

1. If you were in Obie’s position, how would you respond to the bill? Are there parts of the bill that appear incorrect to you? If so, what argument would you employ to convince Geek Chic Company that the bill is too high?

2. Use the headings that follow to construct a table. Fill in the table by listing the costs identified in the activity in the left-hand column. For each cost, place a check mark in the appropriate column identifying the correct cost classification. Assume that each service call is a job.

Cost Direct Materials Direct Labor

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images