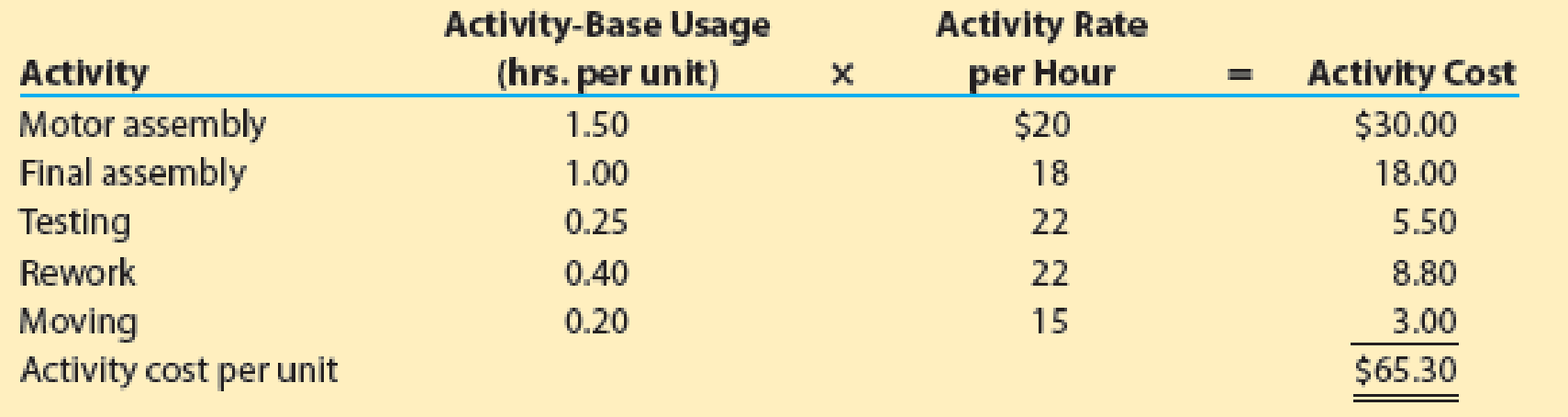

Life Force Fitness, Inc., assembles and sells treadmills. Activity-based product information for each treadmill is as follows:

All of the activity costs are related to labor. Management must remove $2.00 of activity cost from the product in order to remain competitive.

Rework involves disassembling and repairing a unit that fails testing. Not all units require rework, but the average is 0.40 hour per unit. Presently, the testing is done on the completed assembly; but much of the rework has been related to motors, which can be tested independently prior to adding the motor to the treadmill during final assembly. Thus, motor issues can be diagnosed and solved without having to disassemble the complete treadmill. This change will reduce the average rework per unit by one-quarter.

a. Determine the new activity cost per unit under the rework improvement scenario.

b. If management had the choice of doing the rework improvement in (a) or cutting the moving activity in half by improving the product flow, which decision should be implemented? Why?

Trending nowThis is a popular solution!

Chapter 18 Solutions

Financial And Managerial Accounting

- Boston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardOne of the tennis rackets that Ace Sporting Goods manufactures is a titanium model (Slam) that sells for 149. The cost of each Slam consists of: Job 100 produced 100 Slams, of which six were spoiled and classified as seconds. Seconds are sold to discount stores for 50 each. Required: 1. Under the assumption that the loss from spoilage will be distributed to all jobs produced during the current period, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units. 2. Under the assumption that the loss due to spoilage will be charged to Job 100, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units.arrow_forward

- Salley is developing material and labor standards for her company. She finds that it costs $0.55 per pound of material per widget. Each widget requires 6 pounds of material per widget. Salley is also working with the operations manager to determine what the standard labor cost is for a widget. Upon observation, Salley notes that it takes 3 hours in the assembly department and 1 hour in the finishing department to complete one widget. All employees are paid $10.50 per hour. A. What is the standard materials cost per unit for a widget? 8. What is the standard labor cost per unit for a widget?arrow_forwardHawkins Manufacturing Company produces connecting rods for 4- and 6-cylindcr automobile engines using the same production line. The cost required to set up the production line to produce the 4-cylinder connecting rods is 2,000, and the cost required to set up the production line for the 6-cylinder connecting rods is 3,500. Manufacturing costs are 15 for each 4-cylinder connecting rod and 18 for each 6-cylinder connecting rod. There is no production on weekends, so on Friday the line is disassembled and cleaned. On Monday, the line must be set up to run whichever product will be produced that week. Once the line has been set up, the weekly production capacities are 6,000 6-cylinder connecting rods and 8,000 4-cylinder connecting rods. Let x4 = the number of 4-cylinder connecting rods produced next week x6 = the number of 6-cylinder connecting rods produced next week s4 = 1 if the production line is set up to produce the 4-cylinder connecting rods; 0 if otherwise s6 = 1 if the production line is set up to produce the 6-cylinder connecting rods; 0 if otherwise a. Using the decision variables x4 and s4, write a constraint that sets next weeks maximum production of the 4-cylinder connecting rods to either 0 or 8,000 units. b. Using the decision variables x6 and s6, write a constraint that sets next weeks maximum production of the 6-cylinder connecting rods to either 0 or 6,000 units. c. Write a constraint that requires that production be set up for exactly one of the two rods. d. Write the cost function to be minimized.arrow_forwardPinter Company had the following environmental activities and product information: 1. Environmental activity costs 2. Driver data 3. Other production data Required: 1. Calculate the activity rates that will be used to assign environmental costs to products. 2. Determine the unit environmental and unit costs of each product using ABC. 3. What if the design costs increased to 360,000 and the cost of toxic waste decreased to 750,000? Assume that Solvent Y uses 6,000 out of 12,000 design hours. Also assume that waste is cut by 50 percent and that Solvent Y is responsible for 14,250 of 15,000 pounds of toxic waste. What is the new environmental cost for Solvent Y?arrow_forward

- Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The company needs 100,000 sets per year (currently it pays 1.90 per set of rollers). The rollers can be produced using an available area within the plant. However, equipment for production of the rollers would need to be leased (30,000 per year lease payment). Additionally, it would cost 0.50 per machine hour for power, oil, and other operating expenses. The equipment will provide 60,000 machine hours per year. Direct material costs will average 0.75 per set, and direct labor will average 0.25 per set. Since only one type of roller would be produced, no additional demands would be made on the setup activity. Other overhead activities (besides machining and setups), however, would be affected. The companys cost management system provides the following information about the current status of the overhead activities that would be affected. (The supply and demand figures do not include the effect of roller production on these activities.) The lumpy quantity indicates how much capacity must be purchased should any expansion of activity supply be needed. The purchase price is the cost of acquiring the capacity represented by the lumpy quantity. This price also represents the cost of current spending on existing activity supply (for each block of activity). Production of rollers would place the following demands on the overhead activities: Producing the rollers also means that the purchase of outside rollers will cease. Thus, purchase orders associated with the outside acquisition of rollers will drop by 5,000. Similarly, the moves for the handling of incoming orders will decrease by 200. The company has not inspected the rollers purchased from outside suppliers. Required: 1. Classify all resources associated with the production of rollers as flexible resources and committed resources. Label each committed resource as a short- or long-term commitment. How should we describe the cost behavior of these short- and long-term resource commitments? Explain. 2. Calculate the total annual resource spending (for all activities except for setups) that the company will incur after production of the rollers begins. Break this cost into fixed and variable activity costs. In calculating these figures, assume that the company will spend no more than necessary. What is the effect on resource spending caused by production of the rollers? 3. Refer to Requirement 2. For each activity, break down the cost of activity supplied into the cost of activity output and the cost of unused activity.arrow_forwardA local barbershop cuts the hair of 1,200 customers per month. The clients are men, and the barbers offer no special styling. During the month of May, 1,200 customers were serviced. The cost of haircuts includes the following: Required: 1. Explain why process costing is appropriate for this haircutting operation. 2. Calculate the cost per haircut. 3. Can you identify some possible direct materials used for this haircutting service? Is the usage of direct materials typical of services? If so, provide examples of services that use direct materials. Can you think of some services that would not use direct materials?arrow_forwardIngles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 16 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40 percent of next months sales are in the finished goods inventory. Ingles also purchases sufficient materials to ensure that materials inventory is 60 percent of the following months scheduled production. Ingless sales budget in units for the next quarter is as follows: Ingless ending inventories in units for July 31 are as follows: Required: 1. Calculate the number of tables to be produced during August. 2. Disregarding your response to Requirement 1, assume the required production units for August and September are 2,100 and 1,900, respectively, and the July 31 materials inventory is 4,000 units. Compute the number of table legs to be purchased in August. 3. Assume that Ingles Corporation will produce 2,340 units in September. How many employees will be required for the Assembly Department in September? (Fractional employees are acceptable since employees can be hired on a part-time basis. Assume a 40-hour week and a 4-week month.) (CMA adapted)arrow_forward

- Otero Fibers, Inc., specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. Otero has been in business since 1985 and has been profitable every year since 1993. The company uses a standard cost system and applies overhead on the basis of direct labor hours. Otero has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 10 percent after income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of 30 per blanket are not likely to be considered. In order to prepare the bid for the 800,000 blankets, Andrea Lightner, cost accountant, has gathered the following information about the costs associated with the production of the blankets. Direct machine costs consist of items such as special lubricants, replacement of needles used in stitching, and maintenance costs. These costs are not included in the normal overhead rates. Otero recently developed a new blanket fiber at a cost of 750,000. In an effort to recover this cost, Otero has instituted a policy of adding a 0.50 fee to the cost of each blanket using the new fiber. To date, the company has recovered 125,000. Lightner knows that this fee does not fit within the definition of full cost, as it is not a cost of manufacturing the product. Required: 1. Calculate the minimum price per blanket that Otero Fibers could bid without reducing the companys operating income. 2. Using the full-cost criteria and the maximum allowable return specified, calculate Otero Fibers bid price per blanket. 3. Without prejudice to your answer to Requirement 2, assume that the price per blanket that Otero Fibers calculated using the cost-plus criteria specified is greater than the maximum bid of 30 per blanket allowed. Discuss the factors that Otero Fibers should consider before deciding whether or not to submit a bid at the maximum acceptable price of 30 per blanket. (CMA adapted)arrow_forwardWalloon Company produced 150 defective units last month at a unit manufacturing cost of 30. The defective units were discovered before leaving the plant. Walloon can sell them as is for 20 or can rework them at a cost of 15 and sell them at the regular price of 50. What is the total relevant cost of reworking the defective units? a. 2,250 b. 3,000 c. 4,500 d. 6,750arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning