Concept explainers

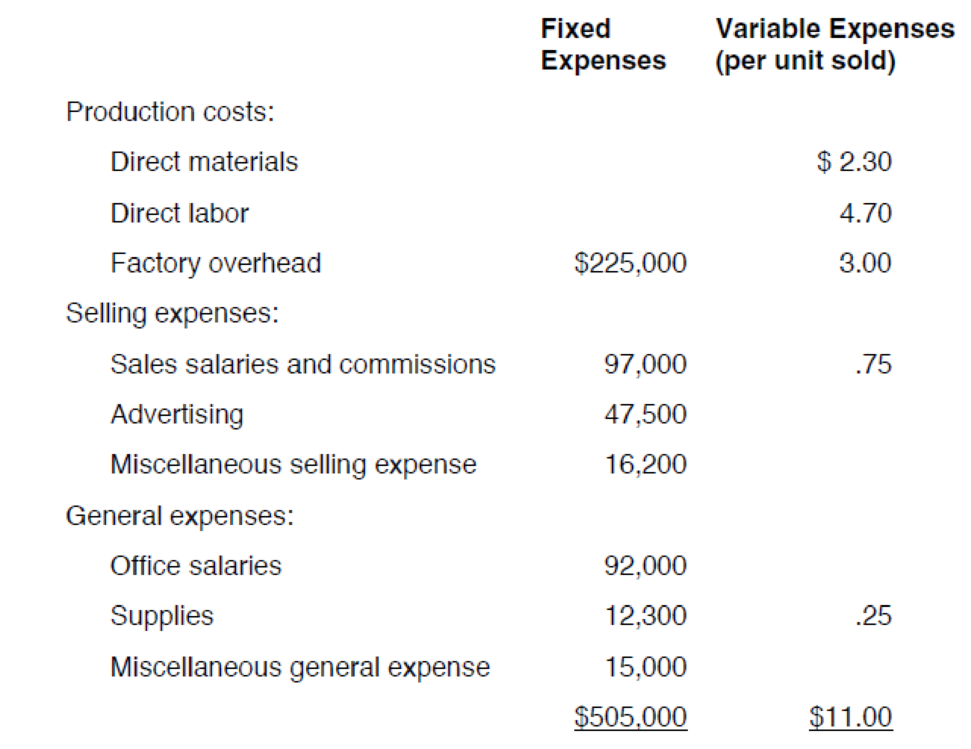

Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year:

The selling price of Poleskiʼs single product is $16. In recent years, profits have fallen and Poleskiʼs management is now considering a number of alternatives. Poleski wants to have a net income next year of $250,000, but expects to sell only 120,000 units unless some changes are made.

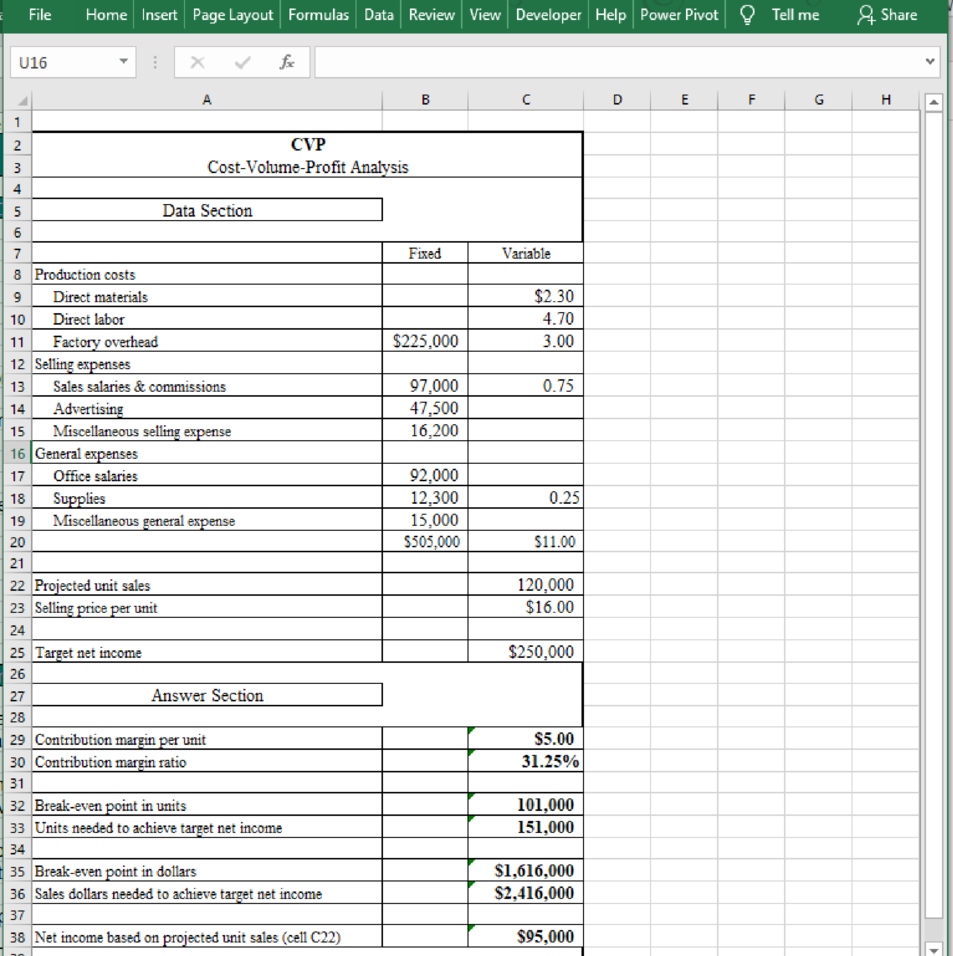

The president of Poleski has asked you to calculate the companyʼs projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companyʼs net income objective for next year. Also, compute Poleskiʼs contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.

Compute the projected net income of the company and the sales required to attain the net income objective for next year. Calculate contribution margin per unit, contribution margin ratio, and break-even point for next year.

Explanation of Solution

The projected net income, sales required to attain the net income, contribution margin per unit, contribution margin ratio, and break-even pointfor next year are calculated as follows:

Table (1)

Want to see more full solutions like this?

Chapter 18 Solutions

Excel Applications for Accounting Principles

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the annual ordering cost. 2. Compute the annual carrying cost. 3. Compute the cost of Ottiss current inventory policy. Is this the minimum cost? Why or why not?arrow_forwardDel Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Reset the purchase prices to their original values (cells C11 through C14). Suppose Del had purchased 250 units on November 20 rather than 150. Enter 250 in cell C14 and alter column G in the Data Section. Explain what happens to net income under each inventory cost flow assumption and why. Also, what management implications might this have for Del?arrow_forwardDel Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Using a pencil, fill in columns F and G in the Data Section of the worksheet printout at the end of this problem.arrow_forward

- Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Del has heard that the choice of an inventory cost flow assumption can have a significant effect on net income and taxes. He asks you to show him the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods. Review the worksheet FIFOLIFO that follows these requirements. Note that all of the problem data have been entered in the Data Section of the worksheet.arrow_forwardDel Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Examine your completed worksheet and answer the following questions: a. Which inventory cost flow assumption produces the most net income? b. Which inventory cost flow assumption produces the least net income? c. What caused the difference between your answers to a and b? d. Which inventory cost flow assumption produces the highest ending cash balance? e. Which inventory cost flow assumption produces the lowest ending cash balance? f. Does the assumption that produces the highest net income also produce the highest cash balance? Explain. g. As you recall, Del originally used the specific identification method in his initial calculations when he projected 51,600 net income. According to Dels reckoning, that should have left him cash of 25,800 (50% of 51,600) after paying his investors. Why would he only have 3,800 left? Explain. h. Which inventory cost flow assumption would you suggest Del use? Explain.arrow_forwardClick the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forward

- Pietro expects to produce 50,000 units and sell 49,300 units. Beginning inventory of finished goods is 42,500, and ending inventory of finished goods is expected to be 34,000. Required: 1. Prepare a statement of cost of goods sold in good form. 2. What if the beginning inventory of finished goods decreased by 5,000? What would be the effect on the cost of goods sold?arrow_forwardNoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Based solely on financial factors, explain why NoFat should accept or reject PUs special sales offer.arrow_forwardNoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that NoFat rejected PUs special sales offer because the 2.20 price suggested by PU was too low. In response to the rejection, PU asked NoFat to determine the price at which it would be willing to accept the special sales offer. For its regular sales, NoFat sets prices by marking up variable costs by 10%. If Allyson decides to use NoFats 10% markup pricing method to set the price for PUs special sales offer, a. Calculate the price that NoFat would charge PU for each pound of olestra. b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its markup pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.) c. Explain why NoFat should accept or reject the special sales offer if it uses its markup pricing method to set the special sales price.arrow_forward

- NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that Allysons relevant analysis reveals that NoFat would earn a positive relevant profit of 10,000 from the special sale (i.e., the special sales alternative). However, after conducting this traditional, short-term relevant analysis, Allyson wonders whether it might be more profitable over the long term to downsize the company by reducing its manufacturing capacity (i.e., its plant machinery and plant facility). She is aware that downsizing requires a multiyear time horizon because companies usually cannot increase or decrease fixed plant assets every year. Therefore, Allyson has decided to use a 5-year time horizon in her long-term decision analysis. She has identified the following information regarding capacity downsizing (i.e., the downsizing alternative): The plant facility consists of several buildings. If it chooses to downsize its capacity, NoFat can immediately sell one of the buildings to an adjacent business for 30,000. If it chooses to downsize its capacity, NoFats annual lease cost for plant machinery will decrease to 9,000. Therefore, Allyson must choose between these two alternatives: Accept the special sales offer each year and earn a 10,000 relevant profit for each of the next 5 years or reject the special sales offer and downsize as described above. Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all cash flows occur at the end of the year. Using an NPV approach to discount future cash flows to present value, a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of 10,000 per year (i.e., the special sales alternative). b. Calculate the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). c. Based on the NPV of Requirements 5a and 5b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardDenali Company manufactures household products such as windows, light fixtures, ladders, and work tables. During the year it produced 10,000 Model 10X windows but only sold 5,000 units at $40 each. The remaining units cannot be sold through normal channels. Cost for inventory purposes on December 31 included the following data on the unsold units: Denali can sell the 5,000 windows at a liquidation price of $20.00 per window, but it will incur a packaging and shipping charge of $7.50 per window. Required: Identify the relevant costs and revenues for the liquidation sale alternative. Is Denali better off accepting the liquidation price rather than doing nothing? Assume that Model 10X can be reprocessed to another size window, Model 20X, which will require the same amount of labor and overhead as was required to initially produce, but sells for only $33. Determine the most profitable course of action—liquidate or reprocess.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning