Concept explainers

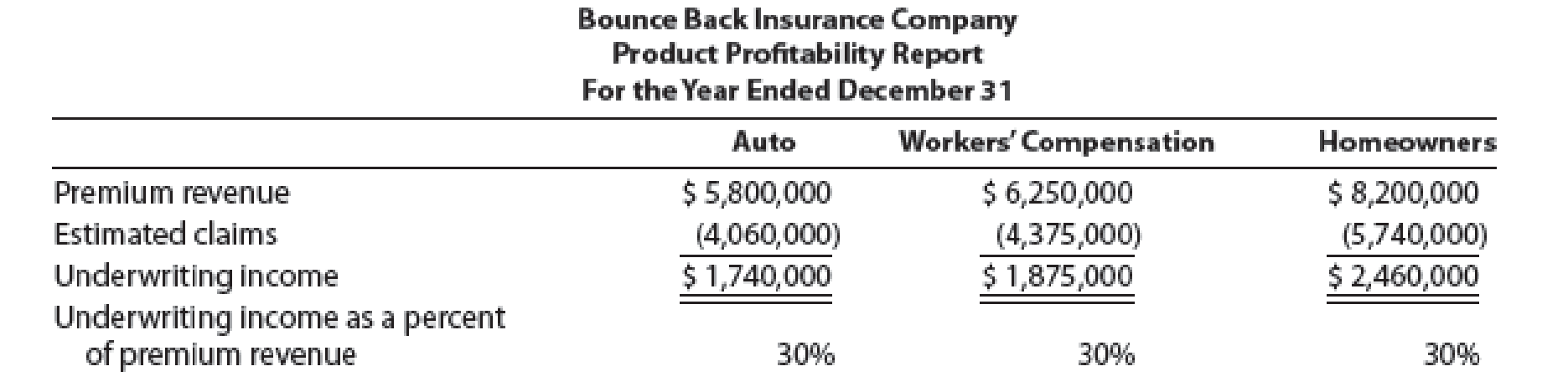

Bounce Back Insurance Company carries three major lines of insurance: auto, workers’ compensation, and homeowners. The company has prepared the following report:

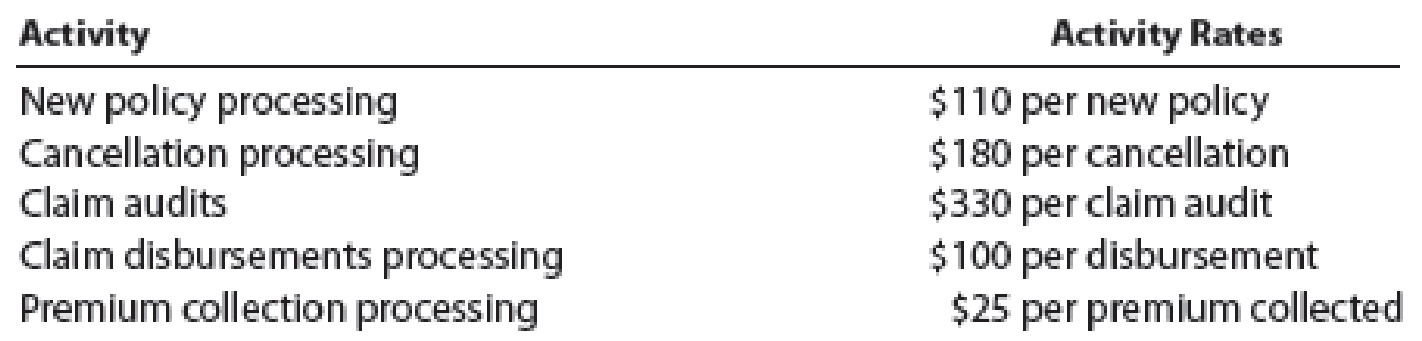

Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows:

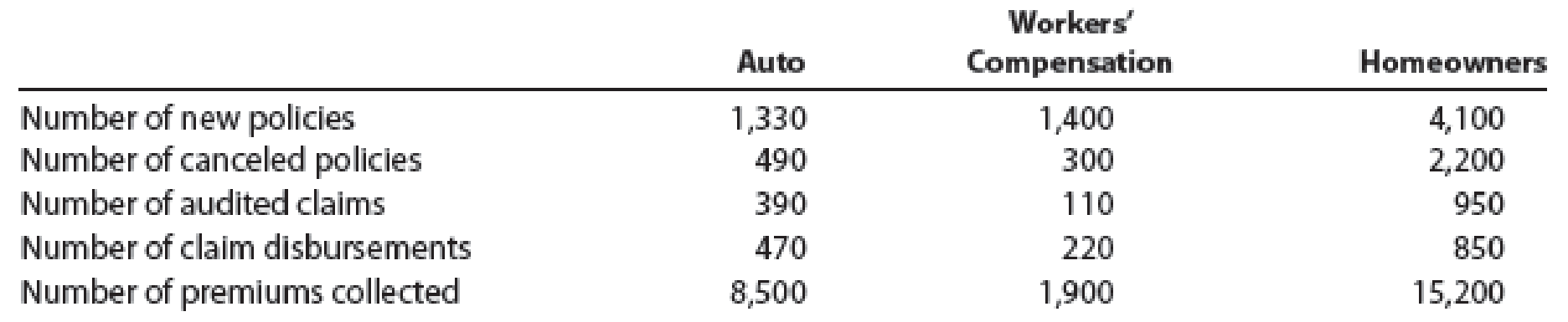

Activity-base usage data for each line of insurance were retrieved from the corporate records as follows:

- a. Complete the product profitability report through the administrative activities. Determine the operating income as a percent of premium revenue, rounded to the nearest whole percent.

- b. Interpret the report.

Trending nowThis is a popular solution!

Chapter 18 Solutions

Financial And Managerial Accounting

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardFor apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as either a product cost or a period cost: a. Advertising expenses b. Chief financial officers salary c. Depreciation on office equipment d. Depreciation on sewing machines e. Fabric used during production f. Factory janitorial supplies g. Factory supervisors salaries h. Property taxes on factory building and equipment i. Oil used to lubricate sewing machines j. Repairs and maintenance costs for sewing machines k. Research and development costs l. Sales commissions m. Salaries of distribution center personnel n. Salaries of production quality control supervisors o. Travel costs of media relations employees p. Utility costs for office building q. Wages of sewing machine operatorsarrow_forwardThe following describes the job responsibilities of two employees of Barney Manufacturing. Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collecting costs associated with the manufacture of the garden hose product line. She is also responsible for preparing periodic reports that compare the actual costs with planned costs. These reports are provided to the production line managers and the plant manager. Joan helps to explain and interpret the reports. Steven Swasey, Production Manager. Steven is responsible for the manufacture of the high-quality garden hose. He supervises the line workers, helps to develop the production schedule, and is responsible for seeing that production quotas are met. He is also held accountable for controlling manufacturing costs. Required: CONCEPTUAL CONNECTION Identify Joan and Steven as line or staff and explain your reasons.arrow_forward

- Jansen Corp. has decided to implement an activity-based costing system for its in-house legal department. The legal department’s primary expense is professional salaries, which are estimated for associated activities as follows: Reviewing supplier or customer contracts (Contracts) P270,000 Reviewing regulatory compliance issues (Regulation) 375,000 Court actions (Court) 862,500 Management has determined that the appropriate cost allocation base for Contracts is the number of pages in the contract reviewed, for Regulation is the number of reviews, and for Court is number of hours of court time. For 2010, the legal department reviewed 450,000 pages of contracts, responded to 750 regulatory review requests, and logged 3,750 hours in court. Determine the allocation rate for each activity in the legal department. What amount would be charged to a producing department that had 21,000 pages of contracts reviewed, made 27 regulatory review requests, and consumed 315 professional hours…arrow_forwardClassify the following costs of this new product as direct materials, direct labor, manufacturing overhead, selling, or administrative 1. President's salary. 2. Packages used to hold the skin wipes. 3. Cleaning materials used to clean the skin wipe packages. 4. Wages of workers who package the product. 5. Cost of advertising the product. 6. The salary of the supervisor of the workers who package the product. 7. Cost accountant's salary (the accountant works in the factory). 8. Cost of a market research survey. 9. Sales commissions paid as a percent of sales. 10. Depreciation of administrative office building. Problem B Classify the costs listed in the previous problem as either product costs or period costs.arrow_forwardSecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measuresare miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will beassigned using the activity-based costing system: Required:Complete the first stage allocations of costs to activity cost pools as illustrated in Exhibit 7–6.arrow_forward

- University Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each. The following data appear in the company records for the current period: Required: Use the direct method to allocate these service department costs to the operating departments. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forwardSecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system:arrow_forwardSecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system: Driver and guard wages $ 720,000 Vehicle operating expense 280,000 Vehicle depreciation 120,000 Customer representative salaries and expenses 160,000 Office expenses 30,000 Administrative expenses 320,000 Total cost $ 1,630,000 The distribution of resource consumption across the activity cost pools is as follows: Travel…arrow_forward

- SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system: Driver and guard wages $ 920,000 Vehicle operating expense 350,000 Vehicle depreciation 230,000 Customer representative salaries and expenses 260,000 Office expenses 120,000 Administrative expenses 420,000 Total cost $ 2,300,000 The distribution of resource consumption across the activity cost pools is as follows: Travel…arrow_forwardSecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system: Driver and guard wages $ 1,100,000 Vehicle operating expense 530,000 Vehicle depreciation 410,000 Customer representative salaries and expenses 440,000 Office expenses 300,000 Administrative expenses 600,000 Total cost $ 3,380,000 The distribution of resource consumption across the activity cost pools is as follows:…arrow_forwardSchneider Electric manufactures power distribution equipment for commercial customers, such as hospitals and manufacturers. Activity-based costing was used to determine customer profitability. Customer service activities were assigned to individual customers, using the following assumed customer service activities, activity base, and activity rate: Customer Service Activity Activity Base Activity Rate Bid preparation Number of bid requests $400 per request Shipment Number of shipments $80 per shipment Support standard items Number of standard items ordered $25 per standard item Support nonstandard items Number of nonstandard items ordered $150 per nonstandard item Assume that the company had the following gross profit information for three representative customers: Income Statement Item Customer 1 Customer 2 Customer 3 Revenue $120,000 $200,000 $160,000 Cost of goods sold 76,800 110,000 83,200 Gross profit…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning