To determine: The net funds available to the parent corporation (a) if foreign taxes can be applied against the U.S. tax liability and (b) if they cannot.

Answer to Problem 19.1WUE

Explanation of Solution

Given information:

Subsidiary pretax income: $55,000

Local tax: 40.00%

Dividend withholding tax: 5.00%

US tax rate: 34.00%

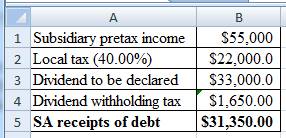

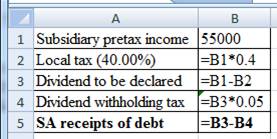

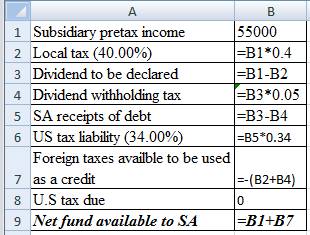

Calculation of the SA receipts of dividend:

Excel working:

Therefore, the SA receipt of debt is $31,250.

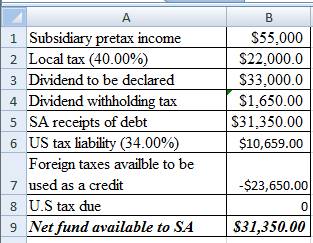

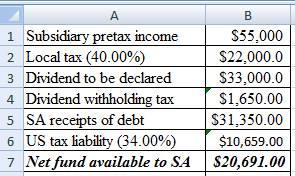

(a) if foreign taxes can be applied against the U.S. tax liability

Calculation of the net fund available to SA:

Excel working:

Therefore, net fund available to SA is $31,500.

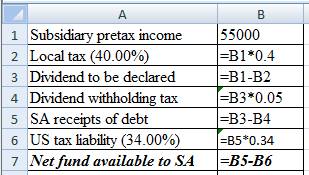

(b) if they cannot.

Foreign taxes cannot be applied against the U.S. tax liability

Excel working:

Therefore, Net fund available to SA is $20,691.00

Want to see more full solutions like this?

Chapter 19 Solutions

Principles of Managerial Finance Plus MyLab Finance with Pearson eText -- Access Card Package (15th Edition)

- 5. XYZ Corporation reported the following gross income and expenses: Gross income in the Philippines is 38,000,000 while deductions is 15,000,000 for a total taxable income of 23,000,000. Outside the Philippines, the gross income is 14,000,000 while the deduction is 3,000,000 for a total taxable income of 11,000,000. Compute the income tax due for 2021 if XYZ is a private proprietary educational institution. P3,400,000 P10,200,000 P8,500,000 P340,000arrow_forwardA U.S.-based MNC has three subsidiaries: S1 (40 percent owned by the MNC); S2 (33 percent owned by S1), and S3 (20 percent owned by S2). The taxable income for each firm is $100 million. The local taxes for each firm are $15 million, $20 million, and $10 million, respectively. The MNC's tax rate is 40 percent. 19. Can the MNC apply all of its local taxes as a credit against its U.S. taxes? If not, which subsidiaries can it use to get a credit against its U.S. taxes. Explain your rationale briefly. 20. Based on the "grossing up" concept, calculate all tax credits applicable to the MNC.arrow_forwardThe Tacurong Company has the following business income and expenses in year 2020: Gross Income From Philippine sources: From business 450,000 Dividends from domestic corporation 80,000 From other countries: Saudi Arabia 180,000 Australia 75,000 Japan 190,000 Total foreign income tax paid is 60,000 and Philippine quarterly income tax paid is 42,000. a. Compute for the income tax still due and payable if Tacurong is a domestic corporation. b. Compute for the tax still due and payable if Tacurong is a resident foreign corporation.arrow_forward

- P Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Private Proprietary Educational Institution majority of its income is from related activities. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was incurred in connection with non-related activities. Compute the income tax due if all the income of Qalvin is used for educational purposes. P, a large non-profit non-stock school has a gross income of P4,000,000, only 40% of which was contributed by related activities and total expenses of P 3,000,000, 50% of which was…arrow_forwardRich Future Fund Sdn Bhd Income/(Loss):Dividend income – Malaysia 4,454,000Dividend income – overseas 650,000Interest income from deposits with licensed financial institutions 129,700Rental from business outlet in Penang 120,000Realised loss from foreign exchange (68,400) Common expenses:Trustee’s fee 250,000Manager’s remuneration 1,450,000 Audit fee 15,000Tax agent fees 6,000Share registration expenses (transaction cost) 398,000Management fee in respect of outlet in Penang 32,000Telephone,printing and stationeries 20,000 Required:Compute the chargeable income for Rich Future Fund Sdn Bhdarrow_forwarda) Explain, in three sentences or less, ‘cross-credit’ in relation to the foreign tax credit. Make sure to identify the problem, and how cross-crediting solves the problem. b) Treadwell, Inc. had $2,500,000 taxable income, $250,000 of which was generated by business activities in foreign jurisdictions. If Treadwell paid $55,500 foreign tax to Utopia. Compute the following: US tax paid______________________ Worldwide tax paid_______________arrow_forward

- 4. XYZcorporation reported the following gross income and expenses: Gross income in the Philippines is 38,000,000 while deductions is 15,000,000 for a total taxable income of 23,000,000. Abroad, the gross income is 14,000,000 while the deduction is 3,000,000 for a total taxable income of 11,000,000. Compute the income tax due for 2021 if XYZ is a domestic corporation. P10,200,000 P6,900,000 P8,500,000 P6,800,000arrow_forwardCorporation Growth has $86,000 in taxable income, and Corporation Income has $8,600,000 in taxable income. Use the tax rates from Table 2.3. a. What is the tax bill for each firm? Firms Tax Bill Corporation Growth $ Corporation Income $ b. Suppose both firms have identified a new project that will increase taxable income by $10,000. How much in additional taxes will each firm pay? Firms Additional taxes Corporation Growth $ Corporation Income $arrow_forwardA resident foreign corporation has the following income and expenses for the year: Philippines Abroad Gross sales P100,000,000 P40,000,000 Cost of sales 40,000,000 20,000,000 Operating expenses 30,000,000 12,000,000 1. How much is the income tax due assuming the taxable year is 2021?2. Assuming the corporation is a nonresident foreign corporation and the taxable year is 2021, how much is the income tax due?arrow_forward

- The income and expenses for an Armenian Co (Ararat) for the 2022 tax year (the same as a calendar year) are: trading income – AMD 235,000,000; gross rent income from Armenian company – AMD 200,000; dividend income from its Armenian subsidiary – AMD 3,500,000; salary expenses – AMD 25,000,000; raw materials expenses – AMD 35,000,000; fuel and utilities expenses – AMD 10,000,000; representative expenses – AMD 6,000,000; accounting depreciation expenses – AMD 8,150,000; tax depreciation expenses – AMD 5,700,000; tax interest and penalty expenses – AMD 950,000; property tax expenses – AMD 500,000; penalty expenses charged by clients – AMD 750,000, prepayments provided to the suppliers AMD 23,000,000, loans received from the bank AMD 10,000,000.• The accumulated tax loss for previous three years was AMD 15,400,000. Please asses the corporate profit tax for 2022arrow_forward13. A U.S. corporation established a 100% owned business in Germany. The U.S. corporation has U.S. source income in the current year of $300,000. The German business reports the following information for the current year: German-source net income 200,000 German income tax 80,000 Net income after taxes 120,000 Cash remitted to U.S. owner 30,000 German withholding tax 3,000 Cash received by U.S. owner 27,000 Assume the business is a foreign branch and that the income is subpart F income. What is the U.S. corporation’s taxable income? a. $300,000 b. $330,000 c. $350,000 d. $500,000arrow_forwardHow much is the income from sources within?Gross Income from the practice of profession as CPA in the Philippines, P220,000;Rent on a building located in Makati, net of 5% withholding tax, P95,000;Rent on a commercial building located in USA, P70,000;Interest income, debtor resides in Hongkong, P10,000;Dividends from Ford Motors, a foreign company, declared in 2020 (its total worldwide income for three years is P2,000,000; income within, P1,200,000), P50,000;Royalties received from Ford Motors for use of patents in the USA, P30,000;Dividend from Walmart Corp., USA, declared in 2020 (its total worldwide income for three years is P1,800,000; its income from the Philippines is P800,000), P80,000;Gain on sale of land. The contract of sale was entered in the Philippines. The land was located in Japan, P300,000;Gain on sale of car in the Philippines. The taxpayer purchased the car directly from Toyota, which manufactured the car in Japan, P50,000;arrow_forward