Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 30P

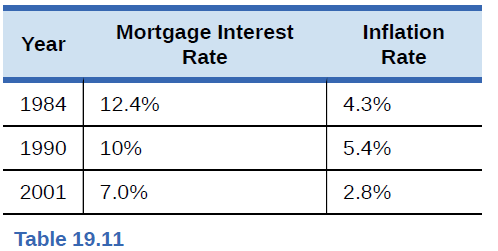

A mortgage 105m is a loan that a person makes to purchase a house. Table 19.11 provides a list of the mortgage interest rate for several different years and the rate of inflation for each of those years. In which years would it have been better to be a person borrowing money from a bank to buy a home? In which years would it have been better to be a bank lending money?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Principles of Economics 2e

Ch. 19 - Country A has export sales of 20 billion,...Ch. 19 - Which of the following are included in GDP, and...Ch. 19 - Using data from Table 19.5 how much of the nominal...Ch. 19 - Without looking at Table 19.7, return to Figure...Ch. 19 - According to Table 19.7, how often have recessions...Ch. 19 - According to Table 19.7, how long has the average...Ch. 19 - According to Table 19.7, how long has the average...Ch. 19 - Is it possible for GDP to rise while at the same...Ch. 19 - The Central African Republic has a GDP of...Ch. 19 - Explain briefly whether each of the following...

Ch. 19 - What are the main components of measuring GDP with...Ch. 19 - What are the main components of measuring GDP with...Ch. 19 - Would you usually expect GDP as measured by what...Ch. 19 - Why must you avoid double counting when measuring...Ch. 19 - What is the difference between a series of...Ch. 19 - How do you convert a series of nominal economic...Ch. 19 - What are typical GDP patterns for a high-income...Ch. 19 - What are the two main difficulties that arise in...Ch. 19 - List some of the reasons why economists should not...Ch. 19 - U.S. macroeconomic data are among the best in the...Ch. 19 - What does GDP not tell us about the economy?Ch. 19 - Should people typically pay more attention to...Ch. 19 - Why do you suppose that U.S. GDP is so much higher...Ch. 19 - Why do you think that GDP does not grow at a...Ch. 19 - Cross country comparisons of GDP per capita...Ch. 19 - Why might per capita GDP be only an imperfect...Ch. 19 - How might you measure a green GDP?Ch. 19 - Last year, a small nation with abundant forests...Ch. 19 - The prime interest rate is the rate that banks...Ch. 19 - A mortgage 105m is a loan that a person makes to...Ch. 19 - Ethiopia has a GDP of 8 billion (measured in U.S....Ch. 19 - In 1980, Denmark had a GDP of 70 billion (measured...Ch. 19 - The Czech Republic has 3 GDP of 1,800 billion...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Identify whether each of the following accounts would be considered a permanent account (yes/no) and which fina...

Principles of Accounting Volume 1

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

What is the best way to control labor costs? What tools are discussed in the chapter that may be used to help c...

Construction Accounting And Financial Management (4th Edition)

Using the weighted-average method, compute the equivalent units of production if the beginning inventory consis...

Principles of Accounting Volume 2

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Knowledge Booster

Similar questions

- The total price of purchasing a basket of goods in the United Kingdom over four years is: year 1=940, year 2=970, year 3=1000, and year 4=1070. Calculate two price indices, one using year 1 as the base year (set equal to 100) and the other using year 4 as the base year (set equal to 100). Then, calculate the inflation rate based on the first price index. If you had used the other price index, would you get a different inflation rate? If you are unsure, do the calculation and find out.arrow_forwardHow does indexing wage contracts to inflation help workers?arrow_forwardThe prime interest rate is the rate that banks charge their best customers. Based on the nominal interest rates and inflation rates in Table 19.10, in which of the years would it have been best to be a lender? Based on the nominal interest rates and inflation rates in Table 19.10, in which of the years given would it have been best to be a borrower?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax