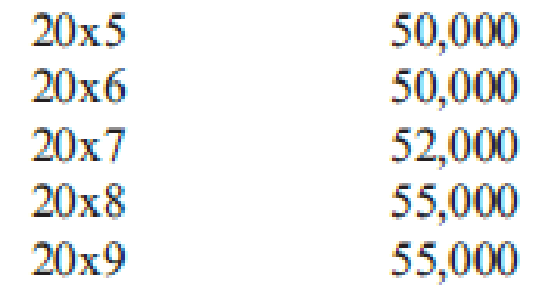

Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows:

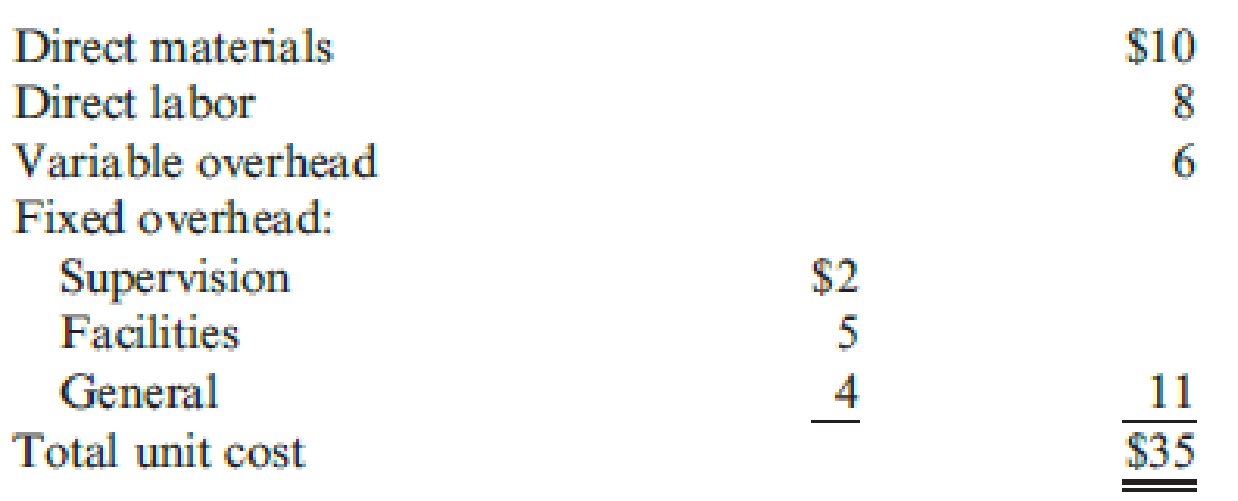

The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of $945,000 with terms of 2/10, n/30; the company’s policy is to take all purchase discounts. The freight on the equipment would be $11,000, and installation costs would total $22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of $12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in

The old equipment is fully

Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at $45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment.

Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate.

Required:

- 1. Prepare a schedule of cash flows for the make alternative. Calculate the

NPV of the make alternative. - 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative.

- 3. Which should Jonfran do—make or buy the containers? What qualitative factors should be considered? (CMA adapted)

1.

Calculate the cash flow and net present value (NVP) for make alternative of Company J.

Explanation of Solution

Cash inflows: The amount of cash received by a company from the operating, investing, and financing activities of the business during a certain period is referred to as cash inflow.

Cash outflows: The amount of cash paid by a company for the operating, investing, and financing activities of the business during a certain period is referred to as cash outflow.

Net present value method (NVP): Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Calculate the cash flow and net present value (NVP) for make alternative of Company J as follows:

| Year |

Cash inflow (9) (A) | Present value factor @12% (B) |

Present value |

| 2015 | $ -499,013 | 0.893 | -$ 445,619 |

| 2016 | $ -456,312 | 0.797 | -$ 363,681 |

| 2017 | $ -594,130 | 0.712 | -$ 423,021 |

| 2018 | $ -658,546 | 0.636 | -$ 418,835 |

| 2019 | $ -679,800 | 0.567 | -$ 385,447 |

| Total present value | -$ 2,036,602 | ||

| Less: Cash outflow for investment (7) | $ 956,600 | ||

| Net present value | ($ 2,993,202) | ||

Table (1)

Working note (1):

Calculate the variable cost per unit.

Working note (2):

Calculate the variable cost after tax for each year.

Year 2015:

Year 2016:

Year 2017:

Year 2018:

Year 2019:

Working note (3):

Calculate the fixed cost after tax for each year.

Working note (4):

Calculate the operating expense for each year.

| Year | Variable cost (2) (E) |

Fixed cost (3) (F) |

Total operating expense |

| 2015 | $600,000 | $27,000 | $627,000 |

| 2016 | $600,000 | $27,000 | $627,000 |

| 2017 | $624,000 | $27,000 | $651,000 |

| 2018 | $660,000 | $27,000 | $687,000 |

| 2019 | $660,000 | $27,000 | $687,000 |

Table (2)

Working note (5):

Calculate the initial investment.

Working note (6):

Calculate the depreciation expense after tax for each year.

| Depreciation Schedule | ||||

| Year |

MACRS Percentage (W) |

Depreciation |

Tax Rate (Y) |

Depreciation Tax Shield |

| 2015 | 33.33% | $319,968 | 40% | $127,987 |

| 2016 | 44.45% | $426,720 | 40% | $170,688 |

| 2017 | 14.81% | $142,176 | 40% | $56,870 |

| 2018 | 7.41% | $71,136 | 40% | $28,454 |

| Total | $960,000 | |||

Table (3)

Working note (7):

Calculate the cash outflow for new equipment.

Working note (8):

Calculate the salvage value after tax.

Working note (9):

Calculate the cash inflow of new equipment each year.

| Year |

Operating expense after tax (P)(4) | Depreciation expenses after tax (Q) (6) | Salvage value after tax (R) (8) |

Net cash inflow |

| 2015 | ($627,000) | $127,987 | ($499,013) | |

| 2016 | ($627,000) | $170,688 | ($456,312) | |

| 2017 | ($651,000) | $56,870 | ($594,130) | |

| 2018 | ($687,000) | $28,454 | ($658,546) | |

| 2019 | ($687,000) | $7,200 | ($679,800) |

Table (4)

2.

Calculate the cash flow and net present value (NVP) for buy alternative of Company J.

Explanation of Solution

Calculate the cash flow and net present value (NVP) for buy alternative of Company J as follows:

| Year |

Cash inflow (10) (A) | Present value factor @12% (B) (11) |

Present value |

| 2015 | $ -810,000 | 0.893 | -$ 723,330 |

| 2016 | $ -810,000 | 0.797 | -$ 645,570 |

| 2017 | $ -842,400 | 0.712 | -$ 599,789 |

| 2018 | $ -891,000 | 0.636 | -$ 566,676 |

| 2019 | $ -891,000 | 0.567 | -$ 505,197 |

| Total present value | -$ 3,040,562 | ||

| Less: Salvage value (11) | -$ 600 | ||

| Net present value | -$ 3,039,962 | ||

Table (5)

Working note (10):

Calculate the cash inflow for each year.

Year 2015:

Year 2016:

Year 2017:

Year 2018:

Year 2019:

Working note (11):

Calculate the salvage value after tax for year 2014.

3.

Indicate whether company J should make the containers or buy the containers, and explain the quantitative factors that should be considered for the capital investment analysis.

Explanation of Solution

Indicate whether company J should make the containers or buy the containers, and explain the quantitative factors that should be considered for the capital investment analysis as follows:

In this case, company J should make the containers because make decision ($2,993,203) has less cost than the buy decision ($3,039,662). Qualitative factors of capital investment analysis are,

- Reliability of supplier,

- Quality of the product,

- Stability of purchasing price,

- Labor relations, and

- Community relation.

Want to see more full solutions like this?

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- ZZOOM, Inc., has decided to discontinue manufacturing its Z Best model. Currently, the company has 4,600 partially completed Z Best models on hand. The government has put a recall on a particular part in the Z Best model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these Z Best models to their current state. Reworking each Z Best model will cost $22 for materials and $25 for direct labor. In addition, $9 of variable overhead and $34 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. If ZZOOM completes the Z Best models, it can sell them for $180 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $105 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if ZZOOM should complete the Z Best models or sell them in their current state.arrow_forwardThaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forward

- Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardTrifecta Distributors has decided to discontinue manufacturing its X Plus model. Currently, the company has 4,600 partially completed X Plus models on hand. The government has put a recall on a particular part in the X Plus model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these X Plus models to their current state. Reworking each X Plus model will cost $20 for materials and $20 for direct labor. In addition, $7 of variable overhead and $32 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. Il Trifecta completes the X Plus models, it can sell them for $160 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $104 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if Trifecta should complete the X Plus models or sell them in their current state.arrow_forwardShelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?arrow_forward

- Basuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tear, growth, and other factors, Basuras places about 200,000 new containers each year (about 20% of the total households). Several years ago, Basuras decided to manufacture its own containers as a cost-saving measure. A strategically located plant involved in this type of manufacturing was acquired. To help ensure cost efficiency, a standard cost system was installed in the plant. The following standards have been established for the products variable inputs: During the first week in January, Basuras had the following actual results: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in January. Also, a new manufacturing process was implemented on a trial basis. The new process required a slightly higher level of skilled labor. The higher- quality material has no effect on labor utilization. However, the new manufacturing process was expected to reduce materials usage by 0.25 pound per container. Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assume that the 0.25 pound per container reduction of materials occurred as expected and that the remaining effects are all attributable to the higher-quality material. Would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing process, should it be continued or discontinued? In answering, consider the new processs materials reduction effect as well. Explain. 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new process should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 9,000 and the labor cost was 99,000. Should the new process be adopted? Assume the variances are attributable to the new process. Assuming production of 6,000 units per week, what would be the projected annual savings? (Include the materials reduction effect.)arrow_forwardKeith Golding has decided to purchase a personal computer. He has narrowed his choices to two: Brand A and Brand B. Both brands have the same processing speed, hard disk capacity, RAM, graphics card memory, and basic software support package. Both come from companies with good reputations. The selling price for each is identical. After some review, Keith discovers that the cost of operating and maintaining Brand A over a three-year period is estimated to be 200. For Brand B, the operating and maintenance cost is 600. The sales agent for Brand A emphasized the lower operating and maintenance cost. She claimed that it was lower than any other PC brand. The sales agent for Brand B, however, emphasized the service reputation of the product. She provided Keith with a copy of an article appearing in a PC magazine that rated service performance of various PC brands. Brand B was rated number one. Based on all the information, Keith decided to buy Brand B. Required: 1. What is the total product purchased by Keith? 2. Is the Brand A company pursuing a cost leadership or differentiation strategy? The Brand B company? Explain. 3. When asked why he purchased Brand B, Keith replied, I think Brand B offered more value than Brand A. What are the possible sources of this greater value? If Keiths reaction represents the majority opinion, what suggestions could you offer to help improve the strategic position of Brand A?arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forward

- Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The company needs 100,000 sets per year (currently it pays 1.90 per set of rollers). The rollers can be produced using an available area within the plant. However, equipment for production of the rollers would need to be leased (30,000 per year lease payment). Additionally, it would cost 0.50 per machine hour for power, oil, and other operating expenses. The equipment will provide 60,000 machine hours per year. Direct material costs will average 0.75 per set, and direct labor will average 0.25 per set. Since only one type of roller would be produced, no additional demands would be made on the setup activity. Other overhead activities (besides machining and setups), however, would be affected. The companys cost management system provides the following information about the current status of the overhead activities that would be affected. (The supply and demand figures do not include the effect of roller production on these activities.) The lumpy quantity indicates how much capacity must be purchased should any expansion of activity supply be needed. The purchase price is the cost of acquiring the capacity represented by the lumpy quantity. This price also represents the cost of current spending on existing activity supply (for each block of activity). Production of rollers would place the following demands on the overhead activities: Producing the rollers also means that the purchase of outside rollers will cease. Thus, purchase orders associated with the outside acquisition of rollers will drop by 5,000. Similarly, the moves for the handling of incoming orders will decrease by 200. The company has not inspected the rollers purchased from outside suppliers. Required: 1. Classify all resources associated with the production of rollers as flexible resources and committed resources. Label each committed resource as a short- or long-term commitment. How should we describe the cost behavior of these short- and long-term resource commitments? Explain. 2. Calculate the total annual resource spending (for all activities except for setups) that the company will incur after production of the rollers begins. Break this cost into fixed and variable activity costs. In calculating these figures, assume that the company will spend no more than necessary. What is the effect on resource spending caused by production of the rollers? 3. Refer to Requirement 2. For each activity, break down the cost of activity supplied into the cost of activity output and the cost of unused activity.arrow_forwardTaylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each products unit contribution margin is as follows: Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming years production. There is no other source of the material. Required: 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material. 2. Determine the optimal usage of the companys inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend. 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year. a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints. b. Solve the linear programming problem using the graphical approach. c. Compute the total contribution margin produced by the optimal mix.arrow_forwardDimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,