Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 18MCQ

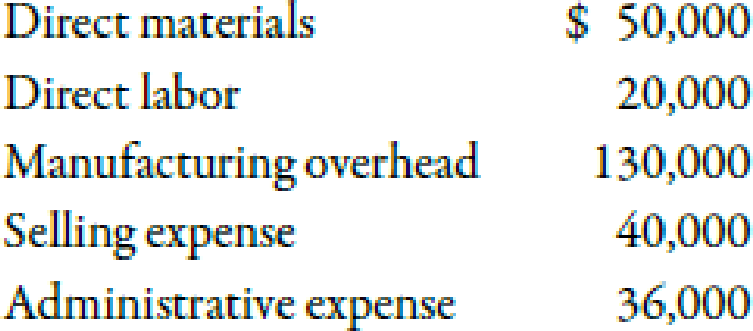

2-18 Use the following information for Multiple- Choice Questions 2-13 through 2-18:

Last year, Barnard Company incurred the following costs:

Barnard produced and sold 10,000 units at a price of $31 each.

Refer to the information for Barnard Company on the previous page. Operating income is

- a. $34,000.

- b. $110,000.

- c. $234,000.

- d. $270,000.

- e. $74,000.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Q1) A company has the following accounts’ balances at the end of the year:

Building (Net) 20 year life left $ 4,000,000. The replacement cost for the Building is 4,500,000 USD.

Inventory 40,000 unit at $20 each with a replacement cost $22. And cost of goods sold of $500,000 with a replacement cost of 520,000.

Required:

Indicate how the above information would affect the financial statements of the company when adopting the current cost accounting model. You need to determine the realized and unrealized profit.

I need answer of first three question

I need answer of first three question

please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)

Fancy Company reported a contribution margin of $10 per unit. The company’s fixed costs per period were $30,000. Sales were $48,000 for the 3,200 units sold during the period. The income tax rate is 25%.

Required:a. What is current net income?b. What is the breakeven point (BEP) in units?c. If the income tax rate is increased to 30%, what is the BEP in dollars?d. If the number of units sold decreases to 3,100 units, what is the BEP in dollars?e. If the sales price is increased by $2, what is the BEP in units? Assume the variable costs, which consist of direct materials, direct labor, and variable overhead, are not changing as a result of increasing the sales price.

2. A boat manufacturer produces 30 boats this year and incurred $3.6 million in material, labor, and overhead costs. 19 boats were sold during the year, and each boat was allocated the same amount of costs.

a. How much of the $3.6 million of total manufacturing costs should appear on the Company's income statement as Costs of Goods Sold?

b. Assuming Finished Goods Inventory consisted of only the unsold boats produced this year then what is the $ amount of Finished Goods Inventory?

(Show all calculations)

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-17 Refer to the information for Barnard Company on the previous page. The total period expense is a. 276,000. b. 200,000. c. 76,000. d. 40,000. e. 36,000.arrow_forwardUse the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-13Refer to the information for Barnard Company above. Prime cost per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forwardUse the following information for Multiple- Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-15 Refer to the information for Barnard Company on the previous page. The cost of goods sold per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forward

- Use the following information for Multiple-Choice Questions 2-13 through 2-18: Last year, Barnard Company incurred the following costs: Barnard produced and sold 10,000 units at a price of 31 each. 2-14Refer to the information for Barnard Company above. Conversion cost per unit is a. 7.00. b. 20.00. c. 15.00. d. 5.00. e. 27.60.arrow_forwardALLOCATING OPERATING EXPENSEMILES DRIVEN Herbert Quiong owns a furniture store that offers free delivery of merchandise delivered within the local area. Mileage records for the three sales departments are as follows: The cost of using the truck for the last year, including depreciation, was 5,000. Allocate the cost of the truck among the three departments on the basis of miles driven.arrow_forward2. The records of the Dodge Corporation show the following results for the most recent year: Given the provided date, identify the contribution margin. There is not a word length requirement for this question; however, you must show your work. sales (16000 units) 256,000 variable expenses 160,000 net operating income 32,000arrow_forward

- Carson Print Supplies, Inc., sells laser printers and supplies. Assume Carson started the year with 100 containers of ink (average cost of $8.90 each, FIFO cost of $9.00 each, LIFO cost of $7.80 each). During the year, the company purchased 800 containers of ink at $9.80 and sold 600 units for $21.50 each. Carson paid operating expenses throughout the year, a total of $4,000. Ignore income taxes for this exercise. Prepare Carson’s income statement for the current year ended December 31 using the aver-age-cost, FIFO, and LIFO inventory costing methods. Include a complete statement heading.arrow_forwardI need answer of last three question I need answer of last three question please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Fancy Company reported a contribution margin of $10 per unit. The company’s fixed costs per period were $30,000. Sales were $48,000 for the 3,200 units sold during the period. The income tax rate is 25%. Required:a. What is current net income?b. What is the breakeven point (BEP) in units?c. If the income tax rate is increased to 30%, what is the BEP in dollars?d. If the number of units sold decreases to 3,100 units, what is the BEP in dollars?e. If the sales price is increased by $2, what is the BEP in units? Assume the variable costs, which consist of direct materials, direct labor, and variable overhead, are not changing as a result of increasing the sales price.arrow_forward2. A boat manufacturer produces 30 boats this year and incurred $3.6 million in material, labor, and overhead costs. 19 boats were sold during the year, and each boat was allocated the same amount of costs. a. How much of the $3.6 million of total manufacturing costs should appear on the Company's income statement as Costs of Goods Sold? b. Assuming Finished Goods Inventory consisted of only the unsold boats produced this year then what is the $ amount of Finished Goods Inventory?arrow_forward

- 3-16 Jack’s Jax has total fixed costs of $25,000. If the company’s contribution margin is 60%, the incometax rate is 25% and the selling price of a box of Jax is $20, how many boxes of Jax would the company needto sell to produce a net income of $15,000?a. 5,625 b. 4,445c. 3,750 d. 3,3333-17 During the current year, XYZ Company increased its variable SG&A expenses while keeping fixedSG&A expenses the same. As a result, XYZ’s:a. Contribution margin and gross margin will be lower.b. Contribution margin will be higher, while its gross margin will remain the same.c. Operating income will be the same under both the financial accounting income statement and contributionincome statement.d. Inventory amounts booked under the financial accounting income statement will be lower than underthe contribution income statement.3-18 Under the contribution income statement, a company’s contribution margin will be:a. Higher if fixed SG&A costs decrease.b. Higher if variable SG&A costs…arrow_forwardQuestion 3 A Lighting industry manufactures and sells a single product, heavy-duty battery operated standby lamp. The financial controller has prepared the following income statement for the most recent year: An Industry Income Statement under Absorption costing, for the year ended December 31. Sales Revenue RM2,450,000 Less: Cost of Goods Sold RM1,140,000 Gross Profit RM1,310,000 Less: Operating Expenses RM 750,000 Operating Income RM 560,000 The company produced 40,000 units and sold 30,000 units during the ear ending Dec 31. Fixed manufacturing overhead (MOH) for the year was RM320,000, while fixed operating expenses were RM450,000. Assume per unit cost of Direct Material and direct labor is RM15 and RM12 respectively. The company had no beginning inventory. Requirements Will the company’s operating income under variable costing be higher, lower or the same as operating income under absorption costing? Why? Project the company’s operating income…arrow_forwardChoose the correct letter of answer In 20x2 the Cranky Processing Company had the following data coming from its income statement (in Pesos): Sales, P1,200,000; Variable costs: (a) Goods sold, P400,000 and (b) S&A Expenses, P100,000; Fixed costs: (a) Factory overhead, P110,000, and S&A Expenses, P80,000. Income tax rate is 15%. Determine the required peso sales to provide an after-tax net income of P150,000. a. P261,765b. P176,471c. P366,471d. P628,235arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License