College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 3PA

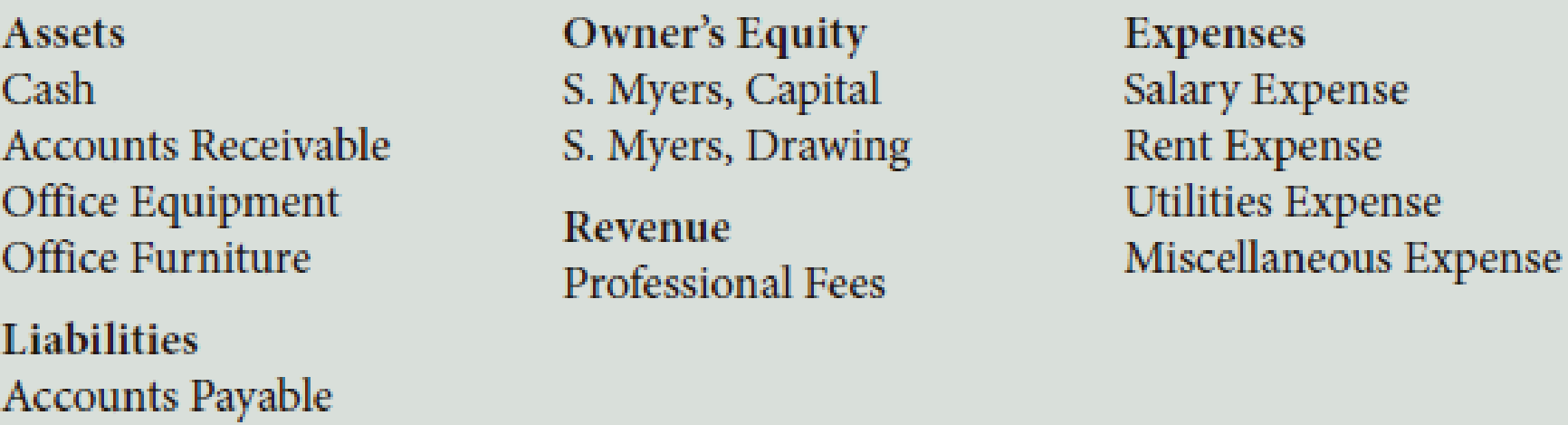

S. Myers, a speech therapist, opened a clinic in the name of Myers Clinic. Her accountant prepared the following chart of accounts:

The following transactions occurred during June of this year:

- a. Myers deposited $40,000 in a bank account in the name of the business.

- b. Bought waiting room chairs and tables on account, $1,330.

- c. Bought a fax/copier/scanner combination from Max’s Equipment for $595, paying $200 in cash and placing the balance on account, Ck. No. 1001.

- d. Bought an intercom system on account from Regan Office Supply, $375.

- e. Received and paid the telephone bill, $155, Ck. No. 1002.

- f. Sold professional services on account, $1,484.

- g. Received and paid the electric bill, $190, Ck. No. 1003.

- h. Received and paid the bill for the state speech therapy convention, $450, Ck. No. 1004.

- i. Sold professional services for cash, $2,575.

- j. Paid on account to Regan Office Supply, $300, Ck. No. 1005.

- k. Paid the rent for the current month, $940, Ck. No. 1006.

- l. Paid salary of the receptionist, $880, Ck. No. 1007.

- m. Myers withdrew cash for personal use, $800, Ck. No. 1008.

- n. Received $885 on account from patients who were previously billed.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of June 30, 20--. - 6. Prepare an income statement for June 30, 20--.

- 7. Prepare a statement of owner’s equity for June 30, 20--.

- 8. Prepare a balance sheet as of June 30, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001. c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. f. Sold professional services for cash, 3,482. g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005. i. Paid the salary of the assistant, 1,050, Ck. No. 1006. j. Sold professional services for cash, 3,295. k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardD. Johnston, a physical therapist, opened Johnstons Clinic. His accountant provided the following chart of accounts: The following transactions occurred during July of this year: a. Johnston deposited 35,000 in a bank account in the name of the business. b. Bought filing cabinets on account from Muller Office Supply, 560. c. Paid cash for chairs and carpeting for the waiting room, 835, Ck. No. 1000. d. Bought a photocopier from Robs Office Equipment, 650, paying 250 in cash and placing the balance on account, Ck. No. 1001. e. Received and paid the telephone bill, which included installation charges, 185, Ck. No. 1002. f. Sold professional services on account, 2,255. g. Received and paid the bill for the state physical therapy convention, 445, Ck. No. 1003. h. Received and paid the electric bill, 335, Ck. No. 1004. i. Received cash on account from credit customers, 1,940. j. Paid on account to Muller Office Supply, 250, Ck. No. 1005. k. Paid the office rent for the current month, 1,245, Ck. No. 1006. l. Sold professional services for cash, 1,950. m. Paid the salary of the receptionist, 960, Ck. No. 1007. n. Johnston withdrew cash for personal use, 1,200, Ck. No. 1008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--.arrow_forward

- On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6arrow_forwardOn June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001 (Rent Expense). c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. Sold professional services for cash, 3,482 (Professional Fees). g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005 (Utilities Expense). i. Paid the salary of the assistant, 1,050, Ck. No. 1006 (Salary Expense). j. Sold professional services for cash, 3,295 (Professional Fees). k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001. c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600. g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005. i. Paid the salary of the assistant, 1,150, Ck. No. 2006. j. Sold professional services for cash, 3,868. k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001 (Rent Expense). c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600 (Professional Fees). g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005 (Utilities Expense). i. Paid the salary of the assistant, 1,150, Ck. No. 2006 (Salary Expense). j. Sold professional services for cash, 3,868 (Professional Fees). k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- During February of this year, H. Rose established Rose Shoe Hospital. The following asset, liability, and owners equity accounts are included in the chart of accounts: The following transactions occurred during the month of February: a. Rose deposited 25,000 cash in a bank account in the name of the business. b. Bought shop equipment for cash, 1,525, Ck. No. 1000. c. Bought advertising on account from Milland Company, 325. d. Bought store shelving on account from Inger Hardware, 750. e. Bought office equipment from Sharas Office Supply, 625, paying 225 in cash and placing the balance on account, Ck. No. 1001. f. Paid on account to Inger Hardware, 750, Ck. No. 1002. g. Rose invested his personal leather working tools with a fair market value of 800 in the business h. Sold services for the month of February for cash, 250. PART 1: The Accounting Cycle for a Service Business: Analyzing Business Transactions Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts. 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.arrow_forwardOn May 1, B. Bangle opened Self-Wash Laundry. His accountant listed the following chart of accounts: The following transactions were completed during May: a. Bangle deposited 35,000 in a bank account in the name of the business. b. Bought chairs and tables, paying cash, 1,870, Ck. No. 1000. c. Bought supplies on account from Barnes Supply Company, 225. d. Paid the rent for the current month, 875, Ck. No. 1001. e. Bought washing machines and dryers from Lara Equipment Company, 12,500, paying 3,600 in cash and placing the balance on account, Ck. No. 1002. f. Sold services for cash for the first half of the month, 1,925. g. Bought insurance for one year, 1,560, Ck. No. 1003. h. Paid on account to Lara Equipment Company, 1,800, Ck. No. 1004. i. Received and paid electric bill, 285, Ck. No. 1005. j. Sold services for cash for the second half of the month, 1,835. k. Paid wages to an employee, 940, Ck. No. 1006. l. Bangle withdrew cash for his personal use, 800, Ck. No. 1007. m. Paid on account to Barnes Supply Company, 225, Ck. No. 1008. n. Received and paid bill from the county for sidewalk repair assessment, 280, Ck. No. 1009. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of May 31, 20--. 6. Prepare an income statement for May 31, 20--. 7. Prepare a statement of owners equity for May 31, 20--. 8. Prepare a balance sheet as of May 31, 20--.arrow_forwardIn April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700. g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250. i. Received and paid the bill for utilities, 280, Ck. No. 103. j. Received a bill for gas and oil for the truck, 130. k. Paid wages to the employees, 2,680, Ck. Nos. 104106. l. Sold services for cash for the remainder of the month, 3,500. m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY