Concept explainers

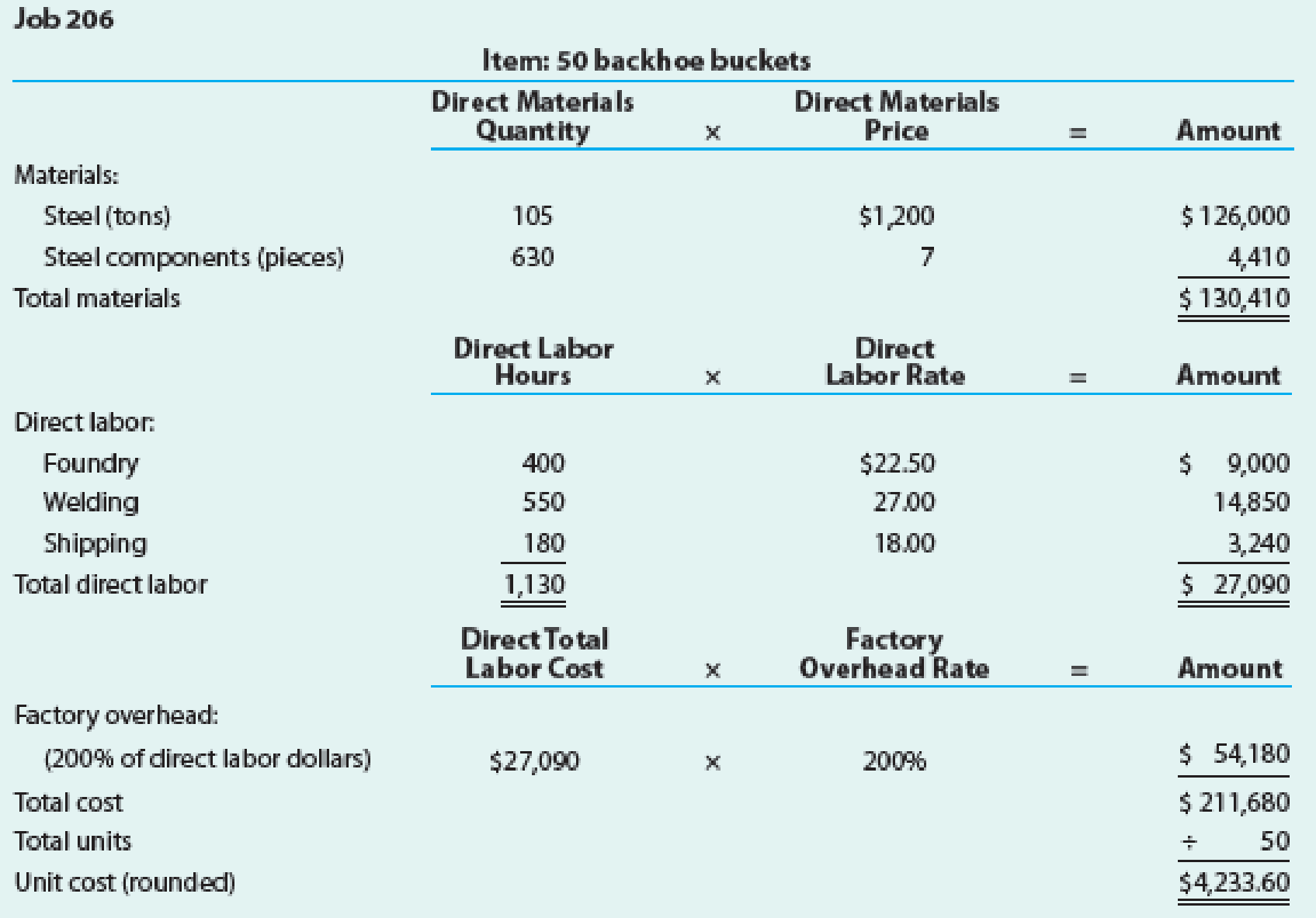

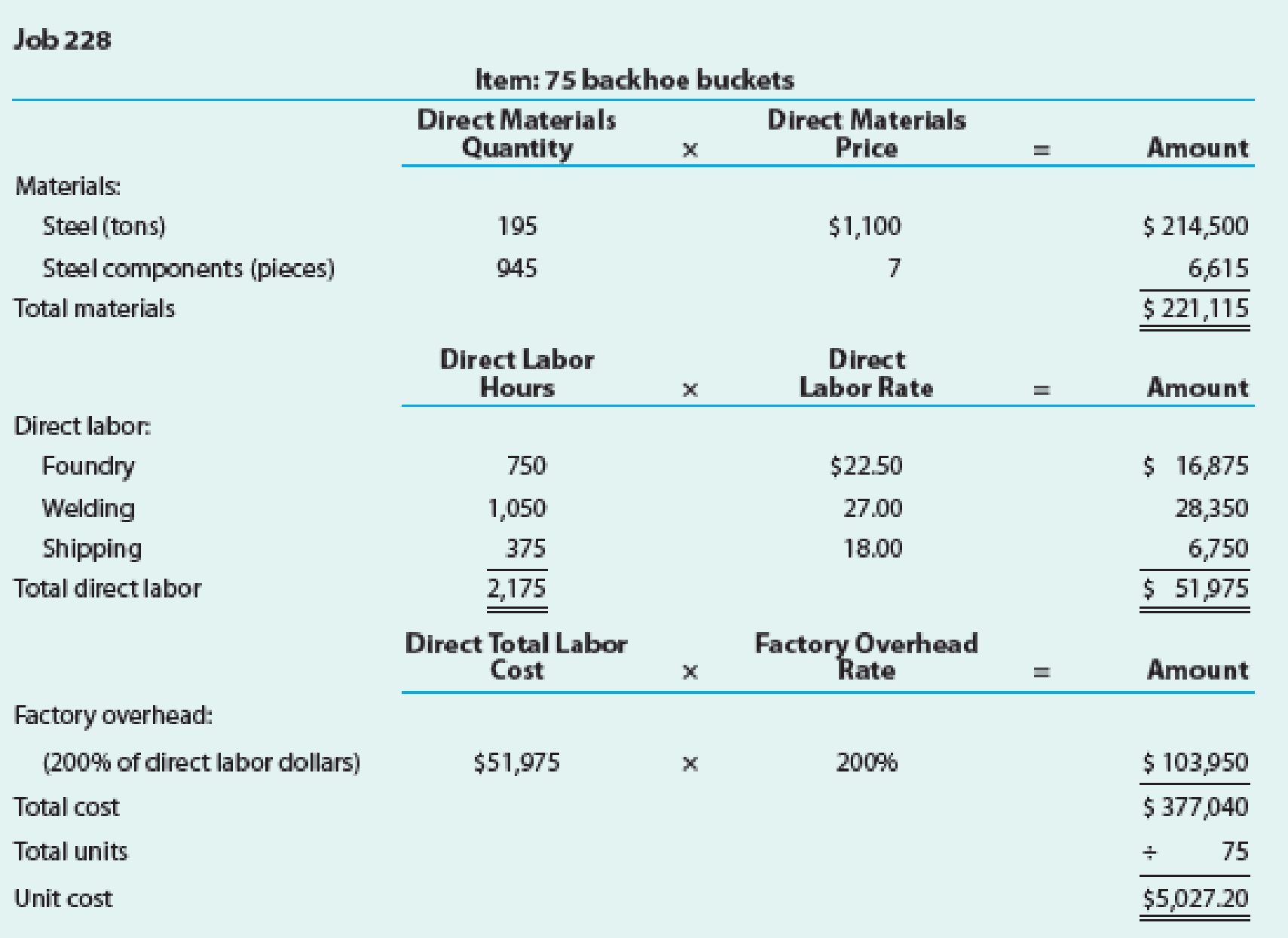

RIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the

Management is concerned about the increase in unit costs over the months from October to December. To understand what has occurred, management interviewed the purchasing manager and quality manager.

Purchasing Manager: Prices have been holding steady for our raw materials during the first half of the year. I found a new supplier for our bulk steel that was willing to offer a better price than we received in the past. I saw these lower steel prices and jumped on them, knowing that a reduction in steel prices would have a very favorable impact on our costs.

Quality Manager: Something happened around mid-year. All of a sudden, we were experiencing problems with respect to the quality of our steel. As a result, we’ve been having all sorts of problems on the shop floor in our foundry and welding operation.

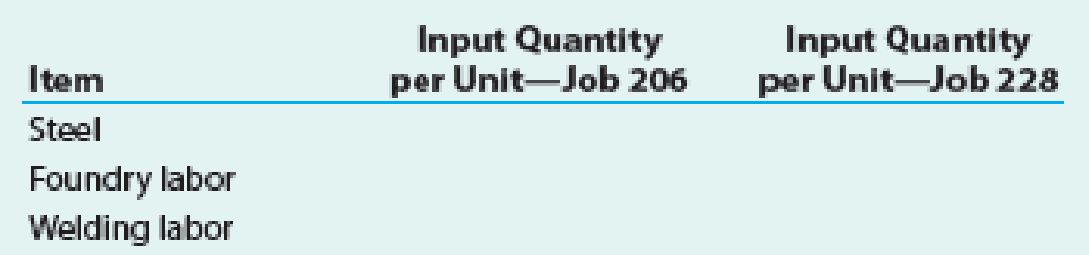

- a. Analyze the two job cost sheets and identify why the unit costs have changed for the backhoe buckets. Complete the following schedule to help in your analysis:

- b.

How would you interpret what has happened in light of your analysis and the interviews?

How would you interpret what has happened in light of your analysis and the interviews?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- Gerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forwardBrady Furniture Company manufactures wooden oak furniture. The company employs a job cost system to trace manufacturing costs to jobs. Each job represents a batch of furniture of the same type. Information regarding direct materials on selected jobs throughout the year is as follows: Dining tables are the most difficult furniture item in Bradys catalog to manufacture. Thus, the most skilled employees are scheduled to make dining tables, unless they are required for other jobs. a. Determine the material cost per unit for each job. b. Use the January material cost per unit for each type of furniture as the base material cost. For each month and each type of furniture, determine the unit material cost as a percent of the base unit material cost. Round percent to one decimal place. Use the following table format: c. Develop a line chart of the percent of unit material cost to the base unit material cost. Place the months on the horizontal axis and use three lines for the three different types of furniture. d. Interpret the chart. What is happening to the dining tables?arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forward

- The following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forwardSultan, Inc. manufactures goods to special order and uses a job order cost system. During its first month of operations, the following selected transactions took place: Required: 1. Prepare a schedule reflecting the cost of each of the four jobs. 2. Prepare journal entries to record the transactions. 3. Compute the ending balance in Work in Process. 4. Compute the ending balance in Finished Goods.arrow_forwardNutts management is very concerned about the cost of overhead on its jobs. When jobs are complete, overhead costs should be between 15% and 20% of total costs. For example, the labor cost on Job 8958 is 25% of total costs, higher than the norm. Open Job 8961 and click the Chart sheet tab. A pie chart appears showing the cost components on that job. Record the labor cost percentage in the space provided. Repeat this for each of the jobs worked on in August. Did Nutt maintain good cost control on all its jobs? Explain. Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the job cost sheet to include an area for four direct material requisition entries instead of three. Then enter the following two materials requisitions onto the worksheet: Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT. Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 4246 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.arrow_forward

- Phono Company manufactures a plastic toy cell phone. The following standards have been established for the toys materials and labor inputs: During the first week of July, the company had the following results: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in July. Also, a new manufacturing layout was implemented on a trial basis. The new layout required a slightly higher level of skilled labor. The higher-quality material has no effect on labor utilization. Similarly, the new manufacturing approach has no effect on material usage. (Note: Round all variances to the nearest dollar.) Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assuming that the materials variances are essentially attributable to the higher quality of materials, would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing layout, should it be continued or discontinued? Explain. 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new layout should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 13,200 and the labor cost was 132,000. Should the new layout be adopted? Assume the variances are attributable to the new layout. If so, what would be the projected annual savings?arrow_forwardChrome Solutions Company manufactures special chromed parts made to the order and specifications of the customer. It has two production departments, Stamping and Plating, and two service departments, Power and Maintenance. In any production department, the job in process is wholly completed before the next job is started. The company operates on a fiscal year, which ends September 30. Following is the post-closing trial balance as of September 30: Additional information: The balance of the materials account represents the following: The company uses the FIFO method of accounting for all inventories. Material A is used in the Stamping Department, and materials B and C are used in the Plating Department. The balance of the work in process account represents the following costs that are applicable to Job 905. (The customer’s order is for 1,000 units of the finished product.) The finished goods account reflects the cost of Job 803, which was finished at the end of the preceding month and is awaiting delivery orders from the customer. At the beginning of the year, factory overhead application rates were based on the following data: In October, the following transactions were recorded: Purchased the following materials and supplies on account: The following materials were issued to the factory: Customers’ orders covered by Jobs 1001 and 1002 are for 1,000 and 500 units of finished product, respectively. Factory wages and office, sales, and administrative salaries are paid at the end of each month. (Assume FICA and federal income tax rates of 8% and 10%, respectively.) Record the company’s liability for state and federal unemployment taxes. (Assume rates of 4% and 1%, respectively, and that none of the employees had reached the $8,000 limit.) Record the payroll distribution for October. Wages of the supervisors, custodial personnel, etc., totaled $9,500; administrative salaries were $18,300. Miscellaneous factory overhead incurred during October totaled $4,230. Miscellaneous selling and administrative expenses were $1,500. These items as well as the FICA tax and federal income tax withheld for September were paid. (See account balances on the post-closing trial balance for September 30.) Annual depreciation on plant assets is calculated using the following rates (round to nearest dollar): Factory buildings–5% Machinery and equipment–20% Office equipment–20% The balance of the prepaid insurance account represents a three-year premium for a fire insurance policy covering the factory building and machinery. It was paid on the last day of the preceding month and became effective on October 1. The summary of factory overhead prepared from the factory overhead ledger is reproduced here: The total expenses of the Maintenance Department are distributed on the basis of floor space occupied by the Power Department (8,820 sq ft), Stamping Department (19,500 sq ft), and Plating Department (7,875 sq ft). The power department expenses are then allocated equally to the Stamping and Plating departments. After the actual factory overhead expenses have been distributed to the departmental accounts and the applied factory overhead has been recorded and posted, any balances in the departmental accounts are transferred to Under- and Overapplied Overhead. Jobs 905 and 1001 were finished during the month. Job 1002 is still in process at the end of the month. During the month, Jobs 803 and 905 were sold with a mark-on percentage of 50% on cost. Received $55,500 from customers in payment of their accounts. Checks were issued in the amount of $43,706 for payment of the payroll. Required: Set up the beginning trial balance in T-accounts. Prepare materials inventory ledger cards and enter October 1 balances. Prepare a Payroll Summary and Schedule of Earnings and Payroll Taxes for the month of October. Set up job cost sheets as needed. Record all transactions and related entries for October and post to T-accounts. Prepare a service department expense distribution worksheet for October. At the end of the month: Analyze the balance in the materials account, the work in process account, and the finished goods account. Prepare the statement of cost of goods manufactured for the month ended October 31.arrow_forwardAntolini Enterprises produces mens sports coats that are sold by popular department stores. Each retail order is treated as a job that accumulates materials, labor, and overhead costs for a batch of sports coats. Management has obtained data on the labor costs for four selected jobs over a six-month period. Each selected job represents a similar style and size of sports coat. The data are as follows: a. Determine the direct labor cost per unit for each job. b. Interpret the trend in per-unit labor cost. c. Determine the direct labor hours per sports coat. d. Interpret what may be happening with Job 192.arrow_forward

- Cycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardSpokane Production Co. obtained the following information from its records for July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for July: a. The gross profit or loss for each job completed and sold, and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning