Concept explainers

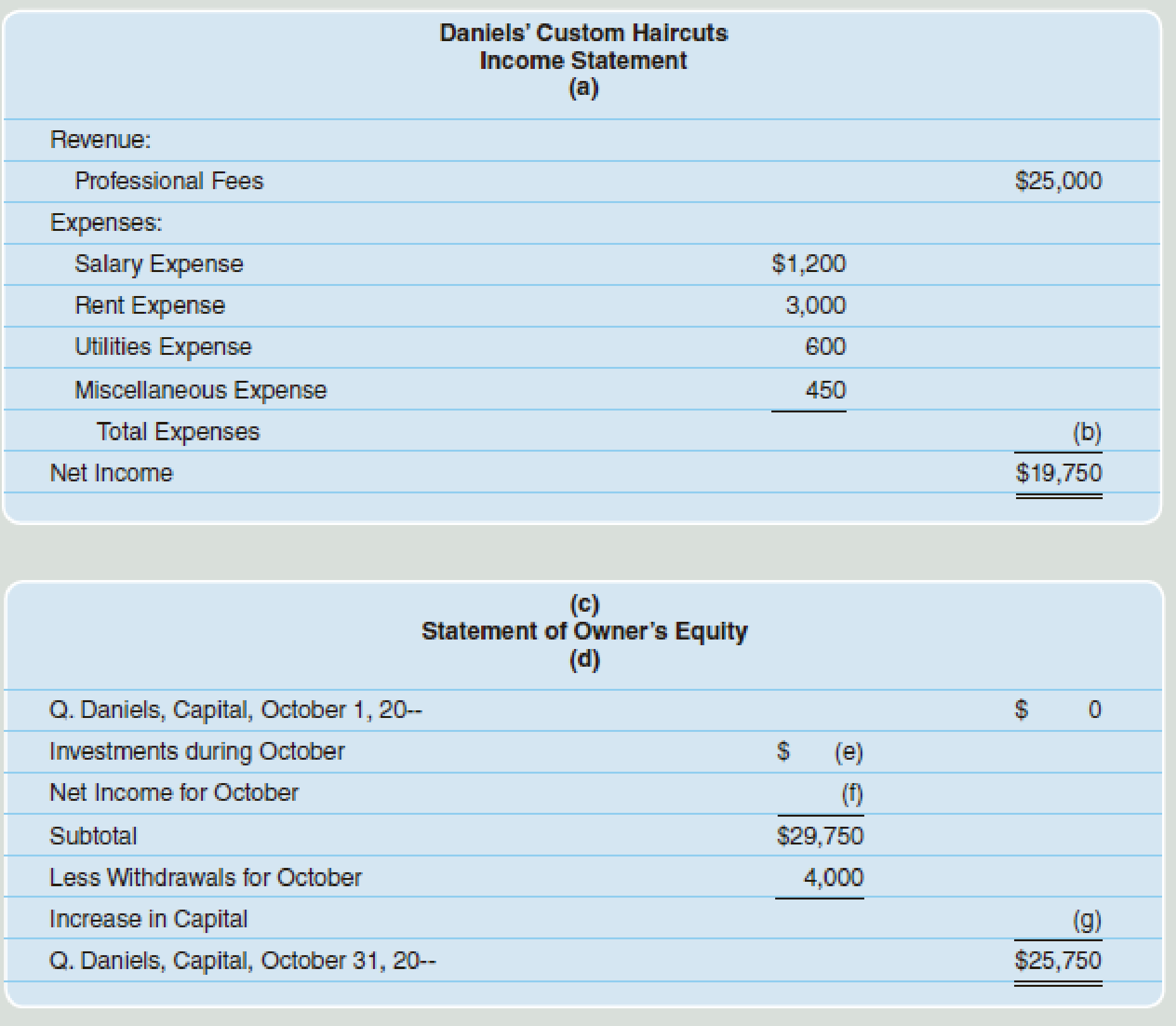

The financial statements for Daniels’ Custom Haircuts for the month of October follow.

Required

Solve for the missing information.

Solve the missing information.

Answer to Problem 5PA

(a) For the year ended October 31

(b) 5,250.

(c) Company D.

(d) For the year ended October 31.

(e) 10,000.

(f) 19,750.

(g) 25,750.

(h) For the year ended October 31.

(i) 36,400.

(j) 25,750.

(k)36,400.

Explanation of Solution

Financial statement:

Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making. The financial statements reports, and shows the financial status of the business. The financial statements consist of the balance sheet, income statement, statement of retained earnings, and the cash flow statement.

Missing information (a):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the income statement.

| Company D |

| Income Statement |

| (a) For the year ended October 31 |

Table (1)

Missing information (b):

The amount of total expense is missing in the income statement and it is calculated by adding all expenses:

| Company D | ||

| Income Statement | ||

| (a) For the year ended October 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Professional Fees | 25,000 | |

| Expenses: | ||

| Salary Expense | 1,200 | |

| Rent Expense | 3,000 | |

| Utilities Expense | 600 | |

| Miscellaneous Expense | 450 | |

| Total Expenses | (b)5,250 | |

| Net income | 19,750 | |

Table (2)

Therefore, the amount of total expenses is (b) 5,250.

Missing information (c):

In this case, “Name of the Company “(Company D) is missing in the statement of owners’ equity.

| (c) Company D |

| Statement of Owners' equity |

| (d) For the year ended October 31 |

Table (3)

Missing information (d):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the statement of owners’ equity.

| (c) Company D |

| Statement of Owners' equity |

| (d) For the year ended October 31 |

Table (4)

Missing information (e):

In this case, the amount of investments made during the month of October is missing and it is calculated as follows:

| (c) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October (1) | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

Table (5)

Therefore, the amount of investments during October is (e) $10,000.

Working note:

(1) Calculate the amount of investment made during October:

Missing information (f):

In this case, the net income mentioned in the income statement is recorded in the statement of owners’ equity. Therefore, amount of net income is $19,750.

| (c) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October (1) | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

Table (6)

Note:

The net income or net loss computed in the income statement is reported in the statement of owners’ equity for ascertaining the amount of ending capital balance. Then, the balance of ending capital is reported in the balance sheet (owners’ equity section). Therefore, any transaction affecting the income statement eventually, affects the balance sheet through the balance of owners’ equity.

Missing information (g):

In this case, the amount of increase in capital is (g) $25,750 and it is same as the Ending capital of Person Q as on October 31, since the amount of beginning capital is given as zero. Suppose, If the amount of beginning capital is given, then the increase in capital is computed by deducting the ending capital from the beginning capital.

| (c ) Company D | ||

| Statement of Owners' equity | ||

| (d) For the year ended October 31 | ||

| Particulars | Amount($) | Amount($) |

| Person Capital, October 1 | ||

| Investments during October | (e) 10,000 | |

| Net income for October | (f) 19,750 | |

| Subtotal | 29,750 | |

| Less: Withdrawals for October | 4,000 | |

| Increase in capital | (g)25,750 | |

| Person Q, Capital, October 31 | 25,750 | |

Table (7)

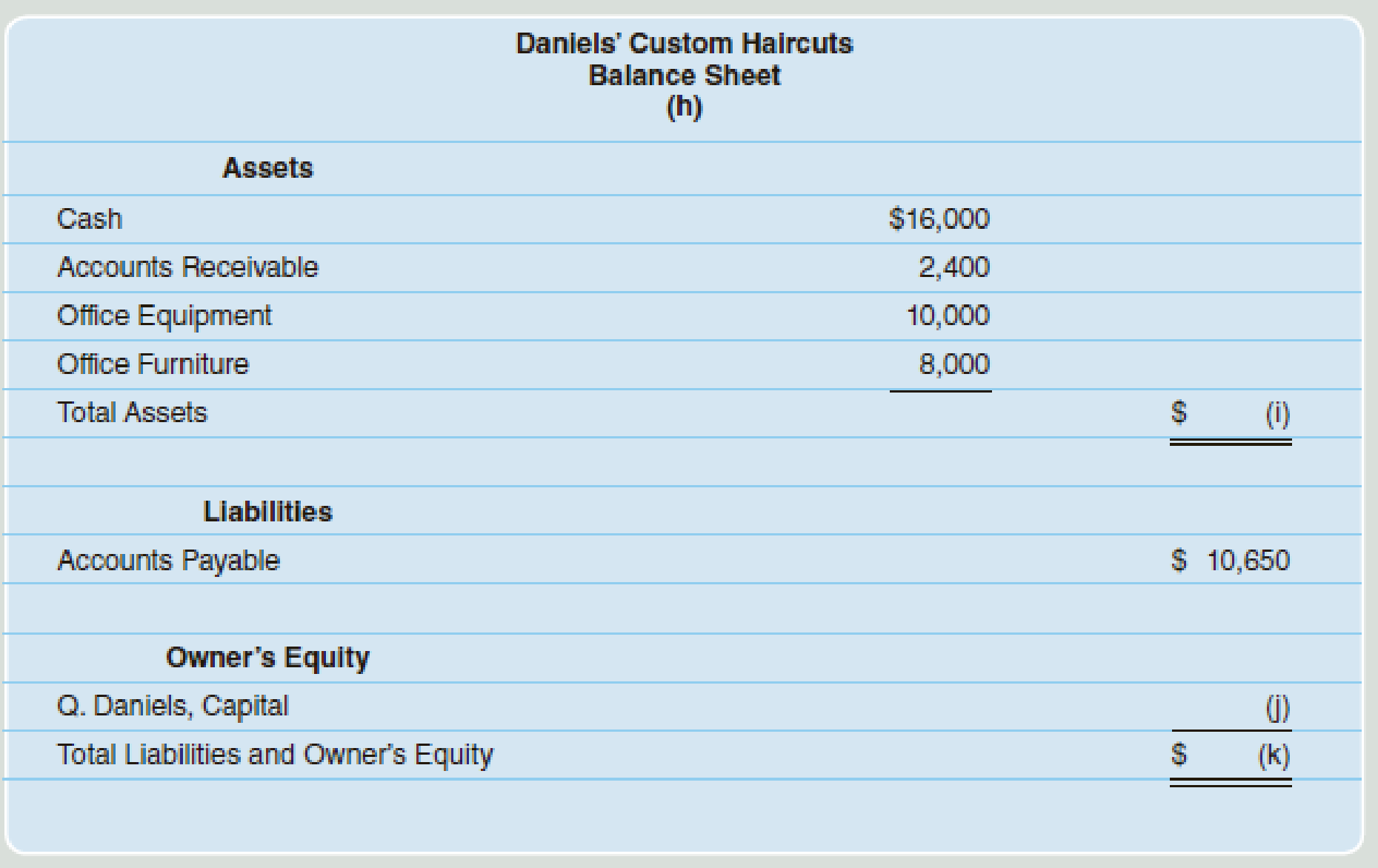

Missing information (h):

In this case, information regarding “Period of time” (For the year ended October 31) is missing in the balance sheet.

| Company D |

| Balance Sheet |

| (h) For the year ended October 31 |

Table (8)

Missing information (i):

In this case, the amount of total assets is missing and it is calculated as follows;

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

Table (9)

Therefore, the amount of total assets is (i) 36,400.

Missing information (j):

In this case, the amount of Person Q, Capital is (j) $25,750 and it is the same as the amount of ending capital of Person Q that is calculated in the statement of owners’ equity.

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

| Liabilities | ||

| Accounts Payable | 10,650 | |

| Owners' Equity | ||

| Person Q, Capital | (j) 25,750 | |

Table (10)

Note:

The net income or net loss computed in the income statement is reported in the statement of owners’ equity for ascertaining the amount of ending capital balance. Then, the balance of ending capital is reported in the balance sheet (owners’ equity section). Therefore, any transaction affecting the income statement eventually, affects the balance sheet through the balance of owners’ equity.

Missing information (k):

In this case, the amount of total liabilities and owners’ equity is same as the amount of total assets ($36,400) and it is calculated as follows:

| Company D | ||

| Balance Sheet | ||

| (h) For the year ended October 31 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | 16,000 | |

| Accounts receivable | 2,400 | |

| office Equipment | 10,000 | |

| Office Furniture | 8,000 | |

| Total Assets | (i) 36,400 | |

| Liabilities | ||

| Accounts Payable | 10,650 | |

| Owners' Equity | ||

| Person Q, Capital | (j) 25,750 | |

| Total liabilities and owners’ equity (2) | (k)36,400 | |

Table (11)

Therefore, the total amount of liabilities and owners’ equity is (k) $36,400.

Working note:

(2) Calculate the amount of total liabilities and owners’ equity:

Want to see more full solutions like this?

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Introduction To Managerial Accounting

Principles Of Taxation For Business And Investment Planning 2020 Edition

Construction Accounting And Financial Management (4th Edition)

Horngren's Accounting (12th Edition)

Auditing and Assurance Services (16th Edition)

Advanced Financial Accounting

- The financial statements for Baker Custom Catering for the month of April are presented below. Required Solve for the missing information.arrow_forwardThe adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forward

- The trial balance for Harris Pitch and Putt on June 30 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 380. b. Depreciation expense on equipment, 1,950. c. Depreciation expense on repair equipment, 1,650. d. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). e. Supplies remaining at end of month, 120. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during June. If you are using CLGL, use the year 2020 when recording transactions.arrow_forward1. Calculate the Supplies expense in each case and write the adjusting journal entry:a) For the month of March, if at the end of March, the Ledger account shows $1,235 worth of supplies, but a physical count shows only $655 left.b) For the month of July, if the ledger account shows $1,960 worth of supplies, but a count shows just $245.arrow_forwardThe following information is for Bonnies Buds, a nursery and floral shop, for the month ended May 31, 2012: Click the Chart sheet tab on the FMERCH3 file. You will see a chart depicting the five-month trend in sales, gross profit, and net income. What favorable and unfavorable trends do you see in this month-to-month comparison? Comment on any unusual changes. When the assignment is complete, close the file without saving it again. Worksheet. Your boss would prefer to have the balance sheet shown before the income statement and the statement of retained earnings. Please make this change on the FMERCH3 file. Preview the printout to make sure that the worksheet will print neatly on two or three pages, and then print the worksheet. Save the completed file as FMERCHT. Chart. Using the FMERCH3 file, prepare a 3-D pie chart that shows the amount of each of the selling expenses in June. No Chart Data Table is needed. Select A57 to A62 as one range on the worksheet to be charted and then hold down the CTRL key and select E57 to E62 as the second range. Enter your name somewhere on the chart. Save the file again as FMERCH3. Select the chart and then print it out.arrow_forward

- At the end of the current month, Gil Frank prepared a trial balance for College App Services. The credit side of the trial balance exceeds the debit side by a significant amount. Gil has decided to add the difference to the balance of the miscellaneous expense account in order to complete the preparation of the current month's financial statements by a 5 o'clock deadline. Gil will look for the difference next week when he has more time. Discuss whether Gil is behaving in a professional manner in your opinion.arrow_forwardPreparing a partial worksheet Just Right Hair Stylists has begun the preparation of its worksheet as follows: Year-end data include the following: a. Office supplies on hand, $300. b. Depreciation, $700. c. Accrued interest expense, $800. Complete just Right’s worksheet through the adjusted trial balance section. In the adjustments section, mark each adjustment by letter.arrow_forwardSara is considering whether to open a gadgets shop. She provided you, as a consultant, the following information: Sales of $60,000 and $72,000 are expected for July and August, respectively. All goods are sold on account. The collection pattern for Accounts Receivable is 80 percent in the month of sale and 20 percent in the month following the sale. Purchases of $40,000 and $54,000 are expected for July and August. The payment pattern for purchases is 70 percent in the month of purchase, 30 percent in the month following the purchase. Other monthly expenses are $8,000, which includes $2000 of depreciation. All operating expenses are paid in the month of their incurrence. $2,000 of cash is available on August 1, 2021. Required: Prepare the cash collection budget for the two months ending August 31, 2021 Prepare the cash budget for the two months ending August 31, 2021arrow_forward

- I am stuck on this question, i think i just need record the hair stylist being paid in cash as a salries expense. i do not understand the part that says "do not forget the portion of salaries were recorded as an expense at the end of january" can someone please help me.arrow_forwardAt the end of the current month, Hannah Kinsey prepared a trial balance for Seaside Rescue Service. The credit side of the trial balance exceeds the debit side by a significant amount. Hannah has decided to add the difference to the balance of the miscellaneous expense account in order to complete the preparation of the current month’s financial statements by a 5 ‘o clock deadline. Hannah will look for the difference next week when she has more time. Discuss whether Hannah is acting in a professional manner. Please post your comments and (optionally) respond to your classmates comments as well. Search entries or authorarrow_forwardUsing the information, determine the amount of revenue and expenses for Mateo’s Maple Syrup for the month of February.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning